BTCUSDT: Bullish Breakout from ConsolidationHi

BTC was moving sideways inside a clear rectangle, showing a period of consolidation and balance after the previous move. This range allowed the market to build energy. Price has now broken above the upper boundary with strong bullish candles, confirming a valid breakout. As long as BTC stays above the former resistance area, which should now act as support, the bullish structure remains intact. Based on the rectangle height, the next upside target is around 93,367 . A short pullback to the breakout zone would be normal and healthy, but a return inside the range would weaken the bullish outlook.

Trend Analysis

HBAR-Ready for a bullish rally back to $0.19, $0.24, $0.29Looking at a daily timeframe the super trend indicator is showing bullish green. On this timeframe it rarely produces a fake out. You can see that the retest of its previous highs lines up with the POC. I have an alert set I suggest getting in now with a take profit at $0.19 there's another take profit at $0.24 and a very aggressive take profit would be at $0.29

MACD and RSI are flashing bullishness

Best of luck on your trading journey to success.

Bakkt Holdings, Inc. 400% move? - January 2026

Timeframe : Weekly

Core Thesis BKKT has been in a punishing downtrend since October. However, the weekly chart now shows the first tentative signs of seller exhaustion and structural improvement, forming a sequence of higher lows (HL) and a higher highs (HH). We are monitoring the current pullback to see if it can establish another HL, forming a potential reversal foundation. This is a high-risk, speculative play on a possible trend change in its earliest stage.

Key Levels

Support (Higher-Low Zone): $11.00 - $12.00. This is the critical area for buyers to defend to maintain the improving structure.

Invalidation: A sustained break (meaningful weekly close) below the support zone. This would indicate the nascent bullish structure has failed.

Resistance Targets (Scale-Out Levels):

T1: ~$17.50 (Previous swing high & initial reaction zone).

T2: ~$28.00 (Next significant weekly supply area from Q4 2025).

T3 (Stretch): ~$48.33 (The September 2025 breakdown level – a full trend reversal target).

Conclusion

BKKT is showing the first signs of potential trend exhaustion and base formation. The trade setup is a pure play on whether the new pattern of higher lows can sustain. A hold at current levels could spark a stronger relief rally toward T1/T2. However, given the stock's history, failure remains a significant probability. Trade is invalidated if the new support structure breaks.

Ww

===============================================================

Disclaimer

This is not financial advice. It’s a technical-analysis idea, not a guarantee, not a signal service, and definitely not a substitute for your own research. Markets are risky; small caps can be especially chaotic. Manage position size, use stops appropriate to volatility, and assume you can be wrong, because you can. I may hold a position at any time, and this idea may be invalidated without notice.

EURUSD Bearish Continuation After PullbackQuick Summary

EURUSD broke below 1.16824, A corrective move toward the orderblock at 1.17143 is possible

This pullback is expected to act as a continuation zone for further downside and The main objective remains which is filling the liquidity void after the bullish trendline break

Full Analysis

After EURUSD successfully broke below the 1.16824 level the bearish structure remains valid

This break confirms that sellers are still in control following the loss of the previous bullish trendline

From here price may attempt a corrective move higher toward the orderblock around 1.17143

This area is viewed as a potential mitigation zone rather than a reversal point

If price reacts from this orderblock the expectation is continuation to the downside

The overall objective of this move is to continue filling the liquidity void that was left behind during the previous impulsive bullish move

As long as price remains below the broken structure this pullback is considered corrective

The bearish bias remains intact and the focus stays on downside continuation.

USDCAD 1W – Demand Zone Rejection & Potential Trend ContinuationTechnical Analysis (Weekly Timeframe)

The USDCAD pair is exhibiting a clear long-term bullish structure. Following a peak near 1.4600, the price underwent a healthy corrective phase, reaching a major Point of Interest (POI).

