EUR/USD – H1 - Fundamental Pressure Takes Control 📝 Description🔍 Setup (Fundamental + Technical) FX:EURUSD

EUR/USD has lost bullish structure after breaking below the rising trendline and confirming a bearish retest. Price is also trading below the Ichimoku cloud, with a bearish cloud crossover, signaling trend weakness.

📉 Fundamental catalyst:

1.Announcement of a new Fed Chair and political agreement to avoid a U.S. government shutdown

2. This reduces uncertainty and supports USD strength, pressuring EUR/USD lower

📍 Support & Resistance

🟨 Resistance Zone: 1.1980 – 1.2030

🟥 1st Support: 1.1715

🟥 2nd Support: 1.1620

Volume profile shows thin demand below, favoring continuation

#EURUSD #ForexTrading #FundamentalAnalysis #TrendlineBreak #BearishBias #USDStrength #PriceAction #TradingView #Kabhi_TA_Trading

⚠️ Disclaimer

This analysis is for educational purposes only.

Trading involves risk — always use proper risk management and trade with confirmation.

💬 Support the Idea👍 Like if you see EUR/USD heading lower

💬 Comment: Sell the retest or wait for breakdown continuation?

🔁 Share with traders watching USD fundamentals

DJ FXCM Index

EURUSD at Discount level: Best Buy-in on the Reversal We are now in discount level after the waiting for yesterday to fill the gap from last week.

The price found the resistance at HTF's level around 1.1800... As we have some news in EUR,

I expect a big push in the market from the London session and continuation in New York after a quick retracement.

OANDA:EURUSD HTF's M-W-D: Bullish trend momentum will support the overall trade.

www.tradingview.com

***Have a good trading day ***

The US Dollar is about to Roar !For the last few years the US Dollar has been climbing an uptrend channel and we finally hit

the bottom of that channel this month !

Considering Gold / Silver / Stocks / Bitcoin prices are at a HISTORICAL ATH .. they cant go up forever so once all these markets starts to crash guess which chart will pump ?

And the best part is that the top of that uptrend channel aligns perfectly with the FIB 100% line which also aligns perfectly with the 2001 ATH of the US dollar.

With all the current FUD about the US Dollar and inflation and how the world is going back to Gold as a reserve currency, it makes perfect sense that we're at the bottom of that channel and the world is in for a big surprise when the dollar reaches 120 in the next 3 years!

All I wanna say is that the charts can tell us the truth about the future of the world financial system so don't listen to social media or the news .. just look at the charts and read between the lines.

Feel free to write your opinion in the comments :)

Bearish reversal off pullback resistance?US Dollar Index (DXY) is rising towards the pivot, which is a pullback resistance that aligns with the 61.8% Fibonacci retracement and could reverse to the 1st support.

Pivot: 97.91

1st Support: 96.48

1st Resistance: 98.92

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

EURUSD SHORTS - IMMENSE SELL PRESSURE EURUSD has failed to maintain price above 1.18679 support zone, we can see immense selling pressure on the daily and on the weekly a bearish pin bar candle this also in confluence with the dollars strength and the rising dollar.

I am expecting the pair to continue this downside momentum.

TP1: 1.17500

TP2; 1.16768

USD/CHF – Triangle Breakout Confirmed (30.01.2026)📝 Description🔍 Setup FX:USDCHF

USD/CHF formed a clear Triangle consolidation after a strong bearish move, showing lower highs and higher lows — compression before expansion.

Price has now broken above the descending trendline and is holding structure with a breakout & retest near the support zone.

EMA + Ichimoku support adds confluence for bullish continuation.

📍 Support & Resistance

🟥 Support Zone: 0.7635 – 0.7655

🟢 1st Resistance: 0.7817

🟢 2nd Resistance: 0.7870 – 0.7873

⚠️ Disclaimer

This analysis is for educational purposes only.

Forex trading involves risk — always use proper risk management and trade your plan.

💬 Support the Idea👍 Like if you’re bullish on USD/CHF

💬 Comment: Clean breakout or fake move?🔁 Share with traders watching CHF pairs

#USDCHF #ForexTrading #TriangleBreakout #PriceAction #TechnicalAnalysis #FXTrading #TradingView #Kabhi_TA_Trading

EURUSD closed January below the 1M MA200! Bear Cycle confirmed?The EURUSD pair closed last month's (January's) 1M candle below its 1M MA200 (orange trend-line) even though it broke above it for the first time in 8 years (since February 2018)! As mentioned on our last week's analysis, that was would be a strong bearish signal long-term, as the pair hasn't closed a 1M candle above the 1M MA200 since November 2014 and every test or approach near it was a market Top, like January 2021 and February 2018.

