TSLA In Trouble! WARNING!🚫 Why No One Should Be Holding TSLA Right Now

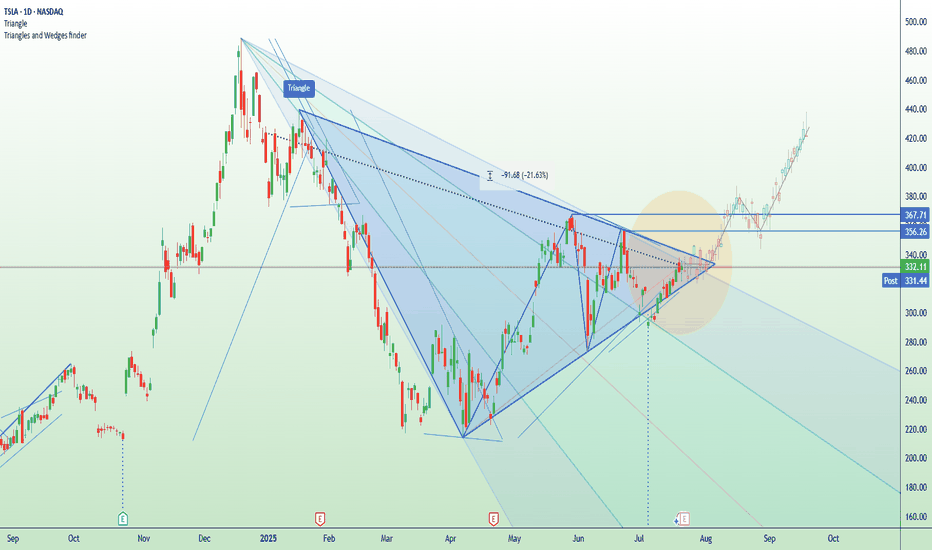

Charting:

Triple Top! Rising wedge fully formed 3-wave rising wedge structure that has hooked and broken! mini double top.

I’ve been saying this for a while — no one should be long TSLA. The stock has done nothing since 2021, yet the hype machine for the boy band keeps spinning.

Ask yourself honestly: Where does Tesla actually lead anymore?

Not in EVs

Not in autonomy

Not in robots

Not in AI

Not in tech innovation

It’s become a stock story with no story left.

And when leadership is built on hype, not execution, it always ends the same way.

Never invest in toxic leadership or cult narratives.

TSLA is a real company, sure — but in fundamental terms, it’s an $8 stock wearing a $450 costume.

If you agree and sell, and it's wrong. Guess what? You will have a bunch of cash waiting to buy it. If you disagree, you won't have a bunch of cash waiting to buy lower BC YOU NEVER SOLD! You can't "BUY THE DIP" Ubless you first SELL THE RIP! It's 2nd-grade math that the boy band who will come in here hating on my call again cannot do. They will give me colorful charts, tell me about cup and handles while riding it all the way down!

They are always buying but NEVER selling. That's the trick with paper money, you can never run out of it. hahah!

Click boost, follow, comment nicely for more authentic, no BS, raw analysis. Let's get to 6,000 followers. ))

Tslashort

Tesla: A overview of itHi!

Trend Analysis:

TSLA has been trading in an ascending channel for several months, with higher highs and higher lows visible since April.

The recent price action broke above the midline of the channel but is currently consolidating near the $420-$425 area.

Pattern Formation:

A Double Top pattern near the $460 level formed.

This pattern signals a potential reversal if the price fails to break above the resistance zone (marked in pink).

The neckline of this double top appears around $400, which is also a key support zone.

Potential Price Action:

Short-term rebound:

TSLA could retest the resistance zone near $455-$460.

If it fails to break this area convincingly, the double top pattern could trigger a reversal.

Medium-term correction:

If the reversal occurs at the resistance zone, price may fall toward the neckline/support area near $380.

This aligns with the lower boundary of the channel and previous support levels.

TSLA Bearish Setup: Double Top BreakdownTSLA’s 1D chart has shifted from a clean uptrend into a clear corrective phase. After a strong run into the $475 area, price printed a potential Double Top and then rolled over, breaking the neckline around $410 alongside a bearish Market Structure Shift. Price now sits below the 20 and 60-day MAs while still above the rising 120-day MA, framing this as a short-term bearish move within a longer-term uptrend.

The primary path favors further downside as long as TSLA stays capped below the $410–416 neckline zone and the $420 reclaim level. A daily close below the recent swing low at $385 would confirm continuation, opening room toward the $373 area and the 120-day MA support near $369, with an extended downside magnet around $360–345 if selling accelerates. MACD turning negative and increasing downside Squeeze Momentum both align with this bias.

