GOLD - Consolidation ahead of the news? Will the trend continue?FX:XAUUSD is attempting to recover to $5,000 after a sharp 3.5% drop on Thursday. There are no clear reasons for this. All market attention is focused on today's US inflation report - CPI.

Yesterday's gold sell-off was caused not only by technical factors, but also by capital flight to the dollar amid renewed fears surrounding AI. There was no news driver, the market was overstretched, and the sharp momentum of the dollar triggered sell-offs (liquidations) in the markets.

Despite strong NFP, the market is still pricing in at least two rate cuts this year.

Ahead is CPI — the main trigger: Forecast — Core CPI slowdown to 2.5% y/y. If inflation turns out to be higher than expected, the market will reassess the Fed's plans, which will strengthen the dollar and hit gold.

High volatility is inevitable today.

Resistance levels: 4990, 5100

Support levels: 4944, 4902

Technically, local and global trends are bullish, and any correction could quickly end in growth, especially from strong levels. A breakout of 4990 and maintaining the price above this level could confirm the bullish nature of the market. On news amid high volatility, the market may test the support of the trend and the range of 4878 - 4812.

Negative scenario: a breakout and close below 4800 could trigger a fall to 4700 - 4600.

Best regards, R. Linda!

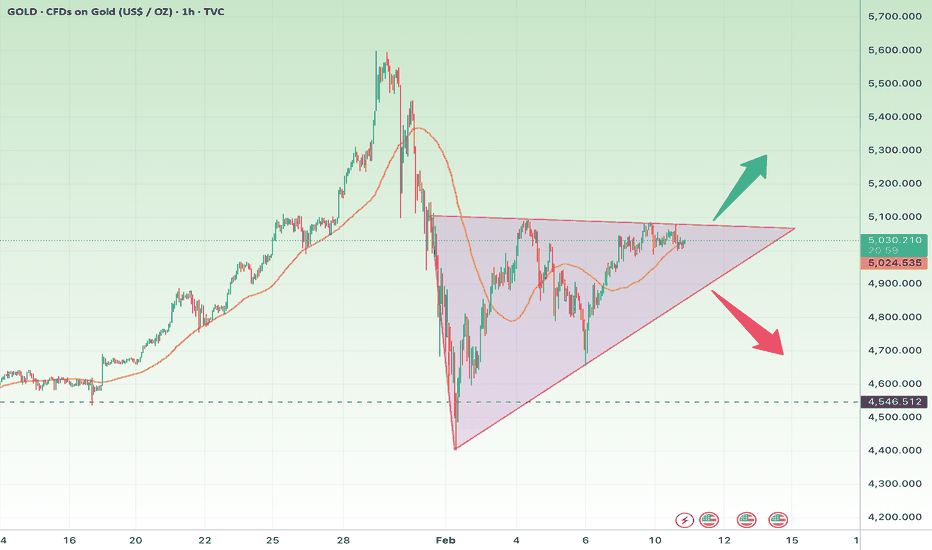

Triangle

XAUUSD: Range Holding Strong - Upside Expansion PossibleHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD previously experienced a strong bearish impulse, breaking decisively below a key support area and triggering an acceleration to the downside. This sell-off marked a clear loss of bullish control and led to a deep corrective phase. After forming a local bottom, price began to recover and transitioned into a consolidation phase, signaling a slowdown in selling pressure. During this recovery, Gold started forming higher lows while respecting a rising triangle support line, indicating that buyers were gradually stepping back into the market. As price continued to stabilize, XAUUSD broke above the descending triangle resistance line, confirming a short-term structural shift in favor of buyers. Following this breakout, price entered a well-defined range above the support zone, showing acceptance above demand rather than an immediate rejection. Multiple breakout and retest behaviors around the support area suggest that buyers are actively defending this level. The market is now compressing within this range, reflecting absorption of supply and preparation for a potential directional move.

Currently, XAUUSD is trading above the key support zone around 5,040–5,060, while holding structure above the rising triangle support line. Price action remains constructive, with recent pullbacks appearing corrective rather than impulsive. This behavior suggests that bearish attempts are being absorbed, and buyers maintain short-term control as long as price stays above support.

My Scenario & Strategy

My primary scenario favors a bullish continuation, provided XAUUSD continues to hold above the 5,040 support zone and respects the ascending triangle support line. Consolidation above demand indicates accumulation rather than distribution. A confirmed breakout and acceptance above the current range would open the path toward the 5,180 resistance zone (TP1), which aligns with a major resistance and previous supply area. This level is expected to attract selling pressure, making it a key upside objective.