Key Bullish Arguments:

Demand Zone Reaction: Price has shown a precise reaction to the broad Weekly Demand Zone (grey box) and the refined decisionary Order Block (green zone) around 1.3650–1.3700.

Price Action: The most recent weekly candle closed with a significant lower wick, signaling strong buying pressure and a clear rejection of lower price levels.

Liquidity Sweep: The market successfully swept liquidity below the EQL (Equal Lows), a classic precursor to an impulsive reversal.

Market Structure: Despite the recent pullback, the high-timeframe structure remains bullish. The ultimate target remains the "Weak High" at the 1.4800 level.

Trade Setup

Entry: Around 1.3800 (Current Market Price).

Target 1 (TP1): 1.4245 – Local resistance and previous BOS level.

Target 2 (TP2): 1.4800 – Long-term target (New Highs).

Stop Loss (SL): Below the recent swing low at 1.3618. A break below this level invalidates the current bullish thesis.

Risk Management

As this is a Weekly (1W) setup, patience is key. Ensure your position size reflects the wider stop-loss required for high-timeframe swings.

Disclaimer

Risk Disclosure: This post represents my personal opinion and is for educational purposes only. It is not financial or investment advice. Trading Forex involves a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. Always conduct your own due diligence and never risk more than you can afford to lose.

XRP Consolidation Phase Could Precede Major ExpansionXRP is far from finished. The recent surge in volume signals renewed participation and a decisive shift in market interest, strong enough to challenge broader market dynamics, including relative performance against major large-caps. This influx of volume validates the current consolidation phase, which is structurally healthy and characteristic of a re-accumulation process rather than distribution.

Price continues to respect the ascending channel structure, with higher lows remaining intact and demand consistently stepping in at key levels. This confirms that the broader bullish framework has not been compromised. As long as the channel support holds, the probability favors a continuation move rather than a breakdown.

From a technical perspective, this consolidation acts as a pressure-building phase, often preceding an impulsive expansion. A confirmed breakout or sustained acceptance above local resistance could trigger a strong upside push toward the medium-term targets already outlined on the chart. Market participants should closely monitor volume behavior and reaction at channel boundaries for confirmation.

This zone represents a strategic re-accumulation opportunity, not a sign of weakness. Structure, volume, and trend alignment all suggest that XRP is positioning for its next directional move.

Do you see this consolidation as the final pause before expansion, or do you expect a deeper reset first? Share your outlook, bullish or bearish. let’s break this structure down together.

EUR/USD 1D CHART PATTERNThe EUR/USD daily chart shows price reacting strongly from a well-defined resistance zone, marked by multiple rejections in the highlighted supply area. These repeated failures to break higher suggest weakening bullish momentum and increasing selling pressure. Price has recently broken below the rising trendline that was supporting the previous upward structure, indicating a possible trend shift or deeper correction. The Ichimoku cloud reflects market indecision, with price hovering near the cloud and struggling to regain strong bullish control. This structure favors a cautious bearish outlook while below resistance. A sustained move downward could open the path toward the first support zone near 1.16744. If bearish momentum continues and sellers remain in control, the second downside objective around 1.15980 becomes likely. Risk management remains essential.

If you found this XAUUSD analysis helpful, don’t forget to LIKE 👍 and COMMENT !

