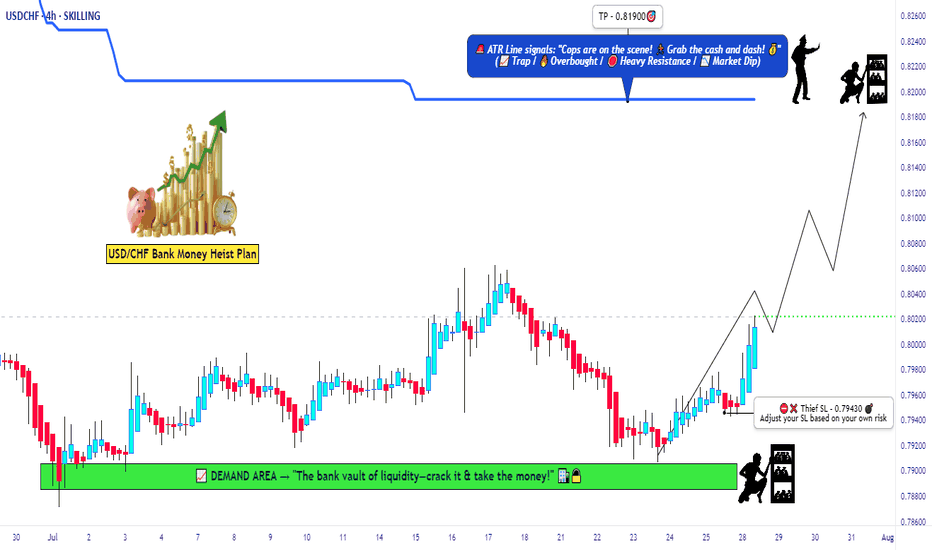

Swiss-Dollar Bank Job: Breakout or Bust!💵🕵️ USD/CHF "Swiss-dollar" Forex Bank Heist Plan (Swing/Day Trade) 💎🚀

🌍 Dear Thieves, Robbers & OG’s of the Market Vault,

This is our master robbery blueprint based on 🔥Thief Strategy🔥 using layered entries & alarms to catch the breakout in real-time.

📈 Plan: Bullish (Pending Order Plan)

Breakout Entry ⚡: 0.81100 (set your alarms, don’t miss the crack in the vault 🚨)

Pullback Entries (Layer Method) 🧱:

0.79000

0.79300

0.79500

0.79700

0.80000

(add more layers if needed, stack your bullets 🎯)

💡 Thief Layer Strategy: Place multiple buy limit orders like thieves placing ladders at different points of entry. Confirm every layer only after breakout @0.81100.

🛑 Stop Loss (SL)

Breakout Entry SL: 0.80000

Pullback Entry SL: 0.78500

⚠️ Place your SL only after breakout/pullback confirms. Adjust as per your own risk appetite & layering style.

🎯 Target

Police barricade spotted 🚓 around 0.83000

Escape Target 🎒: 0.82500 (collect profits before the cops close in 🚔💨)

🔔 Important Reminder

✅ Always set alarms in TradingView so you catch the breakout without missing it.

✅ SL & Target levels are based on Thief OG method — tweak them for your style.

✅ This is not financial advice, just a robbery blueprint.

💖 If you enjoyed this heist plan, boost the idea & join the Thief Crew 🚀💵.