However, a decisive breakdown and acceptance below the support zone and triangle support line would invalidate the bullish scenario and signal a return of bearish pressure, potentially leading to a deeper corrective move. Until that happens, market structure and price behavior continue to favor buyers.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

BTCUSDT Short: Bearish Structure Holds - Focus on 65,000 DemandHello traders! Here’s a clear technical breakdown of BTCUSDT (3H) based on the current chart structure. BTCUSDT has been trading within a well-defined descending channel, reflecting sustained bearish pressure and consistent seller control. Throughout this phase, price respected the channel boundaries, forming a series of lower highs and lower lows — a classic bearish continuation structure rather than impulsive capitulation. Eventually, BTC broke below the lower boundary of the descending channel, confirming a continuation of the bearish trend and accelerating downside momentum. After this breakdown, price entered a short consolidation range, suggesting temporary balance as sellers paused and buyers attempted to absorb supply.

Currently, BTCUSDT is consolidating beneath the descending supply line and below the horizontal Supply Zone near 71,000, signaling that bullish attempts remain corrective in nature. Price action shows compression between the descending supply line and the rising demand trend line, forming a tightening structure where a directional move is likely to emerge. Importantly, BTC has failed to reclaim the supply zone or break above the descending trend line with acceptance, suggesting that sellers still maintain higher-timeframe control.

My primary scenario favors bearish continuation, as long as BTCUSDT remains below the descending supply line and the 71,000 supply zone. A rejection from this area increases the probability of a continuation move toward the 65,000 Demand Zone (TP1), which serves as the main downside target and a key area where buyers may attempt another reaction. A clean breakdown and acceptance below this demand zone would expose even lower levels. However, a strong breakout and sustained acceptance above the supply line and resistance zone would invalidate the bearish scenario and signal a potential structural shift. For now, market structure and price behavior continue to favor sellers. Manage your risk!

EURUSD: Bearish Pressure Building Inside TriangleHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD was previously trading within a clearly defined downward channel, where price respected both the resistance and support boundaries while forming consistent lower highs and lower lows. This structure confirmed sustained bearish pressure and controlled selling rather than impulsive panic moves. The market eventually broke out of this channel to the upside, signaling a potential shift in short-term momentum. Following the breakout, price rallied strongly and pushed into the major Resistance Zone near 1.1890. However, the bullish move failed to sustain acceptance above this area, forming a fake breakout near the triangle resistance line. This rejection suggests that sellers remain active at higher levels. After the rejection, price pulled back and entered a consolidation range inside a contracting triangle structure. This phase reflects temporary balance between buyers and sellers, with volatility compression as price approaches the apex of the pattern.

Currently, EURUSD is trading below the Resistance Zone while respecting the triangle boundaries, indicating that the recent recovery may be corrective rather than a full trend reversal. Overall, the broader structure now shows weakening bullish momentum inside resistance, increasing the probability of a downside rotation toward support.

My Scenario & Strategy

My primary scenario favors a short setup as long as EURUSD remains below the 1.1890 Resistance Zone and continues to respect the triangle resistance line. The recent consolidation appears to be distribution rather than accumulation, suggesting that sellers may regain control once price breaks lower from the structure. If bearish momentum resumes, the next logical downside target lies near the 1.1800 Support Zone, which aligns with previous breakout levels and a strong demand reaction area (TP1). This level represents a natural zone for price to seek liquidity and potentially stabilize.

However, if EURUSD manages to break decisively above the triangle resistance and reclaim the 1.1890 level with strong acceptance, this would weaken the bearish scenario and suggest a broader bullish continuation or range expansion. For now, structure favors sellers, with rallies viewed as corrective moves unless resistance is reclaimed.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

XAUUSD Long: Rebounds From Support - Buyers Target 5,100Hello traders! Here’s my technical outlook on XAUUSD (2H) based on the current chart structure. Gold was previously trading inside a well-defined ascending channel, where price respected both the rising support and resistance boundaries, forming a steady sequence of higher highs and higher lows. This structure reflected controlled bullish momentum rather than impulsive expansion. The move culminated near a clear pivot high, where bullish pressure weakened and sellers stepped in aggressively. Following this pivot, price broke decisively below the ascending channel, confirming a structural shift and signaling that the prior bullish trend had exhausted. The breakdown was strong and impulsive, driving price sharply lower and reclaiming previously defended levels. This move established a new bearish leg and pushed gold toward a major pivot low, where buyers finally reacted and triggered a recovery phase.

Currently, after the rebound, price formed a rising demand structure supported by a clear ascending demand line. This recovery has been more corrective than impulsive, with price gradually climbing back toward the horizontal Supply Zone near 5,100. Recently, gold has been consolidating inside a defined range just beneath this supply area while holding above the Demand Zone around 4,900. This behavior suggests a temporary balance between buyers defending support and sellers protecting resistance.

