GOLD - Correction ahead of the Fed meeting. What next?FX:XAUUSD hit a new high of 5311 and entered a correction phase (profit-taking) ahead of the Fed's interest rate meeting...

Fundamental situation

Tensions between the US and NATO over plans for Greenland. Trump's threats to impose 100% tariffs on goods from Canada. Fruitless negotiations between Russia and Ukraine

Fed:

Expectations that rates will remain unchanged at the January 31 meeting. Powell's tone and the appointment of a new Fed chair (announcement possible today) could increase volatility. However, the market is pricing in two Fed rate cuts in 2026, despite a possible pause in the near term.

US consumer confidence index fell to an 11.5-year low (84.5), supporting demand for gold

Resistance levels: 5285, 5310, 5350

Support levels: 5250, 5230, 5190

Gold maintains its upward momentum thanks to geopolitical risks and expectations of a soft Fed policy. However, news volatility could trigger a correction before the growth continues. Focus on key (marked) support levels.

Best regards, R. Linda!

Trend Line Break

GOLD - Correction after the rally. Focus on support!FX:XAUUSD , after hitting a new all-time high of 5597, is entering a correction phase due to profit-taking triggered by local news. Overall, the structure is bullish, and the market will be able to return to growth after the pullback.

Fundamental situation

Trump's threats against Iran and Tehran's response. The active conflict between Russia and Ukraine generally supports interest in hedge assets.

Fed : Rates remain unchanged, investigation against Powell and pressure on the Fed undermine confidence in the regulator's independence. The market still expects two Fed rate cuts in 2026.

Near-term indicators: US jobless claims data (today). Any further weakening of the dollar or escalation of geopolitical tensions will resume gold's growth.

Gold's correction is a natural pause after a sharp rise. The combination of geopolitical risks, pressure on the Fed, and a weak dollar supports the uptrend. Pullbacks to $5475 - 5391 can be seen as a buying opportunity.

Resistance levels: 5515, 5595, 5597

Support levels: 5475, 5453, 5391

After strong growth, the market may form a correction of 50-70% relative to the momentum formed within the trading session. All attention is on the support zones: 5475, 5453, 5391. A long squeeze will provide an opportunity for growth.

Sincerely, R. Linda!

XAUUSD – M30 Technical Outlook Mild Pullback Before the Next High | Lana ✨

Gold has extended sharply and is now trading into a high-resistance zone, where price often needs a light correction or consolidation to rebuild liquidity before attempting higher levels again. The broader trend remains bullish, but the next clean opportunity is more likely to come from a pullback into structure, not from chasing the highs.

📈 Market Structure & Trend Context

Price is still respecting the broader bullish structure, but the current leg is stretched after a strong impulsive run.

The market is now reacting under the highest resistance zone, which typically creates short-term profit-taking and liquidity reactions before continuation.

As long as price holds above key structural support, the bullish trend remains intact.

🔍 Key Technical Zones

Highest resistance zone: 5585 – 5600

This is a premium area where price may hesitate or reject in the short term.

First support zone: 5508

A key decision level where price can rebalance before choosing direction.

Buy liquidity zone: 5446 – 5450

A strong liquidity pocket where buyers are more likely to step back in.

Long-term support zone: 5265 – 5285

A deeper base area if volatility expands into a broader correction.

🎯 Trading Scenarios

Gold may correct modestly from resistance and retest structure before pushing higher.

Buy Entry: 5446 – 5450

Stop Loss: 5438 – 5440

Take Profit targets:

TP1: 5508

TP2: 5538 – 5545

TP3: 5585 – 5600

TP4: 5650+

A shallower pullback toward 5508 could also be enough to reset momentum before another attempt higher, but repeated rejection at the top would increase the risk of deeper consolidation.

🧠 Lana’s View

Gold remains bullish, but the market is now at a level where patience matters more than speed.

Rather than chasing price near resistance, the focus should stay on how price reacts during pullbacks into key structural zones.