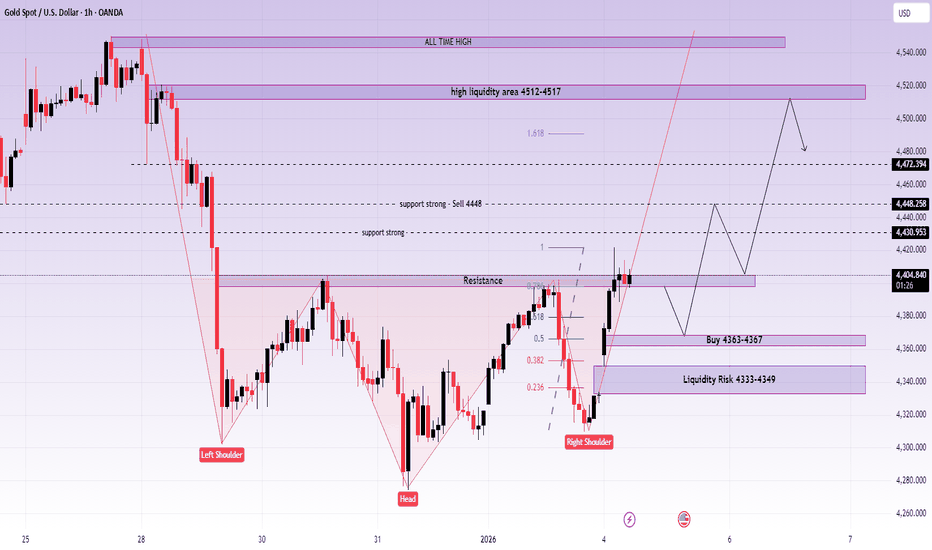

XAUUSD (H1) – Inverse Head & Shoulders in play Lana focuses on pullback buys above key liquidity 💛

Quick overview

Timeframe: H1

Pattern: Inverse Head & Shoulders confirmed on the chart

Bias: Bullish continuation while price holds above neckline

Strategy: Buy pullbacks into liquidity zones, avoid chasing highs

Technical view – Inverse Head & Shoulders

On H1, gold has completed a clean Inverse Head & Shoulders structure:

Left shoulder: Formed after the first sharp sell-off

Head: Deeper liquidity sweep, followed by strong rejection

Right shoulder: Higher low, showing weakening selling pressure

Neckline: Around the 4030–4040 resistance zone (now being tested)

The recent breakout and strong follow-through suggest buyers have regained control. As long as price holds above the neckline, the structure favors continuation to the upside.

Key levels Lana is watching

Primary buy zone – Pullback entry

Buy: 4363 – 4367

This area aligns with prior structure support and sits inside a healthy pullback zone. If price revisits and shows acceptance, it offers a good risk-to-reward buy.

Liquidity risk zone – Deeper pullback

Liquidity risk: 4333 – 4349

If volatility increases and price sweeps deeper liquidity, this zone becomes the secondary area to watch for bullish absorption.

Upside targets & resistance

High liquidity area: 4512 – 4517

ATH zone: Above the previous all-time high

These zones are expected to attract profit-taking or short-term reactions, so Lana avoids chasing price near these levels.

Fundamental context (market drivers)

Geopolitics: Rising tension after comments about potential military intervention in Colombia adds background support for gold as a safe haven.

Goldman Sachs: Views Venezuela-related developments as having limited impact on oil, keeping broader commodity sentiment stable.

ISM Manufacturing PMI (US): Any sign of slowing manufacturing can pressure USD and indirectly support gold.

Overall, fundamentals remain supportive for gold, reinforcing the bullish technical structure.

Trading plan (Lana’s approach)

Prefer buying pullbacks into 4363–4367 while structure holds.

Be patient if price dips into 4333–4349 and wait for confirmation before entering.

If price falls back below the neckline and fails to reclaim it, Lana steps aside and reassesses.

This is Lana’s personal market view and not financial advice. Please manage your own risk before trading. 💛

EURUSD: Fake Breakout at Resistance Signals Move Toward 1.1680Hello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD previously traded inside a clear downward channel, reflecting sustained bearish pressure during that phase. After forming a base, price broke out of the descending channel and transitioned into a strong upward channel, confirming a shift in market control toward buyers. This bullish leg was supported by a sequence of higher highs and higher lows, showing healthy upside momentum. As price approached the key Resistance Zone around 1.1770–1.1780, bullish momentum started to weaken. Multiple attempts to break above this resistance resulted in fake breakouts, signaling strong seller interest at the highs.

