USDMXN

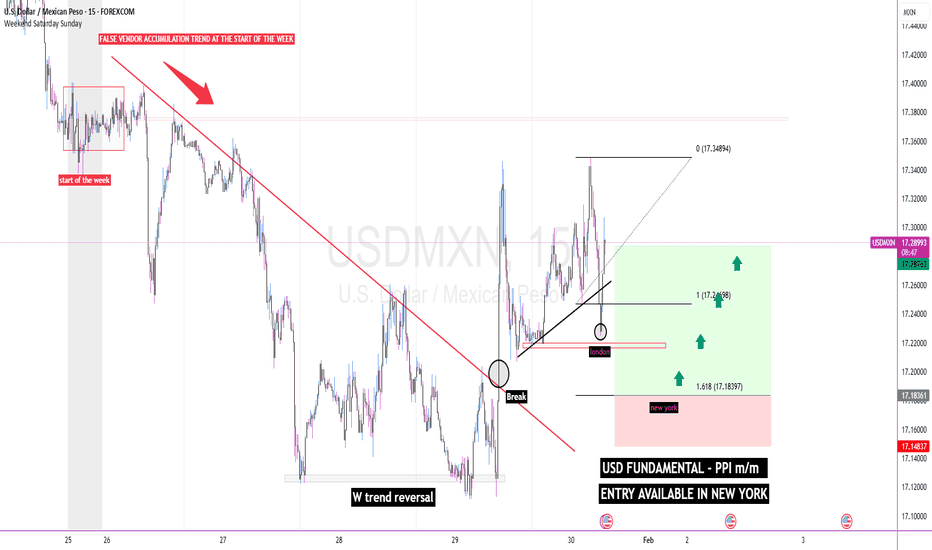

USD/MXN trend breakout monitoringWe see that the price created a false bearish accumulation trend at the start of the week to generate the midweek reversal in the corresponding liquidity zone, which produced a trend breakout telling me that the price will change direction. Therefore, along with the daily setup, it's telling me that if New York sweeps the London low, improving prices to buy with a stop hunt, we can go with an institutional buy. However, the entry can only be taken in New York; if it doesn't occur at the corresponding time, the opportunity will not be pursued.

Marked market manipulation in USD/MXN**We can clearly see mass accumulation in Asia; the buy at 8 a.m. was used to break that accumulation and take sellers out of the market, where New York sought to improve the price by making it more expensive in order to continue selling within the trend. We expect the upcoming news in 1 hour to push the price lower.**

USD/MXN Extends Downtrend as Key Support BreaksThe daily chart of USD/MXN highlights a persistent bearish trend, with price recently breaking below the 17.62 support zone, marking a fresh multi-month low. This move reinforces the dominant downside momentum that has been in place since early 2025.

Key Technical Observations:

Moving Averages:

The 50-day SMA (blue) at 18.09 and the 200-day SMA (red) at 18.67 are both sloping downward, confirming a strong bearish bias. Price remains well below these averages, signaling sustained selling pressure.

Momentum Indicators:

MACD: The MACD line is deeply below the signal line, with both in negative territory, indicating strong bearish momentum.

RSI: Currently at 24.67, the RSI is in oversold territory, suggesting the pair may be vulnerable to a short-term corrective bounce, though the broader trend remains bearish.

Price Structure:

After consolidating near 18.50 earlier in the year, USD/MXN accelerated lower, breaking successive support levels. The latest breach of 17.62 opens the door for potential continuation toward the next psychological level near 17.30.

Summary:

USD/MXN is entrenched in a strong downtrend, supported by bearish moving averages and momentum indicators. While oversold conditions could trigger a temporary rebound, the overall technical picture favors continued weakness unless price reclaims key resistance levels.

-MW

USD/MXN 2026 Outlook: Volatility Returns After Stellar RallyThe Mexican Peso (MXN) enters 2026 at a crossroads. After a stellar 2025 where it appreciated approximately 23% against the US Dollar (USD), the currency now faces a "perfect storm" of geopolitical friction and shifting macroeconomic tides. The pair plunged from 20.50 to 17.88 last year, driven by a resilient carry trade and a weaker dollar. However, analysts warn that the easy gains are over. The year ahead promises heightened volatility as trade renegotiations and central bank pivots collide.