My primary scenario favors bullish continuation as long as XAUUSD holds above the Demand Zone and continues respecting the rising demand line. A sustained hold above demand increases the probability of an upside move toward the 5,100 Supply Zone (TP1), which represents the first major resistance and a logical area for seller reaction. A confirmed breakout and acceptance above this supply level would signal a broader bullish continuation and potential expansion toward higher highs. On the other hand, a decisive breakdown below the Demand Zone and loss of the rising demand structure would invalidate the bullish recovery scenario and suggest a deeper corrective move. Until such confirmation appears, the current structure reflects consolidation with a mild bullish bias from support. Manage your risk!

ADAUSDT - Short squeeze before falling to 0.22BINANCE:ADAUSDT , after breaking through the global support zone of 0.275 and updating its lows to 0.22, entered a phase of correction and consolidation below key levels. Another short squeeze could trigger a decline.

Bitcoin is falling after a correction, which generally indicates a weak market and increases bearish pressure on the market. I recently said that Bitcoin would fall even lower, as global targets have not yet been achieved, so against this backdrop, altcoins may react accordingly.

Any corrections and volume spikes can be seen as a hunt for liquidity and quickly sold off.

ADA has been strengthening since the session opened and is showing strength against a weak market (top gainers). There are no fundamental reasons for growth, and technically, the market is heading towards a zone of interest.

Resistance levels: 0.2688, 0.276, 0.284

Support levels: 0.243, 0.2200

From a medium-term perspective, the altcoin has not yet tested the global support level hidden behind 0.22 - 0.2167, formed in 2023. A retest and short squeeze of the resistance zone could trigger a decline towards the target

Best regards, R. Linda!

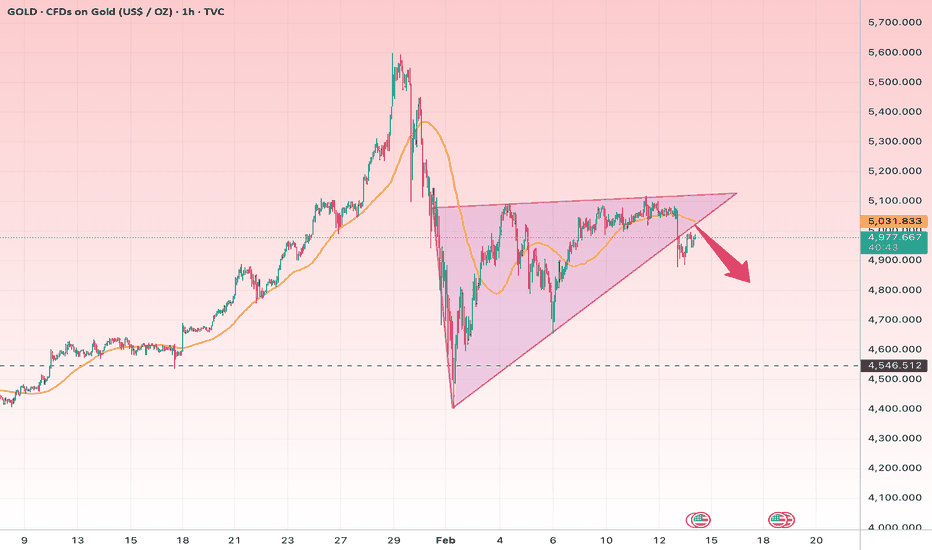

Gold Rejected at Triangle ResistanceGold on the 1H timeframe is still trading inside a symmetrical triangle, but price has just shown clear rejection near the upper boundary (~5,030–5,050).

Key observations:

• Lower highs forming near resistance

• Price struggling to hold above short-term moving average

• Momentum weakening near triangle apex

• Rising trendline support currently around 4,950–4,970

Compression is almost complete — breakout likely soon.

🔴 Bearish Scenario (Currently Higher Probability)

If price breaks below 4,950, the triangle support fails.

Downside targets:

• 4,900

• 4,820

• 4,700

• Extended target: 4,550 major support

This would confirm bearish expansion from compression.

✅ Short Stop Loss:

• Above 5,050

• Conservative SL: above 5,100

🟢 Bullish Scenario (Invalidation of Bearish View)

If price reclaims and closes above 5,050, then:

Upside targets:

• 5,150

• 5,300

• 5,500

Would confirm bullish breakout from triangle.

✅ Long Stop Loss:

• Below 4,950

• Conservative SL: below 4,900

⚠ Trading Notes

• Apex zone = high fake breakout probability

• Avoid mid-structure entries

• Wait for 1H close confirmation

• Volatility expansion imminent

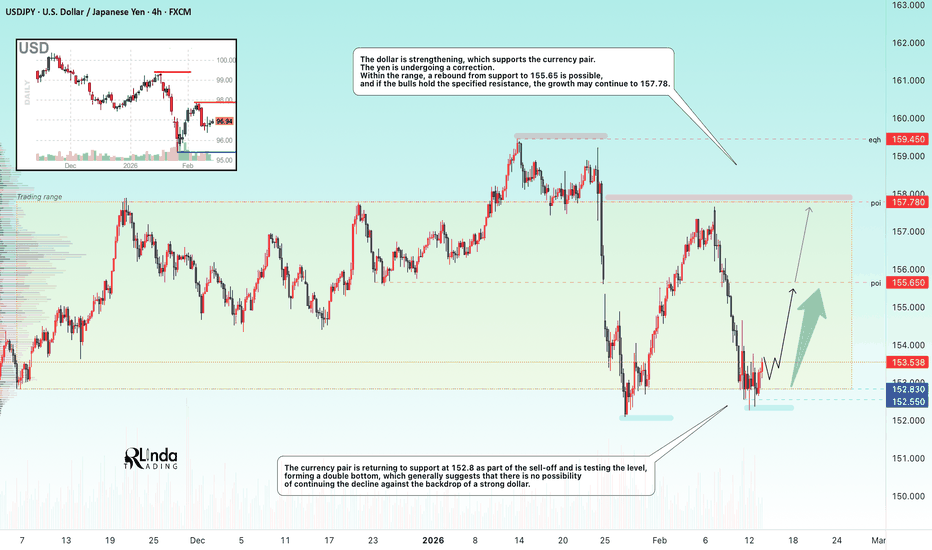

USDJPY - Reversal setup relative to range support FX:USDJPY faces strong support within the correction. The price closed within the trading range of 152.8 - 157.78 and is forming a strong reversal setup relative to the lower boundary.

The dollar is strengthening, which supports the currency pair. The yen is undergoing a correction. Within the range, a rebound from support to 155.65 is possible, and if the bulls hold the specified resistance, the growth may continue to 157.78.

The currency pair is returning to support at 152.8 as part of the sell-off and is testing the level, forming a double bottom, which generally suggests that there is no possibility of continuing the decline against the backdrop of a strong dollar.

Resistance levels: 155.65, 157.78, 159.45

Support levels: 152.83

The false breakout of support indicates that the bulls are trying to maintain their positions and are not letting the price fall, which also confirms the formation of a double bottom. If the bulls keep the price above 153.0, this move could support the price growth.

Best regards, R. Linda!

GOLD - Consolidation & compression to 5090. A show of strengthFX:XAUUSD fell back to $5018 after the release of NFP data, but the market is actively buying up the decline and heading towards resistance at 5090. Buyers are waiting for new triggers — US unemployment data and geopolitics

The NFP report was strong, but the dollar performed poorly and was unable to sustain its growth. Most likely, the market quickly digested the strong NFP, focusing on the large downward revision of employment for 2025 (181K instead of 584K).

The renewed tension between the US and Iran (no agreement after talks with Israel) is keeping gold buyers in the game.

Traders are waiting for Friday's CPI as a possible driver. It will determine whether expectations of two Fed rate cuts this year will remain.

Resistance levels: 5090, 5110, 5144

Support levels: 4975, 4902

Technically, everything is moving towards breaking the resistance at 5090. Activation (breakthrough) of the trigger could provoke further growth. I do not rule out that before the growth, the market may test the support at 5050, 4975

Best regards, R. Linda!

EURUSD Short: Corrective Pullback Into Demand Zone 1.1850Hello traders! Here’s a clear technical breakdown of EURUSD (4H) based on the current market structure visible on the chart. EURUSD previously printed a strong impulsive bullish move that topped at a well-defined pivot high, where buying momentum began to weaken and sellers stepped in aggressively. From this pivot point, price reversed and entered a corrective bearish phase, forming a sequence of lower highs and lower lows. This decline was guided by a clean descending supply trend line, confirming controlled selling pressure rather than panic-driven liquidation. During this bearish leg, price also broke below a key rising trend line, reinforcing short-term bearish control. Eventually, the decline slowed near a lower pivot low, where selling pressure faded and buyers started to respond with strong demand. This reaction marked an important structural shift, as price began to stabilize and form higher lows, signaling that bearish momentum was losing strength. Following this pivot, EURUSD reclaimed structure with a strong bullish impulse, breaking above the descending supply trend line and confirming a change in short-term market character. After the breakout, price transitioned into a ranging phase, indicating temporary balance between buyers and sellers rather than immediate continuation. This range acted as a consolidation zone after the impulsive recovery, suggesting accumulation rather than distribution. A bullish breakout from the range confirmed renewed buyer interest and pushed price back into a higher supply area, where upside momentum has recently slowed.

Currently, EURUSD is pulling back from the Supply Zone and approaching the Demand Zone around 1.1850, which aligns closely with a rising demand trend line. This confluence makes the area a key battlefield between buyers and sellers. Price action so far suggests a corrective pullback rather than a full trend reversal, with no strong acceptance below demand yet. As long as price holds above this demand zone and continues to respect the rising trend line, the broader bullish structure remains intact.