Together we raid the market vaults daily! 🏆💸

Usdchfidea

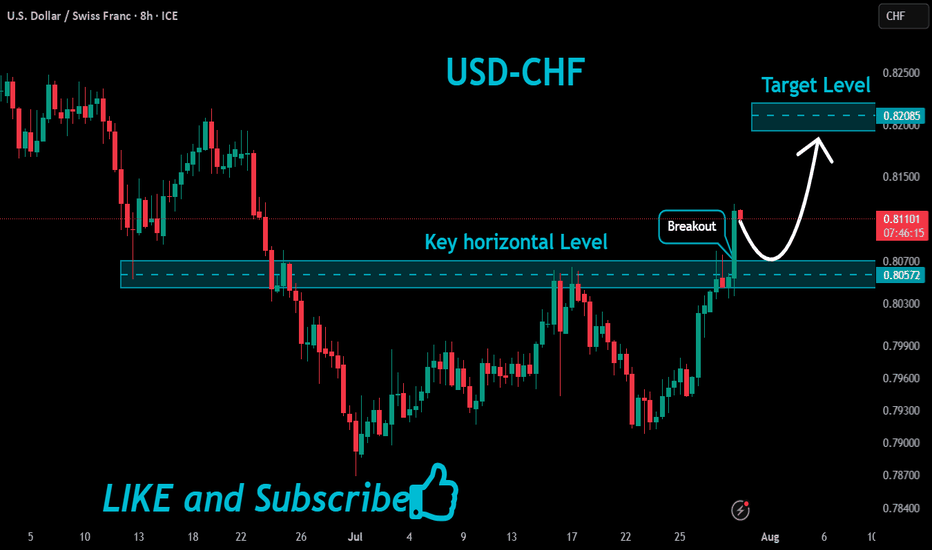

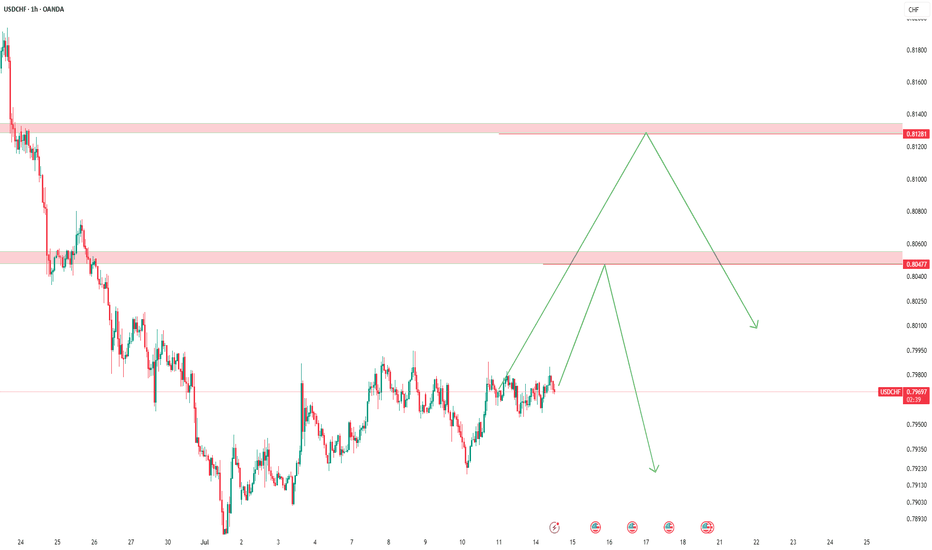

USDCHF Bulls Eye 0.8060 as Support Holds FirmUSDCHF has bounced strongly from the 0.7920 support zone, with buyers showing commitment to defend this base. The pair is building momentum for a push toward the 0.7990 and 0.8060 levels as dollar strength combines with fading CHF demand. With the Swiss franc losing some safe-haven appeal and the Fed remaining cautious but still tighter than the SNB, the path of least resistance favors further upside.

Current Bias

Bullish – Momentum is shifting upward after defending 0.7920 support.

Key Fundamental Drivers

Federal Reserve: Slower pace of cuts than initially expected keeps USD relatively firm.

Swiss National Bank (SNB): Maintains accommodative stance with minimal inflation pressure, weighing on CHF.

Risk Sentiment: Reduced safe-haven demand for CHF as equities stabilize and US yields remain attractive.

Macro Context

Interest rates: Fed is more hawkish relative to SNB, supporting USDCHF upside.

Economic growth: US remains resilient, while Swiss growth is subdued.

Commodity flows: Limited direct impact, but safe-haven demand dynamics remain key.

Geopolitical themes: CHF lags as safe-haven flows rotate into gold and USD instead.

Primary Risk to the Trend

A renewed surge in global risk aversion (e.g., geopolitical shocks or equity sell-offs) could reignite CHF strength, capping USDCHF upside.

Most Critical Upcoming News/Event

US CPI and Fed guidance – main drivers for USD momentum.

SNB policy commentary – could impact if there’s any surprise tightening language.

Leader/Lagger Dynamics

USDCHF tends to be a lagger to broader USD moves (following EURUSD and DXY). However, it can lead CHF crosses such as EURCHF and CADCHF, particularly when safe-haven flows dominate.

Key Levels

Support Levels: 0.7920, 0.7910

Resistance Levels: 0.7990, 0.8060

Stop Loss (SL): 0.7910 (below key support zone)

Take Profit (TP): 0.8060 (major resistance target)

Summary: Bias and Watchpoints

USDCHF is shaping up for a bullish continuation as long as the 0.7920 base holds. The bias is bullish, with SL set at 0.7910 and TP at 0.8060. Fed-SNB policy divergence and softer CHF safe-haven flows keep momentum tilted higher, but the key risk is a sudden return of global risk-off sentiment. Watch US inflation and Fed commentary as the deciding catalysts for a push toward the 0.8060 resistance zone.