Geopolitics & Geostrategy: The USMCA Stress Test

The political landscape remains the primary driver of USD/MXN volatility. President Donald Trump’s second term has already introduced significant friction, most notably with the "Liberation Day" tariffs imposed in April 2025. While the subsequent suspension of tariffs following President Claudia Sheinbaum’s immigration agreements provided relief, the underlying tension persists.

The formal review of the United States-Mexico-Canada Agreement (USMCA) scheduled for summer 2026 is the next major flashpoint. The White House is expected to leverage trade policy to extract concessions on migration and drug enforcement. Specifically, US negotiators aim to enforce stricter Rules of Origin to prevent Chinese firms from using Mexico as a "backdoor" into the US market. This aggressive stance could periodically pressure the Peso, pushing the pair higher during negotiation stalemates.

Macroeconomics: The Interest Rate Differential

The wide interest rate spread between Mexico and the US has been the Peso's primary shield. With Banxico’s reference rate at 7% and the Fed’s funds rate at 3.50%-3.75%, the 325-basis point differential remains attractive. However, this gap is set to narrow.

Banxico is poised to continue its easing cycle, with markets pricing in a cut to 6.50% by year-end 2026. While Governor Victoria Rodriguez Ceja notes that currency appreciation has helped tame inflation (projected at 3.5% for early 2026), she acknowledges that external US financial conditions will dictate the pace of cuts. Conversely, uncertainty surrounds the Federal Reserve. The potential nomination of a loyalist like Kevin Hassett as Fed Chair could trigger aggressive US rate cuts, weakening the Dollar. A more traditional pick like Kevin Warsh would likely stabilize the greenback, posing a risk to the Peso’s strength.

Industry Trends: The Carry Trade Unwind Risk

The "Carry Trade" borrowing in low-yielding currencies to invest in high-yielding ones powered the Peso’s 2025 rally. However, the funding side of this equation is changing. The Bank of Japan (BoJ) raised rates to 0.75% in December and is expected to hike further.

If the BoJ adopts a hawkish stance in 2026, the cost of funding these trades will rise, shrinking the net margin for investors. A rapid unwinding of these positions would trigger a sharp depreciation of the Peso, regardless of domestic Mexican fundamentals.

Technical Analysis: Bears Target 2024 Lows

Technically, the USD/MXN pair remains in a downtrend. The price action has broken below the confluence of the 100- and 200-week Simple Moving Averages (SMA) near 18.82. Momentum indicators like the RSI remain in bearish territory but are not yet oversold, suggesting further downside potential.

Sellers are eyeing the July 2024 low of 17.60 . A decisive break below this level exposes the massive psychological support at 17.00 , with a potential extension toward the 2024 yearly low of 16.26 . Conversely, bulls need to reclaim the 18.82 resistance level to invalidate the bearish thesis.

Summary

The Mexican Peso’s "Goldilocks" period is ending. While the currency remains fundamentally supported by a 6.50% projected yield, the external environment is deteriorating. Traders should prepare for a volatile 2026 defined by USMCA headlines, potential Fed politicization, and the looming threat of a Japanese rate hike unwinding the carry trade. The bias remains lower for USD/MXN, but the path will be far more turbulent than in 2025.

USD/MXN Bulls Prepare for Breakout as Momentum Rebuilds🕵️♂️💰 Thief Trader’s Heist on USD/MXN! 💹💎

“US Dollar vs Mexican Peso – Profit Pathway Setup (Swing / Day Trade)”

🧭 Plan Overview

We’re going BULLISH 🟢 on USD/MXN — quiet before the breakout 💥

✅ Confirmation comes from HULL Moving Average pullback

✅ + Triangular Moving Average breakout 🔺

Once that combo fires, it’s game on! 🏁

Our thief-style blueprint? Layered limit buys to catch every dip like a pro sniper 🎯

💸 Entry Plan – “Thief Strategy” (Layering Style)

We don’t chase — we set traps for price!

Multi-layer buy limits ready to ambush the market 👇

💰 18.45000

💰 18.50000

💰 18.55000

(Add more layers if you feel spicy 🌶️)

🧠 Logic: Price respects your zone → Layers get filled → Ride the breakout!