My primary short scenario favors a move lower toward the 1.1850 Demand Zone, as long as price remains capped below the Supply Zone and fails to reclaim bullish momentum. The current pullback appears corrective, not impulsive, supporting the short continuation bias toward demand. A strong bearish reaction into 1.1850 would complete the corrective leg, where partial profits can be secured. However, a strong bullish reaction or acceptance above supply would invalidate the short idea and signal renewed upside potential. Until then, structure and price behavior favor a downside rotation into demand. Manage your risk!

XAUUSD Long: Holds Demand - Upside Toward $5,180 in PlayHello traders! Here’s a clear technical breakdown of XAUUSD (1H) based on the current market structure shown on the chart. Gold previously experienced a strong impulsive bullish move, which ultimately topped at a clear pivot high, where buying pressure began to fade and sellers stepped in aggressively. From this pivot point, price reversed sharply and entered a corrective bearish phase, forming a sequence of lower highs and lower lows. This move was guided by a well-defined descending supply trend line, confirming sustained selling pressure and controlled downside continuation rather than panic-driven selling. During this decline, price broke below a key Demand Zone around 5,000, triggering a bearish continuation and accelerating the sell-off toward the next pivot low. However, at this lower pivot point, selling momentum weakened significantly, and buyers responded with strong demand. This marked a structural shift, as price began forming higher lows and eventually broke above the descending supply trend line — an early signal that bearish control was losing strength.

Currently, after reclaiming the broken structure, XAUUSD transitioned into a ranging phase above demand, suggesting accumulation rather than distribution. The recent breakout from this range confirmed renewed buyer interest, with price now holding above the Demand Zone while respecting a rising demand trend line. Current price action shows consolidation near demand, indicating a healthy pause rather than rejection.

My primary scenario favors bullish continuation, as long as price holds above the 5,000 Demand Zone and continues to respect the ascending demand line. From a structural perspective, the failure of sellers to regain acceptance below demand suggests that the previous breakdown was corrective. A sustained bullish reaction from this area could lead to a move toward the 5,180 Supply Zone (TP1), where sellers may attempt to defend. A clean breakout and acceptance above supply would open the door for further upside expansion. However, a decisive breakdown and acceptance below the demand zone and rising trend line would invalidate the bullish scenario and signal deeper corrective risk. Until then, structure and price behavior continue to favor buyers. Manage your risk!

Nasdaq 100 Coiling in Ascending TriangleNDX is consolidating inside an ascending triangle pattern after a strong impulsive rally.

Structure details:

• Strong prior bullish leg (impulse move)

• Horizontal resistance near 26,000

• Rising trendline support around 24,800–25,000

• Price compressing toward apex → volatility expansion likely

The moving average is still upward sloping, confirming that the broader trend remains bullish.

This is a classic continuation pattern, but confirmation is required.

🟢 Bullish Scenario

• Daily close above 26,000

• Strong breakout with follow-through

• Upside targets:

• 26,800

• 27,500

• Potential extension toward 28,000

This would confirm continuation of the primary uptrend.

✅ Long Stop Loss:

• Below 24,800

• Conservative SL: below 24,500

🔴 Bearish Scenario

• Breakdown below ascending trendline (~24,800)

• Loss of structure support

• Downside targets:

• 24,000

• 23,200

• Deeper pullback toward 22,500

Would signal a failed breakout structure and corrective phase.

✅ Short Stop Loss:

• Above 25,800

• Aggressive SL: above 26,000

⚠ Trading Notes (English)

• Avoid trading inside compression zone

• Wait for breakout + volume confirmation

• Triangle apex → increased fake breakout risk

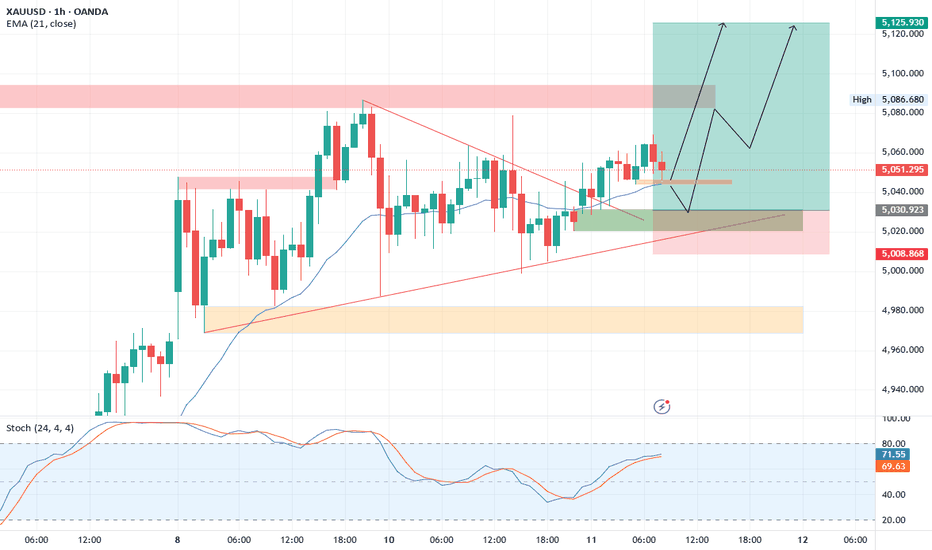

GOLD (XAUUSD) H1 – Symmetrical Triangle Near BreakoutGold remains inside a well-defined ascending channel , maintaining a bullish market structure with higher highs and higher lows.