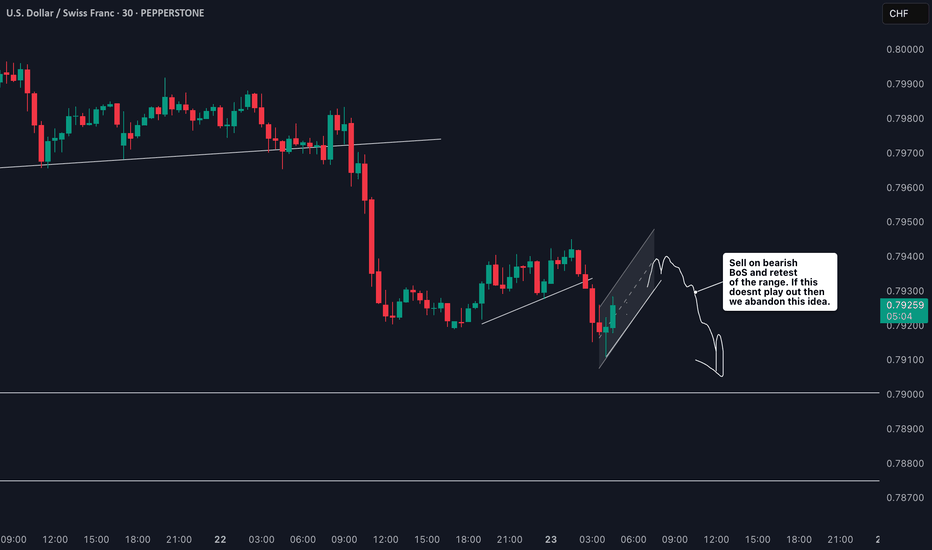

USDCHF Fresh Breakdown Opens the Door for Deeper LossesUSDCHF has cracked below the 0.8000 handle with strong bearish momentum. The pair has been grinding lower in a descending channel, and this latest push confirms sellers are in control. With the market leaning toward further Fed easing and the Swiss franc supported by safe-haven demand, the path of least resistance points lower, with room to test key support zones ahead.

Current Bias

Bearish downside momentum accelerating after a clean break below 0.8000.

Key Fundamental Drivers

U.S.: August NFP showed softer jobs growth and unemployment ticking up to 4.3%. Core PCE eased to 2.9%, keeping the Fed on track for cuts.

Switzerland: CPI cooled to 1.0% y/y, giving the SNB room to stay neutral. However, CHF continues to benefit from haven flows tied to Middle East and trade tensions.

Risk Sentiment: Heightened geopolitical uncertainty (Israel–Hamas tensions, OPEC+ supply moves, Trump tariff push) supports CHF demand.

Macro Context

Interest Rates: Fed cuts priced in for late 2025, while SNB keeps policy cautious but stable.

Economic Growth: U.S. growth slowing; Swiss growth steady but muted.

Commodities/Flows: Oil’s weakness pressures USD indirectly via risk sentiment, while CHF gains from capital inflows in risk-off environments.

Geopolitics: Middle East conflict headlines, U.S.–China trade disputes, and Russia sanctions remain CHF-positive.

Primary Risk to the Trend

A sharp rebound in U.S. inflation or CPI surprise could stall Fed cut bets, boosting USD.

Rapid de-escalation in geopolitical tensions could unwind CHF safe-haven flows.

Most Critical Upcoming News/Event

U.S. CPI release will set the tone for Fed rate expectations.

SNB September policy meeting — potential signals on FX intervention or inflation outlook.

Leader/Lagger Dynamics

USDCHF is a lagger, often following broader USD direction (DXY) and global risk sentiment. CHF strength typically mirrors moves in gold and JPY, especially during periods of geopolitical stress.

Key Levels

Support Levels: 0.7949, 0.7918

Resistance Levels: 0.8010, 0.8070

Stop Loss (SL): 0.8010

Take Profit (TP): 0.7949 (first), 0.7918 (extended)

Summary: Bias and Watchpoints

USDCHF has turned decisively bearish with momentum pressing the pair below 0.8000. The trade setup favors selling rallies with a stop above 0.8010 and targets at 0.7949 and 0.7918. Fundamentals back the downside as Fed cut expectations weigh on the dollar and safe-haven demand keeps CHF supported. The key watchpoint is the upcoming U.S. CPI release, which could make or break the move softer inflation would accelerate the drop, while a strong surprise could provide USD relief. Until then, the bias stays bearish.