Currently, following these rejections, EURUSD failed to hold above the upper boundary of the ascending channel and broke below short-term support, indicating a loss of bullish structure. Price is now compressing below resistance and forming a structure that resembles a triangle breakdown, suggesting increasing downside pressure. Below current price, a well-defined Support Zone around 1.1680 stands out as the next key area where buyers may attempt to defend and slow the decline.

My Scenario & Strategy

My primary scenario: as long as EURUSD remains below the 1.1770 Resistance Zone and continues to respect the broken channel / triangle resistance, the bias favors sellers. Any pullbacks toward resistance that show rejection can be considered short opportunities, with downside continuation toward the 1.1680 Support Zone as the main target.

However, a clean breakout and acceptance back above resistance would invalidate the short scenario and signal a potential return to bullish continuation. Until then, structure and price action favor further downside or corrective movement lower.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

BTC Breakout in Play Retest Zone Will Define ContinuationAs highlighted in our previous BTC update, price was approaching a structural decision point and the breakout has now been confirmed.

BTCUSDT has now broken above the upper trendline of the bearish structure , signaling a short-term shift in market behavior after prolonged downside pressure.

A sustained break and acceptance above the immediate resistance will confirm bullish stability, with a natural retest expected toward the breakout zone and the immediate support zone.

If this retest is successful and price holds above reclaimed structure, upside continuation remains favored toward the projected targets marked on the chart. Failure to maintain acceptance above this zone would invalidate the breakout scenario and shift focus back toward lower support.

EURUSD: Three Targets Swing Buy, One Entry! **EURUSD ANALYSIS**

🔺The daily timeframe suggests a strong bullish price trend is likely to continue. After hitting some important levels and then reversing, with a big push from bullish volume, we expect the upward momentum to keep going. The lowest point of the day was at 1.1474, where the reversal happened and they broke through the main bearish trendline. Then, they tested 1.1510 again, and things have been moving up steadily since then.

🔺Looking at the basics, the US dollar might keep losing value, mainly because of what’s happening with Venezuela. This could hurt the US dollar but help the euro and other metal prices.

🔺The *Blue Marked Zone* is where we think it’s a good time to buy, and we reckon there’s a good chance of a sharp price change with strong buying pressure. We suggest setting your stop-loss order below this zone.

🔺We’ve set up three different places to make a profit, which you can use in your trading plan. When you get to the first profit level, it’s a good idea to close some of your position and move the rest to the second level. You should do the same thing for the last time you enter.

🔺If you find our work helpful, please like and comment so we can share more. We wish you all the best with your trading and really recommend making sure you have good risk management in place. Also, we suggest doing your own thorough analysis and using this information just to learn.

