EURUSD Descending Channel Points to Further Downside To 1.1560Hello traders! Here’s a clear technical breakdown of EURUSD (3H) based on the chart structure shown in the screenshot. EURUSD initially traded inside a well-defined ascending channel, confirming a bullish recovery phase after forming a base from the prior decline. Price respected the rising support line and produced higher highs and higher lows, showing strong buyer control. During this bullish phase, the market experienced several breakouts and fake breakouts near the upper boundary of the channel, signaling increasing volatility and early signs of exhaustion. As price approached the upper resistance area, buying momentum weakened, and the market failed to sustain acceptance above the highs. Near the top of the structure, EURUSD formed a clear turnaround and distribution phase, followed by a loss of bullish momentum. Price then broke below the ascending channel, confirming a structural shift. After this breakdown, the market transitioned into a descending channel, where price is now forming lower highs and lower lows. This confirms that sellers have taken short-term control, and bullish moves are now corrective in nature. A key Seller Zone / Resistance Level around 1.1680 was tested multiple times after the breakdown. Each attempt to reclaim this area resulted in rejection, reinforcing it as a strong supply zone. Recent price action shows continued respect of the descending channel resistance, with pullbacks failing and momentum favoring the downside. Currently, EURUSD is trading below resistance and is moving toward the Buyer Zone and Support Level around 1.1560, which aligns with previous structure and demand. This area represents the next key reaction zone and the primary downside objective (TP1). A reaction or temporary pause may occur there, but structurally it remains a bearish continuation zone unless buyers regain control. My scenario: as long as EURUSD stays below the 1.1680 Resistance / Seller Zone and continues to respect the descending channel, the bearish bias remains valid. I expect sellers to push price toward the 1.1560 Support / Buyer Zone (TP1). A clean breakdown and acceptance below this level would open the door for a deeper bearish continuation. However, a strong bullish breakout and acceptance back above 1.1680 would invalidate the short scenario and suggest a shift back toward consolidation or recovery. For now, market structure clearly favors sellers. Please share this idea with your friends and click Boost 🚀

Trend Analysis

GOLD - A long squeeze of support could trigger growthFX:XAUUSD continues to consolidate, Friday's long squeeze (false breakdown) of support provides an opportunity for growth amid geopolitical issues...

The dollar is strengthening against the backdrop of Thursday's economic data and Trump's geopolitical actions, but against this backdrop, gold is behaving quite cautiously and looks quite strong.

Trump said that tariffs on eight European countries could rise to 25% if Greenland is not sold to the US - more tariffs and an escalation of the trade war could lead to a strong market reaction.

In the new trading week, we are awaiting Trump's speech (high volatility possible), US GDP, Core PCE, and PMI. The data may set the medium-term tone for the market...

Resistance levels: 4593, 4621, 4639

Support levels: 4581, 4561, 4550

The long squeeze has shifted the market imbalance towards buyers. Locally, we are seeing consolidation in the 4581-4593 zone. A close above 4593 or a retest of 4581 could trigger further growth within the current trend

Best regards, R. Linda!

XAUUSD: Holds Key Support - Buyers Aim for $4,720 ResistanceHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD is trading within a broader bullish market structure, supported by a rising trend line that has guided price action from the recent swing lows. Earlier in the move, gold advanced inside a well-defined upward channel, confirming strong buyer control with consistent higher highs and higher lows. This bullish leg eventually led to a breakout attempt near the upper boundary of the channel, after which price experienced a sharp corrective move and transitioned into a consolidation phase. Following the correction, XAUUSD formed a range, where price moved sideways as buyers and sellers reached temporary equilibrium. This range acted as an accumulation zone before the next directional move. Price eventually broke out of the range to the upside, signaling renewed bullish momentum. However, shortly after the breakout, a fake breakout occurred on the downside, where price briefly dipped below support but was quickly reclaimed by buyers, reinforcing demand strength.

Currently, price is holding above a clearly defined Support Zone around 4,650, which aligns with the former range high and a key structural level. This area is now acting as demand after the successful breakout and retest. On the upside, XAUUSD is approaching a major Resistance Zone near 4,720, where selling pressure has previously emerged. The recent price action shows controlled consolidation above support, suggesting continuation rather than distribution.