USDCHF - Short Term Sell IdeaH4 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

USDCHF BUY Bias on W1 is quite weak on the bullish side as previous low is still intact, on D1 we have an OB which price is looking to respect and head up as much liquidity accumulating remain visible.

Entry is expected to be taken on H1 close above the horizontal level within the marked AOI. Fingers crossed

USD/CHF: Swiss Slide to 0.79795 Ahead? FX:USDCHF is showing signs of a bearish move on the 4-hour chart , with an entry zone at the red box around 0.8065 near a key resistance level. The target at 0.79795 aligns with the next support zone, offering a clear downside potential. Set a stop loss at 0.81 on a close above to manage risk effectively.

A break below 0.805 with increasing volume could confirm this slide, driven by USD weakness and CHF strength. Watch Swiss economic data and global risk sentiment as catalysts.

Ready for this move? Do you see this USD/CHF slide coming? Share your view!

#USDCHF #ForexTrading #TechnicalAnalysis #TradingView #CurrencyPairs #DayTrading #MarketSignals

USDCHF - GET READY TO KILL THE MARKETTeam, my track record last 3 months almost impossible to achieve on USDCHF results..

here is the plan for you to trade on USDCHF in 3 houses

30 mins before release → Market often drifts sideways, thinner liquidity, algos waiting.

At release → Massive whipsaws (first move often a fake-out).

15–30 mins after → Real direction emerges once the dust settles.

Buy small now at 0.8030 - very small volume,

make sure buy at sweep 0.8000-7985 ranges

MAKE SURE STOP LOSS FIRST AT 0.7920 AVOID STOP LOSS, once it ride up above 8030- bring stop loss toward 0.7960

REMEMBER to hold tight until next week, I want to see above 0.8055-60 resistance - take 50%-70% and bring stop loss to BE,

Next target at 0.8078-0.8085 and possible heading toward 0.8100

PLAN CAREFULLY AND LETS BUILT THE WEALTH TOGETHER.

IMPORTANT NOTE: WORK OUT YOUR RISK, how much are you you risking.. that the most important concept.

NOW, LETS GO AND MAKE MILLIONS.

Bearish Bat Pattern Forms – USDCHF Looks Ready to DropToday, I want to review USDCHF ( OANDA:USDCHF ) and lay out the fundamental and technical reasons supporting a Short position bias.

1-Fed policy expectations are the main focus — attention is on the Jackson Hole symposium and signals about the Fed’s path; this has tilted market pricing toward a less hawkish Fed.

2-Dovish bets weigh on the USD — markets are pricing in a softer Fed outlook (rate-cut expectations/pauses), which weakens the dollar.

3-CHF supported by safe-haven flows — amid global uncertainty, the Swiss franc tends to attract demand; SNB’s stance also matters for medium-term flows.

Fundamental takeaway: weaker USD (on Fed expectations) + safe-haven CHF demand = a reinforced bearish case for USDCHF in the short term.

-----------------------------------------------

Now let's take a look at the USDCHF chart on the 4-hour time frame .

USDCHF is trading in the Resistance zone(0.819 CHF-0.804 CHF) and near the Resistance line .

It also looks like USDCHF could continue its downtrend with the help of the Bearish Bat Harmonic Pattern .

I expect USDCHF to decline at least to the Support lines .

Second Target: Support zone(0.783 CHF-0.767 CHF)

Note: Stop Loss(SL): 0.818 CHF

Please respect each other's ideas and express them politely if you agree or disagree.

U.S Dollar/Swiss Franc Analysis (USDCHF), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

USDCHF - enter the zone with caution, follow the plan Team,

please follow the guideline carefully! we been killing the USDCHF last few months with proper strategy

The first probe (0.8055–0.8060) is absorbing, but sellers still have momentum.

A wick down into 0.8045–0.8035 would be the “capitulation flush” — weak longs stop out, liquidity

Phase 1 (light probe): You’re already in smal

Phase 2 (storm entry): Add heavier size at 0.8045–0.8035 (but keep stops just below 0.8020).

Phase 3 (ride the wave): If price reclaims 0.8080 → momentum flips bullish, shorts trapped.

Upside magnet: 0.8120 zone (prior supply).