🛑 Stop Loss (SL)

📍 Thief’s defensive wall: 18.40000

💬 Note: Dear Ladies & Gentleman (Thief OG’s) — this SL is my version of the escape hatch. Manage risk your own way — you’re the final boss of your account! 👑

🎯 Take Profit (TP)

🎯 Primary Target: 18.85000 (🚔 Police Barricade Resistance)

⚡ Quick Escape Zone: 18.80000

💬 Reason: Strong resistance + overbought trap ahead — grab the loot and vanish 🏃♂️💨

📢 Note: Dear Ladies & Gentleman (Thief OG’s) — my TP is just my play. Take your own prize at your own pace! 💼

🌍 Correlated Pairs to Watch

$USD/JPY – Check USD momentum 💪

💶 FOREXCOM:EURMXN – Confirms MXN weakness 🔻

💵 OANDA:USDCAD – USD trend + oil link 👀

💂 CAPITALCOM:GBPMXN – MXN risk sentiment barometer 📊

INDEX:ME / IPC Mexico (Mexican Stock Index): A strong Mexican economy can strengthen the MXN.

TVC:DXY (US Dollar Index): The USD side of the pair. A strong DXY generally boosts USD/MXN.

EUR/USD: The world's most popular pair often has an inverse correlation with USD pairs.

📈 If USD flexes strength across majors or EM currencies get shaky, USD/MXN could rally harder.

🧠 Market Key Points

✨ USD strength → Supports bullish thesis

✨ EM risk-off → Peso weakness tailwind

✨ MXN reacts to oil + domestic news

✨ HULL MA + Triangular MA = breakout clarity ⚙️

Simple formula:

📉 Pullback → 📈 Breakout → 💰 Profit potential

⚡ Final Words

Trade smart, layer smarter.

Don’t chase candles — let candles chase your layers 🔥

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

🧩 Disclaimer: This is Thief-style trading strategy just for fun — educational purpose only!

#Forex #USDMXN #SwingTrade #DayTrade #ThiefTrader #LayeringStrategy #HULLMA #TriangularMA #Breakout #USDStrength #ForexAnalysis #TradingViewIdeas #MarketHeist #ProfitPathway

USD/MXN Extends Its Downtrend as Price Breaks Below Key SupportUSD/MXN continues to follow a well-established bearish structure, with price making a fresh move below the 18.04 support zone—an area that previously served as a mid-2023 pivot and has acted as a consolidation base in recent months. The clean breakdown reinforces the prevailing downtrend that has persisted since the spring reversal.

Both moving averages support this directional bias. Price remains well beneath the 50-day SMA, which has consistently acted as dynamic resistance throughout the decline. The 200-day SMA also slopes downward, underscoring the longer-term weakness and offering a wide separation from current price levels—typical of a mature trending environment.

Momentum indicators align with this directional pressure. The MACD histogram remains negative with the signal lines trending lower, reflecting sustained downside momentum rather than a short-lived impulse. Meanwhile, the RSI sits near the lower third of its range, showing persistent bearish momentum without yet signaling extreme oversold conditions.

The recent violation of support highlights continued dominance by sellers within the broader downtrend. Attention now turns to how price behaves around the next historical level near 17.62, which previously acted as a structural floor on the chart.

-MW

USD/MXN: Super Peso Defies Dollar StrengthHere is the revised article with all hyperlinks removed, maintaining the professional formatting and analysis.

The Mexican peso continues to frustrate dollar bulls, maintaining a defiant stability despite broad greenback strength.

Over the last five sessions, the USD/MXN pair moved just 0.4%. This neutrality highlights the peso's formidable resistance. While the U.S. dollar gains ground globally, Mexico’s currency holds the line. Investors call this the "Super Peso" phenomenon. It stems from a unique confluence of high yields and structural economic shifts.

Macroeconomics: The Rate Differential Shield

Mexico’s high interest rates act as a primary defensive wall. The Bank of Mexico (Banxico) set its benchmark rate at 7.25% in November. Conversely, the U.S. Federal Reserve maintains a target of 4.00%. This 3.25% spread creates a massive incentive for carry traders. Investors borrow cheap dollars to buy yielding pesos. This constant demand buoys the currency even when market sentiment sours.

