Stop!Loss|Market View: BRENT🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the BRENT ☝️

Potential trade setup:

🔔Entry level: 70.18

💰TP: 72.97

⛔️SL: 68.96

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: Technically, the situation is favorable for oil buyers. This is confirmed by the price movement within the ascending channel, as well as a likely retest of the 70-degree area, with a subsequent likely upward breakout. Furthermore, we shouldn't forget the geopolitical factor to which oil is very sensitive: the situation in the Middle East, which will likely push the price higher once again.

Thanks for your support 🚀

Profits for all ✅

Crude Oil Brent

This oil does not show a good outlook...This oil does not show a good outlook???

It may be due to the policies of seizure (you read theft) of oil wells, and after the seizure of oil, we had up to 3 times the price in history, which has become expensive to cover the costs of shameless war by killing children and men and of course women in certain parts of the world.

In the meantime: a number of countries played the role of executioners (they are still killing)

A number of countries played the role of supplying goods for the world after high oil prices (China)

And a number of countries played the role of sellers of expensive oil and small amounts of goods supplied with expensive oil to some people! (Oil well owners)

With the great theft of Venezuelan oil, this behavior will probably be repeated again!

We will have to spend a lot of time on the road to realize this scenario again

We hope for God's justice to eliminate the corrupt and those who participate in corruption, whether on earth or activists and participants in Ep/stein's personal island

Introduce me to your friends so we can build a bigger community together.

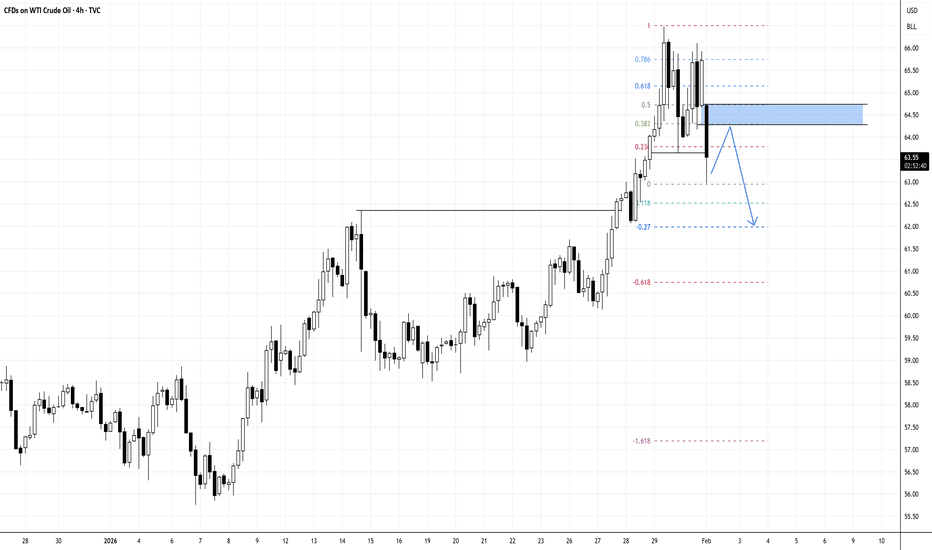

OIL SHOWING PRICE BREAKDOWN, MAY FALL BELOW 62.50!Crude oil structure breaks down on lower timeframe.

N.B!

- USOIL price might not follow the drawn lines . Actual price movements may likely differ from the forecast.

- Let emotions and sentiments work for you

- ALWAYS Use Proper Risk Management In Your Trades

#usoil

#ukoil

#UKOIL - Double bottom, aiming $95Hi guys! 👋

🔔Brent crude has been in a prolonged corrective phase since the 2022 highs, but price action now suggests a potential trend reversal from a well-defined long-term support zone.

🔔 The market has twice defended the $58.7 level, forming a clear double bottom structure and signaling seller exhaustion after an extended downtrend.

🔔 The first rebound occurred near the 0.5 Fibonacci retracement, strengthening the validity of the base and increasing the probability of a sustained upside move.