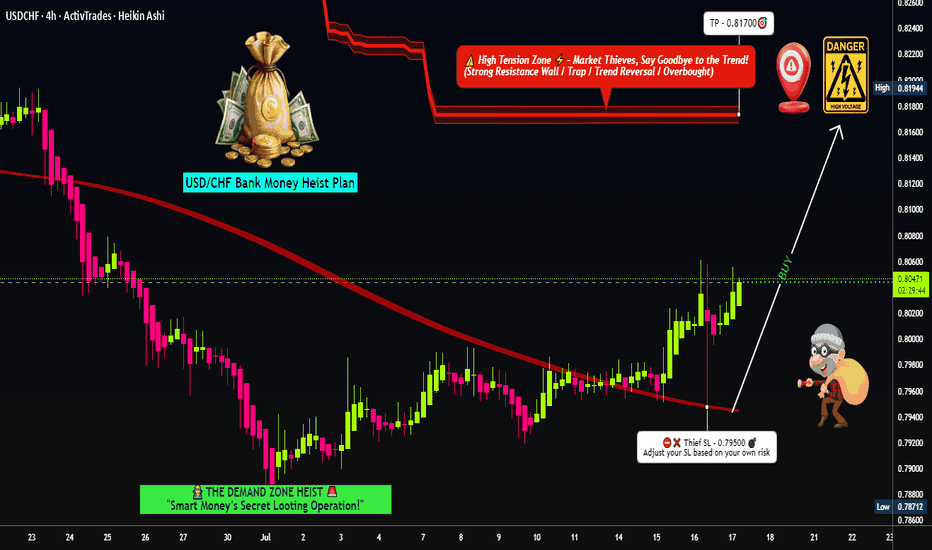

USD/CHF Swissie Heist Plan: Rob the Trend, Ride the Bull!🔐💰 USD/CHF Swissie Forex Heist 💰🔐

“Rob the Trend, Escape the Trap – Thief Style Day/Swing Master Plan”

🌎 Hola! Hello! Ola! Marhaba! Bonjour! Hallo!

Dear Market Looters, Swing Snipers & Scalping Shadows, 🕶️💼💸

Welcome to another elite Thief Trading Operation, targeting the USD/CHF "SWISSIE" vault with precision. Based on sharp technical blueprints & macroeconomic footprints, we're not just trading – we're executing a Forex Bank Heist.

This robbery mission is based on our day/swing Thief strategy – perfect for those who plan, act smart, and love stacking pips like bricks of cash. 💵🧱

💹 Mission Brief (Trade Setup):

🎯 Entry Point – Open the Vault:

Swipe the Bullish Loot!

Price is prepped for an upside raid – jump in at any live price OR set smart Buy Limit orders near the 15m/30m recent pullback zones (last swing low/high).

Use DCA / Layering for better entries, thief-style.

🧠 Thief Logic: Let the market come to you. Pullbacks are entry doors – robbers don’t rush into traps.

🛑 Stop Loss – Exit Strategy If Caught:

📍 Primary SL: Below recent swing low on the 4H chart (around 0.79430)

📍 Adjust based on lot size, risk, and number of stacked entries.

This SL isn’t your leash – it’s your getaway route in case the plan backfires.

🏴☠️ Profit Target – Escape Before the Cops Arrive:

🎯 Target Zone: 0.81900

(Or dip out earlier if the vault cracks fast – Robbers exit before alarms trigger!)

📌 Trailing SL recommended as we climb up the electric red zone.

🔥 Swissie Heist Conditions:

📈 USD/CHF showing upward bias based on:

Momentum shift

Reversal zone bounce

Strong USD sentiment & macro factors

✅ COT positioning

✅ Intermarket correlations

✅ Sentiment & Quant data

➡️ Do your fundamental recon 🔎

⚔️ Scalpers – Here's Your Mini-Mission:

Only play LONGS. No counter-robbing.

💸 Big bags? Enter with aggression.

💼 Small stack? Follow the swing crew.

💾 Always trail your SL – protect the stash.

🚨 News Alert – Avoid Laser Alarms:

🗓️ During high-volatility releases:

⚠️ No new trades

⚠️ Use trailing SLs

⚠️ Watch for spikes & fakeouts – the vault traps amateurs

💣 Community Boost Request:

If this plan helps you loot the market:

💥 Smash that Boost Button 💥

Let’s strengthen the Thief Army 💼

The more we grow, the faster we move, and the deeper we steal. Every like = one more bulletproof trade.

#TradeLikeAThief 🏆🚨💰

📌 Legal Escape Note:

This chart is a strategic overview, not personalized advice.

Always use your judgment, manage risk, and review updated data before executing trades.