Team SetupsFX_👨💻📊❤️

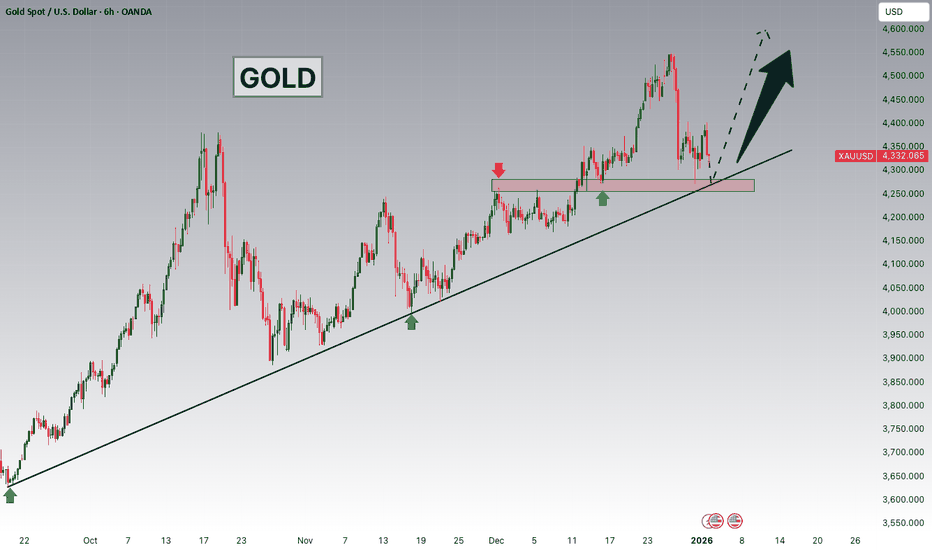

Gold Technical & Fundamental Outlook – Bullish ConsolidationGold remains in a bullish consolidation phase after recently breaking above the 4,400 level and pushing higher. This breakout confirms strong upside momentum, supported by both technical strength and rising geopolitical uncertainty.

On the fundamental side, gold prices gained on Monday following comments from U.S. President Donald Trump over the weekend, stating that Washington would temporarily run the Venezuelan government after ordering large-scale military operations. Reports suggesting the possible capture of President Nicolás Maduro have increased uncertainty over Venezuela’s future leadership, driving demand for safe-haven assets such as gold.

Technically strong support is seen near the 4,400 zone if bulls manage to defend this level, gold could resume its upward movement a sustained hold above support may trigger a quick rebound toward 4,390 / 4,480 if bullish momentum continues, upside targets are expected in the 4,438 to 4,500 range a clear break below the 4,400 support could lead to temporary consolidation, but the broader trend would remain constructive as long as prices recover quickly.

You may find more details in the chart,

Trade wisely best of luck buddies.

Ps; Support with like and comments for better analysis thanks for supporting.

USDJPY 30-Min — Volume Buy & sell Reversal Triggered⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

✈️ Technical Reasons

/ Direction — LONG / Reversal 156.200 Area

☄️Bullish momentum confirmed through strong candle body.

☄️Structure shifted with higher-low near key demand base.

☄️Volume expanding confirms order-flow alignment upward.

☄️Buyers reclaimed imbalance with sustained clean break.

☄️Algorithm detects rising momentum under low liquidity.

✈️ Technical Reasons

/ Direction — SHORT / Reversal 156.800 Area

☄️Bearish rejection confirmed through sharp candle body.

☄️Lower-high forming beneath resistance supply region.

☄️Volume decreasing confirms exhaustion in price rally.

☄️Sellers regained imbalance with heavy top rejection.

☄️Algorithm detects fading demand and shift to control.

⚙️ Hanzo Alpha Trading Protocol

The Alpha Candle defines the day’s real control zone — the first battle of momentum.

From this origin, the Volume Window reveals where the next precision strike begins.

⚙️ Hanzo Volume Window / Map

Window tracked from 10:30 — mapping true market behavior.

POC alignment exposes institutional bias and breakout potential zones.

⚙️ Hanzo Delta Window / Pulse

Delta window monitors real buying vs. selling power behind each move.

Tracks volume aggression to expose who controls the candle — buyers or sellers.

When Delta aligns with Volume Map, momentum becomes undeniable.

XRP’s Final Bull Run Mapped Out: $33 → $186 → $285 → $1,115.

• Path A (Red) = Immediate delivery

• Path B (Blue) = Normal delivery

• Path B #2 = ONLY triggered if price stays suppressed — final backup execution in Jan 1–6, 2026

This model has 3 possible executions, but only 2 primary paths. Path B #2 only happens if suppression continues.

🔴 PATH A — Immediate Delivery

(Starts: Nov–Dec 2025)

First impulse: $30–$33

Secondary spike: $186

Consolidation → climb toward $285

Final blow-off targets later: $1,115

This is the fast outcome.

🔵 PATH B — Standard Delivery

(Starts: Jan–Mar 2026)

First stop: $30–$33

Volatility waves through Feb–March

Breaks into the macro expansion zone

Major target: $285

Final target: $1,115

This path is smoother and slightly delayed.