🔔 Key resistance levels to watch are $72.5, $77, and $86.5, each acting as a structural barrier that must be cleared to maintain bullish momentum.

🔔 A confirmed breakout above these zones opens the path toward the $95–$95.7 target, which represents the measured move of the double bottom pattern.

🔔 From a macro perspective, steady global oil demand growth and persistent geopolitical risk in major producing regions may support higher prices by sustaining a risk premium.

Bias : Bullish above $58.7

Invalidation : Sustained breakdown below the double-bottom base

✊ Good luck with your trades! ✊

• If you like the idea, hit the 🚀 button

• Please ✍️ your thoughts in the Comments section

• And follow me for more updates.

OIL analysis, What will happen given the tensions ?The price is moving inside an ascending channel, which can push it higher. Now and in the future, as tensions in the Middle East increase, we should expect energy prices to rise. This upward pressure on prices will likely continue until the tensions come to an end.

Best regards CobraVanguard.💚

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

XTI/USD WTI Crude Oil | Breakout, Pullback and Target Map📊 🔥 XTI/USD — US WTI CRUDE OIL SPOT (Energies Sector)

Bullish Momentum Play | Swing + Day Trade Setup 🚀

🚀 TRADE IDEA SUMMARY

Asset: XTI/USD (US WTI Crude Oil Spot)

Market Bias: Bullish bias confirmed

Timeframe: Swing & Day Trade

Strategy Focus: Moving Average Breakout + Pullback Liquidity Zones 🛢️

📈 TECHNICAL PLAN

Trend Confirmation:

✔ Triangular Moving Average breakout confirmed

✔ Price retest of MA & demand zone validating setup ✔

Primary Entry Zones:

• 🟩 Breakout Entry: After MA breakout — Enter around $62.00

• 🟦 Pullback Entry: Demand + liquidity zone — $58.00–$59.00

👉 Two potential entries — set alerts at these levels to catch momentum.

Target (TP):

🎯 $63.50 — key resistance & liquidity area (overbought region, potential trap).

Stop-Loss (SL):

• Pullback entry SL @ 57.50

• Breakout entry SL @ 61.80 (below breakout level)

💡 Risk Reminder: Execute SL & TP per your own risk tolerance — trades always carry inherent risk.

📊 MACRO & ECONOMIC FUNDAMENTALS (Real-Time Context)

Oil Supply & Demand Dynamics:

🔹 Global crude supply is currently large with inventories building — supply outpacing demand.

🔹 US WTI price recently hovered near $59–$60/bbl — range forming with volatile swings.

🔹 IEA reports world oil supply rising ~2.5 mb/d in 2026, pressuring prices.

🔹 Forecasts show mixed direction — some models see WTI averaging <$60 in 2026.

Geopolitical & Inventory Drivers:

⚠ US winter storm disrupted Gulf Coast output but prices dipped.

⚠ US shale responsiveness tied to price levels near $60.

⚠ OPEC+ output pause may support price stability.

📅 Economic catalysts to watch (London GMT):

• US Crude Oil Inventories & EIA STEO reports

• US CPI inflation data

• Global PMIs (China demand signals)

• OPEC+ meeting outcomes & supply commentary

→ These data points drive risk sentiment and crude volatility.

🔄 RELATED PAIRS & CORRELATIONS TO WATCH

📌 USOIL / CL1! (WTI Futures) — closely correlated (confirm breakout structure).

📌 Brent Crude (UKOIL) — global energy trend confirmation.

📌 Energy Sector ETF (XLE) — risk flow in energy equities.

📌 USD Index (DXY) — stronger USD often pressures crude.

👉 Correlation Notes:

• If Brent also breaks resistance, bullish energy sentiment strengthens.

• USD strength can create pullbacks in commodities (incl. WTI).

✨ TACTICAL TAKEAWAYS FOR TRADERS

🟢 Strong breakout areas + liquidity clusters provide clear entry zones.

🔔 Alerts at $62 and $58–$59 capture intraday momentum.