✨ Respect the structure, manage risk, and let price come to your level.

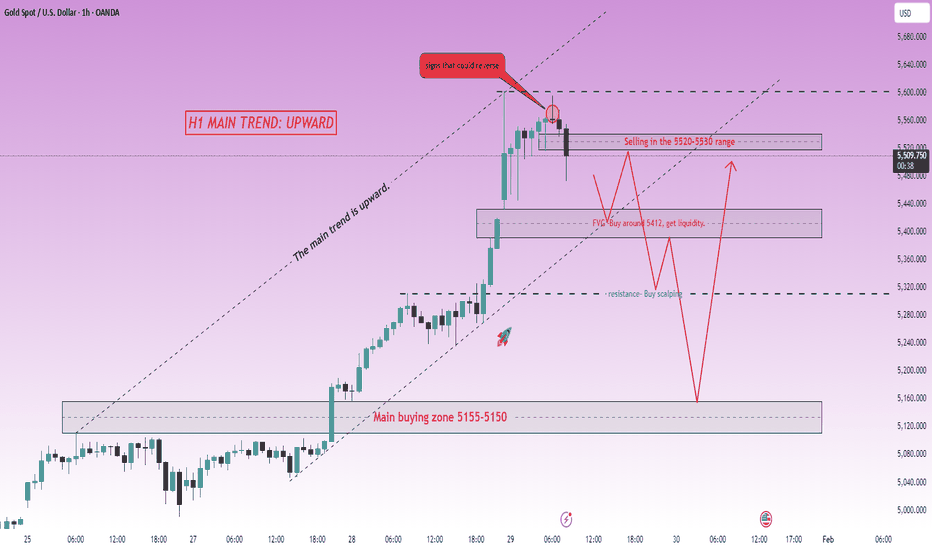

XAUUSD (H1) – Liam Plan

Uptrend intact, but signs of short-term exhaustion | Trade reactions, not impulse

Quick summary

Gold remains in a strong H1 uptrend, continuing to print higher highs and higher lows within a well-defined bullish structure. However, after the recent sharp advance, price is starting to slow near the highs, increasing the likelihood of short-term pullbacks and two-sided price action.

➡️ The broader trend stays bullish, but execution should now be level-driven and reaction-based, not momentum chasing.

Technical view

Price is currently trading at elevated levels relative to recent structure, where prior buying activity has already been absorbed.

Key price areas to watch:

Short-term sell area: 5520 – 5530

Upper resistance area: around 5600

Pullback buy area: 5405 – 5420

Primary buy zone: 5150 – 5155

The current structure favors a pullback and rebalancing phase before any sustained continuation higher.

Trading scenarios

SELL – short-term reaction trades

Look for sell reactions around 5520 – 5530 if price shows weakness.

Downside targets sit near 5420, with further extension possible if the pullback develops.

These sells are tactical and short-term, not calls for a trend reversal.

BUY – aligned with the main trend

Primary scenario

Buy pullbacks into 5405 – 5420 if the area holds.

Targets back toward 5520 and higher.

Deeper scenario

If volatility increases, wait for price to retrace toward 5150 – 5155.

This area offers the best risk-to-reward for trend continuation.

Key notes

Strong trends still correct; patience matters.

Avoid entries in the middle of the range where risk outweighs reward.

Short positions are tactical only while the broader structure remains bullish.

What’s your plan:

selling reactions near 5520 – 5530, or patiently waiting for a pullback into 5405 – 5420 to rejoin the uptrend?

— Liam

What is the final price level for gold this January?1️⃣ Trendline

Main trend: STRONG UP

Price is moving within a steep ascending channel (blue channel).

The Higher High – Higher Low structure remains clearly intact.

The recent rally was an accelerated breakout move, showing buyers are in control.

👉 Currently, price is in the upper half of the channel, meaning the market is strong but prone to a short-term technical pullback.

2️⃣ Resistance

🔵 5,700 – 5,702:

A strong resistance zone (top of the channel + supply area above).