Currently, price is forming a short-term descending pullback trendline, indicating temporary consolidation within the broader uptrend.

EMA 21 continues to act as dynamic support.

📈 Bullish Scenario:

A breakout above the descending pullback trendline could trigger continuation toward:

➡️ 5,120

➡️ 5,160

➡️ 5,180 (channel resistance zone)

Momentum expansion is expected once consolidation ends.

⚠️ Bearish Scenario:

Failure to hold above 5,055 support and breakdown below the ascending channel may lead to:

➡️ 5,030

➡️ 5,000 psychological level

🔎 Technical Notes:

• Overall structure remains bullish

• Consolidation inside trend = healthy correction

• Stochastic neutral — room for momentum expansion

📌 Waiting for breakout confirmation before increasing exposure.

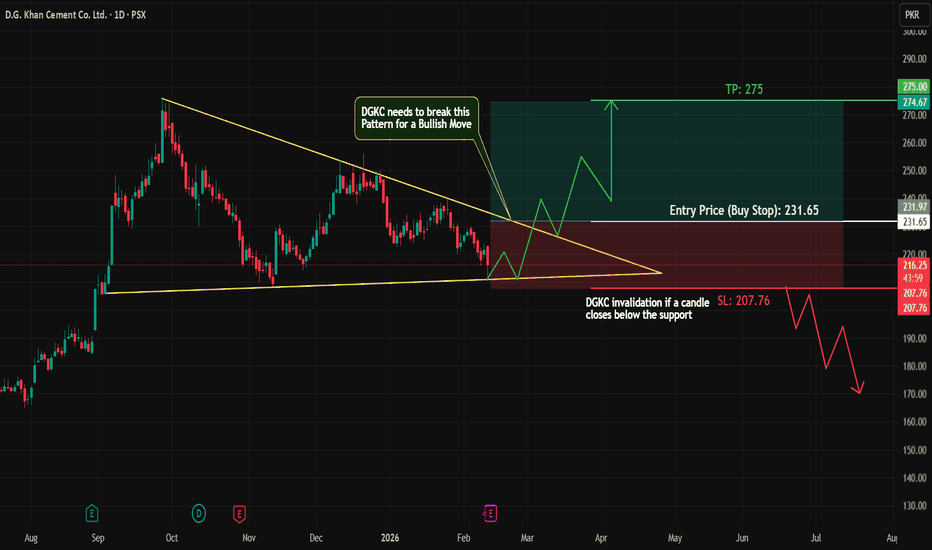

DGKC Approaching Major Support | Triangle Pattern in Play#DGKC is currently trading near a strong higher-timeframe support zone, and on the Daily chart, price is forming a clear Triangle pattern — indicating compression and a potential explosive move ahead.

Current Observations:

Price holding near key support

Daily timeframe triangle structure forming

No major bearish confirmation yet

Volatility contraction → Breakout likely soon

Bullish Plan:

I will wait for a confirmed breakout of the triangle resistance on strong volume.

After breakout, I’ll look for:

A clean candle close above resistance

Possible retest of breakout zone

Entry with proper risk management

Target: Previous resistance / measured move of triangle

Stop Loss: Below breakout level or recent swing low

No breakout = No trade. Patience is key.

This setup has strong potential, but confirmation is required. Let the market show direction before committing capital.

What’s your view on #DGKC? Accumulation phase or fake breakout coming?

Like & Follow for more high-probability setups with proper risk management.

#DGKC #PSX #StockMarket #TechnicalAnalysis #Breakout #TrianglePattern #SupportResistance #SwingTrading #PriceAction #PakistanStocks

XAUUSD H1 Technical AnalysisGold has been trading in a tight range over the past two days, showing signs of accumulation before a potential expansion move.

Market Structure Overview:

Price is forming equal highs near the resistance zone.

Lows are gradually getting higher, creating a rising trendline.

Price has respected the rising trendline multiple times, confirming strong dynamic support.

The previously drawn falling trendline has been broken, indicating a shift in short-term momentum.

A symmetrical triangle pattern has also broken to the upside, strengthening the bullish bias.

Momentum & Indicators:

EMA (21) is supporting price from below.

Stochastic is recovering and moving toward the upper zone, suggesting increasing bullish momentum.