📉 Watch key macro releases around London open (~07:00–09:00 GMT).

📊 Confirm with related markets (Brent, DXY, Energy equities) for bias alignment.

📌 ENGAGE WITH THIS IDEA ✨

❤️ Like if you trade energy markets

💬 Comment your entry plan

🔔 Follow for updates on USOIL, Brent, and correlated setups

BRENT Oil → Bullish Breakout | Capital Flow Confirmed🛢️ BRENT CRUDE OIL (UKOIL) - Energy Market Capital Flow Blueprint ⚡

Swing/Day Trade | Bullish Triangular Breakout Strategy

📊 ASSET OVERVIEW

Asset Ticker: BRENT CRUDE / UKOIL (ICE Futures Europe)

Current Price Zone: $64.12 USD/BBL (As of Jan 26, 2026)

Market Status: 📈 Bullish Formation Testing Resistance

Trading Type: Swing Trade / Day Trade Setup

🎯 TECHNICAL PLAN - BULLISH BREAKDOWN

Primary Bias: BULLISH CONFIRMED ✅

Setup: Triangular Moving Average (TMA) Breakout & Retest Pattern

Structure: Clean impulsive move with shallow corrective pullback

Confirmation: No structural breakdown signals observed

Timeframe: Multiple timeframes (H1, H4, D1 alignment)

💰 ENTRY STRATEGY - "THIEF LAYERING SYSTEM" 🎯

Multi-Level Limit Order Entry (Pyramid Strategy)

The "Thief Method" = Smart accumulation on dips using multiple buy limits

Primary Entry Layers (Build Position Progressively):

🔵 Layer 1: $63.50 (20% Position Size)

🔵 Layer 2: $64.00 (25% Position Size)

🔵 Layer 3: $64.50 (30% Position Size)

🔵 Layer 4: $65.00 (25% Position Size)

💡 Pro Tip: Adjust layer density (add $63.75, $64.25, etc.) based on your account size & risk tolerance. This layering approach averages your entry cost and reduces emotional decisions!

Entry Confirmation:

✓ Price bounces from support zone $63.00-$63.50

✓ Volume surge on upside break

✓ TMA bullish crossover

✓ Break above triangular resistance

🎪 PROFIT TARGETS - ESCAPE WITH GAINS! 🚀

Primary Target: $67.50 USD/BBL

Logic: Simple Moving Average (SMA 200) acts as dynamic resistance + Overbought zone + Historical swing high

Risk/Reward: Typically 2.0-2.5:1 depending on entry

Secondary Targets (Pyramid Out):

📍 Target 1: $66.50 (Partial TP - 40% position)

📍 Target 2: $67.00 (Partial TP - 35% position)

📍 Target 3: $67.50 (Full TP - 25% position)

⚠️ IMPORTANT DISCLAIMER:

These are suggested levels. As traders, YOU have full autonomy on your profit targets. Take profits at your own discretion based on market conditions, risk management, and personal strategy. Never risk more than you can afford to lose! 💪

🛡️ STOP LOSS - PROTECTION FIRST!

Stop Loss Level: $63.00 USD/BBL

Placement: Positioned BELOW the key moving average support

Logic: Clean break below this level = trend invalidation

Position Risk: Typically 1-1.5% of account per trade (strict!)

⚠️ CRITICAL DISCLAIMER:

SL placement shown is a GUIDE ONLY. Your risk management is YOUR responsibility. Adjust SL based on your risk tolerance, position size, and account protection strategy. Never ignore your stops! 🚨

📈 RELATED PAIRS TO WATCH - CORRELATION TRADING 🔗

1️⃣ WTI CRUDE OIL / TVC:USOIL

Correlation: POSITIVE (Brent/WTI typically move together)

Current: ~$61.83/barrel

Key Level: Watch $60.00 support zone

Why Watch: WTI breaks often precede BRENT moves

Strategy Tip: Confirm BRENT signals with WTI chart alignment

2️⃣ US DOLLAR INDEX ( TVC:DXY )

Correlation: DYNAMIC (Recently shifted from inverse to positive)

Current Zone: 98.68-99.38 (Testing resistance)

Key Info: 🔄 Since 2021, rising oil prices = stronger USD (Modern relationship!)