My Scenario & Strategy

My primary scenario remains bullish as long as XAUUSD holds above the 4,650 Support Zone and continues to respect the rising trend line. In this case, I expect buyers to remain in control and attempt another push toward the 4,720 Resistance Zone (TP1). A clean breakout and acceptance above this resistance would confirm bullish continuation and open the door for further upside expansion.

However, a strong rejection from resistance followed by a decisive breakdown below the 4,650 support would weaken the bullish bias and signal a deeper corrective move. Until that happens, the overall structure favors buyers, and pullbacks into support are viewed as potential continuation opportunities.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

Trendline Resistance SetupThis chart represents a detailed intraday analysis of gold prices, focusing on key levels and potential price movements for January 19, 2026. The chart highlights crucial support and resistance zones, trendline resistance, and expected price reactions at various levels. Key strategies include waiting for a breakout above 4620.851 for potential upside, or monitoring a break below 4657.992 for potential downside. The final target is set at 4550.000, providing a clear risk-to-reward setup for traders.

BTCUSDT Long: Rising Trend Line and Demand Supports Bullish BiasHello traders! Here’s a clear technical breakdown of BTCUSDT (2H) based on the current chart structure. Bitcoin is trading within a developing bullish structure after forming a clear pivot low, from which a rising trend line has been established. This trend line reflects increasing buyer participation and gradual strength returning to the market. Following the pivot, price moved higher and transitioned from consolidation into an impulsive bullish leg, confirming a structural shift. After the upside move, BTC reached a clearly defined Supply zone around 94,500, where selling pressure stepped in. This reaction led to a range formation just below supply, indicating temporary consolidation after the impulsive rally. This range reflects short-term equilibrium rather than a trend reversal, as price remains structurally supported.

Currently, BTC is reacting from a strong Demand zone around 91,900, which aligns closely with the rising trend line. This confluence between horizontal demand and dynamic support strengthens the level. The recent pullback into demand appears corrective rather than impulsive, suggesting that sellers are losing momentum and buyers continue to defend structure.

My scenario: as long as BTCUSDT holds above the 91,900 demand zone and respects the ascending trend line, the market structure remains bullish. A sustained reaction from demand could lead to another attempt toward the 94,500 supply zone, and a confirmed breakout above this level would open the door for further upside continuation. A decisive breakdown and acceptance below demand would invalidate the bullish bias and shift focus toward deeper corrective levels. For now, price remains compressed between demand and supply, with buyers maintaining structural control. Manage your risk!

Silver Strength (XAG/USD) – Safe-Haven Demand Fuels Upside📝 Description 🔍 Setup (Market Structure) FX:XAGUSD

XAG/USD continues to show strong bullish structure on the H1 timeframe.

Price has respected a well-defined demand zone with multiple retests and rejections, confirming strong buyer interest. Silver is trading above EMA and Ichimoku cloud support, signaling trend continuation rather than exhaustion.

The broader backdrop supports metals as safe-haven assets, keeping the upside bias intact.

📍 Support & Resistance

🟡 Key Demand / Support Zone: 85.00 – 87.00

🟢 1st Resistance: 98.00

🟢 2nd Resistance / Extension Target: 101.00

Trend strength remains valid above demand with higher-high structure intact

🌍 Fundamental Context

1.Rising geopolitical tensions and trade-related uncertainty

2.Investors rotating into safe-haven assets like Silver

3.Risk-off sentiment continues to support precious metals

#XAGUSD #Silver #PreciousMetals #SafeHaven #ForexTrading #TechnicalAnalysis #PriceAction #TradingView #Kabhi_TA_Trading

⚠️ Disclaimer

This analysis is for educational purposes only.

Markets are volatile — always manage risk properly and use a stop-loss.

💬 Support the Idea 👍 Like if you’re bullish on Silver

💬 Comment: Breakout continuation or pullback first? 🔁 Share with traders watching metals

XAUUSD – The Bullish Trend Remains DominantHello traders, I observe that XAUUSD is currently in a phase where fundamental news and technical structure are fully aligned in favor of a bullish trend.

On the fundamental side , global risk-off sentiment has intensified after U.S. President Donald Trump proposed new tariffs on eight European countries related to the Greenland issue . This rise in geopolitical and financial uncertainty has driven strong capital flows into safe-haven assets , pushing gold to new record highs and reinforcing its key role in central banks’ reserve strategies.