📌 Market is dynamic – so keep your eyes sharp, your plan tighter, and your strategy ruthless.

🕶️ Stay dangerous. Stay profitable.

See you soon for the next Forex Vault Hit.

Until then – Lock. Load. Loot.

USDCHF Precision Heist Strategy – Buy Dips, Bag Pips💼💸 USDCHF "SWISSIE" – Bullish Vault Infiltration Plan 🕶️📈

"Plan the Layer. Stack the Cash. Escape Clean."

🧠 Mastermind Setup (Thief Trader Blueprint)

🔍 Asset: USDCHF – “The Swissie”

📊 Market Bias: Bullish

🎯 Method: Multi-limit Entry via GRID / Layering / DCA Strategy

🔓 Entry Point: Any live price – thief never waits for permission

🛑 Stop Loss: 0.80000 – the trapdoor in case of reversal

🎯 Target: 0.82400 – cash out before the sirens blare

🧰 Tactical Details:

🎯 Entry Strategy:

Layer entries like a precision bank job – DCA into support zones or pullback levels. Let price come to your ambush.

“A wise thief doesn't chase the vault – he waits in the shadow.”

🧠 Thief Psychology:

We're hunting liquidity pools. Every fake-out is a distraction. Our plan? Predict the move, then ambush it.

🔥 Fundamentals Fueling the Heist:

✅ USD Strengthening on macro pressure

✅ CHF weakening under global risk reset

✅ Institutional net long bias in USD

✅ Intermarket confluence supports USD/CHF upside

“Read the tape. Watch the flows. Follow the smart money.”

📛 Stop Loss Plan:

Set SL below 0.80000 – deeper than the market’s false traps.

Use dynamic SL with trade size + risk model.

SL = Exit plan, not an emotion control leash. Be tactical, not scared.

🎯 Take Profit Tactics:

Target zone at 0.82400 – near historical resistance vault.

Use trailing SL as price flies to protect the bag.

Partial exit if momentum wanes.

⚔️ Scalper's Mini Mission:

🕵️♂️ Focus ONLY on longs – counter moves are traps

💰 Fast fingers? Ride intraday pullbacks

📍 Secure profits fast – alarms ring quick in Forex banks

🚨 Risk Event Alert:

🗓️ Avoid execution during major USD/CHF economic reports

⚠️ Pause entries

⚠️ Use trail SLs if active

⚠️ Expect fakeouts – vault traps trigger easily during news bombs

🔊 Call to Thief Army – Boost This Plan 📣💥

If this setup lights up your chart like a vault scanner:

👍 Smash that LIKE

💬 Drop your entry below

🔁 Share with the crew

Every boost = another brick stacked in our empire 💼

“Pips build pyramids. But unity builds empires.”

#TradeLikeAThief #ForexHeist #SwissieSnatch

📌 Legal Escape Note:

This is not financial advice. It’s a battle plan.

Stay sharp. Manage risk. Execute with precision.

🕶️ Until next vault… Lock it. Load it. Loot it.

🔥 The Swissie won’t rob itself.

USDCHF - Looking To Buy Pullbacks In The Short TermH1 - We have a clean bullish trend with the price creating a series of higher highs, higher lows structure.

This strong bullish momentum is followed by a pullback.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Liquidity Grab Complete? Why USDCHF Could Be Heading South📉 USDCHF remains firmly in a downtrend on both the weekly (1W) and daily (1D) timeframes. The recent bullish retracement is now confronting a critical resistance zone 🔒 — defined by a descending trendline and a daily order block between 0.8150–0.8200.

🧱 Price action at this level shows clear signs of rejection, aligning with a bear flag formation, which could pave the way for continued downside toward the 0.7800–0.7600 region.

📊 Fundamentally, the Swiss Franc (CHF) continues to gain strength, supported by Switzerland’s stable economic outlook and ongoing safe-haven demand. Meanwhile, the US Dollar faces headwinds from dovish Fed expectations and rising political uncertainty in the US 🇺🇸.

🔮 From a Wyckoff/ICT perspective, this upward move appears to be a liquidity grab into a premium zone, with smart money likely distributing positions before initiating a new markdown phase. A sell bias is favored below 0.8200, with downside targets set at 0.8000 and beyond.

📅 Keep a close eye on this week’s US NFP and Swiss CPI releases — both could inject fresh volatility into the pair.

Market Analysis: USD/CHF Consolidates GainsMarket Analysis: USD/CHF Consolidates Gains

USD/CHF is rising and might aim for a move toward the 0.8120 resistance.