If price reaches this zone, profit-taking and strong volatility are likely.

📌 Bullish continuation scenario:

A clear break and close above 5,700 is needed to confirm continuation toward higher price levels.

3️⃣ Support

🟢 5,500 – 5,502:

Nearest support, the consolidation zone before the recent breakout.

If this level holds → short-term uptrend remains strong.

🟢 5,448 – 5,450:

Strong support (pullback low + bottom of the consolidation range).

This is a zone where strong buying pressure may appear if price corrects deeper.

4️⃣ Quick Summary

The main trend remains UPTREND.

Price is near a volatile area → it’s safer to wait for a pullback to support to buy rather than chasing at high levels.

A break below 5,445 would be the first clear sign of weakness in the current bullish move.

Trading Plan

BUY GOLD: 5,500 – 5,502

Stop Loss: 5,510

Take Profit: 100 – 300 – 500 pips

BUY GOLD: 5,448 – 5,450

Stop Loss: 5,440

Take Profit: 100 – 300 – 500 pips

GBPUSD - The hunt for liquidity before the trend continues FX:GBPUSD entered a local correction phase amid a pullback in the dollar after a strong rally. The main trend is bearish, and growth after the correction may continue.

A correction has been forming since the opening of the session. The dollar is recovering slightly, while the pound is correcting towards the daily level of 1.377 and the Fibonacci area of 0.5-0.6. If the bulls hold back the correction, the market may return to the trend.

The main/medium-term trend is bullish. The correction and false breakout of support may shift the imbalance of forces towards buyers, which could trigger growth from strong levels.

Resistance levels: 1.3831, 1.38688

Support levels: 1.377, 1.3748

A false breakdown of support and the upward trend line could trigger growth within the main trend

Best regards, R. Linda!

SOLUSDT - Bears increased pressure after retesting resistance BINANCE:SOLUSDT bounces off trend resistance and updates its local minimum to 122.4. A bearish phase is developing in the market, and a small correction is possible before the fall.

The daily timeframe indicates a crypto winter, a downtrend, and weak buying power due to capital outflows and a weak fundamental background.

Bitcoin is testing 90K and has once again been rejected by the resistance zone. Liquidation and a fall to the intermediate support zone have formed. Altcoins reacted aggressively to this impulse.

Resistance levels: 126.6, 130.5

Support levels: 123.0

SOLANA has two key levels: 123.0, closing below which could trigger a sell-off and a drop to 116.7. And resistance at 126.6, which acts as a zone of interest. It is possible that altcoins may test resistance in search of liquidity.

Best regards, R. Linda!

USDJPY - Interventions strengthen the JPY (price decline)FX:USDJPY is in a negative rally phase, passing through the entire trading range, breaking through the daily timeframe support at 154.450 and closing below the level, hinting at a possible continuation of the decline.

The dollar is falling, the yen is strengthening. The Bank of Japan intervened, which contributed to the strengthening of the national currency. The current movement may continue...

The currency pair breaks through the fairly important support level of 154.500 (154.45) as part of the rally and closes below the level. Consolidation is forming on the local timeframe, which may be aimed at a further decline. A short squeeze in the 154.45 zone could trigger a decline to 153 - 151.8

Resistance levels: 154.45, 155.65

Support levels: 152.96, 151.85

A breakdown from the local consolidation could trigger a continuation of the decline, as could a retest of the nearest resistance (liquidity hunt).

The market still has the potential to continue falling to 151.85 and to the intermediate bottom of 149.5.

Best regards, R. Linda!

GOLD - The market bought the dip. ATH retest. 5150?FX:XAUUSD , after an aggressive rally, faced a correction (profit-taking) near 5100. However, the market is quickly buying back the decline and is once again storming the ATH with the aim of continuing its growth.

Fundamental situation

- Trump continues to escalate relations with Canada (new tariffs) and maintains tensions with the EU...

- Russia-Ukraine negotiations in Abu Dhabi ended without result, which maintains geopolitical risks.

