Bearish drop off?USD/JPY is reacting off the pivot and could drop to the 1st support, which is an overlap support.

Pivot: 156.08

1st Support: 155.35

1st Resistance: 156.84

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USD

Potential bearish continuation?Swissie (USD/CHF) could make a short-term pullback to the pivot, which is a pullback resistance and could drop from this level to the 1st support.

Pivot: 0.7933

1st Support: 0.7894

1st Resistance: 0.7965

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Could we see a reversal from here?Kiwi (NZD/USD) is rising towards the pivot and could reverse to the 1st support, which acts as a pullback support.

Pivot: 0.5806

1st Support: 0.5780

1st Resistance: 0.5818

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USDSGD LongHello traders, I just noticed this setup. It seems the price for second time breaks the trendline. We have also a good support formed on levels between 1.2915/1.2935. In my opinion it will be a fake double top pattern which already formed by breaking the trendline, thus I remain long on this pair.

XAUUSD | Rate-Cut Hopes & Geopolitical Risks Fuel RallyGOLD | Technical & Fundamental Overview

Gold surged to a record high above $4,420, driven by growing expectations of U.S. rate cuts next year and rising safe-haven demand amid heightened geopolitical tensions.

Markets are increasingly positioning for a looser U.S. monetary policy into 2026, which remains a strong supportive backdrop for non-yielding assets like gold.

The rally is also supported by continued central-bank purchases, steady inflows into gold-backed funds, and escalating geopolitical risks following renewed U.S. pressure on Venezuela.

Technically:

To maintain the bullish continuation, gold needs to close a 1H candle above 4420, which would open the way toward 4430 and 4445, with further extension toward 4460.

However, as long as the price trades below 4420, a short-term correction is likely:

First toward 4400

Then potentially toward 4379 – 4367

Pivot Line: 4420

Resistance: 4430, 4445, 4460

Support: 4400, 4380, 4368

Bias: Bullish above 4420; corrective below it.

Bullish bounce setup?USD/CHF is falling towards the support level, which is a pullback support and could bounce from this level to our take profit.

Entry: 0.7928

Why we like it:

There is a pullback support level

Stop loss: 0.7892

Why we like it:

There is a multi-swing low support

Take profit: 0.7992

Why we lik eit:

There is an overlap resistance level that is slightly below the 50% Fibonacci retracement

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bullish bounce off?GBP/USD has bounced off the support level whichis a pullback support that align swith the 61.8% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.3348

Why we like it:

There is a pullback support level that aligns with the 61.8% Fibonacci retracement.

Stop loss: 1.3293

Why we like it:

There is a pullback support level that aligns with the 38.2% Fibonacci retracement.

Take profit: 1.3455

Why we like it:

There is a multi-swing high resistance

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Falling towards strong support?EUR/USD is falling towards the support level, which is a pullback support that aligns with the 38.2% and the 61.8% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.1682

Why we like it:

There is a pullback support level which aligns with the 38.2% and the 61.8% Fibonacci retracement.

Stop loss: 1.18033

Why we like it:

There is a swing high resistance level

Take profit: 1.1757

Why we like it:

There is a pullback resistance level

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Could we see a reversal from here?AUD/USD is rising towards the resistance level whcih is a pullback resistance that aligns with the 61.8% Fibonacci retracement and could reverse to the take profit.

Entry: 0.6645

Why we like it:

There is a pullback resistance that aligns with the 61.8% Fibonacci retracement.

Stop loss: 0.6676

Why we like it:

There is a swing high resistance

Take profit: 0.6571

Why we like it:

There is a pullback support that is slightly above the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Potential bearish reversal?Cable (GBP/USD) is reacting off the pivot and could reverse to the 1st support which acts as an overlap support.

Pivot: 1.3405

1st Support: 1.3199

1st Resistance: 1.3585

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off key support?Loonie (USD/CAD) is reacting off the pivot which is an overlap support, and could bounce to the 1st resistance which has been identified as an overlap resistance.

Pivot: 1.3744

1st Support: 1.3577

1st Resistance: 1.3914

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off pullback support?Kiwi (NZD/USD) is falling towards the pivot and could bounce to the 1st resistance which acts as an overlap resistance.

Pivot: 0.5682

1st Support: 0.5584

1st Resistance: 0.5838

Dow Jones (US30) is falling towards the pivot, which is a pullback support and could rise to the 161.8% Fibonacci extension.

Pivot: 47,063.30

1st Support: 45,135.60

1st Resistance: 50,049.13

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Falling towards pullback support?Aussie (AUD/USD) is falling towards the pivot, which acts as a pullback support that aligns with the 50% Fibonacci retracement and could bounce to the 1st resistance.