Important Takeaways for USD/CHF Analysis Today

- USD/CHF is showing positive signs above the 0.8040 resistance zone.

- There is a connecting bullish trend line forming with support at 0.7990 on the hourly chart.

USD/CHF Technical Analysis

On the hourly chart of USD/CHF at FXOpen, the pair started a decent increase from the 0.7910 support. The US Dollar climbed above the 0.8000 resistance zone against the Swiss Franc.

The bulls were able to pump the pair above the 50-hour simple moving average and 0.8040. A high was formed at 0.8079 and the pair is now consolidating gains above the 23.6% Fib retracement level of the upward move from the 0.7911 swing low to the 0.8079 high.

There is also a connecting bullish trend line forming with support at 0.7990. On the upside, the pair is now facing resistance near 0.8080. The main resistance is now near 0.8120.

If there is a clear break above the 0.8120 resistance zone and the RSI remains above 50, the pair could start another increase. In the stated case, it could test 0.8200. If there is a downside correction, the pair might test the 0.7990 level.

The first major support on the USD/CHF chart is near the 0.7950 level and the 76.4% Fib retracement level.

The next key support is near 0.7910. A downside break below 0.7910 might spark bearish moves. Any more losses may possibly open the doors for a move towards the 0.7850 level in the near term.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Is USDCHF Ready to Drop? Short Setup Explained📉 USDCHF Trade Idea Breakdown

Taking a close look at USDCHF, we’re currently in a clear downtrend 🔻. Price is under pressure on the higher timeframes, but on the lower timeframes (15m & 30m), we’re seeing a pullback 🌀.

What I’m watching for now is a rejection at resistance 🔄 followed by a bearish break in market structure ⛔️. If that confirms, I’ll be looking to take a short entry with targets set at the two previous lows marked out in the video 🎯📉.

Stop loss placement would be just above the recent swing high for risk management 🛑.

As always — this is not financial advice ⚠️.

USD/CHF Swissie Heist Plan: Rob the Trend, Ride the Bull!🔐💰 USD/CHF Swissie Forex Heist 💰🔐

“Rob the Trend, Escape the Trap – Thief Style Day/Swing Master Plan”

🌎 Hola! Hello! Ola! Marhaba! Bonjour! Hallo!

Dear Market Looters, Swing Snipers & Scalping Shadows, 🕶️💼💸

Welcome to another elite Thief Trading Operation, targeting the USD/CHF "SWISSIE" vault with precision. Based on sharp technical blueprints & macroeconomic footprints, we're not just trading – we're executing a Forex Bank Heist.

This robbery mission is based on our day/swing Thief strategy – perfect for those who plan, act smart, and love stacking pips like bricks of cash. 💵🧱

💹 Mission Brief (Trade Setup):

🎯 Entry Point – Open the Vault:

Swipe the Bullish Loot!

Price is prepped for an upside raid – jump in at any live price OR set smart Buy Limit orders near the 15m/30m recent pullback zones (last swing low/high).

Use DCA / Layering for better entries, thief-style.

🧠 Thief Logic: Let the market come to you. Pullbacks are entry doors – robbers don’t rush into traps.

🛑 Stop Loss – Exit Strategy If Caught:

📍 Primary SL: Below recent swing low on the 4H chart (around 0.79500)

📍 Adjust based on lot size, risk, and number of stacked entries.

This SL isn’t your leash – it’s your getaway route in case the plan backfires.

🏴☠️ Profit Target – Escape Before the Cops Arrive:

🎯 Target Zone: 0.81700

(Or dip out earlier if the vault cracks fast – Robbers exit before alarms trigger!)

📌 Trailing SL recommended as we climb up the electric red zone.

🔥 Swissie Heist Conditions:

📈 USD/CHF showing upward bias based on:

Momentum shift

Reversal zone bounce

Strong USD sentiment & macro factors

✅ COT positioning

✅ Intermarket correlations

✅ Sentiment & Quant data

➡️ Do your fundamental recon 🔎

⚔️ Scalpers – Here's Your Mini-Mission:

Only play LONGS. No counter-robbing.

💸 Big bags? Enter with aggression.

💼 Small stack? Follow the swing crew.

💾 Always trail your SL – protect the stash.

🚨 News Alert – Avoid Laser Alarms:

🗓️ During high-volatility releases:

⚠️ No new trades

⚠️ Use trailing SLs

⚠️ Watch for spikes & fakeouts – the vault traps amateurs

💣 Community Boost Request:

If this plan helps you loot the market:

💥 Smash that Boost Button 💥

Let’s strengthen the Thief Army 💼

The more we grow, the faster we move, and the deeper we steal. Every like = one more bulletproof trade.