Impact: Stronger DXY = Potential headwind for oil

Watch Level: DXY breakdown below 98.23 = Dollar weakness = Oil support

Why It Matters: Oil priced in USD - dollar strength makes oil more expensive globally

3️⃣ FX:EURUSD 💶

Correlation: INVERSE to Oil (Weaker euro = Oil strength)

Current: Monitor ECB policy signals

Trade Hint: EUR/USD breakdown often coincides with oil strength

Key Level: 1.0700 zone critical

4️⃣ FX:GBPUSD

Correlation: INVERSE (Weaker pound = Oil bullish)

Why: UK oil exports increase when GBP softens

Watch: Bank of England rate decisions

Sweet Spot: GBP/USD dips = BRENT strength likely

5️⃣ COPPER / METALS

Correlation: POSITIVE (Economic growth proxy)

Logic: Rising copper = Industrial demand = Oil demand up

Watch: Copper above $4.00 = Oil tailwind; Below = Headwind

Macro Signal: Copper strength validates risk-on environment

6️⃣ GOLD ( OANDA:XAUUSD ) 🏆

Correlation: MIXED (Risk sentiment dependent)

Inverse Risk Indicator: Gold spike = Flight to safety = Oil weakness

Current: Monitor inflation expectations

Edge: Gold spike above $2,100 = Caution for oil shorts

📰 FUNDAMENTAL & ECONOMIC FACTORS - WHAT'S MOVING THE MARKET 🌍

🔴 BEARISH PRESSURES (Short-term headwinds)

1. Global Oil Oversupply⚖️

IEA Projection: 3.8 million bpd surplus forecast for 2026

EIA Outlook: Brent average declining to $56/barrel in 2026 (vs $66+ current)

Driver: OPEC+ restraint + US production records + Guyana scaling + Canadian output

Impact: ⬇️ Price ceiling pressure - Don't expect explosive rallies

2. Abundant Global Inventories 📦

Status: Chinese onshore inventories at RECORD HIGHS

US Data: Crude oil storage volumes climbing above recent lows

Signal: Market well-supplied = Limited upside surprise

3. OPEC+ Production Pause ⏸️

Decision: 8 OPEC+ members pausing output increases Jan-Mar 2026 (Seasonality reasons)

Members: Saudi Arabia, Russia, UAE, Kazakhstan, Kuwait, Iraq, Algeria, Oman

Next Review: February 1, 2026 - KEY DATE TO WATCH

Context: 1.65 million bpd voluntary cuts could be restored gradually

Implication: No fresh production cuts coming - Supply likely to grow

4. Weak Demand Growth 📉

Global Demand Growth: ~1.2% annually (MODEST)

Context: Not enough to absorb supply growth

Risk: Structural oversupply becomes normalized

🟢 BULLISH CATALYSTS (Support factors)

1. Geopolitical Risk Premium ⚠️

Status: ACTIVE - Iran tensions elevated

Trump Position: Armada deployed toward Iran region

Risk Event: Potential military escalation = Supply disruption fear

Oil Response: Every Iran threat = $0.50-$2.00 premium added

Probability: Remains tail-risk but keeps bids elevated

2. Middle East Supply Disruptions 🔥

Kazakhstan Issue: Tengiz oilfield production still hasn't fully resumed

Impact: Estimated production shortfall present

Status: Repairs ongoing - Completion timeline critical

3. Softer US Dollar Support 💵

Current DXY: Trending down from recent highs (Positive for oil)

US-Europe Tensions: Strains weighing on dollar

Ukraine Uncertainty: Unresolved peace talks = Safe-haven weakness

Implication: Weak dollar = Oil cheaper for foreign buyers = Demand lift

4. China Strategic Reserves Demand 🇨🇳

Estimated Rate: Nearly 1.0 million bpd being added to strategic stockpiles

Duration: Continuing through 2026 (potential support)