🔵 PATH B #2 — Suppressed Variant (Only if A and B fail)

If price stays held down → algorithm resets and fires between Jan 1–6, 2026

Same opening move: $30–$33

Same structure as Path B afterward

Same macro targets: $285 → $1,115

📅 Key Timing Windows

Nov 2025 → Jan 2026: Entry + breakout window

Mar 21, 2026: Mid-cycle reversal point

Aug 14, 2026: Warning Zone

Oct–Nov 2026: Pullback

Jan 1, 2027: Final liquidity window

🔑 Summary

Only Path A or Path B are required. Path B #2 is the failsafe if price remains artificially suppressed. All three lead to the same final targets.

— NeverWishing

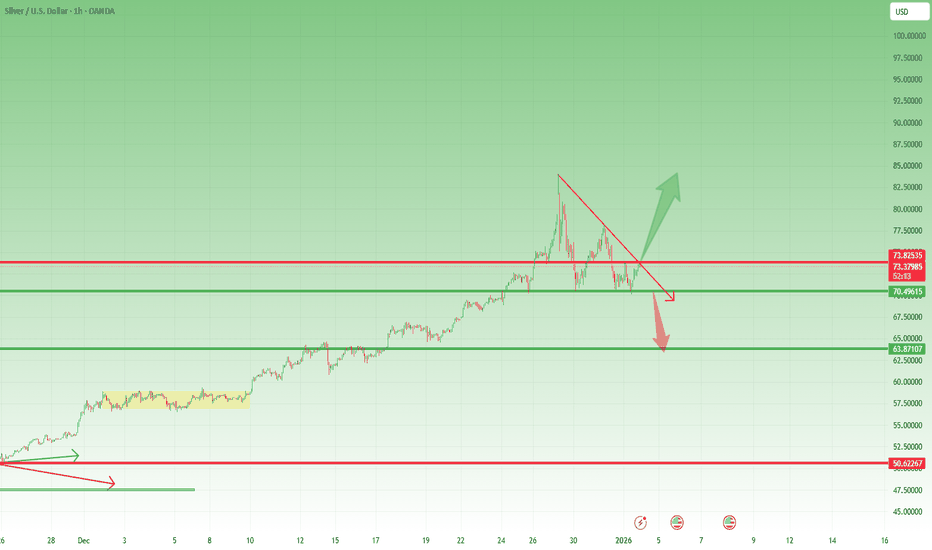

Sell Silver silver is on a corrective move, forming a descending triangle at the moment, with lower highs and equal lows on the higher time frame 4h. the lower time frame, 5m is forming the opposite, equal highs and higher lows, which means there is a correction inside a correction, and the extension on the 5m is targeted at 74, so the setup here becomes, sell stop limit order at 74. with stop loss at 75, and take profit at 62.

entry type: sell stop limit order: 74.00

stop loss: 75.00

take profit: 62.00

TradeCityPro | Bitcoin Daily Analysis #256👋 Welcome to TradeCity Pro!

Let’s move on to Bitcoin analysis. The market trend has started, and long triggers are being activated one after another.

⏳ 1-hour timeframe

Yesterday, Bitcoin made another bullish leg, and after breaking 89,040 and 90,373, it also activated the next trigger at 91,585.

✔️ At the moment, the zone Bitcoin has reacted to is 93,026, but the main resistance is located at 94,157.

📊 So far, we have had three entry points on Bitcoin, all of which are in profit, and from now on, any new entry on Bitcoin will be much riskier.

⚡️ For now, we can move our stop-losses up to the previous low at 91,118, and for taking profit, the next suitable zone would be 94,157.

↗️ For a new position, we can consider the break of 93,026 as a trigger, but the key point is that we have a major resistance at 94,157, which lies before Bitcoin reaches its target and can prevent this bullish wave from continuing, pushing the price into a correction.