#TradeLikeAThief 🏆🚨💰

📌 Legal Escape Note:

This chart is a strategic overview, not personalized advice.

Always use your judgment, manage risk, and review updated data before executing trades.

📌 Market is dynamic – so keep your eyes sharp, your plan tighter, and your strategy ruthless.

🕶️ Stay dangerous. Stay profitable.

See you soon for the next Forex Vault Hit.

Until then – Lock. Load. Loot.

USDCHF – Two Levels, One PlanWe’re watching two key resistance zones for a potential short.

If the first level holds and gives a signal, we’ll short from there.

If that level breaks, we may switch to a short-term buy up to the next level.

Once price reaches the second resistance, we’ll be ready for another sell opportunity.

No predictions — just following the flow.

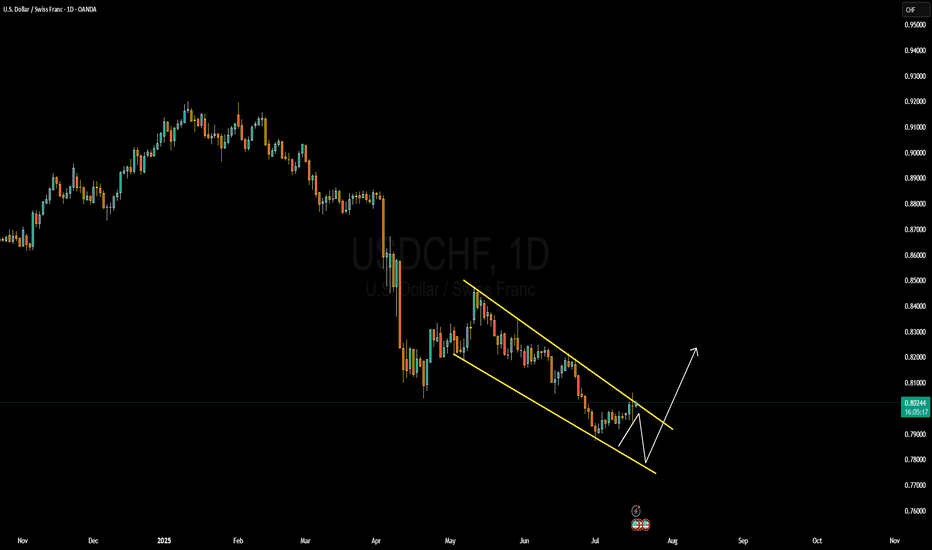

USDCHF Forming Descending ChannelUSDCHF is currently moving within a well-defined descending channel on the daily timeframe. The structure has been respecting this pattern for several months, and we are now approaching a potential breakout zone. Price recently tapped the midline of the channel and showed early signs of bullish rejection. I'm closely monitoring this pair as it builds momentum for a possible bullish reversal, either from a deeper retest at the lower channel boundary or directly breaking above the upper trendline.

On the fundamental side, today's shift in sentiment around the US dollar is quite clear. After a series of weaker US inflation reports and growing market anticipation of a Fed rate cut, USD has come under pressure. However, the Swiss franc is also showing signs of weakness, especially after the Swiss National Bank became the first major central bank to cut interest rates earlier this year and is likely to remain dovish through the remainder of 2025. This monetary policy divergence creates space for USDCHF to rally as investors price in a potential stabilization or rebound in the dollar.

Risk sentiment also plays a role here. With global equities slightly pulling back and geopolitical tensions simmering, safe haven demand is mixed. While CHF typically benefits in risk-off environments, the lack of recent SNB hawkishness gives USDCHF bulls a clearer edge, especially if US data stabilizes or improves.

Technically, I’m anticipating a potential false break to the downside before a sharp bullish wave toward 0.8300 and beyond. Momentum indicators are flattening, and with volume starting to pick up on bullish candles, this setup has potential. I’ll be looking to add further confirmation as price approaches the lower trendline or breaks out with clean structure. Keep a close eye — this setup could turn into a strong profit opportunity in the coming days.

USD/CHF Breakout Done , Long Setup Valid To Get 100 Pips !Here is my opinion on USD/CHF , We have a clear breakout and the price now above my support area , i`m waiting the price to go back to retest it and then give me any bullish price action and i will enter a buy trade , the reason for cancel this idea , if we have a daily closure again below my area.