Impact: Artificial demand creation = Price floor supporter

Note: Rate decreases ~33% in 2027 - Watch this transition

5. Strong Global Oil Demand Momentum 📊

2025 Achievement: Record oil consumption globally

2026 Projection: OPEC expects +1.4 million bpd growth

OPEC Confidence: Cartel maintaining bullish demand outlook despite IEA skepticism

Key Driver: AI infrastructure energy needs, aviation recovery, industrial activity

📅 CRITICAL DATES & ECONOMIC CALENDAR - WHAT TO MONITOR 🗓️

IMMEDIATE (Next 2 Weeks)

Jan 28-29: US CPI Release - MAJOR (Impacts Fed expectations & dollar)

If hot: USD strength = Oil headwind

If cool: USD weakness = Oil support

Feb 1, 2026: OPEC+ Monthly Meeting - WATCH CLOSELY

Production decision review

Any hints at Q2/Q3 production changes?

Cartel messaging critical

February 2026

Feb 7: US Jobs Report (NFP)

Economic health indicator - impacts oil demand expectations

Feb 14: OPEC Monthly Oil Market Report Release

Updated 2026 demand/supply forecasts

Sentiment gauge

Q1 2026 Focus

ECB Policy: European Central Bank meetings - EUR weakness = Oil strength

Fed Stance: Rate hold expectations - Dollar direction crucial

China Data: Manufacturing PMI, economic activity signals

⚡ TRADE EXECUTION CHECKLIST

BEFORE ENTRY ✅

Confirm TMA breakout on H4/D1 chart

Check volume surge on breakout candle

Verify no negative divergences on MACD

Monitor DXY position (avoid entry if DXY spiking higher)

Check geopolitical news - Any Iran/Middle East developments?

Confirm all 4 layers placed at limits

POSITION MANAGEMENT 🎯

Set 50% TP at $67.00 (secure profits early!)

Move SL to breakeven after 1.5R profit

Pyramid out of position gradually

Trail stops on partial profits

NO holding through FOMC/OPEC meetings without hedges

EXIT SIGNALS 🚨

❌ Break below $63.00 = Stop loss hit (exit 100%)

❌ Close below 200-SMA = Trend invalidation

❌ Major DXY rally begins = Risk/reward deteriorates

❌ Negative gap opens (overnight) = Reassess position

🎓 STRATEGY SUMMARY

Best Case Scenario:

Break above $65.50 → Run to $67.50 TP = 2.5:1 Risk/Reward ✅

Worst Case Scenario:

Rejection at $65.00 → Fall to SL $63.00 = 1:1.5 Risk Loss ✅ (Managed)

Breakeven Trade:

Bounce to $64.50 then reversal = Tighten SL, exit flat

⚠️ FINAL RISK DISCLAIMER

Oil trading involves substantial risk:

Volatility: Brent can swing $1-3/barrel intraday on news

Geopolitical Risk: Unexpected escalations can gap prices overnight

Liquidity Events: Thin volume periods can cause slippage

Leverage Risk: If using leverage, losses amplify quickly

Margin Calls: Futures trading can wipe accounts quickly

YOU are responsible for:

✓ Your position sizing (risk max 1-2% per trade)

✓ Your stops (ALWAYS set them)

✓ Your profits targets (take them!)

✓ Your research (verify all signals yourself)

✓ Your broker selection (regulated, reputable)

Trade with discipline. Trade with a plan. Trade what you can afford to lose. 💪

🚀 ENGAGEMENT BOOST TIPS FOR TRADERS

Share this idea if:

✅ You believe in the bullish breakout thesis

✅ You're tracking geopolitical oil risks

✅ You're using this for swing trade confirmation

✅ You found the layering strategy useful

✅ You're monitoring OPEC+ next move (Feb 1)