🎲 For this reason, in my opinion, the 93,026 trigger is not very attractive and is quite risky, and personally, until 94,157 is broken, I won’t open any new positions on Bitcoin using another trigger.

🔽 As for short positions, the situation is completely clear: for now, we need to wait until a trend change occurs and a bearish structure is formed, and only then look for short triggers.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Silver — Strong Bull Trend, but Is the Correction Really Over?After the explosive rally to a new all-time high near the 84 zone, OANDA:XAGUSD experienced a sharp correction, dropping nearly 15,000 pips — a natural reaction after such an extended move.

Buyers eventually regained control just above the 70 zone, where the market established a solid floor.

However, the first rebound produced a lower high, and the following high was also lower — which currently shapes what appears to be a potential descending triangle structure (still unconfirmed at this stage).

❓ Key Question: Is the Correction Finished?

From a long-term perspective, there is no doubt about the dominant trend — Silver remains strongly bullish over the macro horizon.

But the short-term issue remains:

👉 Has the correction already ended, or is there more downside risk ahead?

Right now, the answer depends on two critical levels.

⚖️ Decision Levels to Watch

1️⃣ 74 Resistance Zone

A clean breakout above 74 would

✔️ invalidate the current corrective structure

✔️ confirm bullish continuation

✔️ open the door toward further upside extensions

2️⃣ 70 Support Zone

A breakdown below 70 would

⚠️ strengthen the descending-triangle scenario

⚠️ expose Silver to a deeper correction

➡️ potentially toward the 63 zone

📌 Trading Stance for Now

Given today’s low-liquidity environment, the prudent approach is:

👉 wait for confirmation rather than forcing a position

Price action around 70 and 74 will likely provide the next major directional clue. Until then — patience remains the best strategy. 🚀

USDCAD Outlook | Downtrend + January FOMC Rate Cut Risk!Hey Traders,

In tomorrow’s trading session, we are closely monitoring USDCAD for a potential selling opportunity around the 1.37800 zone. USDCAD remains in a clear downtrend and is currently in a corrective pullback, approaching a key trendline confluence and the 1.37800 support-turned-resistance area, which could act as a strong rejection zone.

From a fundamental perspective, growing expectations of a potential interest rate cut at the January FOMC meeting could weaken the US Dollar, adding further downside pressure on USD-based pairs, including USDCAD, and reinforcing the bearish bias.

As always, wait for confirmation and manage risk accordingly.

Trade safe,

Joe.

Gold Bullish Outlook | Dollar Weakness & Geopolitical Risks!Hey Traders,

In the coming week, we are closely monitoring XAUUSD (Gold) for a potential buying opportunity around the 4,280 zone. Gold remains in a strong bullish trend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and 4,280 support & resistance zone, which could act as a high-probability demand area.

From a macro perspective, the recent weakness in the US Dollar continues to support upside momentum in Gold. Additionally, last night’s escalation of US tensions with Venezuela has increased geopolitical uncertainty, further boosting safe-haven demand for Gold, which strengthens the bullish bias.

As always, wait for confirmation and manage risk accordingly.

Trade safe,

Joe.

XAUUSD (H2) – BUY priority today Gold holds above 4,400 on safe-haven flows | Trade liquidity, don’t chase

Quick summary

Gold started the week with strong momentum and pushed above 4,400 during the Asian session as global markets rotated into safe-haven assets. Geopolitical risk is the key driver after reports of US ground strikes in Venezuela and the detention of President Nicolás Maduro and his wife.

With that backdrop, my plan today is simple: prioritise BUY setups at liquidity zones, and avoid FOMO while price is elevated.

1) Macro context: Why gold is supported

When geopolitical risk escalates, capital typically flows into gold.

Headline-driven sessions often bring:

✅ fast pumps, ✅ liquidity sweeps, ✅ larger wicks/spreads.

➡️ The safest execution is waiting for pullbacks into predefined buy zones, not chasing highs.