If buyers manage to reclaim $420 on a daily close, that would threaten the bearish thesis by taking price back above the neckline and the 60-day MA. Such a squeeze could fuel a move toward $460 and potentially a retest of the $475 supply zone. Until that happens, rallies into $405–416 remain vulnerable to rejection.

Thought of the Day 💡: The strongest trade ideas start with a precise invalidation, not a prediction.

This is a study, not financial advice. Manage risk and invalidations.

-------------------------

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts!

TSLA: Wave 4 or Explosive Momentum – Get Ready for a Big MoveTSLA: Wave 4 or Explosive Momentum – Get Ready for a Big Move

📈 Weekly Scenarios

Bullish scenario:

The price holds the $436–$449 zone, ending the correction with wave 4.

Breaks above $470–$471, triggering wave 5 → target of $488–$505+.

Consolidation:

The price is in the $436–$471 range, without a clear breakout, preparing for the next impulse.

Bearish scenario:

Breakthrough of support at $425–$397 → possible reversal or deep correction instead of growth.

✅ Conclusion

Tesla is at an important wave crossroads – it either completes the correction and prepares for a strong rally, or reverses downward.

Key points to watch: $436–$449 (correction support) and $470–$471 (resistance breakout).

Confirmation of the wave structure and price reaction at these levels will be critical for making trading decisions.

TSLA is going UP! .. time to buy!Tsla aka Tesla was stuck in-between 2 powerful support and resistance zones (the red and green lines) .. It finally broke to the upside and broke above the resistance level. It is now very likely to head to the next resistance zone which was the previous high (the next resistance zone has been drawn as the white line shown on the chart) - this is where we will be taking profit at. BUY NOW!

TSLA $375 Call –Momentum + Options Flow Edge!

⚡ **TSLA 1‑Day Earnings/Weekly Scalp!**

📅 **Expiry:** 2025-09-12

🎯 **Strike:** \$375 CALL

💵 **Entry:** \$1.38 (Ask)

🛑 **Stop Loss:** \$0.69 → strict 50%

📈 **Profit Target:** \$2.07 (\~+50%)

📊 **Confidence:** 70% (Moderate Bullish)

⏰ **Entry Timing:** Market Open

💎 **Why This Trade:**

* Multi-timeframe momentum bullish (daily RSI 70.4, weekly RSI 67.8)

* Institutional call flow C/P = 1.57 → strong directional skew

* Low VIX (14.9) supports call buying

* Balanced strike with high liquidity (OI 16,237)

* Quick scalp: exit by Thursday close — avoid Friday gamma crush

⚠️ **Key Risks:**

* 1 DTE → extreme gamma & theta decay

* Underlying volume moderate → pullbacks possible

* News can reverse the move rapidly

* Use **small position sizing** (1–3% max risk)

💡 **Execution Tips:**

* Use limit at ask (\$1.38) or slightly better for control

* Hard stop at \$0.69

* Scale out at \$2.07 or partial at \$1.80

* Monitor intraday VWAP & price action; abort if momentum stalls

🎯 **Quick Take:** Cheap, high-conviction 1-day scalp with defined risk & asymmetric upside. Fast in, fast out, gamma-aware trade.

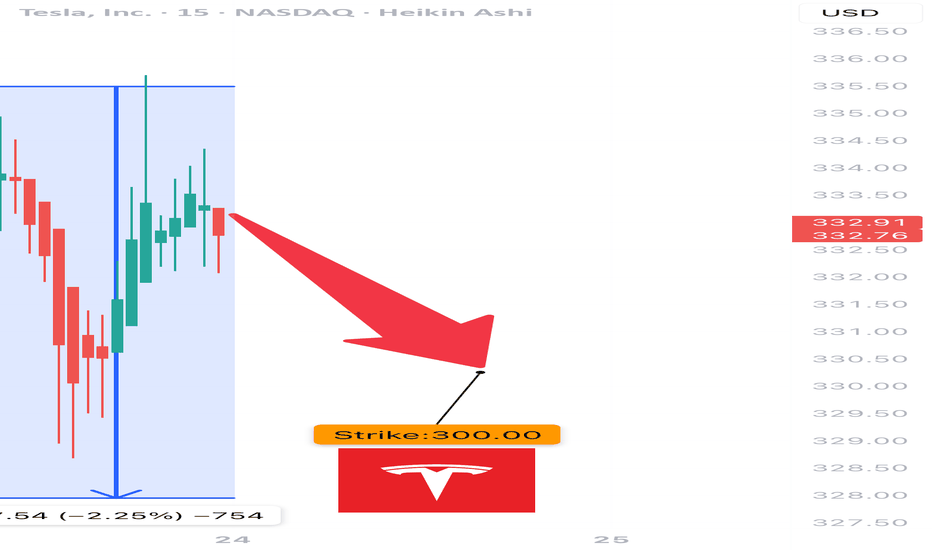

TSLA Weekly Bearish Play — August 2, 2025

🔻 **TSLA Weekly Bearish Play — August 2, 2025** 🔻

🚨 **Multi-Model Consensus Signals a Tactical Put Opportunity**

### 🔍 Market Snapshot:

* **Daily RSI:** 39.9 (Bearish)