Questions? Comments? Drop them below - Let's discuss the setup! 💬

Good luck, fellow traders! May your entries be timely and your stops be tight! 🎯

Will #USOIL (WTI Crude) Falling Channel Rise? –Weekly Timeframe Will #USOIL USOIL (WTI Crude) Falling Channel Rise? – Weekly Timeframe Technical Analysis

Current Price: 61.1

Market Structure

WTI remains in a long-term corrective phase following the 2022 peak - Over 50% Retracement. Price action is clearly contained within a well-defined descending channel (red), characterised by lower highs and lower lows. This confirms that, structurally, the market is still bearish on a primary timeframe. However, price is now trading very close to the lower boundary of the channel with a double bottom, where downside momentum historically weakens.

Key Support & Demand Zone

Major support is between 56.00 – 61.00

This zone has acted as a multi-year demand area, repeatedly absorbing selling pressure.

The most recent weekly candles show **rejection wicks and reduced downside follow-through**, suggesting seller exhaustion rather than aggressive distribution.

A sustained weekly close **below 56** would invalidate this current recovery and expose the low-40s.

Resistance & Upside Levels

If price holds above support and breaks channel resistance, the following upside levels come into focus:

73.96 Prior structural resistance and midpoint reaction zone

91.95 Major range resistance from previous distribution

111.65: Upper macro resistance

127.95: Long-term target aligned with prior highs. These levels align well with historical supply zones and would likely trigger profit-taking on any rally.

Momentum, Bias and Invalidation

Momentum remains neutral-to-bearish but losing downside strength

A weekly close above the descending channel would signal a structural shift from bearish continuation to bullish recovery. Until that breakout occurs, rallies should still be treated as corrective within a broader downtrend.

Invalidation and Bearish Continuation lives below 56 (A weekly close below)

Conclusion

WTI is at a critical inflection point. While the dominant trend remains bearish, price location favours a potential upside reaction due to strong historical demand and channel compression. Confirmation, not anticipation, is key.

Not Financial Advice!!

Oil is Boiling! 1/23/2026

After CRYPTOCAP:BTC ’s big run to $126K (now cooling off in corrective mode), Silver and Gold are pushing into new highs and closing in on their projected targets. Meanwhile, Oil popped +2.45% today and the chart is heating up — technically it looks primed for a major upside move.

With rising geopolitical tensions in the Middle East, the energy market is getting extra fuel.

Historically, geopolitical shocks have been one of the strongest catalysts for sharp Oil price swings — more than almost any other factor.

Momentum is shifting fast across the board… the next big rotation could be explosive!

Happy Trading!

UKOIL/BRENT Chart Shows That OIL Can RallyI am using UKOIL/BRENT chart because there is a direct correlation between this and any other USOIL/WTI chart.

What we have are:

1. It has been falling in a wedge pattern and is coiling. Hence a breakout sooner or later is expected.

2. It has reached an FCO zone which is acting as a good support. The price has started to form a possible double bottom this week.

3. We have Trend Line support which price has not been able to break though.

This presents a very good medium to longer bullish opportunity on OIL and associated sectors

Lets wait and watch and always this is not and advice but just an observation. Risk management is extremely important as always.

Follow for more. Please support this analysis by liking, commenting, and sharing with friends, colleagues, traders, and trading communities. Thanks👍🙂

UKOIL Bearish Opportunity — Is This the Pullback to Sell?🛢️ BRENT CRUDE (UKOIL) - BEARISH SWING TRADE SETUP 📉

📊 CURRENT MARKET DATA (Live as of Nov 21, 2025)

Brent Crude: $64.07/barrel (+0.88% from previous day)

WTI Crude: $57.77/barrel (-2.09% from previous day)

Market Status: Bearish momentum with descending channel pattern confirmed

🎯 TRADE SETUP - BEARISH CONFIRMATION

📍 ENTRY STRATEGY: Layered Limit Orders (Thief Method)

Layer 1: 63.00

Layer 2: 62.50

Layer 3: 62.00

(Scale entries based on your risk tolerance - add more layers if desired)

🛑 STOP LOSS: 64.00

⚠️ Risk Disclaimer: Adjust SL according to YOUR strategy and risk management. This is reference only - manage YOUR capital YOUR way.