2) Technical view (based on your chart)

On H2, gold has bounced sharply and your chart highlights clear execution areas:

Key levels for today

✅ Buy zone: 4340 – 4345 (trend/structure pullback zone)

✅ Strong Liquidity: lower support band (marked on chart)

✅ Sell zone: 4436 – 4440 (near-term supply / reaction area)

✅ Sell swing / target: 4515 – 4520 (higher objective / profit-taking zone)

3) Trading plan (Liam style: trade the level)

Scenario A (priority): BUY the pullback into 4340–4345

✅ Buy: 4340 – 4345

SL (guide): below the zone (adjust to spread / lower TF structure)

TP1: 4400 – 4410

TP2: 4436 – 4440

TP3: 4515 – 4520 (if momentum continues with headlines)

Logic: 4340–4345 offers a cleaner R:R than chasing above 4,400.

Scenario B: If price holds above 4,400 and only dips lightly

Look for a buy only on clear holding signals near the closest support/strong liquidity (M15–H1).

Still not recommending FOMO entries in headline volatility.

Scenario C: SELL reaction (scalp) at supply

✅ If price tags 4436–4440 and shows weakness:

Sell scalp: 4436 – 4440

SL: above the zone

TP: back toward 4400–4380

Logic: This is a near-term supply area — good for quick profit-taking, not a long-term reversal call.

4) Notes (avoid getting swept)

Asian session can spike hard on headlines → wait for pullback confirmations.

Reduce size if spreads widen.

Only execute when price hits the level and prints a clear reaction (rejection / engulf / MSS).

What’s your plan today: buying the 4340–4345 pullback, or waiting for price to push into 4515–4520 before reassessing?

USDJPY 30-Min — Volume Buy & sell Reversal Triggered⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

✈️ Technical Reasons

/ Direction — LONG / Reversal 156.200 Area

☄️Bullish momentum confirmed through strong candle body.

☄️Structure shifted with higher-low near key demand base.

☄️Volume expanding confirms order-flow alignment upward.

☄️Buyers reclaimed imbalance with sustained clean break.

☄️Algorithm detects rising momentum under low liquidity.

✈️ Technical Reasons

/ Direction — SHORT / Reversal 156.920 Area

☄️Bearish rejection confirmed through sharp candle body.

☄️Lower-high forming beneath resistance supply region.

☄️Volume decreasing confirms exhaustion in price rally.

☄️Sellers regained imbalance with heavy top rejection.

☄️Algorithm detects fading demand and shift to control.

⚙️ Hanzo Alpha Trading Protocol

The Alpha Candle defines the day’s real control zone — the first battle of momentum.

From this origin, the Volume Window reveals where the next precision strike begins.

⚙️ Hanzo Volume Window / Map

Window tracked from 10:30 — mapping true market behavior.

POC alignment exposes institutional bias and breakout potential zones.

⚙️ Hanzo Delta Window / Pulse

Delta window monitors real buying vs. selling power behind each move.

Tracks volume aggression to expose who controls the candle — buyers or sellers.

When Delta aligns with Volume Map, momentum becomes undeniable.

USNAS100 remains in a medium-term ascending channelUS100 remains in a medium-term ascending channel, respecting both higher highs and higher lows. Price is currently consolidating near the mid-channel support, suggesting a potential continuation move.

The USNAS100 are higher on Monday following the capture of Venezuela president Nicolas Maduro by the U.S in a military strike over the weekend Donald stated that the united states would run Venezuela until a proper political transition takes place

Tecnically bullish reaction from the rising trendline could lead to a push toward the 25,800 resistance, with a breakout opening the door for a move toward the 26,100–26,200 zone If the bulls manage due the price recently back to support and is now holding above it this suggest still active bullish momentum the small may price test the support after growth.

You may find more details in the chart,

Trade wisely best of luck buddies.

Ps; Support with like and comments for better analysis thanks for supporting.