Economics: Inflation and Policy

Inflation in Mexico is cooling, validating Banxico's strategy. October data showed headline inflation dropping to 3.57%. This progress allows policymakers to consider gradual easing. However, aggressive cuts pose a risk. Narrowing the yield spread too quickly could erode the peso's appeal. Banxico must balance growth needs against currency stability.

Geostrategy & Geopolitics: The Nearshoring Fortress

Global trade tensions have inadvertently strengthened Mexico's hand. The U.S.-China decoupling forces corporations to shorten supply chains. Mexico is the logical beneficiary of this "nearshoring" wave. Its geographic proximity to the U.S. market is a supreme strategic asset. This geopolitical realignment drives Foreign Direct Investment (FDI) to record levels. Long-term capital inflows provide a structural floor for the peso, independent of daily speculative flows.

Industry Trends: Manufacturing Renaissance

Industrial parks across Northern Mexico are operating at near capacity. Global manufacturers are relocating essential production lines from Asia to states like Nuevo León. This shifts Mexico’s economy higher up the value chain. We see a transition from simple assembly to complex manufacturing. This industrial depth creates sustained demand for pesos to pay local operational costs.

Technology & Cyber: Digital Finance Evolution

Mexico’s financial sector is undergoing a rapid technological maturation. Fintech adoption is surging, facilitating record remittance flows. Digital platforms now process billions of dollars efficiently and securely. Cybersecurity investment is rising in tandem to protect this digital infrastructure. Robust cyber-defenses build institutional trust, encouraging further capital repatriation.

Science & High-Tech: The Innovation Hub

The narrative of cheap labor is evolving into one of skilled innovation. Hubs like Guadalajara are attracting high-tech R&D centers. This "Silicon Valley of Mexico" fosters a new class of engineering talent. Science-based industries, including medical devices and aerospace, are expanding. This diversification reduces reliance on oil exports and strengthens the currency's fundamental value.

Patent Analysis: Intellectual Property Growth

Patent filings reflect this high-tech shift. International companies are increasingly filing IP protections within Mexico. Patent data indicates growth in automotive and aerospace engineering sectors. This signals a long-term commitment to the market. Companies do not protect IP in transient manufacturing bases. They do so in strategic, long-term hubs. This entrenchment further stabilizes the economic outlook.

Management & Leadership: Central Bank Discipline

Banxico’s leadership has demonstrated exceptional discipline. They moved earlier and more aggressively against inflation than many G7 peers. This assertiveness established deep credibility with global markets. Investors trust the central bank to defend the currency’s purchasing power. Prudent management serves as an intangible but vital asset for the peso.

Outlook: The Dollar Threat

Risks remain despite these strengths. The U.S. Dollar Index (DXY) is rebounding toward the 100 level. A sustained breakout could pressure emerging market currencies. If the DXY reclaims early-2025 highs of 110, the peso will face a severe test. Traders should watch the 18.59 resistance level closely. A break above this could signal a shift in momentum.

USD/MXN Breaks Channel Resistance as Momentum Turns PositiveThe U.S. Dollar is showing renewed strength against the Mexican Peso, breaking above the descending channel that has contained price action since April. This breakout coincides with a push above the 50-day simple moving average (SMA), signaling a potential shift in momentum after months of consolidation.

The next resistance area sits around 18.85–19.07, aligning with prior swing highs, while the 200-day SMA near 19.26 remains the broader resistance level to watch. On the downside, 18.50 now acts as immediate support, followed by 18.20 at the recent base of the channel.

Momentum indicators support the bullish tone: the MACD has crossed above its signal line and is trending higher, while the RSI has moved above the neutral 50 level, indicating strengthening buying interest without yet entering overbought territory.

Overall, USD/MXN appears to be in the early stages of a potential trend reversal, as technical conditions shift from bearish to neutral-to-bullish following the confirmed breakout from the long-term descending channel.

-MW

USD/MXN Tests Upper Channel Resistance as Momentum ImprovesUSD/MXN continues to trade within a well-defined descending channel that has guided price action since March. The pair recently rebounded from the lower boundary of this structure near 18.20 and is now testing the upper trendline resistance around 18.55–18.60.

The 50-day SMA (18.55) aligns closely with this resistance area, reinforcing its technical significance, while the 200-day SMA (19.42) remains above price — a reminder that the broader trend bias is still tilted downward.