* **Weekly RSI:** 53.2 → Falling

* **Volume:** Weak (0.8x last week)

* **Options Flow:** Neutral (C/P Ratio \~1.04)

* **VIX:** 20.38 → Favorable for Options Plays

* **Institutional Support:** Weak

---

### 🔮 Model Consensus:

📉 **All major models (xAI, Google, Claude, Meta, DeepSeek)** confirm:

* Bearish momentum on both daily + weekly RSI

* Weak volume = cautious institutional behavior

* Volatility setup perfect for short-dated puts

---

### 🎯 Viral Trade Setup:

**💥 Trade Type:** PUT (Short TSLA)

**🔻 Strike:** \$300

**📆 Expiry:** 2025-08-08

**💰 Entry Price:** \$6.65

**🎯 Target Exit:** \$10.64 – \$13.30 (60%-100% gain)

**🛑 Stop Loss:** \$3.99

**📊 Confidence:** 65%

**📍 Entry Timing:** Monday open

**🕒 Signal Timestamp:** 2025-08-03 01:33:56 EDT

---

### ⚠️ Key Levels:

* Support to watch: **\$297.82**

* News/event risks: Stay alert ⚡

* Use tight risk controls for weekly plays!

---

🔥 **If you trade TSLA — don’t sleep on this one.**

Bearish consensus + clean setup = **high-probability weekly play.**

TSLA Earnings Play (Bearish Bias)

🚨 TSLA Earnings Play (Bearish Bias) 🚨

Earnings Date: July 23, 2025 (AMC)

🧠 Confidence: 75% Bearish | 🎯 Target Move: -10%

⸻

🔍 Key Takeaways:

• 📉 TTM Revenue Growth: -9.2% → EV demand weakness

• 🧾 Margins Under Pressure: Gross 17.7%, Operating 2.5%, Net 6.4%

• ❌ EPS Beat Rate: Only 25% in last 8 quarters

• 🐻 Options Flow: High put volume at $330 strike

• 🧊 Low Volume Drift: Trading above 20/50MA but losing steam

• 📉 Sector Macro: EV competition + cyclical headwinds

⸻

🧨 Earnings Trade Setup:

{

"instrument": "TSLA",

"direction": "put",

"strike": 300,

"expiry": "2025-07-25",

"entry_price": 2.02,

"confidence": 75,

"profit_target": 6.06,

"stop_loss": 1.01,

"entry_timing": "pre_earnings_close",

"expected_move": 7.1,

"iv_rank": 0.75

}

⸻

🛠️ Trade Details:

Parameter Value

🎯 Strike Price $300 PUT

💰 Premium Paid $2.02

📅 Expiry Date 2025-07-25

🛑 Stop Loss $1.01

🚀 Profit Target $6.06

📏 Size 1 Contract

⏱ Entry Timing Pre-Earnings

📊 IV Rank 75%

🕒 Signal Time 7/23 @ 14:14 EDT

⸻

📈 Strategy Notes:

• 🧯 IV Crush Risk: Exit within 2 hours post-earnings

• 🎲 Risk/Reward: 1:3 setup | Max Loss: $202 | Max Gain: $606+

• 🧭 Volume Weakness & put/call skew signal downside

• 🧩 Macro + Tech + Flow Alignment = Tactical bearish play

⸻

🧠 “Not all dips are worth buying — this might be one to short.”

📢 Drop your thoughts — would you take the trade or fade it?

TSLA squeezes into resistance ahead of earnings Tesla is set to report Q2 earnings after the closing bell on Wednesday, covering the quarter ending June 2025.

The stock has been highly volatile this year, amid concerns about tariffs, Elon Musk’s politics (and nazi salutes), and his public clashes with President Donald Trump.

Tesla bulls Wedbush think, “We are at a 'positive crossroads' in the Tesla story,” suggesting that investors will look past the current numbers and focus on Tesla’s long-term AI potential.

Technically, Tesla is now testing a major descending trendline that’s capped every rally since December. The current price action resembles an ascending triangle pattern — a bullish structure — with resistance around $356 and a series of higher lows from May through July. This tightening formation suggests building pressure ahead of the earnings release.

Tesla, Below 200 Next - The Crash Can Reach 140, 150 & 160Tesla has been bearish since December 2024 and producing lower highs since. A strong lower high happened late May with a shooting start candlestick pattern. A month later another lower high and bullish rejection with an inverted hammer.