🎯 PRIMARY TARGET: 60.50

Strong support zone identified

Oversold conditions anticipated

Trap zone detected - secure profits accordingly

💡 Exit Strategy Note: Not financial advice. Take profits when YOUR targets align with YOUR risk/reward ratio.

📈 TECHNICAL CONFLUENCE

✅ Volume-weighted moving average pullback confirmed

✅ Retest of resistance completed

✅ Descending channel pattern active

✅ Bearish momentum building

🔗 CORRELATED ASSETS TO MONITOR

1. WTI CRUDE (USOIL) 💵

Current: $57.77/barrel

Correlation: Direct (85%+ correlation with Brent)

Watch for breakdown below $57.00 support

2. USD/CAD

Inverse Correlation with oil prices

CAD weakens when oil falls

Monitor for USD strength continuation

3. ENERGY SECTOR ETFs 📊

XLE (Energy Select Sector SPDR)

XOP (Oil & Gas Exploration ETF)

Follow for confirmation of sector weakness

4. NATURAL GAS (NATGAS) ⚡

Parallel Energy Market

Similar bearish patterns observed

Confirms broader energy sector weakness

5. RUSSIAN RUBLE (USD/RUB)

Oil-dependent currency

Weakens with falling oil prices

Geopolitical risk indicator

🌍 KEY MARKET FACTORS

⚠️ Supply Pressure

Increased global production capacity

OPEC+ policy uncertainties

📉 Demand Concerns

Global economic slowdown fears

Industrial activity softening

💵 Dollar Strength

Stronger USD = Lower oil prices

Monitor Federal Reserve policy

⚡ RISK MANAGEMENT REMINDER

🚨 Ladies & Gentlemen (Thief OG's) - This is NOT financial advice:

✓ Position size according to YOUR account

✓ Never risk more than you can afford to lose

✓ Adjust stops based on YOUR strategy

✓ Take profits at YOUR comfort levels

✓ Market can remain irrational longer than you can stay liquid

Your Capital = Your Responsibility = Your Profits/Losses

🎯 Trade Smart | Stay Disciplined | Manage Risk 🎯

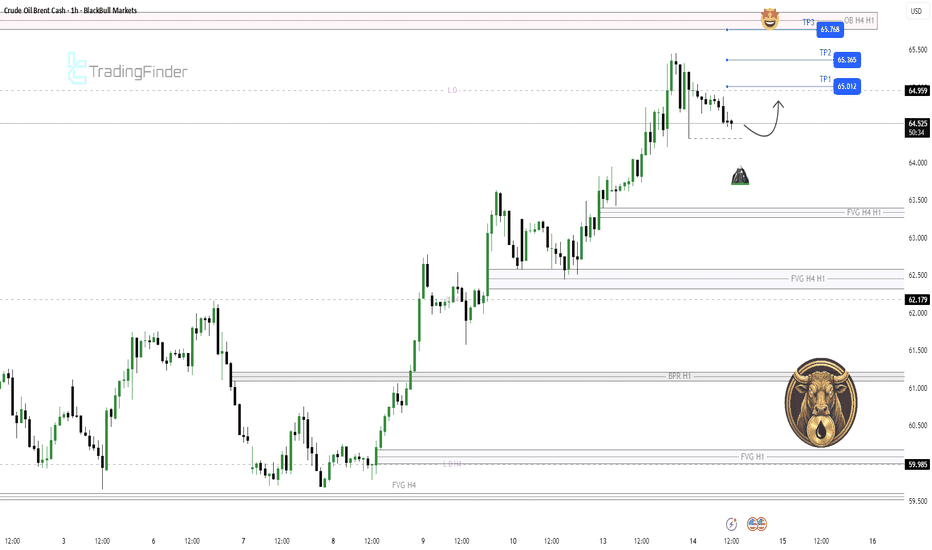

BRENT H1 HTF Pullback and Bullish Continuation Setup📝 Description

Crude Oil is trading within a strong bullish structure after a clean impulsive move. The current price action represents a shallow corrective pullback, with no signs of structural breakdown so far.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish while price holds above the H1 pullback