- The Fed meeting (decision on January 31) will be the main event of the week. Rates are expected to remain unchanged, but Powell's tone could cause volatility. However, the market expects two Fed rate cuts in 2026.

Technically, the market has the potential to continue its movement due to fundamental support.

Resistance levels: 5100, 5111, 5125, 5150

Support levels: 5075, 5055

In the current situation, it is logical to consider two scenarios:

- steady growth without pullbacks and a storming of resistance could lead to a breakout of 5100 and an upward momentum. Local target 5125-5150

- retest of the liquidity zone (long-squeeze) 5075 - 5055 before continuing growth

Best regards, R. Linda!

XAUUSD – Brian | M45 Technical Outlook

Gold remains firmly supported above the 5,000 level, with price action continuing to respect the broader bullish structure on the M45 timeframe. Despite recent intraday volatility, the market shows clear signs of acceptance at higher prices rather than distribution.

From a fundamental perspective, holdings of the SPDR Gold Trust, the world’s largest gold-backed ETF, remained unchanged at 1,086.53 tonnes. While ETF flows are neutral for now, the lack of outflows suggests that institutional positioning remains stable even as gold trades at record levels — a constructive backdrop for the broader trend.

Market Structure & Technical Context (M45)

On the M45 chart, XAUUSD continues to trade above its ascending trendline, maintaining a sequence of higher highs and higher lows. The recent pullback appears corrective in nature rather than impulsive, fitting well within a continuation framework.

Key technical elements highlighted on the chart:

Price holding above the value area, indicating ongoing buyer participation.

A buy-on-dip zone around 5,040, aligned with trendline support and prior structure.

Sell-side liquidity resting below recent lows, suggesting downside moves may be driven by liquidity sweeps rather than genuine weakness.

A push through recent highs opens the path toward ATH continuation.

Key Levels & Liquidity Zones

Primary support: 5,040 (value + trendline confluence)

Intermediate resistance: 5,150 (short-term reaction / scalping zone)

Major resistance: 5,209 (strong resistance and potential reaction area)

As long as price remains above the rising trendline, pullbacks should be viewed as part of trend development rather than reversal signals.

Forward Expectations & Bias

The market continues to trade in a momentum-driven environment, where structure and liquidity play a larger role than traditional indicators. Acceptance above 5,000 keeps the upside scenario intact, while short-term consolidations are likely to serve as fuel for continuation.

Primary bias: Bullish continuation while structure holds

Focus: Patience on pullbacks, discipline near resistance zones

Preferred confirmation timeframe: M45–H1

Strong trends do not move in straight lines. Staying aligned with structure and liquidity remains key in this phase.

Refer to the accompanying chart for a detailed view of market structure, liquidity zones, and key technical levels.

Follow the TradingView channel to get early market structure updates and join the discussion.

"How does the extreme volatility of gold manifest itself?"📈 1️⃣ Trendline / Main Trend

The overall trend remains BULLISH as price continues to hold above the long-term ascending trendline (the lower diagonal support).

The market structure is still forming long-term Higher Lows, with no signs of a major trend breakdown.

The recent sharp decline appears to be a shakeout rather than a reversal, since price has not closed below the main trendline.

➡️ Trend Conclusion: The medium-term uptrend remains valid, and the current move is a corrective phase.

🟥 2️⃣ Resistance

🔹 5,316 – 5,320

Former breakout zone → now acting as near-term resistance.

Price may react when pulling back to retest this area.

🔹 5,438 – 5,450

Strong resistance (previous top + prior supply zone) + GAP.

A clear break and strong candle close above this zone would confirm bullish continuation.

➡️ At the moment, rallies into these zones may face short-term selling pressure.

🟩 3️⃣ Support

🔹 5,090 – 5,100

Key support zone aligned with the ascending trendline.

This area is crucial for maintaining the bullish market structure.

A strong bounce here would help preserve the medium-term uptrend.

🔹 If 5,090 is broken

Price may enter a deeper corrective phase.