This looks like an ABC correction with the low in March/April being the A wave. The lower high in May the B wave and the next low the final C wave. This would complete the corrective pattern.

Conditions for bullish

An invalidation of the bearish bias and potential would happen with a rise and close, weekly, above 355. Any trading below this number and the bearish bias remains intact.

Indicators: RSI & MACD

» RSI:

The RSI looks pretty bad as it already curved down; trending down and moving lower since December 2024.

» MACD:

The weekly MACD is weak, starting to curve but still on the bullish zone. The daily MACD already turned bearish and moving lower.

Summary

Overall, market conditions are weak for this stock and everything points lower. The chart structure points to a lower low based on a broader bearish trend.

Thank you for reading.

Namaste.

Diamond Reversal Forming On Tesla ($TSLA)This pattern on TSLA fits the outline for a diamond reversal that is referenced on Investopedia.

It has all the "classical" facets of a diamond reversal which is a high (A), a low (C) a higher-high.

Furthermore, this is happening alongside a very similar pattern on NFLX and some bearish patterns on many other stocks.

Similar forms also occurred on SPX in 2021-2222 and Bitcoin in 2021.

The move up from the 2023 lows has the form of an ABC up... which suggests another 5 wave downmove on-par with or even exceeding the previous downmove is on the way.

The move off the highs was a whole 75% so even presuming a moderate 1:1 ratio, the next wave down could be very aggressive which means that an excellent short could be lining up.

Trade safe and be careful out there.

TSLA Honey Ticking Bull Trap!TSLA has a beautiful big ars bear flag! While it should have broken down to trigger a short trade, it decided to Honey Tick people right into a Trap!

It formed a perfect MEGAPHONE in wave 3 up that has now CRACKED! This is a much juicer short setup with the potential of collapsing from here and taking out the entire bear flag and MORE!!

First, we need a lower low and then a lower high and off we GO BABY!!!

Don't Get HONEY TICKED!

As I always say, never EVER!! Invest in toxic people like Elona. They always blow themselves up in the end. It's in their nature!

Click boost and follow, let's get to 5,000 followers. ;)

Tesla's Perfect Storm: A $152 Billion MeltdownTesla's Perfect Storm: A $152 Billion Meltdown, Chinese Rivals on the Attack, and a Faltering Shanghai Fortress

A tempest has engulfed Tesla, the electric vehicle behemoth, wiping a staggering $152 billion from its market capitalization in a single day. This monumental loss, the largest in the company's history, was triggered by a dramatic and public feud between CEO Elon Musk and former U.S. President Donald Trump. The confrontation, however, is but the most visible squall in a much larger storm. Lurking just beneath the surface are the relentless waves of competition from Chinese automakers, who are rapidly eroding Tesla's dominance, and the ominous sign of eight consecutive months of declining shipments from its once-impenetrable Shanghai Gigafactory.

The confluence of these events has plunged Tesla into a precarious position, raising fundamental questions about its future trajectory and its ability to navigate the turbulent waters of a rapidly evolving automotive landscape. The narrative of Tesla as an unstoppable force is being rewritten in real-time, replaced by a more complex and challenging reality.

The Trump-Musk Spat: A Bromance Turned Billion-Dollar Blow-Up

The relationship between Elon Musk and Donald Trump, once a seemingly symbiotic alliance of power and influence, has spectacularly imploded, leaving a trail of financial and political wreckage in its wake. The public falling out, which played out in a series of scathing social media posts and public statements, sent shockwaves through Wall Street and Washington, culminating in a historic sell-off of Tesla stock.

The genesis of the feud lies in Musk's vocal criticism of a sweeping tax and spending bill, a cornerstone of the Trump administration's second-term agenda. Musk, who had previously been a vocal supporter and even an advisor to the President, lambasted the legislation as a "disgusting abomination" filled with "pork." This public rebuke from a figure of Musk's stature was a direct challenge to Trump's authority and legislative priorities.

The President's response was swift and sharp. In an Oval Office meeting, Trump expressed his "disappointment" in Musk, questioning the future of their "great relationship." The war of words then escalated dramatically on their respective social media platforms. Trump, on his social media platform, threatened to terminate Tesla's lucrative government subsidies and contracts, a move that would have significant financial implications for Musk's business empire. He also claimed to have asked Musk to leave his advisory role, a statement Musk labeled as an "obvious lie."

Musk, in turn, did not hold back. On X (formerly Twitter), he claimed that without his substantial financial support in the 2024 election, Trump would have lost the presidency. This assertion of his political influence was a direct jab at the President's ego and a stark reminder of the financial power Musk wields. The spat took an even more personal and inflammatory turn when Musk alluded to Trump's name appearing in the unreleased records of the Jeffrey Epstein investigation.