Pivot: 0.6538

1st Support: 0.6404

1st Resistance: 0.6681

Dow Jones (US30) is falling towards the pivot, which is a pullback support and could rise to the 161.8% Fibonacci extension.

Pivot: 47,063.30

1st Support: 45,135.60

1st Resistance: 50,049.13

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish drop?WTI Oil (XTI/USD) could make a short-term pullback to the pivot and could reverse to the swing low support.

Pivot: 60.30

1st Support: 54.80

1st Resistance: 65.75

Dow Jones (US30) is falling towards the pivot, which is a pullback support and could rise to the 161.8% Fibonacci extension.

Pivot: 47,063.30

1st Support: 45,135.60

1st Resistance: 50,049.13

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

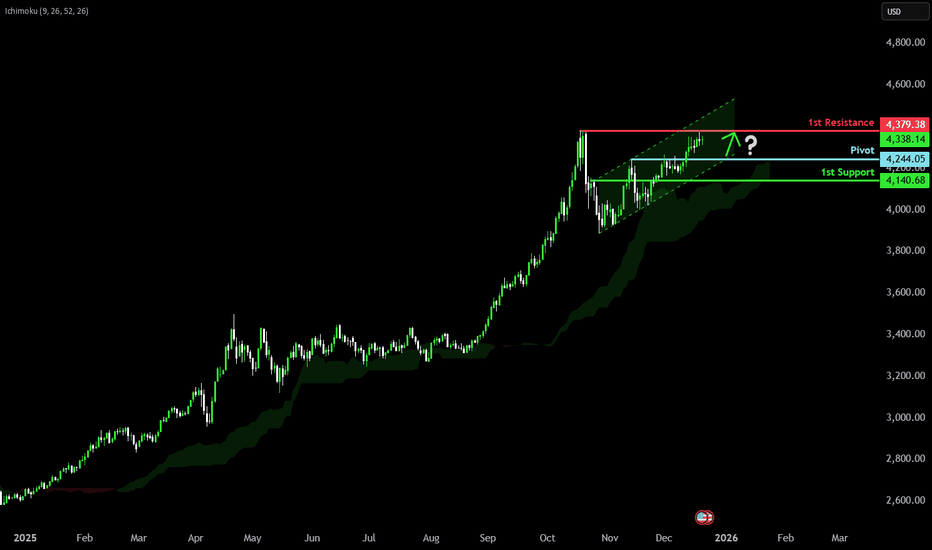

Bullish continuation on Gold?The is falling towards the pivot and could bounce to the 1st resistance, which is a swing high resistance.

Pivot: 4,244.05

1st Support: 4,140.68

1st Resistance: 4,379.38

Dow Jones (US30) is falling towards the pivot, which is a pullback support and could rise to the 161.8% Fibonacci extension.

Pivot: 47,063.30

1st Support: 45,135.60

1st Resistance: 50,049.13

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

GBPUSD is Nearing an Important Support Area!!Hey Traders, in tomorrow's trading session we are monitoring GBPUSD for a buying opportunity around 1.33250 zone, GBPUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 1.33250 support and resistance area.

Trade safe, Joe.

GBP/USD - H4 Weekly Outlook- Channel Breakout📝 Description 🔍 Setup (Market Structure) OANDA:GBPUSD

GBP/USD is trading inside a rising channel on H4 and has recently shown a channel breakout attempt followed by a retest near the upper zone. Price is now consolidating under a key resistance area, making this a decision week.

🔴Higher highs & higher lows intact

🔴Breakout + retest structure visible

🔴Momentum slowing near resistance → wait for confirmation

📍 Key Levels :

🟢 Resistance Zone: 1.3420 – 1.3455

🔴 1st Support: 1.3215 – 1.3200

🔴 2nd Support: 1.3135 – 1.3100

#GBPUSD #ForexTrading #WeeklyOutlook #ChannelBreakout #PriceAction #SupportResistance #TradingView #Kabhi_TA_Trading

⚠️ Disclaimer

This analysis is for educational purposes only.

Forex trading involves risk — always use proper risk management and stop-loss.

💬 Support the Analysis👍 Like if you’re watching GBP/USD this week

💬 Comment: Breakout or Rejection?

🔁 Share with traders following GBP pairs

GBPUSD - Relief Rally Into Resistance? Sellers Watching Closely📉GBPUSD remains overall bearish on the higher timeframe. Price is still trading within a descending structure, and the broader trend continues to favor sellers rather than buyers.

The recent upside move is best viewed as a corrective bounce, not a trend reversal. Price is now approaching a key confluence zone, where the former structure, horizontal resistance, and the descending trendline align.

This is the type of location where trend-following shorts become interesting. I’m not interested in selling blindly, but rather in waiting for lower-timeframe bearish confirmation once price reacts at this resistance zone.