The short-term bullish structure would then be invalidated.

🔻 Trade Setups

SELL GOLD: 5,316 – 5,318

Stop Loss: 5,330

Take Profit: 200 – 400 pips – Open

SELL GOLD: 5,438 – 5,440

Stop Loss: 5,452

Take Profit: 200 – 400 pips – Open

🟢 BUY Setup

BUY GOLD: 5,098 – 5,100

Stop Loss: 5,086

Take Profit: 200 – 400 pips – Open

Gold prices hit a record high ahead of the interest rate decisio1️⃣ Trendline

Price is moving clearly within an ascending channel.

The Higher High – Higher Low structure remains intact → the main trend is still BULLISH.

The most recent strong rally was a breakout from a consolidation zone, confirming that buyers are in control.

2️⃣ Resistance

🔵 5,278 – 5,280 (Strong Resistance Zone)

Confluence of: channel top + previous supply zone + trendline + Fibonacci level.

Profit-taking and short-term pullbacks are likely to appear here.

To confirm further upside → price needs a clear breakout and candle close above this zone.

3️⃣ Support

🟢 5,200 (Near-term Support)

The most recent breakout area → first technical support.

If price pulls back and holds here, the uptrend remains valid.

🟢 5,105 (Strong Support)

Recent structural low + lower boundary of the ascending channel.

If price drops deeper into this area and shows a buying reaction → potential continuation of the medium-term uptrend.

4️⃣ Main Scenario

✔ The trend still favors buying the dip while price holds above 5,200.

✔ A strong break above 5,280 → opens room for further upside within the channel.

⚠ A break below 5,105 → warns of a short-term structure breakdown and a deeper correction.

📌 Trading Plan

BUY GOLD: 5,200 – 5,202

Stop Loss: 5,190

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 5,278 – 5,280

Stop Loss: 5,288

Take Profit: 100 – 300 – 500 pips

BITCOIN - Consolidation below 90K. Weak marketBINANCE:BTCUSDT failed to break through the 90K area, and the market is forming a cascade of resistance, indicating the dominant position of sellers in the current circumstances.

The market still looks quite weak, and any attempts at growth are a hunt for liquidity. Global and local trends are bearish, with sales dominating (outflow of funds).

There is no fundamental support, the transfer of assets to crypto exchanges and the outflow of funds from ETF funds continues, which in general indicates weak market sentiment during the crypto winter. The current cycle is downward, and there is a possibility of a retest of the 80,000-75,000 zone.

Technically, Bitcoin is facing strong resistance at 89K and, unable to continue its growth, is rebounding and heading downwards. A short squeeze may form before the fall.

Resistance levels: 88,950, 89,590, 90,350

Support levels: 86970, 86100

If the bears keep the price below 89000, the market may fall to an intermediate bottom of 86000, however, closing below 86K could signal a further decline to 80K.

Best regards, R. Linda!

Bitcoin Squeeze Point – Breakout or Breakdown?Bitcoin is approaching a key inflection zone where the Daily Downtrend Resistance and the Monthly Uptrend Support intersect. This confluence could be setting the stage for a major breakout or breakdown, and the next move could define BTC’s medium-term trend.

🧠 Key Levels to Watch:

Daily Downtrend Resistance (Red) – Price is testing this descending trendline again.

Monthly Uptrend Support (Green) – Strong support held since August 2024.

Fibonacci 0.5 Level (~79.3K) – Acting as mid-zone control point.

Fibonacci 0.618 Golden Zone (~72K) – Strong historical retracement support.

🟦 Bullish Scenario (Blue Arrow):

If BTC breaks above the daily downtrend and holds above the green uptrend line:

Possible target: 110K, aligning with the 1.0 Fibonacci extension.

Would confirm continuation of the larger bullish trend.

🔻 Bearish Scenario (Not drawn but implied):

If BTC breaks down below 79K and the monthly trendline:

Eyes on 72K for a potential bounce at the 0.618 Fib level.