The market's reaction to this public spectacle was brutal. Tesla's stock plummeted by over 14% in a single day, erasing more than $152 billion in market capitalization and pushing the company's valuation below the coveted $1 trillion mark. The sell-off was a clear indication of investor anxiety over the political instability and the potential for tangible financial repercussions from the feud. The incident underscored how intertwined Musk's personal and political activities have become with Tesla's financial performance, a vulnerability that has been a recurring theme for the company.

The Chinese Dragon Breathes Fire: Tesla's EV Dominance Under Siege

While the political drama in Washington captured headlines, a more fundamental and perhaps more enduring threat to Tesla's long-term prosperity is brewing in the East. The Chinese electric vehicle market, once a key engine of Tesla's growth, has become a fiercely competitive battleground where a host of domestic rivals are not just challenging Tesla, but in some aspects, surpassing it.

Companies like BYD, Nio, XPeng, and now even the tech giant Xiaomi, are relentlessly innovating and offering a diverse range of electric vehicles that are often more affordable and technologically advanced than Tesla's offerings. This intense competition has led to a significant erosion of Tesla's market share in China. From a dominant position just a few years ago, Tesla's share of the battery electric vehicle market has fallen significantly.

One of the key advantages for Chinese automakers is their control over the entire EV supply chain, particularly in battery production. This allows them to produce vehicles at a lower cost, a crucial factor in a price-sensitive market. The result is a growing disparity in pricing, with many Chinese EVs offering comparable or even superior features at a fraction of the cost of a Tesla.

Furthermore, Chinese consumers are increasingly viewing electric vehicles as "rolling smartphones," prioritizing advanced digital features, connectivity, and a sophisticated user experience. In this regard, many domestic brands are seen as more innovative and in tune with local preferences than Tesla. This shift in consumer sentiment has been a significant factor in the declining interest in the Tesla brand in China.

The numbers paint a stark picture of Tesla's predicament. While the overall new-energy vehicle market in China continues to grow at a remarkable pace, Tesla's sales have been on a downward trend. This is a worrying sign for a company that has invested heavily in its Chinese operations and has historically relied on the country for a substantial portion of its global sales.

The pressure on Tesla's sales in China is so intense that its sales staff are working grueling 13-hour shifts, seven days a week, in a desperate attempt to meet demanding sales targets. The high-pressure environment has reportedly led to high turnover rates among sales staff, a clear indication of the immense strain the company is under in this critical market.

The Shanghai Gigafactory: A Fortress with a Faltering Gate

The struggles in the Chinese market are reflected in the declining output from Tesla's Shanghai Gigafactory. For eight consecutive months, shipments from the factory, which serves both the domestic Chinese market and is a key export hub, have seen a year-on-year decline. In May 2025, the factory delivered 61,662 vehicles, a 15% drop compared to the same period the previous year.

This sustained decline in shipments is a significant red flag for several reasons. Firstly, the Shanghai factory is Tesla's largest and most efficient production facility, accounting for a substantial portion of its global output. A slowdown in production at this key facility has a direct impact on the company's overall delivery numbers and financial performance.

Secondly, the declining shipments are a direct consequence of the weakening demand for Tesla's vehicles in China. Despite being a production powerhouse, the factory's output is ultimately dictated by the number of cars it can sell. The falling shipment numbers are a clear indication that the company is struggling to maintain its sales momentum in the face of fierce competition.

The situation in China is a microcosm of the broader challenges facing Tesla. The company's product lineup, which has not seen a major new addition in the affordable segment for some time, is starting to look dated compared to the rapid product cycles of its Chinese competitors. The refreshed Model 3 and Model Y, while still popular, are no longer the novelties they once were, and are facing a growing number of compelling alternatives.

A Confluence of Crises: What Lies Ahead for Tesla?

The convergence of a high-profile political feud, intensifying competition, and production headwinds has created a perfect storm for Tesla. The company that once seemed invincible is now facing a multi-front battle for its future.

The spat with Trump, while seemingly a short-term crisis, has exposed the risks associated with a CEO whose public persona is so closely tied to the company's brand. The incident has also highlighted the potential for political winds to shift, and for government policies that have benefited Tesla in the past to be reversed.

The challenge from Chinese automakers is a more fundamental and long-term threat. The rise of these nimble and innovative competitors is not a fleeting trend, but a structural shift in the global automotive industry. Tesla can no longer rely on its brand cachet and technological lead to maintain its dominance. It must now compete on price, features, and innovation in a market that is becoming increasingly crowded and sophisticated.

The declining shipments from the Shanghai factory are a tangible manifestation of these challenges. The factory, once a symbol of Tesla's global manufacturing prowess, is now a barometer of its struggles in its most important market.