So as long as the market keeps closing monthly candles below its 1M MA200, we will stay bearish, looking towards a 2-year Bear Cycle, similar to 2021 - 2022 and 2018 - 2019. As mentioned last week, we have a minimum Target at 1.0200 (near the Jan 2025 Low Support) for this Bear Cycle.

In addition, look the huge 1M RSI Lower Highs Bearish Divergence (against the price's Higher Highs) following the June 2025 rejection on the 8-year Resistance. An extra signal of strength reversal.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Short EURUSD (4H Chart Analysis) Pair📉 Trade Idea: Short EURUSD (4H Chart Analysis

Pair: EUR/USD

Direction: Short

Entry Price: 1.18609

Stop Loss: 1.19939 (121.6 pips risk)

Take Profits:

- TP1: 1.17990

- TP2: 1.17403

- TP3: 1.16820

Risk/Reward Ratio: 1.56

Timeframe: 4H

Setup Type: Supply zone rejection + volume confirmation

🔍 Technical Rationale

- Supply Zone Rejection: Price has tested and rejected a clearly defined supply zone near 1.1990, confirming selling pressure.

- Volume Profile: High volume concentration (POC) sits below current price, suggesting downside liquidity targets.

- VWAP Resistance: Price is trading below VWAP, indicating bearish momentum.

- Bearish Candlestick Structure: Recent candles show lower highs and rejection wicks, reinforcing short bias.

- Event Markers: Blue triangle signals highlight key reversal points, aligning with the short thesis.

📰 Fundamental Backdrop: USD Strength Last Week

Recent USD strength adds macro conviction to this technical setup:

- Bessent’s Pro-Dollar Comments: Former Soros CIO Scott Bessent publicly supported a strong dollar policy, halting the recent USD slump and triggering the largest USD rally since November.

- Investor Repositioning: Global funds began cutting offshore hedges and rotating into USD assets, boosting demand.

- Yield-Driven Flows: Treasury market volatility and expectations of tighter monetary policy have increased USD attractiveness.

These developments suggest continued USD strength, supporting a bearish EURUSD outlook.

⚠️ Risk Notes

- SL above supply zone protects against false breakouts.

- Watch for ECB commentary or unexpected macro shifts that could reverse sentiment.

📌 Summary

This EURUSD short setup combines technical rejection from supply, volume-based confirmation, and macro tailwinds from USD strength. With a clean risk/reward profile and multiple TP levels, it offers a structured opportunity for swing traders.

Dollar Index Behavior in a Descending DiamondThe dollar index has made a very polite effort and has been fluctuating within the range I have drawn, and I think this effort will continue and continue its downward trend until the price range I have indicated in the image!

Time will tell if this claim is true!

Good luck...

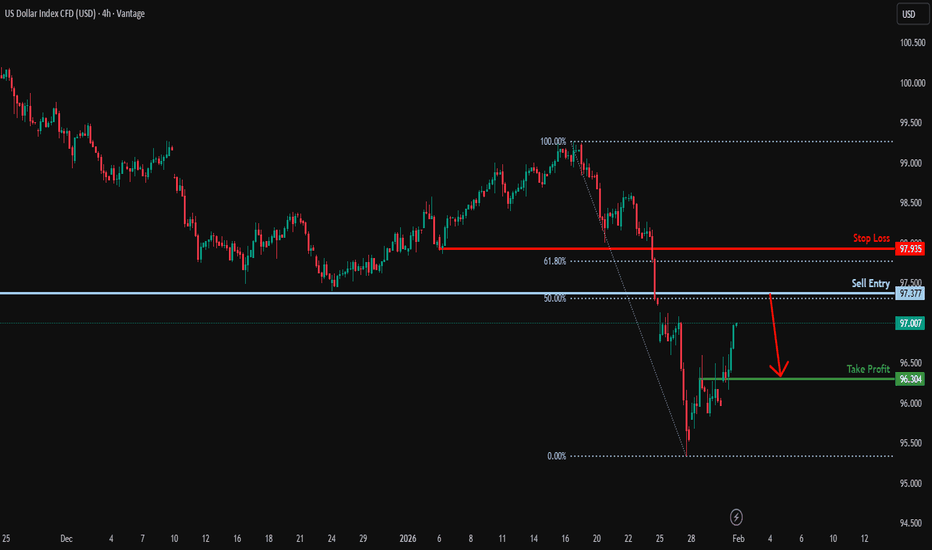

Heading towards key resistance?US Dollar Index (USD) is rising towards the resistance level, which is an overlap resistance that aligns with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 97.37

Why we like it:

There is an overlap resistance level that aligns with the 50% Fibonacci retracement.