Below that, potential deeper retracement toward the 65K–60K zone.

⏳ Conclusion:

BTC is sitting at a high-confluence zone. This is not the time to chase—wait for confirmation of breakout or breakdown before reacting.

GOLD - Waiting for a pullback to enter a long position...FX:XAUUSD continued its record growth for the sixth consecutive day, reaching $5,110. The driving forces behind this are geopolitical uncertainty, expectations of a softening of Fed policy, active purchases by central banks, and an outflow from the dollar...

Fundamental drivers

Geopolitics: Russia-Ukraine, Trump's threats of 100% tariffs on Canada, and the risks of further escalation with the EU...

The dollar fell to its lowest level since September 2025 due to interventions by the Bank of Japan and expectations of interest rate cuts. At the same time, central banks in many countries continue to show high interest in the metal.

The Fed's interest rate meeting is coming up (January 31 - February 1). The tone of the regulator is important; there are doubts about further rate cuts, and if this is confirmed, the market may enter a correction...

Resistance levels: 5110, 5150

Support levels: 5080, 5055, 5031

Technically, it is quite risky to open long trades from the current price position (in the 5090 zone). I recommend waiting for a correction to the specified support zones to find more profitable and safer entry points!

Best regards,

Will gold prices return to a liquid state and continue to rise? 📈 1️⃣ Trendline

Primary Trend: BULLISH

Price is moving within a medium-term ascending channel

Market structure continues to form Higher Highs – Higher Lows

The recent decline is only a technical pullback to the rising trendline

No structural breakdown → no confirmed reversal

➡️ The lower trendline is currently acting as dynamic support

🟦 2️⃣ Support Zones

🔹 4,996 – 4,994 → Near-term support

Confluence of ascending trendline + recent demand zone

If price reacts positively here → high probability of bullish continuation

🔹 4,974 – 4,976 → Stronger support + structure retest

Aligns with Fibonacci level + previous structural low

A break below this zone would signal weakening bullish momentum

🟥 3️⃣ Resistance Zones

🔸 5,109 – 5,111 → Near-term resistance / recent high

Price has reacted multiple times at this level

A clear breakout and close above is needed to confirm bullish continuation

🔸 5,148 – 5,150 → Major resistance / supply zone

Next upside target if breakout occurs

Strong profit-taking pressure may appear here

🎯 Trading Plan

🟢 BUY GOLD: 4,996 – 4,994

Stop Loss: 4,989

Take Profit Targets: +100 / +300 / +500 pips

🔴 SELL GOLD: 5,148 – 5,150

Stop Loss: 5,155

Take Profit Targets: +100 / +300 / +500 pips

GOLD - Test $5000... Will the rally continue?FX:XAUUSD closes Friday's session with a new record and consolidation after the rally. Focus on 4988 - 4968. The session closed quite favorably for continued growth, everything depends on Asian traders...

Fundamentals:

The tense situation between Trump and the EU over Greenland and tariffs is still present. The Bank of Japan intervened (which strengthened the yen), triggering a fall in the dollar, which in turn is affecting the price of gold. Overall, the market remains aggressively bullish.

New session:

- Fed meeting (January 31) – focus on Powell's tone. Softening rhetoric on inflation could weaken the dollar and support gold.

- Selection of a new Fed chair (announcement possible by the end of January) – candidates Waller or Warsh are perceived as more “dovish,” which could put pressure on the dollar.

- Geopolitics – any escalation with Iran will trigger a new influx into gold

Resistance levels: 4988, 5000, 5024

Support levels: 4967, 4958, 4945

Gold maintains its upward momentum, driven by a weak dollar and geopolitical risks. Any correction is likely to be limited.

Asian traders may buy up all the supply. A breakout and close above 4988 could trigger a continuation of the rally to 5025-5050. However, it is possible that the market may test support at 4958-4945 before rallying...

Best regards, R. Linda!