Momentum indicators show early signs of potential recovery:

The MACD histogram has turned positive for the first time in several weeks, suggesting a shift in short-term momentum.

The RSI has risen toward 56, indicating strengthening bullish pressure but still within neutral territory.

A decisive breakout above the channel’s upper boundary could indicate a loss of downside momentum and open the door for a broader retracement phase. However, failure to close above this area would likely reaffirm the ongoing bearish channel structure.

-MW

USD/MXN Loses Ground Toward the Weekly CloseOver the last three trading sessions, USD/MXN has posted a gain of more than 0.6% in the short term in favor of the U.S. dollar. For now, buying pressure has remained steady, partly due to the ongoing government shutdown in the United States, which has allowed the dollar to recover in the short term. This situation has triggered an outflow of capital from higher-risk currencies such as the Mexican peso. However, it is important to note that if U.S. political risk continues to extend over the coming sessions, the dollar may struggle to withstand a prolonged shutdown. In that case, indecision could once again dominate price action in the short term.

Downtrend Holds

Since early April this year, USD/MXN has maintained a steady downtrend in favor of the peso. So far, there has been no significant bullish correction to suggest that this trend has been broken, confirming that it remains the most relevant technical structure in the short term. As selling pressure returns to the market in the coming sessions, the bearish trend could continue to dominate the chart.

RSI

Although the RSI line has attempted to recover consistently, it remains oscillating below the neutral level of 50, indicating that bearish momentum continues to dominate in the short term. This confirms that the selling bias has not completely disappeared and may continue to influence movements in the coming sessions.

MACD

The MACD histogram shows very slight oscillations above the neutral zero line, suggesting that, on average, the strength of moving averages continues to generate a neutral sentiment. If the histogram remains close to zero, this could point to a scenario of price indecision in the next sessions.

Key Levels to Watch:

18.82 – Major Resistance: Located where the 50-period moving average converges with the Ichimoku cloud. A sustained breakout above this level could activate a new short-term bullish trend.

18.55 – Nearby Barrier: Corresponds to the zone marked by the downtrend line currently in place. If the price breaks above this level, the trend would be at risk and could open the way to a more relevant short-term bullish bias.

18.30 – Critical Support: Corresponds to the retracement and recent lows of the past weeks. A break below this level would reinforce the dominance of the prevailing downtrend.

Written by Julian Pineda, CFA – Market Analyst

USD/MXN – Bearish Channel Holds as Price Nears Key Fibonacci SupUSD/MXN continues to trade within a descending channel, maintaining pressure after failing to reclaim the 50-day SMA (18.60) and staying well below the 200-day SMA (19.51). The broader trend remains bearish, with lower highs and lower lows firmly intact.

Currently, price is testing the 18.50 zone, just above the 61.8% Fibonacci retracement (18.17) of the 2023–2024 rally. This area is crucial: a decisive break below it could accelerate downside momentum, exposing the 17.33 support and possibly the 16.26 level, which marks the 100% retracement.

Momentum indicators lean bearish:

MACD remains in negative territory, showing continued downside bias.

RSI sits around 39, reflecting weak momentum but not yet oversold, leaving room for further declines.

If buyers manage to defend the 18.17–18.50 support range, a short-term bounce back toward 18.80–19.00 resistance within the channel is possible. Otherwise, a breakdown could confirm continuation of the broader downtrend.

USD/MXN remains under bearish control, with Fibonacci support now the key level to watch for a potential reaction. -MW

USD/MXN Extends Decline Within Downward ChannelUSD/MXN continues to trade inside a well-defined descending channel that has contained price action since mid-April. The pair recently bounced from the lower boundary of the channel near 18.20, but remains capped by resistance around the 50-day SMA (18.63). The broader structure remains bearish as the 200-day SMA (19.57) continues to slope lower above price.

Momentum indicators align with this view. The RSI is currently at 35, hovering near oversold territory but not yet signaling a clear reversal. The MACD remains in negative territory with the signal line above the MACD line, showing that bearish momentum is still intact despite the recent stabilization.

If the channel persists, traders may monitor the upper boundary near 19.00 as resistance, while the 18.20 region serves as immediate support. A break beyond either side of the channel could indicate a potential shift in trend strength.