On the chart, the bullish structure remains clearly intact, with higher lows forming consistently. Price continues to respect the ascending trendline and is well supported by the Ichimoku system. The 4,610 – 4,615 zone stands out as a critical near-term support; as long as price holds above this area, the bullish trend remains valid. The next upside target is projected around 4,730 – 4,735.

👉 In conclusion , as long as global uncertainty persists and safe-haven flows remain active, XAUUSD retains a strong foundation to continue higher, and higher price levels are likely to be tested sooner rather than later.

(XAUUSD) Gold Bullish Setup After Sell-Side Liquidity SweepPrice swept sell-side liquidity below the higher timeframe demand and quickly reclaimed the range, signaling strong bullish intent.

This move appears to be a liquidity grab rather than a true breakdown, trapping late sellers.

Price is now reacting from a bullish re-entry / mitigation zone, where continuation to the upside is expected after bullish confirmation.

The primary objective is the range high supply, with a possible extension toward the higher timeframe premium supply zone.

Bias remains bullish as long as price holds above HTF demand.

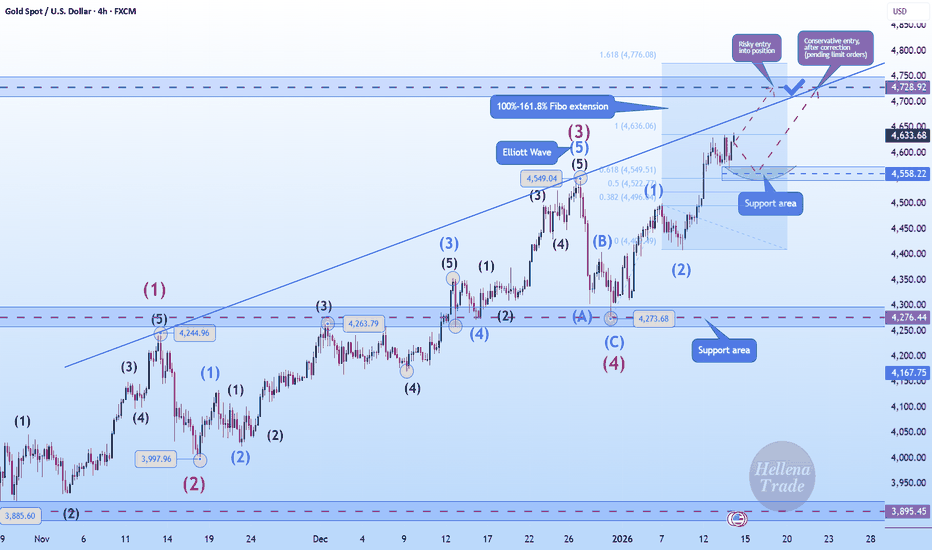

Hellena | GOLD (4H): LONG to 161.8% Fibo 4728 .Colleagues, the price is updating its maximum, and I think we shouldn't stop there.

After re-marking the waves, I realized that it would be more correct to place wave “3” at the 4549 level, since 5 waves fit well into it.

This means that the price is now in wave “5,” which can be quite unpredictable, but if we look at the blue waves, we can assume that there is now a medium-term impulse wave “3,” which means we can apply Fibonacci extension levels and see the 161.8% level as the target.

But I don't want to take such a risk and will set a slightly lower target - in the 4728 area. At the moment, we need to be very careful.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

GOLD - Consolidation after the rally before the rally...FX:XAUUSD started the week with growth, hitting a new all-time high amid geopolitical risks and threats of new tariffs from the US, and is now consolidating around $4,700...

Fundamental situation

Trump threatened to impose tariffs on eight European countries over the issue of buying Greenland.

Escalating tensions around Ukraine and Iran.

Fed:

Expectations of policy easing are supporting gold, but the appointment of a new Fed chair could slow down aggressive rate cuts. The investigation into Powell continues...

This week, PCE inflation data (Thursday) and US GDP for the third quarter are important.

Gold's rise since the beginning of the year has been independent of the strengthening dollar, underscoring the strength of internal drivers. However, a confident breakout to $5,000 will require confirmation of lower inflation in the US and continued high demand for safe-haven assets. Corrections may be profitable against the backdrop of an aggressive bullish trend...