To navigate this storm, Tesla will need to demonstrate a level of agility and adaptability that it has not been required to show in the past. This will likely involve a renewed focus on product development, particularly in the affordable EV segment, to better compete with the value propositions offered by its Chinese rivals. It will also require a more nuanced and strategic approach to the Chinese market, one that acknowledges the unique preferences and demands of Chinese consumers.

The coming months will be a critical test for Tesla and its leadership. The company's ability to weather this storm and emerge stronger will depend on its capacity to innovate, to compete, and to navigate the complex and often unpredictable currents of the global automotive market. The era of unchallenged dominance is over. The battle for the future of electric mobility has truly begun.

TSLA Backtest: A robo-taxi launchpad? TBD ... 𝗧𝗲𝘀𝗹𝗮 𝗕𝗮𝗰𝗸𝘁𝗲𝘀𝘁: A robo-taxi launchpad? 🤖🚗

After a 20%+ breakout, NASDAQ:TSLA is retesting its 200dma with $295–300 now key support. Hold that — and bulls have room to run to $400+.

𝘉𝘶𝘭𝘭𝘪𝘴𝘩 𝘴𝘦𝘵𝘶𝘱 𝘸𝘪𝘵𝘩 𝘢 𝘥𝘢𝘵𝘦: June 12 robo-taxi reveal in Austin could mark Tesla’s first real step toward autonomous ride-hailing at scale.

𝘏𝘪𝘨𝘩 𝘱𝘳𝘪𝘤𝘦, 𝘩𝘪𝘨𝘩 𝘩𝘰𝘱𝘦𝘴: Tesla's valuation has always priced in the future. This time, the future might show up in a self-driving Model Y.

$NQ_F NASDAQ:NDX NASDAQ:QQQ NASDAQ:NVDA NASDAQ:AAPL AMEX:SPY NASDAQ:SOX CBOE:ARKK #Tesla #Robotaxi #FSD #ElonMusk #Stocks

TSLA Weekly Options Outlook — June 1, 2025📉 TSLA Weekly Options Outlook — June 1, 2025

🚨 AI Consensus: Bearish Momentum Ahead of June 6 Expiry

🧠 Summary of AI Model Signals

🔹 Grok (xAI)

Technicals: Below EMAs, RSI deeply oversold (26.95), MACD bearish.

Sentiment: VIX steady, max pain at $340 implies downside.

Trade: Buy $340P @ $8.25 → Target $9.08 (+10%) / Stop $6.60 (−20%)

Confidence: 65%

🔹 Claude (Anthropic)

Technicals: Bearish EMAs/MACD, volume spike on red bars.

Sentiment: Negative sales buzz, falling VIX, max pain $340.

Trade: Buy $340P @ $8.20 → Target +50–100% / Stop $5.74

Confidence: 72%

🔹 Llama (Meta)

Technicals: Bearish M5 EMA stack; support at $345 zone.

Trade: Buy $342.5P @ $9.40 → Target +20% / Stop −50%

Confidence: 70%

🔹 Gemini (Google)

Technicals: Strong bearish momentum, RSI oversold.

Trade: Buy $305P @ $0.95 → Target $1.90 / Stop $0.47 (Day trade)

Confidence: 75%

🔹 DeepSeek

Technicals: Breakdown in progress, momentum fading.

Sentiment: Weak China/Europe news; max pain support at $340.

Trade: Buy $340P @ $8.25 → Target $12.38 (+50%) / Stop $5.78

Confidence: 70%

✅ Consensus Takeaways

🔻 Bearish technical setup on all timeframes

🔄 Max Pain at $340 = potential price magnet

📉 Strong directional momentum + oversold RSI across models

📆 Preferred strategy: Buy weekly naked puts, enter Monday open

🎯 Recommended Trade Setup

💡 Strategy: Bearish Single-Leg Weekly Put

📈 Ticker: TSLA

🔀 Direction: PUT (SHORT)

🎯 Strike: $340

💵 Entry Price: $8.25

🎯 Target: $9.08 (+10%)

🛑 Stop: $6.60 (−20%)

📏 Size: 1 Contract

📆 Expiry: 2025-06-06

⏰ Entry: At Market Open

📊 Confidence: 70%

⚠️ Key Risks to Watch

📉 RSI is oversold — potential for a short-term bounce

🕒 Time decay accelerates midweek — don’t hold too long

🚀 Unexpected bullish catalyst (e.g., SpaceX PR, macro rally)

💵 Liquidity fine (4.4k OI), but wide spreads in fast markets

📊 TRADE DETAILS (JSON)

json

Copy

Edit

{

"instrument": "TSLA",

"direction": "put",

"strike": 340.0,

"expiry": "2025-06-06",

"confidence": 0.70,

"profit_target": 9.08,

"stop_loss": 6.60,

"size": 1,

"entry_price": 8.25,

"entry_timing": "open",

"signal_publish_time": "2025-06-02 09:30:00 UTC-04:00"

}

$TSLA back to $148-155 before correction is overDespite the bounce over the last few days, TSLA's price action is still bearish overall.