Preferred Setup:

• Entry: 64.5

• Stop Loss: Below 64.4

• TP1: 65

• TP2: 65.35

• TP3: 65.75 (HTF OB)

________________________________________

🎯 ICT & SMC Notes

• Bullish continuation after impulse leg

• Pullback aligned with H1–H4 FVG demand

• No bearish BOS or displacement against trend

________________________________________

🧩 Summary

As long as price respects the current FVG support, the expectation remains bullish continuation toward higher-timeframe liquidity levels.

________________________________________

🌍 Fundamental Notes / Sentiment

With the potential for increased geopolitical tensions, risk premium may reprice into the market. Any escalation affecting supply routes or producers could support upside in Brent, keeping prices biased higher despite broader macro headwinds.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

UKOILSPOT H| Bullish Bounce OffBased on the H1 chart analysis, we can see that the price has bounced off our buy entry level at 62.69, whic is a pullback support that aligns with the 50% and the 23.6% Fibonacci retracement.

Our stop loss is set at 61.92, which is a pullback support.

Our take profit is set at 3.80, which acts as a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

Say hello to oil prices at 40 to 50 dollars.Say hello to oil prices at 40 to 50 dollars.

Considering that the Venezuelan government has collapsed, and that major investments will flow into Venezuela in the near future, it can be said that oil prices will experience a sharp decline, and Iranian and Russian oil will become the cheapest oil in the world.

UKOIL H4 | Potential Bullish RiseMomentum: Bullish

The price has bounced off the buy entry, which has been identified as a pullback support.

Buy entry: 61.75

Pullback support

Stop loss: 60.59

Pullback support

Take profit: 63.86

Swing high resistance

High Risk Investment Warning

Stratos Markets Limited (tradu.com ), Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

UKOIL M30 | Bullish Bounce Off Pullback SupportMomentum: Bullish

Price is currently above the ichimoku cloud.

Buy entry: 60.28

- Pullback support

- 50% Fib retracement

- 78.6% Fib projection

Stop Loss: 59.957

- Swing low support

Take Profit: 60.637

- Multi-swing high resistance

High Risk Investment Warning

Stratos Markets Limited (tradu.com/uk ), Stratos Europe Ltd (tradu.com/eu ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com/en ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

UKOIL⬆️ Buy Entry: 63.4500

⏹️ Stop Loss: 61.6500

*️⃣ Take Profit-1: 65.1500

*️⃣ Take Profit-2: 66.7700

🔠 The Brent crude oil forecast suggests an attempt to test the support level and the lower boundary of the internal descending channel near 63.4500. Further growth is expected with a target above 66.0000. A test of the trend line on the relative strength indicator (RSI) will support the asset's price growth. The Brent price rise will be interrupted if the price declines and consolidates below 62.0500 on Chart 4H, which would signal a continued decline below 60.0000.

UKOIL H4 | Bullish Bounce OffBased on the H4 chart analysis, we can see that the price is reacting off the buy entry which is a pullback support that aligns with the 38.2% Fibonacci retracement and could bounce from this level to the upside.

Buy entry is at 63.40, which is a pullback support that aligns with the 38.2% Fibonacci retracement

Stop loss is at 62.64, which is a pullback support that aligns witht he 61.8% Fibonacci retracement.

Take profit is at 66.51, which is a multi swing high resitance.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

UKOIL H1 | Bearish Momentum BuildingBased on the H1 chart analysis, we can see the price rise to the sell entry, which is a pullback resistance, and could drop from this level.

Sell entry is at 64.43, whichis a pullback resitance.

Stop loss is at 65.10, whichis an overlap resistance.

Take profit is at 62.99, which aligns with the 78.6% Fibonacci projection and serves as a pullback support.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.