-MW

USD/MXN Breaking Down - Where Next?The chart shows USD/MXN (daily timeframe) under steady bearish pressure, extending its decline inside a well-defined descending channel. Here’s the breakdown:

Trend & Structure: Price has been moving lower since the peak near 21.00 earlier this year. It is now trading below both the 50-day SMA (18.67) and the 200-day SMA (19.61), reinforcing the bearish bias.

Support & Fibonacci Levels:

The immediate focus is the 18.17 zone, which aligns with the 61.8% Fibonacci retracement of the April–July 2024 rally.

Below that, the next major level is 17.33 (78.6% Fib), followed by 16.26 (100% retracement).

Resistance Levels:

First resistance sits at 19.07, followed by the 19.49 area near the upper channel boundary.

A breakout above the 50-day SMA could open the way to test the 200-day SMA near 19.61.

Momentum Indicators:

MACD is below the signal line, showing continued bearish momentum.

RSI (28) is in oversold territory, suggesting that sellers are losing strength and a short-term bounce may develop.

Outlook:

USD/MXN remains in a strong downtrend, but with RSI flashing oversold and price nearing the 61.8% retracement support, the pair could see a corrective rebound in the short term. However, as long as the price stays below 19.07–19.50, the broader bias remains bearish, favoring further downside toward 18.17 and possibly 17.33.

-MW

USD/MXN Faces Another Key Support ZoneOver the last three sessions, the USD/MXN pair has posted a depreciation of around 0.8%, with selling pressure remaining in favor of the Mexican peso. This move is mainly driven by speculation around the upcoming release of U.S. inflation (CPI) data, scheduled for tomorrow. Markets are looking to confirm whether inflation has started to ease in the short term, which would allow the Federal Reserve to maintain its outlook for lower interest rates. This expectation has weakened the U.S. dollar and, in turn, given the Mexican peso room to strengthen in recent sessions. If the inflation data reinforces this view, selling pressure on the pair could remain relevant.

Sideways Range Remains Intact

Although recent movements are starting to show a more evident bearish bias, they have not yet been sufficient to break the sideways channel between 19.00 pesos per dollar and 18.50 pesos per dollar. This range continues to be the most important technical formation in the short term. As long as the price fails to decisively break these levels, neutrality is likely to dominate trading in the sessions ahead.

Technical Indicators

RSI: The RSI line has crossed below the central 50 level and maintains a downward slope, indicating that selling impulses are beginning to dominate in the short term. However, since the indicator remains close to the neutral zone, the market could easily slip back into a phase of steady neutrality in the coming sessions.

MACD: The MACD histogram shows slight oscillations around the zero line, reflecting a lack of clear direction in the short term. In this context, the broader chart still points to a neutral stance.

Key Levels:

19.00 pesos per dollar – Resistance: Aligned with the 50-period moving average and the upper boundary of the Ichimoku cloud. A breakout above this level could open the way to a short-term bullish bias.

18.70 pesos per dollar – Nearby Barrier: Midpoint of the current sideways range. As long as the price trades around this area, neutrality is likely to prevail and extend the range structure.

18.50 pesos per dollar – Crucial Support: Marks the zone where recent lows have held in the past weeks. A breakdown below this level would represent a significant break, potentially confirming the continuation of the downtrend that has persisted throughout 2025.

Written by Julian Pineda, CFA – Market Analyst

Will USD/MXN Break Above its Bearish Channel?USD/MXN is showing signs of a potential shift after months of steady declines within a well-defined descending channel.

The pair recently found a floor near 18.50, which aligns with the lower boundary of the channel, and has since rebounded back above its 50-day SMA for the first time in weeks. This suggests selling pressure is easing, with early signs of a possible breakout from the downtrend.

The 200-day SMA still looms overhead near 19.70, acting as a longer-term resistance barrier, but intermediate levels such as 19.07 and 19.49 will be key checkpoints if momentum continues higher. On the momentum side, the MACD is flattening and on the verge of a bullish cross, while the RSI has lifted above 50, reinforcing a shift in short-term sentiment.