I think it's likely that we find resistance here or at $290, and then work our way back down to the lower support levels at $148-155.

I think once we get down to those levels, it'll be a good long term buy and we can see price go back to $700+.

𝗧𝗲𝘀𝗹𝗮 𝗕𝗿𝗲𝗮𝗱𝗸𝗼𝘄𝗻: Priced for perfectionPriced for perfection in an imperfect market

NASDAQ:TSLA nearly hit its 200dma and key resistance area (~288–292) after a roughly 20% post-earnings squeeze, and as long as it stays below that level, it risks retesting the long-term uptrend line that has marked major lows twice since COVID.

𝘛𝘢𝘳𝘪𝘧𝘧 𝘢𝘯𝘥 𝘴𝘶𝘱𝘱𝘭𝘺-𝘤𝘩𝘢𝘪𝘯 𝘳𝘪𝘴𝘬: Tesla depends heavily on Chinese-made battery and electronic components now hit by reciprocal U.S. tariffs, while over 60% of global neodymium and dysprosium—vital for its EV motors—are mined and processed only in China, creating a critical bottleneck that could sharply elevate its input costs.

𝘔𝘢𝘳𝘨𝘪𝘯 𝘱𝘳𝘦𝘴𝘴𝘶𝘳𝘦 𝘷𝘴. 𝘭𝘰𝘧𝘵𝘺 𝘷𝘢𝘭𝘶𝘢𝘵𝘪𝘰𝘯: Q1 price cuts of up to 20% on core models drove Tesla’s auto gross margin to its lowest since 2020, calling into question the sustainability of its >70× forward P/E multiple, which assumes exceptionally high profits from future ventures like robotics and autonomous fleets.

$NQ_F NASDAQ:NDX NASDAQ:QQQ NASDAQ:AMZN NASDAQ:META NASDAQ:NVDA NASDAQ:SOX $ES_F AMEX:SPY SP:SPX TVC:DXY NASDAQ:TLT TVC:TNX TVC:VIX #Stocks #TrumpTariffs 🇺🇸 #ChinaTariffs 🇨🇳

TSLA, the king of all meme stocksYesterday, Q1 earnings call. Stock misses earnings by 30% on already reduced expectations of 0.38. Had it been earnings expectations from a week before (which was 0.434), it would've missed by around 45%.

Still, the stock manages to rebound from mid 220s up to 257 in a single day (around 10%). It's impressive, but still looms a ceiling just up ahead (258-260) which I think is the perfect opportunity to short. Will be invalid if it manages to push up above 267.6 which is the local resistance line and a major historic resistance also.

That said. I think the odds are good in shorting around 258-260. Expecting a fall towards low 200s and even towards high 170s.

Breaking: Tesla Up 6% In Premarket Albeit Q1 Profit Drops 71%Shares of Tesla (NASDAQ: NASDAQ:TSLA ) stock surged 6% in early premarket trading on Wednesday amidst missing expectation, Q1 profit drops 71%.

Tesla investors breathed a sigh of relief after CEO Elon Musk said he would refocus his attention on the electric automaker, but that promise did not entirely dispel worries that his right-wing shift had irrevocably damaged the company's image.

The automaker's shares (NASDAQ: NASDAQ:TSLA ), rose about 6.5% in premarket trading on Wednesday after Musk said he would cut back, opens new tab his work for U.S. President Donald Trump to a day or two per week from sometime next month after the automaker posted a 71% slump in net income and a sharp drop in automotive revenue.

Since hitting a record high in December, Shares of Tesla (NASDAQ: NASDAQ:TSLA ) have lost about half its value reducing its market capitalization by more than $500 billion, largely on concerns that brand damage could hurt sales for a second straight year.

Tesla said it will a review of its full-year delivery forecast amid shifting global trade policies in the second quarter earnings update, which is expected in July.

While Tesla is less likely to be affected by global tariffs than legacy automakers, it still expects an outsized impact on the fast-growing energy storage business that uses battery cells from China.

Technical Outlook

As of the time of writing, NASDAQ:TSLA shares are up 6.5% in premarket trading. The asset is undergoing a bullish reversal pattern after bouncing off from the critical support point of $218.

TSLA shares are aiming for a 118% surge should the asset break the key Fibonacci levels highlighted on the chart. With the last trading session's RSI at 46, NASDAQ:TSLA is well primed for a bullish campaign since consolidating late December, 2024 losing almost 56% of value, TSLA shares are looking to capitalize on that.