Resistance levels: 4678, 4691, 4700

Support levels: 4656, 4650, 4640

Within the current range, I focus on the zones 4656 - 4650 - 4639. There is a high probability of a long squeeze/false breakout of support. However, I do not rule out the possibility of a local correction due to the holiday in the US (low liquidity, profit-taking may trigger a correction) before growth.

Best regards, R. Linda!

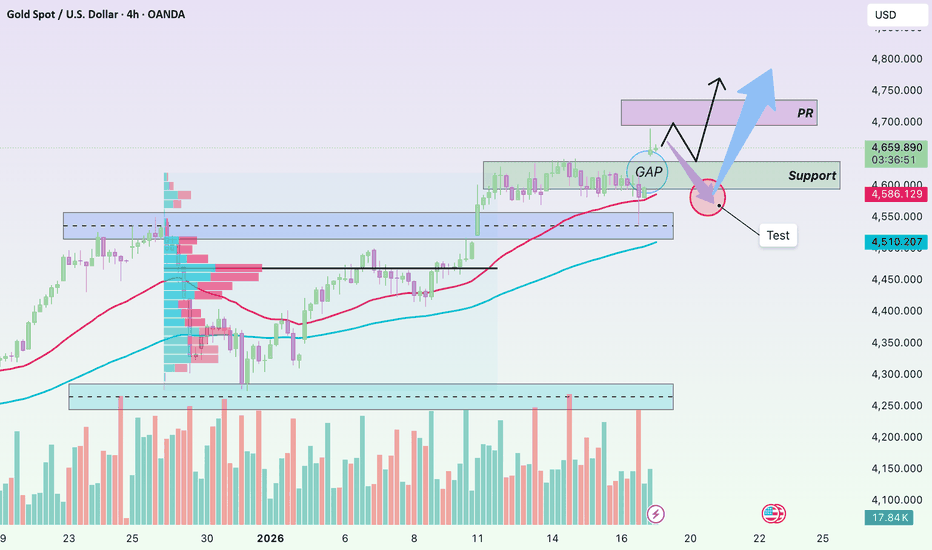

Lingrid | GOLD Bullish Setup After Price Gap HigherOANDA:XAUUSD perfectly played out my previous trading idea . Price remains structurally supported after defending the rising trendline near the 4,620 area, showing that buyers are still active on dips. The recent consolidation beneath 4,700 looks more like a pause than distribution, with price compressing between dynamic support and overhead resistance. Momentum has cooled, but the broader trend remains constructive rather than broken.

If demand continues to absorb pullbacks above 4,620, gold could build enough pressure to challenge the 4,750 resistance zone again. A sustained move through that level may trigger continuation toward higher untested supply above.

➡️ Primary scenario: support holds above 4,620 → continuation toward 4,750.

⚠️ Risk scenario: a clean breakdown below 4,600 may shift momentum short-term and expose deeper pullback.

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Gold Price Respects Ascending Trend Line - Next Target 4,680Hello traders! Here’s my technical outlook on XAUUSD (4H) based on the current chart structure shown in the screenshot. XAUUSD is trading within a broader bullish structure, supported by a well-defined ascending trend line that has guided price action since the market formed a solid base and started to grow. After the initial recovery, gold transitioned into a consolidation range, where price moved sideways, showing temporary balance between buyers and sellers. This range was eventually resolved to the upside with a clean breakout, confirming renewed bullish momentum. Following the breakout, price continued higher along the rising trend line, forming higher highs and higher lows. During this advance, the market experienced several false breakouts and shallow corrections, all of which were absorbed above the trend line, highlighting strong demand on pullbacks. The area around 4,540–4,560 is clearly defined as a Buyer Zone / Support Level, where previous resistance flipped into support and buyers repeatedly stepped in. Currently, XAUUSD is trading above the Buyer Zone and holding above the ascending trend line, which keeps the bullish structure intact. Price is now approaching the Seller Zone / Resistance Level around 4,660–4,680, which aligns with a descending resistance line from prior highs. This area represents a key supply zone where selling pressure may emerge and cause a reaction or short-term consolidation. My scenario: as long as XAUUSD remains above the Buyer Zone and continues to respect the rising trend line, the bullish bias remains valid. I expect buyers to defend pullbacks into support and attempt a continuation move toward the 4,680 Resistance Level (TP1). A clean breakout and acceptance above this resistance would confirm further bullish continuation and open the door for higher targets. However, a strong rejection from the Seller Zone followed by a decisive breakdown below the Buyer Zone and trend line would weaken the bullish structure and signal a deeper corrective move. For now, price is at a key decision area near resistance, and patience with proper risk management is essential. Please share this idea with your friends and click Boost 🚀