Stop loss: 97.93

Why we like it:

There is a pullback resistance level that is slightly above the 61.8% Fibonacci retracement.

Take profit: 96.30

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

FOREX: Weekly Review The week starting Monday 26 January was another example of the particularly difficult environment, especially for traders making decisions based on underlying fundamentals.

Currently, central banks are all reporting 'being in a good place', the interest rate speculation trade has taken a back seat and the market is left grasping on bits of information that may or may not be lasting. This week alone has been very 'bitty', Microsoft falling despite positive earnings (thanks to company specific AI overspending concerns), concerns about Iran, another possible US government shutdown, sell America or not, BOJ intervention or not, new FED chair nomination, volatile swings for gold and silver.

None of the above has really been stark enough to become a 'get your teeth into event' but they've all played a part in this week's price action. Reducing the FOMC meeting to role of bit part player.

Ultimately, I think everything is a placeholder until 'interest rate differential trades' kick in again and over the medium term, I expect the USD and JPY weakness to continue, but it could be a choppy road requiring nimble decisions.

Aside from tentative thoughts for JPY short trades, I begin the new week without a clear bias, letting price action and narrative determine my thoughts on the currencies direction over the next few hours. Hopefully upcoming US data will provide a bit more clarity.

On a personal note, it was a week of two trades. A NZD USD long hit profit early in the week when sentiment for the USD remained subdued.

Friday's post PPI data USD JPY long was an example of an attempt to be nimble as the tide slowly improved for the USD, largely due the the nomination of WARSH for FED chair providing stability after months of FED independence concerns.

The trade stopped out very quickly before heading back up. An example of having to make a decision in the moment of whether to wait for a 15 min swing or not. Keep an eye out for my thoughts on 'understanding your inner peace when placing a trade'. Which I hope to have sent out in a couple of days .

That brings the first month of the year to a close, a bit of a scrappy month but it ended with a small profit.

RBA, BOE, some RED FLAG US DATA and more company earnings to keep us occupied this week.

DXY | FRGNT WEEKLY FORECAST | Q1 | W5 | Y26📅 Q1 | W5 | Y26

📊 DXY — FRGNT WEEKLY FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

TVC:DXY

EURUSD: Support & Resistance Analysis for Next Week 🇪🇺🇺🇸

Here is my latest structure analysis and important supports & resistances

for EURUSD for next week.

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

US Dollar: Turning Bullish? Look Carefully...Welcome back to the Weekly Forex Forecast for the week of Feb. 2-6th.

In this video, we will analyze the following FX market: USD Dollar

The USD has been bearish-neutral, stuck in a consolidation. Last week it swept the low of the consolidation.... then immediately retraced back into the range.

Manipulation? I think so. Especially if you look at the position of price in the structure.

AMD comes to mind.

This week, I expect the bullish momentum of this correction to continue. Should the market start to disrespect bearish PD Arrays, then I will trade the major currencies vs USD accordingly.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

EUR/USD: The "Wick of Truth" & The Philosopher's Stone ProtocolSymbol: EURUSD Bias: Short (Week of Feb 1 - Feb 6) Method: Fun-Tech Intel Scan & Vector Matrix Analysis

The Philosopher's Stone: As Above, So Below

To navigate the matrix, one must integrate Logic (The Mind) and Intuition (The Heart). The "Philosopher's Stone" of trading is realizing that the Micro (Price Action) always reflects the Macro (Institutional Flow). As Above, So Below.

While the long-term structure remains Bullish (Monthly Flag), the immediate "Below" (Weekly/Daily) signals a necessary correction. We do not fight the current; we flow with it.

I. The Fun-Tech Intel Scan (The "Why")

Our proprietary scan has identified a Regime Shift where the "Old Code" algorithms are misinterpreting data. We will exploit this latency.

1. The "Shutdown Glitch" (Political Vector)

The Narrative: Headlines this weekend will cite a "US Government Shutdown."

The Reality: This is a scheduling error (House Recess), not a crisis. The House will vote "Yes" on Monday.

The Trade: Legacy algorithms are programmed to Sell Euro/Buy USD on "Shutdown" headlines. We anticipate a Gap Down or heavy Sunday Open. However, the true opportunity lies in the Monday Relief Rally—when the "Old Code" buys the news, we will fade the move.