LTCUSDT - Hunting for liquidity before the fallBINANCE:LTCUSDT is consolidating below 70.0 before a possible continuation of the decline. The global trend is downward, liquidity is low...

After a sharp decline, the coin entered a consolidation phase, during which a cascade of support is observed, which may falsely indicate the presence of a buyer. The goal of such a maneuver may be to capture liquidity at 69.70 before falling to 65.0

Within the context of a downtrend and low liquidity, MM may form a retest of the 69.3-69.7 zone (liquidity area) to continue consolidation and further decline to 67-65.

Resistance levels: 69.30, 69.70

Support levels: 67.0, 65.3

A retest of the resistance and liquidity zone and the absence of bullish momentum may form a false breakout of the upper boundary of consolidation, which in turn may provoke a continuation of the decline towards both local targets and the global bottom...

Best regards, R. Linda!

BTCUSDT - The battle for 90K may end in a decline BINANCE:BTCUSDT , against the backdrop of Trump's speech and various comments, caused a shake-up within the range of 87,800-90,300, but the price is consolidating below key resistance within the current downtrend...

The downtrend may continue if Bitcoin consolidates below 90K. There is a chance of this happening as there is still no fundamental support for the market. Everyone is talking about the "CLARITY Act" on cryptocurrencies, but there is no date for its signing, and there are rumors that the process may be postponed until late winter or mid-spring, leaving the market without a bullish driver.

The market is experiencing a phase of struggle for the 90K resistance zone. Bears are stubbornly resisting, forming a false breakout and consolidation below resistance. The structure could be broken if there is an impulsive breakout of the 90,500 zone and the bulls are able to keep the price above this zone, but the bears have formed a fairly strong resistance zone.

Resistance levels: 90,400, 91,400

Support levels: 87800, 85000

I do not rule out another attempt to retest the 90350 zone, but if the bears keep the price below 90K, the market will have no chance for growth. In this case, a pullback to 89K - 88K can be considered.

Best regards, R. Linda!

What will the new ATH level be? 26/01/20261️⃣ Trendline

Main trend: BULLISH (UPTREND).

Price remains above the long-term ascending trendline → Higher High – Higher Low structure is still valid.

The current move is a technical pullback after a strong bullish wave, with no reversal signal confirmed yet.

2️⃣ Resistance

5,138 – 5,140: Strong resistance (target peak + upper boundary of the channel).

Scenario: Profit-taking / price congestion is likely to appear.

Bullish continuation condition: Clear break & close above this zone.

3️⃣ Support

5,021 – 5,019: Nearest support (confluence of ascending trendline + horizontal support).

If held → prefer buying in line with the trend.

If broken → price may pull back deeper toward the lower trendline / EMA.

4,967 – 4,965: Deeper support + EMA zone + liquidity sweep area (backup support).

📈 Trade Plan

BUY GOLD: 5,021 – 5,019

Stop Loss: 5,011

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 5,138 – 5,140

Stop Loss: 5,148

Take Profit: 100 – 300 – 500 pips

Why Strategy Performance Depends More on Testing Than LogicTwo traders can trade the exact same strategy and walk away with completely different conclusions. One calls it profitable. The other calls it broken. Most of the time, neither is wrong.

The difference usually isn’t the strategy logic. It’s the testing.

Strategy logic explains why a trade might work. It tells a coherent story about market behavior, momentum, mean reversion, or trend. But logic alone doesn’t tell you how often that behavior holds up, how sensitive it is to small changes, or how it behaves when conditions shift. That’s where many disagreements begin.

Backtesting helps by expanding the sample beyond a single outcome. A strategy that looks reliable on one chart, timeframe, or parameter set may behave very differently when those assumptions are adjusted. Small changes in inputs, market regime, volatility, or timeframe can dramatically alter performance, drawdown, and consistency. Without testing across these variations, it’s easy to mistake coincidence for edge.

This is why strategy debates never really end. Each trader is often judging performance based on a limited slice of data. Within that slice, their conclusion feels justified. One trader may be looking at a period where conditions favored the strategy. Another may be looking at a period where those same rules struggled. Both are drawing conclusions from incomplete information.