Gold 30-Min — Volume Buy Reversal Triggered⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

Technical Reasons

/ Direction — LONG / Reversal 4610 Area

☄️Bullish momentum confirmed through strong candle body.

☄️Structure shifted with higher-low near key demand base.

☄️Volume expanding confirms order-flow alignment upward.

☄️Buyers reclaimed imbalance with sustained clean break.

☄️Algorithm detects rising momentum under low liquidity.

⚙️ Hanzo Alpha Trading Protocol

The Alpha Candle defines the day’s real control zone — the first battle of momentum.

From this origin, the Volume Window reveals where the next precision strike begins.

⚙️ Hanzo Volume Window / Map

Window tracked from 10:30 — mapping true market behavior.

POC alignment exposes institutional bias and breakout potential zones.

⚙️ Hanzo Delta Window / Pulse

Delta window monitors real buying vs. selling power behind each move.

Tracks volume aggression to expose who controls the candle — buyers or sellers.

When Delta aligns with Volume Map, momentum becomes undeniable.

yesterday

Note

☄️ we add inner Reversal 4596 : 4599 Area . ( bearish Reversal zone )

and we will Target 4560 Zone

ES Weekly Levels: Reversal Zone 6865–6875 → Target 6950/6955🔱 ES WEEKLY SNAPSHOT — EXECUTIVE SUMMARY (NEW WEEK | JAN 2026)

✨ Bull reversal setup is the focus — but weakness remains until key sell-side is reclaimed

🧲 Fresh overhead sell-side liquidity / bear FVG: 6950 plus key level 6955

📌 Context: ES gapped down at the open → signals continued weakness into the week

🧲 Bull FVG + preferred reversal zone: 6865–6875 = best area to scale into longs

🛡 Failure zone / risk-off trigger: loss of 6865–6875 opens downside to 6795 → 6790

🎯 Bull target: 6950 fresh liquidity pocket overhead

🏦 Core play: scale buys 6865–6875, manage risk if the zone fails, take profit into 6950–6955

🗳️ ES Weekly Scenarios — What’s Your Play?

Which path do you have for ES next week?

🅰️ Hold 6865–6875 → reversal works → rotation into 6925 → tag 6950

🅱️ Sweep below 6875 → reclaim 6865–6875 → squeeze into 6950–6955

🅲 Drive into 6950–6955 → rejection from sell-side → pullback toward 6925 → 6865

🅳 Break/hold below 6865–6875 → weakness confirms → downside opens to 6795 → 6790

Your key levels: 6955 / 6925 / 6865 / 6795 / 6790

Your FVGs: 6950 (bear sell-side) / 6865–6875 bull reversal

EURUSD Short: Supply Holds, Bears in Control, Move To 1.1550Hello traders! Here’s a clear technical breakdown of EURUSD (3H) based on the current chart structure. EURUSD initially traded within a consolidation range, where price moved sideways after a prior decline, indicating temporary equilibrium between buyers and sellers. This range acted as a base for the next directional move. A confirmed breakout from the range triggered a bullish recovery, shifting short-term control to buyers. Following the breakout, price developed a well-defined ascending channel, marked by consistent higher highs and higher lows. Pullbacks during this phase were corrective and respected the channel structure, confirming sustained bullish momentum. However, as EURUSD approached the upper boundary of the channel, upside strength began to fade. A fake breakout above channel resistance signaled buyer exhaustion and increasing sell-side pressure at higher prices. Near the highs, price formed a clear rounding top pattern around a key pivot point, reflecting a gradual loss of bullish momentum rather than an impulsive reversal. This topping structure was followed by a breakdown below internal support, confirming a short-term shift in market control. After losing the ascending structure, EURUSD transitioned into a descending channel, establishing a bearish corrective phase characterized by lower highs and lower lows.