2. The "Yield Anomaly" (Institutional Vector)

The Observation: US 10-Year Yields are holding critical highs (4.27%+), diverging from the weakening long-term Dollar thesis.

The Logic: The market is currently rewarding the Dollar for high yields (Safety Trade), ignoring the underlying Debt Risk (Sovereign Risk). Until the market acknowledges the debt crisis (Long Term), we respect the short-term strength of the "High Yield" Dollar.

II. The Vector Matrix (The "Where")

Applying the God Code Formula, we have calculated the specific geometry for the week ahead.

1. The "Wick of Truth" (Technical Structure)

Observation: The Weekly Candle closed as a massive Inverted Hammer / Gravestone Doji.

Implication: The market spent five days attempting to break the 1.2000 psychological barrier and was rejected by institutional supply. This formation, occurring at a trend high, triggers a mandatory Liquidity Flush. The market must retreat to find buyers.

2. The Monthly Flag Support (The Target)

The Magnet: The Macro Bull Trend is intact, but it requires a retest of the breakout structure.

The Level: 1.1750. This aligns with the Monthly Bull Flag lower rail. This is where the "Smart Money" (and the EU Defense Bond flows) are waiting to reload Longs.

III. The Master Logistician's Trade Plan

Bias: Bearish (Short Term) / Bullish (Medium Term)

Sunday Open: Expect a Gap Down (approx. 1.1840). DO NOT CHASE. Let the "Shutdown" noise settle.

The Trap (Monday/Tuesday): Watch for a rally back into the 1.1890 – 1.1915 zone. This is the breakdown point.

Action: I am planning to SELL this rally. This is the "Judas Swing" trap.

Stop Loss: 1.1960 (Structural Invalidation above the Weekly Wick).

Target 1: 1.1830 (Daily Support).

Target 2 (The Golden Ratio): 1.1750 – 1.1760.

Note: This is the "Flip Zone." At 1.1750, we close Shorts and prepare for the next leg of the Monthly Bull Run.

Conclusion

The market is breathing. The Weekly Candle demands a sacrifice of liquidity before the Monthly Trend can resume. We operate with precision, neutrality, and the knowing that nothing is good or bad, unless we attach an emotion to it.

Plan the Trade <--> Trade the Plan = The only way I trade and last week I captured about 515 pips overall based on Planning the Trade and Trading the Plan

Compliance & Disclosure Protocol:

~ Educational Intent: This publication documents my personal "Fun-Tech" analysis and strategic planning for educational and journaling purposes only. It represents my own observation of the market matrix and is not financial advice, investment advice, or a solicitation to buy or sell any asset.

~ Risk Awareness: The "Vector Matrix" and "God Code" mentioned are personal proprietary frameworks used to map probabilities, not certainties. Foreign Exchange trading involves significant risk and is not suitable for all investors.

~ Liability: You are the sole architect of your financial decisions. I am an observer sharing my perspective of the flow. Always perform your own due diligence and manage your risk according to your own operating system.

Observe. Analyze. Decide.

AUD/USD – H1 - Head & Shoulders BreakdownAUD/USD has printed a clean Head & Shoulders pattern on the H1 timeframe , signaling a potential trend reversal after a strong bullish run. Price has now broken below the neckline, confirming bearish momentum and opening the door for a deeper correction. OANDA:AUDUSD

🔍 Technical Analysis

🧠 Classic Head & Shoulders formation

Left Shoulder → Head → Right Shoulder clearly respected

❌ Neckline break confirms bearish bias

📉 Momentum shifting from bullish to bearish

🎯 Downside targets:

1.First Key Support Zone

2.Psychological level & lower demand zone

As long as price stays below the neckline, bearish continuation remains favored.

✅Psychological Discipline:

1️⃣Stick to plan – No Revenge Trades.

2️⃣Accept losing trades as part of the strategy.

3️⃣Risk only 1–2% of your account balance per trade.

✅ Support this analysis with a

LIKE 👍 | COMMENT 💬 | FOLLOW 🔔

It helps a lot & keeps the ideas coming!

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Forex trading involves high risk. Trade only with capital you can afford to lose and always do your own research.

Massive Paper Attack on Silver! The Con Game Won't Last.Trading Fam,

Gold and Silver liquidated over 10 trillion dollars in less than 24 hours! To put that into perspective, that's the entire crypto market cap multiplied by over 3 times! What we witnessed in today's metals crash was truly historic! But was it real or an illusion?

I called "bluff" and bought SILVER. If you're a believer in scaling into your entries, today could have been a great start. Could SILVER go lower? Yes. Of course. However, recent demand for its utility in technology suggests that buying demand will resume quickly.