TSLA Weekly Options Trade Plan 2025-04-17TSLA Weekly Analysis Summary (2025-04-17)

Below is an integrated analysis of the reports and market data:

──────────────────────────────

MODEL REPORTS – KEY POINTS

• Grok/xAI – Price and moving averages on both 5‑min and daily charts are below key EMAs; RSI and MACD point to current bearish momentum. – Notable technical support at about 239.75 with resistance above near 242. – The options chain shows heavy put activity at the $240 strike (premium about 0.67), and max pain is at 245, although that level is less relevant for a near‐term (0DTE) trade. – Recommendation: Trade the TSLA $240 PUT at an ask of 0.67 at the open, aiming for roughly a 100% gain and using about a 50% loss as a stop.

• Gemini/Google – Technicals on short‐term and daily timeframes are mixed: the daily chart is clearly bearish while some 5‑min indicators hint at stabilization. – Conflicting signals (including the max pain pull toward 245 and falling VIX) result in not having a high‑conviction directional bias. – Conclusion: “No trade” is recommended today because the conflicting indicators raise the risk of getting whipsawed.

• Claude/Anthropic – Technical analysis on both 5‑min and daily confirms a moderately bearish bias (price well below major EMAs, RSI below 50). – However, one suggested trade was a TSLA $237.50 PUT at an extremely low premium (0.13) which seems less attractive given the preferred premium range. – In essence, the model sees downside potential but selected a strike a bit further out from the current price.

• Llama/Meta – A moderately bearish setup is noted, with the technical picture similar to the others on very short‐term charts. – However, the model also flags the influence of max pain at 245 and concludes that a naked call (for example, at the $240 or $242.50 strike) could profit if the upward “max pain pull” works in play. – Ultimately, this view contrasts with the put trades favored by others.

• DeepSeek – Confirms the overall technical picture: price is below key averages, with bearish momentum evident on both 5‑min and daily charts. – Emphasizes the high open interest on $240 puts and the near-term support at 239.75. – Recommends buying the TSLA $240 PUT at its 0.67 ask price for this weekly (0DTE) option. ────────────────────────────── 2. AREAS OF AGREEMENT AND DISAGREEMENT

Agreements: – Most reports note that TSLA is trading in a moderately bearish state with price below the relevant moving averages and key support levels near 239.75. – There is broad recognition that options activity is concentrated around the $240 strike—especially on the put side, where volume and open interest are very high, underscoring bearish positioning. – Technical indicators (RSI, MACD, Bollinger Bands) on short‑term and daily charts lean toward bearishness despite some very short‑term signals of stabilization.

Disagreements: – Gemini/Google sees too many conflicting signals (including the upward pull implied by max pain) and hence recommends no trade, while the majority of the other analysts view the setup as tradeable. – Llama/Meta is open to trading a naked call (capitalizing on the max pain influence) whereas Grok/xAI, DeepSeek, and to a lesser degree Claude/Anthropic advocate for a bearish put trade instead. ────────────────────────────── 3. CONCLUSION & TRADE RECOMMENDATION

Overall Market Direction Consensus: Most opinions point to a moderately bearish bias for TSLA on a near-term, 0DTE weekly horizon. Even though conflicting signals (like max pain toward 245 and some stabilization on very short timeframes) introduce uncertainty, the weight of the technicals and put side open interest lean toward downside pressure.

Recommended Trade: Trade a single‑leg, naked PUT (weekly option) on TSLA.

Trade Parameters: – Instrument: TSLA – Strategy: Buy a TSLA $240 PUT – Expiration: 2025‑04‑17 (weekly, 0DTE) – Premium: Approximately $0.67 per contract (slightly above the preferred range, but justified by high liquidity and clear technical support) – Entry Timing: At the open – Profit Target: Around 100% gain from the entry premium (i.e. exit near a $1.34 premium) – Stop‑Loss: Roughly a 50% loss at about $0.33 per contract – Confidence Level: Approximately 65% – Key Risks & Considerations: • The mixed signals (especially Gemini’s caution and the max pain theory) mean price could quickly reverse if TSLA rebounds near 245. • Very short‑term trading (0DTE) carries risks related to rapid time decay and volatility spikes. • A failure to break important support (around 239.75) would warrant an early exit. ────────────────────────────── 4. TRADE_DETAILS (JSON Format)

{ "instrument": "TSLA", "direction": "put", "strike": 240.0, "expiry": "2025-04-17", "confidence": 0.65, "profit_target": 1.34, "stop_loss": 0.33, "size": 1, "entry_price": 0.67, "entry_timing": "open" }

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.