Currently, EURUSD is trading within the descending channel and moving toward a key Demand Zone around 1.1550, which aligns with previous structural support and historical reactions. This zone represents the next important area where selling momentum may slow and buyers could attempt a defensive response.

My primary scenario remains bearish as long as EURUSD stays below the 1.1680 Supply Zone and continues to respect the descending channel structure. Pullbacks into supply that show rejection can be viewed as potential continuation opportunities, with 1.1550 Demand Zone acting as the first downside target (TP1). A clean breakdown and acceptance below 1.1550 would open the door for a deeper bearish continuation toward lower demand levels. However, a strong bullish breakout and sustained acceptance above 1.1680 would invalidate the short bias and signal a possible transition back into consolidation or bullish recovery. Until such a breakout occurs, market structure favors sellers, and upside moves are considered corrective. Manage your risk!

XAUUSD (Gold) – 30M Trendline BreakoutPrice has broken above the descending trendline and is holding above the key intraday support, signaling a bullish continuation bias on the 30-minute timeframe.

Key Levels:

Support: 4607 – 4613

Resistance: 4636 – 4643

Target Zone: 4660 – 4670

Bullish structure remains valid above support. Wait for a pullback and confirmation before entry. Always apply proper risk management.

XAUUSD – Strong Opening Gap: When Smart Money Doesn’t WaitHello everyone, Domic here.

Looking at the XAUUSD H4 chart at the start of the week, what really stands out to me is not where price is trading, but the strong bullish GAP that appeared right at the market open.

In context, this GAP formed at a very “logical” spot. Prior to the weekend, price had been holding firmly above both the EMA 34 and EMA 89, with the bullish structure fully intact. At the same time, price action was getting increasingly compressed around the 4,580–4,610 zone. When a market consolidates long enough within a strong uptrend, it often doesn’t climb step by step anymore — it jumps to a new price level. This opening GAP is a direct result of that built-up pressure.

As for the catalyst, the story behind this move is fairly familiar. Expectations of a dovish Fed stance going into next year remain unchanged, US bond yields have failed to establish a fresh upside trend, while geopolitical risks continue to support safe-haven demand. When such factors emerge or intensify over the weekend, the market often cannot react immediately. Instead, the adjustment gets priced in at the weekly open. Combined with thinner liquidity during the Asian session, it doesn’t take much buying pressure for a GAP like this to form.

The key question many traders are asking now is: will this GAP get filled?

My view is quite straightforward — not every GAP is meant to be filled . In a strong uptrend, GAPs often act as continuation signals rather than inefficiencies to be corrected. At this stage, my preferred scenario is a technical pullback toward the upper part of the GAP to “retest conviction,” followed by a continuation toward the 4,700–4,730 area. If that zone is broken decisively, it would add another layer of confirmation to the medium-term bullish trend.

AUDUSD Ready to Rally? Gold Correlation + 0.66700 Support!Hey Traders,

In today’s trading session, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.66700 zone. AUDUSD remains in a well-established uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 0.66700 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

From a fundamental perspective, the Australian Dollar often benefits from its positive correlation with Gold. With Gold maintaining a constructive bullish tone, this relationship could provide additional upside support for AUDUSD, reinforcing the bullish technical outlook.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

XAUUSD (GOLD) – 4-Hour Timeframe Tradertilki AnalysisGuys,

I have prepared a XAUUSD-Gold analysis for you on the 4-hour timeframe.

My friends, the levels of 4657.0 and 4599.0 are the best buy entry points.

When price reaches these levels, I will definitely open a buy position and aim for the following targets:

My targets:

1st Target: 4690.0

2nd Target: 4730.0

3rd Target: 4790.0

My friends, since the U.S. president has recently imposed tariffs on Europe, there is currently strong buying volume in XAUUSD-Gold. From a fundamental perspective, this is the biggest reason for gold’s upward movement.

NOTE – Since the U.S. president has not lifted these tariffs regarding Greenland and has opened a trade war against European countries, XAUUSD-Gold may rise even from these levels and reach my 3 targets.

My friends, I share these analyses thanks to each like I receive from you. Your likes increase my motivation and encourage me to support you in this way.🙏

Thank you to all my friends who support me with their likes.❤️

XAUUSD H1 – Bullish Structure Holds After Early-Week GapHello, I’m Louna.