Backtesting doesn’t exist to “prove” a strategy works. Its real value is in revealing distribution. It shows how often a strategy succeeds, how often it fails, and how fragile or stable it is when assumptions are changed. Robust strategies tend to exhibit similar behavior across a range of conditions. Fragile strategies depend heavily on specific settings or environments remaining intact.

This is also why optimization alone can be misleading. A strategy that produces exceptional results at a single configuration may collapse when slightly perturbed. Testing across broader parameter ranges helps separate genuine structural behavior from overfitting.

Logic still matters. Backtesting doesn’t replace it. But without testing, logic remains theoretical. With testing, it becomes contextualized. Performance stops being a story and starts becoming measurable.

Most disagreements in trading aren’t really about the market. They’re about how much of the picture has actually been tested.

XAUUSD – Brian | H3 Technical Analysis

Gold continues to trade within a well-defined bullish structure on the H3 timeframe, supported by strong technical momentum. Price action remains orderly, with impulsive advances followed by controlled pullbacks — a characteristic of a healthy trending market.

From a macro standpoint, geopolitical uncertainty remains elevated after recent comments from President Trump regarding increased U.S. control over strategic military areas in Greenland. While not implying direct occupation, the development adds to broader risk sensitivity and continues to support gold’s role as a defensive asset.

Market Structure & Technical Context (H3)

On the H3 chart, XAUUSD remains firmly above its rising trendline, with market structure defined by higher highs and higher lows. A prior break of structure (BOS) confirmed bullish continuation and opened the door for further expansion.

Key technical areas highlighted on the chart:

A strong impulsive leg followed by corrective pullbacks, consistent with trend continuation.

Fibonacci expansion with the 2.618 extension near the 5005 zone, acting as a major reaction area.

A liquidity pullback zone around 4825, aligned with trendline support and suitable for continuation scenarios.

A lower POC / value area acting as deeper support if volatility increases.

As long as price holds above these demand zones, the broader bullish structure remains intact.

Liquidity & Forward Expectations

Upside liquidity remains available above recent highs, while short-term pullbacks are likely driven by profit-taking rather than structural weakness. The 5000–5005 area represents a key decision zone where price may pause or consolidate before the next directional move.

Trading Bias

Primary bias: Bullish continuation while structure holds

Key zones to monitor:

4825 – liquidity pullback / trend continuation

5000–5005 – major extension & reaction zone

Preferred timeframe: H1–H4

Risk management remains essential, particularly in a market sensitive to sudden news flows.

Refer to the accompanying chart for a detailed view of market structure, liquidity zones, and Fibonacci extensions.

Follow the TradingView channel to receive early updates and join the discussion on market structure and price action.

GOLD - Correction to 4900. Is there a chance it will reach 5000?FX:XAUUSD continues to update historical highs. New 4967, bears appeared (profit-taking). The market has moved into correction, but the overall fundamental (geopolitical) background is still complex...

Expectations of further easing of Fed policy remain the main factor supporting gold.

Trump's reversal on Greenland temporarily improved sentiment, but did not stop the flow into defensive assets.

Economy : GDP for the third quarter has been revised upward to 4.4%. Core PCE (inflation) rose to 2.8% y/y. Jobless claims (200,000) were better than expected.

Despite strong indicators, the dollar is weakening amid the general trend of de-dollarization .

Today, preliminary PMI (business activity) data for key regions will be released.

The figures may affect global sentiment, but are unlikely to change the main upward trend for gold.

Resistance levels: 4935, 4967, 5000

Support levels: 4900, 4888, 4870

The current correction is a distribution of the formed consolidation 4935 - 4967. In the context of the current movement, the market may test the key support area (liquidity zone) 4900 - 4888. I do not rule out a deep long squeeze (to 4870) before renewed interest in growth. In the current cycle, there is a possibility of a retest of 5000!

Best regards, R. Linda!