⚔️As long as price remains below the descending trendline and fails to reclaim the range above, the bearish bias stays intact. A clean break and hold above this resistance would be the only thing that forces a reassessment.

For now, this looks like sellers getting another chance at a better price.

Will this resistance cap the move once again, or do bulls finally break the structure? 🤔

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

GOLD | Softer Inflation Supports Upside — Key Levels 4314–4347GOLD | Technical Overview

Gold is on track for a weekly gain, supported by rising expectations of U.S. rate cuts after inflation came in lower than forecast.

Although prices slipped slightly in early trading due to a firmer dollar, sentiment remains bullish as traders assign roughly a 25% probability of a January cut and are almost fully pricing in a cut by April.

Lower rates typically benefit non-yielding assets such as gold, while geopolitical tensions continue to enhance safe-haven demand.

Technically:

Gold remains in consolidation between 4314 and 4347, maintaining a bullish bias as long as it stays above the pivot zone.

Given improving inflation conditions, the fundamental outlook supports bullish continuation.

The price is expected to retest 4314 – 4308.

If gold stabilizes above this zone, the bullish trend should extend toward 4347 and 4379.

However, a 1H or 15M close below 4308 would signal intraday weakness and open the way for a drop toward 4291 and 4277.

Key Levels

Pivot Line: 4314

Resistance: 4334, 4347, 4367

Support: 4292, 4278, 4265

Bias: Bullish while above 4314 -4308; bearish only below 4308.

XAUUSD Holds Bullish Structure - Resistance at $4,380 in FocusHello traders! Here’s my technical outlook on XAUUSD (Gold) based on the current chart structure. After a corrective phase, Gold established a solid base and transitioned into a bullish recovery, forming higher lows and respecting the rising Support Line. The price previously moved through a consolidation Range, where accumulation took place before a clear breakout confirmed renewed buying momentum. Following this breakout, XAUUSD continued to trade within an ascending channel, showing a well-structured bullish trend. Recently, price pulled back into the Buyer Zone around 4,280, which aligns with the horizontal Support Level and the lower boundary of the rising structure. Buyers successfully defended this area, keeping the bullish structure intact. From this support, Gold has started to rebound and is now pressing higher toward the Seller Zone / Resistance Level near 4,380 (TP1) — a key supply area where sellers may attempt to slow the move. As long as XAUUSD holds above the 4,280 Support, the bullish scenario remains valid. I expect continued upside pressure toward the 4,380 Resistance (TP1). A clean breakout and acceptance above this seller zone would open the path for further bullish continuation. However, rejection from resistance could lead to a short-term consolidation or a healthy pullback back toward support. For now, the structure favors buyers, with 4,280 as key support and 4,380 as the main upside target. Always manage your risk and trade with confirmation. Please share this idea with your friends and click Boost 🚀

DXY: long-term view🛠 Technical Analysis: On the weekly timeframe (W1), the U.S. Dollar Index is displaying a significant structural shift. Despite a brief breach of the psychological 100 level, the price failed to generate a strong downward impulse, suggesting that bearish momentum is exhausted.

As noted on the chart, "sellers are being bought out," paving the way for a recovery back above the 100 level. The primary objective of this move is a test of the long-term descending resistance line, which currently aligns with the 107.384 target.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: Confirmation of price holding above the pivot level (approx. 100.524).

🎯 Take Profit: 107.384 (Long-term Descending Resistance).

🔴 Stop Loss: Below the recent accumulation lows (approx. 97.787).

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

BTCUSD SELL SETUPPOSSIBLE SELL SETUP BTCUSD

SL ABOVE SUPPLY ZONE

TP 1 BELOW DEMAND ZONE

TP 2 OPEN USE PROPER RISK MANAGEMENT

FOLLOW YOUR TRADING PLAN !!!!

SIMPLE BTCUSD TRADING PLAN

1️⃣ Timeframe

15m or 1H only

2️⃣ Indicators

200 EMA → trend

50 EMA → entry

RSI (14) → confirmation

3️⃣ BUY RULES

✅ Price above 200 EMA

✅ Pullback to 50 EMA

✅ RSI above 50

✅ Bullish candle

➡️ Then BUY

4️⃣ SELL RULES

✅ Price below 200 EMA

✅ Pullback to 50 EMA

✅ RSI below 50

✅ Bearish candle

➡️ Then SELL

5️⃣ Risk Rules

Risk 1% per trade

Always use Stop Loss

Target = 2× Stop Loss (1:2)

6️⃣ Management

At 1:1, move stop to breakeven

Do nothing else

7️⃣ Golden Rules

❌ No stop loss = no trade

❌ No emotions

❌ No overtrading

ONE LINE RULE

If all rules aren’t met → NO TRADE