For now, the bias is cautiously turning constructive. A sustained move above 19.07 would strengthen the case for a broader recovery, while a failure to hold the 18.50 floor could see the downtrend resume. -MW

USD/MXN Downtrend Probing Support AgainTechnical outlook:

Trend: The pair remains locked in a downward channel since late April, with price respecting both the upper and lower boundaries. This confirms a well-defined bearish structure.

Resistance: The upper channel line and the 50-day SMA (18.75) converge as a strong cap. Above that, the 19.07–19.49 zone is the next resistance cluster.

Support: Immediate support lies near 18.58, followed by the lower channel boundary toward the 18.20–18.00 area if pressure persists.

Momentum: RSI sits just below neutral (47), not showing strong conviction yet. MACD remains in negative territory, keeping bearish momentum intact.

Moving averages: Price is still well below the 200-day SMA (19.74), reinforcing the dominant downside bias.

What this means:

USD/MXN remains under selling pressure, with rallies repeatedly capped by the channel top. Unless price breaks above the 18.75/19.00 area, the path of least resistance points lower toward 18.20. A confirmed breakout above the descending channel, however, would suggest the start of a corrective rebound.

This remains a bearish channel play, but traders should watch the interaction with the channel top closely, as a breakout could shift short-term momentum.

-MW

USD/MXN: The Mexican Peso Starts a New Bullish Bias During the latest trading session, the Mexican peso has started to appreciate by nearly 1%, supported by short-term weakness in the U.S. dollar. For now, bearish pressure has begun to dominate the pair, mainly because the dollar is under pressure following signs that the Federal Reserve may consider cutting interest rates after the slowdown in U.S. job growth. The renewed weakness in the U.S. dollar has allowed the Mexican peso to steadily gain ground, and as this dynamic continues, selling pressure may become increasingly relevant in the short term.

Sideways Range Holds:

Recent price fluctuations over the past few weeks have begun to form a steady sideways range, with resistance near the 19.00 pesos per dollar level and support around 18.50 pesos per dollar. So far, recent moves have been insufficient to break out of this lateral formation, which remains the most relevant pattern to monitor for upcoming sessions. As long as price continues to fluctuate within this range, the lack of clear direction may dominate the market in the coming days.

RSI:

The RSI indicator line continues to hover near the 50 level, signaling that neutral momentum between buying and selling pressure is prevailing in the short term. As long as this behavior persists, indecision may continue to dominate price action.

MACD:

The MACD histogram has also started to slowly descend toward the zero line, suggesting that a new bearish slope may be forming. This points to weakening momentum between the moving averages. If the MACD continues to show signs of losing strength, sideways consolidation could remain the dominant structure.

Key Levels to Watch:

19.35 pesos per dollar: Key resistance aligned with the 50-period moving average. Sustained buying above this level could trigger a meaningful bullish trend in upcoming sessions.

19.00 pesos per dollar: Nearby resistance that marks the top of the short-term sideways channel. A breakout above this psychological level could reinforce bullish momentum.

18.50 pesos per dollar: Critical support marking recent multi-week lows. A break below this level could resume the broader bearish trend seen in previous weeks.

Written by Julian Pineda, CFA – Market Analyst

USD/MXN Testing Downtrend Resistance – Bearish Channel Remains IThe USD/MXN pair continues to grind lower within a well-defined descending channel, marked by a series of lower highs and lower lows since April. Although the pair has shown short-term stability near 18.58 support, the broader trend remains bearish.

Price is currently testing the channel’s upper boundary near 18.70, with both the 50-day and 200-day SMAs well above current levels, reinforcing the downside bias. Any bounce is likely to face headwinds unless bulls manage to push the pair back above 19.07 and 19.49 — prior swing levels and confluence zones with moving averages.

Indicators:

MACD remains below zero, showing persistent bearish momentum despite some recent flattening.

RSI sits at 36, indicating mild oversold conditions but with no strong reversal signal yet.

Key Levels:

Support: 18.58 (recent low and channel support).

Resistance: 18.70 (channel top), followed by 19.07 and 19.49.

Conclusion:

USD/MXN remains pressured within a bearish structure. A breakout above 18.70 may trigger short-covering toward the 19.00–19.50 zone, but bears remain in control while price stays beneath key moving averages. Watch for a decisive break of either channel boundary to determine directional bias going forward.

-MW