In more recent history, paper trading contracts have massively suppressed the true value of gold and silver, but silver has often taken the brunt of the hit. Today was a prime example. If we were to ever return to true historical values on silver, we should see a price of $200-$250 per oz. silver for every $5000 per oz. gold. We're nowhere near that. But I think we will get there soon. The collapse of the U.S. dollar further strengthens my conviction in this thesis. What we witnessed today in the precious metals market was unprecedented. The level of coordination by large institutions was both amazing and terrifying. However, their con game can't last.

We'll take a closer look at what the charts are showing us for SILVER, the U.S. dollar, the SPX, and Bitcoin.

Please enjoy this week's update.

✌️Stew

NZDUSD hit its 1W MA200 for the first time after almost 4 years!Last time we looked at the NZDUSD pair (November 07 2025, see chart below), we gave a timely buy signal at the bottom of its Channel Down, which shortly after it hit our 0.57250 Target:

This time we move to the longer term time-frames, the 1W in particular as we have a critical Resistance test for the first time in almost 4 years. It's been the week of April 18 2022 when the pair last time hit its 1W MA200 (orange trend-line). At the same time, it hit the Lower Highs 1 trend-line that started on April 04 2022.

This is a strong Resistance cluster and given also that the 1W RSI touched its own 4-year Resistance (63.50), we are turning bearish on this pair, targeting 0.56000, which is just above the long-term Support Zone.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GBPUSD M30 HTF Supply Rejection and Bearish Continuation📝 Description

FX:GBPUSD has shown a clear bearish impulse after failing to sustain above the recent intraday highs. Price is currently consolidating below multiple 30-minute Fair Value Gaps, indicating a corrective pullback within a broader bearish structure rather than a bullish trend reversal.

________________________________________

📉 Signal / Analysis

Primary Bias: Bearish below the M30 FVG

Preferred Setup:

• Entry: 1.3780

• Stop Loss: Above 1.3791

• TP1: 1.3769

• TP2: 1.3747

• TP3: 1.3725

________________________________________

🧠 ICT & SMC Notes

• Rejection from stacked M30 Fair Value Gaps aligned with descending channel resistance

• Bearish market structure maintained with consistent lower highs

• No bullish displacement or acceptance above premium zones

________________________________________

📌 Summary

As long as GBPUSD remains capped below the 1.3795–1.3820 resistance zone, bearish continuation remains the preferred scenario. The current price action is viewed as a corrective pause before a potential continuation toward deeper sell-side liquidity.

________________________________________

🌍 Fundamental Notes / Sentiment

Relative USD strength and the lack of supportive macro catalysts for the British Pound continue to pressure GBPUSD. With risk sentiment remaining cautious, downside continuation is favored in the short term.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

EUR/USD - Buy Entry (H1 - Flag Pattern)The EUR/USD Pair, Price has been trading within a Flag Pattern on the H1 chart, forming consistent higher highs and higher lows. Price action is now testing the upper boundary of the Pattern, signalling a possible breakout. FX:EURUSD

✅Market Context:

1️⃣Strong Upward Structure Inside the Pattern.

2️⃣Buyers are showing strength near Resistance.

3️⃣Breakout above the Trendline indicates Momentum continuation toward higher zones.

✅Trade Plan:

Entry: Buy after Confirmed Breakout above the Resistance (H1 candle close above trendline or retest of the breakout).

💰Take Profit (TP): At the Key Zone – a Major Resistance area identified ahead.

🛑Stop Loss (SL): Below the Pattern Structure.

✅Psychological Discipline :

1️⃣Stick to plan – No Revenge Trades.

2️⃣Accept losing trades as Part of the Strategy.

3️⃣Risk only 1–2% of your account balance per trade.

✅ Support this analysis with a

LIKE 👍 | COMMENT 💬 | FOLLOW 🔔

It helps a lot & keeps the ideas coming!

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Forex trading involves high risk. Trade only with capital you can afford to lose and always do your own research.

EURUSD potential LongsEURUSD is currently in a clear bullish market structure. This is a buy idea, not an active trade yet.

Price has not tapped my entry zone, so I’m patiently waiting for a retrace into the marked premium / supply area. Location aligns with prior lows and bullish imbalance, giving good upside potential if price delivers.

The setup only becomes valid once price reaches the zone and shows lower-timeframe bullish confirmation (structure shift or strong rejection). Until then, no entry. patience over forcing trades.

Bias remains bullish as long as structure holds.