🎯Bullish Scenario:

If price sustains above the breakout area and holds above the rising trendline:

First target: 5085 – 5090 resistance zone

Break above resistance could push price toward 5125+

Buy Zone:5030

SL: 5008

1st TP: 5085

2nd TP: 5125

⚠️ Bearish Scenario:

If price fails to hold above the trendline and falls back inside the range:

Immediate support: 5030 zone

Below that, 5008 becomes key downside level

Tragets 4965 and 4930.

XAUUSD: Liquidity Grab Below Support, Expansion Ahead To $5,110Hello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

Gold has been trading within a well-defined bullish environment, previously respecting a clean ascending channel, where price consistently formed higher highs and higher lows. This structure reflected strong buyer dominance and healthy trend continuation rather than impulsive exhaustion. During this phase, XAUUSD also went through a consolidation range, signaling accumulation before the next impulsive move. The breakout from the range triggered a strong bullish impulse, pushing price aggressively toward the 5,110 Resistance Zone, where sellers became active. This area acted as a major supply zone, leading to a sharp rejection and a deep corrective move. Price dropped impulsively, breaking below the rising channel and testing lower liquidity, which marked a short-term shift in market structure.

Currently, XAUUSD is stabilizing above the reclaimed support zone, with multiple breakout attempts confirming acceptance above demand. This price behavior indicates that buyers are gradually regaining control, while sellers are unable to push price back below key support.

My Scenario & Strategy

My primary scenario favors a bullish continuation, as long as XAUUSD holds above the 4,970 Support Zone and continues to respect the rising triangle support line. The recent reclaim and consolidation above support suggest that the prior drop was a fake breakdown, not the start of a sustained bearish trend. From a structural perspective, pullbacks toward the support zone are considered corrective, offering potential continuation opportunities rather than reversal signals. The next key upside objective lies at the 5,110 Resistance / Supply Zone (TP1), which aligns with previous supply and remains the main barrier for further upside. A clean breakout and acceptance above the 5,110 resistance would confirm bullish continuation and open the door for a renewed expansion toward higher levels.

However, a decisive breakdown and acceptance below the support zone and triangle support line would invalidate the bullish scenario and signal a return of bearish pressure. For now, structure favors buyers, with Gold holding above key demand and building strength for the next directional move.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

GOLD - Consolidation and compression at resistance ahead of NFPFX:GOLD remains above $5,000 ahead of the key US employment report, NFP, whose publication was delayed due to the shutdown. The market is holding its breath ahead of a possible surge.

The forecast for NFP in January is +70,000 (compared to 50,000 in December). At the same time, the annual revised employment estimate will be released.

Two scenarios for gold's reaction:

Weak data: Will reinforce expectations of a Fed rate cut in June → gold will rise.

Strong data: Will reduce the likelihood of an early Fed easing → a new wave of gold correction.

Gold is in a waiting mode for a strong trigger. The NFP report will set the short-term direction, but a sustainable trend will only form after the release of inflation data on Friday. The key level of $5,000 will remain the nearest support for buyers.

Resistance levels: 5089, 5241

Support levels: 5000, 4976, 4902

A breakout of resistance at 5089 and a close above this level could signal further growth. The market has accumulated enormous potential, and news could be the driving force. It is possible that the market will test support at 4976-4900 before growing.

Best regards, R. Linda!

EURUSD - Consolidation ahead of NFP. Bullish trendAfter rallying and reaching a new high of 1.19266, FX:EURUSD entered a consolidation phase amid a weak dollar, which is generally a positive sign for continued growth.

Against the backdrop of a weak dollar, the euro is forming a bullish trend, the likelihood of which continuing is also high, but depends on further news. NFP is being published today.

Local resistance is appearing at 1.19266, relative to which consolidation is forming. The dollar is falling, and against this backdrop, the euro may continue to grow if it breaks the trigger at 1.19266.

Resistance levels: 1.19266, 1.1972

Support levels: 1.1895, 1.1875

Focus on the current consolidation of 1.1895 - 1.1926. Before rising, the market may test the support range, and if the bulls keep the market above the level, the price may form a rally. However, a premature close above 1.19266 will also trigger a continuation of growth to 1.1972 - 1.2025.

Best regards, R. Linda!

GOLD - Consolidation before the rally. Focus on 5090FX:XAUUSD is storming 5089 as part of a bullish trend. There is a high probability of a breakthrough, but before that, the market may form a correction. Tomorrow is NFP...

The dollar is falling, and against this backdrop, gold looks like a strong asset in terms of buyer interest.

The projected slowdown in retail sales and weak NFP expectations are supporting expectations of a Fed rate cut. The dollar is under pressure due to rumors of Chinese banks diversifying away from US Treasury bonds. Overall, this supports the bullish trend for the metal.