From the H1 perspective, XAUUSD continues to trade cleanly within a well-defined ascending channel, confirming that the broader bullish market structure remains intact. Price is still printing higher highs and higher lows, a clear sign that buyers are firmly in control of the dominant trend.

The early-week bullish gap reinforces this bullish context. Instead of immediately filling the gap, price has held above prior balance, suggesting sustained participation from strong hands. However, with price recently pushing closer to the upper portion of the channel, the market is now slightly extended away from its internal support, increasing the probability of a short-term corrective phase.

In strong gold trends, price rarely moves in a straight line. Corrections are a healthy and necessary process—they allow liquidity to rebalance and provide confirmation that demand beneath the market remains strong rather than speculative.

The primary zone I am monitoring lies between 4,580 and 4,600. This area aligns closely with the midline of the ascending channel and a previous demand zone that has already proven its relevance. Within momentum-driven uptrends, gold often forms a higher high, attracts late buyers, and then retraces to retest structural support before continuing higher.

If price stabilizes within this zone and we see clear bullish reactions—such as strong rejection candles or improving volume behavior—the bullish structure remains healthy, and the market will be well positioned for continuation toward the upper boundary of the channel, with upside targets extending toward 4,750 and potentially 4,800.

As always, confirmation is key. Closely observe price action and volume behavior around this support zone before committing to long positions. Maintain disciplined risk management, follow your trading plan, and avoid chasing price at extended levels.

Wishing you clarity, discipline, and consistent execution in your trading.

GOLD Price Update – Clean & Clear ExplanationGold is moving inside a rising trendline, which shows the overall structure is still bullish. However, price is currently trading in a consolidation zone and reacting strongly around key supply and demand areas.

Two possible scenarios are shown:

🔼 Bullish Scenario

If price holds above the support and respects the trendline a breakout above 4,620 – 4,630 could push Gold toward the 4,645 psychological level this would confirm continuation of the bullish trend.

🔽 Bearish Scenario

If price fails to hold above 4,590 – 4,580 a breakdown could send Gold toward the 4,570 to 4560 support zone a clean break below this support may trigger stronger selling pressure.

Gold is at a critical area. Holding above support favours buying toward higher levels. Breaking below support favours selling toward lower zones. Traders should wait for confirmation before entering, as the market is deciding its next major direction.

“If you come across this post, please like, comment, and share. Thanks!”

THE KOG REPORTTHE KOG REPORT:

In last week’s KOG Report we said we would be looking for the low to hold and for price to push upside into the target region on the chart which worked well for those following. We mentioned during the week that we would want to see a confirmed RIP from that level otherwise we will continue with the hot spots and red boxes and follow price upside, which again was successfully achieved.

On Friday however, we put caution on long trades and suggested traders wait for resistance to hold and rather than long, play the short card and attempt those lower levels mentioned in last weeks report.

As you can see, that also worked well for us in Camelot. We had another successful week, not only on Gold but all the other pairs we trade and analyse.

So, what can we expect in the week ahead?

For this week we have the key level of resistance at the 4610-12 level which if attacked early session will need to hold for us to continue with the move downside to collect the void below. There is support here at the 4590 level which may play as range support again, so let’s play caution early session due to it also being a US holiday. If we can break below that defence levels we will be looking for a temporary swing low to form around the 4520-35 region as we previously mentioned in earlier KOG Reports.

That swing low level is the line in the sand for bulls at the moment in our opinion. Breaking below should lead us into filling that gap that bears have been chasing for the last 2 weeks.

For now, we’ll stick with the plan and keep an eye on the defence levels together with the indicators to guide the way. Also, looking at the 4H liquidity indicators, we should see some bullish volume enter the markets over the next couple of days. Based on that, one of these levels are going to give the RIP!!

RED BOXES:

Break above 4608 for 4635

Break below 4590 for 4555

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

#XAUUSD: +3000 Pips Buying Opportunity Targeting $5000! Dear Traders,

Gold has completed a small correction in both the daily and intraday timeframes. We believe the price will now move in an impulse move likely reaching our ultimate goal of $5000. Our initial targets are $4700, $4800 and finally $5000.

This is our view only so please conduct your own analysis.

Team Setupsfx_❤️🚀