Core Retail Sales, NFP (a key indicator for the Fed), and CPI will determine the inflation trend and the Fed's future policy

Technically, gold is in a bullish trend, but before rising, it may test the following support levels: 4985, 4902 (sharp long squeeze).

Resistance levels: 5089, 5100, 5250

Support levels: 4985, 4902, 4812

The market continues to approach resistance at 5089, a break of which could trigger a rally to 5250-5400. However, it is possible that a correction could form before the news before growth. Focus on key levels

Best regards, R. Linda!

XRPUSDT - Hunting for liquidity before the fallBINANCE:XRPUSDT looks very weak, losing 69% from its high. As part of the downtrend, the coin may experience sharp local spikes in search of liquidity before falling.

Bitcoin is consolidating below 70K without the ability to break through the key level. The market is stagnating after a sharp decline, which may continue.

After the pullback phase, an intermediate consolidation has formed with a liquidity zone of 1.4625 - 1.4886. Within the downtrend, the market may form a short squeeze in the specified zone, followed by a decline to 1.2845.

The market has confirmed two key levels, 1.4625 and 1.3850, with support tested and a weak reaction. If the market begins to contract towards support, this will only increase the chances of a further decline.

Resistance levels: 1.4625, 1.4885, 1.5300

Support levels: 1.412, 1.385, 1.2845

I do not rule out the possibility of an attempt to break the downward structure and grow, but in the current conditions, any bullish momentum can be quickly sold off. Technically, I have identified an area of interest between 1.4625 and 1.4885. There may be a false breakout, a retest of 1.3850, and a further decline

Best regards, R. Linda!

Gold at Symmetrical Triangle ApexGold on the 1H timeframe is consolidating inside a symmetrical triangle following a sharp impulsive move. This structure reflects compression and indecision, usually preceding a strong breakout.

Price is currently trading near the upper boundary of the triangle, while also hovering around the moving average, making this zone a key decision area.

🟢 Bullish Scenario

• Clean breakout and acceptance above triangle resistance (~5100)

• Holding above the MA after breakout

• Upside targets:

• 5200

• 5350

• 5500

• Breakout would confirm trend continuation after consolidation

🔴 Bearish Scenario

• Rejection from upper trendline

• Breakdown below ascending support of the triangle

• Downside targets:

• 4800

• 4550 (major support)

• Would signal failed consolidation and deeper correction

🛑 Risk Notes (English)

• Wait for confirmed breakout with volume

• Triangle apex = high volatility zone

• False breakouts are common → patience is key

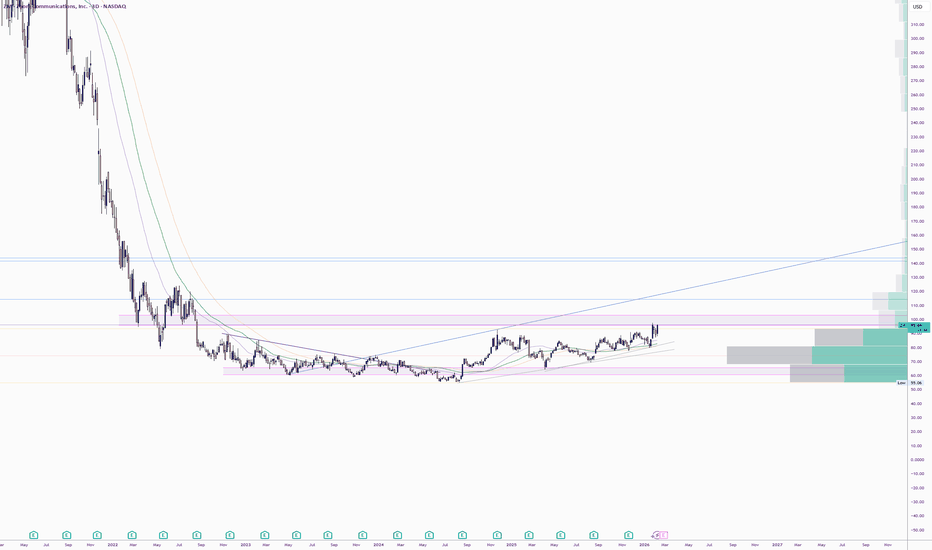

HIMATSEIDE | Last Leg in Formation – Watch Closelythe stock is forming a dual pattern across two different timeframes.

A strong demand zone is clearly visible on both charts, with the same support range between 80–95, reinforcing the reliability of this base.

On the higher timeframe, the structure reflects a Symmetrical Triangle formation. while the intermediate timeframe shows a Broadening Wedge,

The key resistance levels to watch are:

₹200 near the upper boundary of the triangle

₹300 near the broadening wedge resistance

Historically, whenever this support zone has sustained, the stock has gone on to register new highs.

As long as price holds above the base, the broader structure remains bullish and continuation is favored, subject to confirmation by price action.

thank you ..