USDTRY

USD/CAD - SWING - 18. AUGU. 2020 🇺🇸🇨🇦Welcome to the Day Trading Setup (USDCAD)!

This is my personal view of price action

***

6 Six hours

Tendency to rise

***

Forex Swing

Buy USDCAD

Entry Level @ 1.31374

SL @ 1.1.31032

TP @ 1.33947

(Remember to add a few points for all levels - different brokers!)

***

Leave us a comment or want to keep our content free and dynamic.

Have a wonderful day!

***

right Now

Long Turkey: An Alternative to “Short” GoldTurkey is in (continued) currency crisis. CBRT (Cent Bank Repub Turkey) has allegedly run dry of its FX reserves to prop up the lira, which has has been hitting all time record lows vs USD & EUR. As USDTRY broke through the psychological 7 level (and doing so against a weakening dollar at that) in July, CBRT more or less threw in the towel in defending the peg, and began buying up gold. So much so that Turkey overtook Russia as the largest buyer of gold in the world - obviously contributing to gold’s run through prev all time highs, $2k and beyond.

As CBRT bought gold at a seemingly price indiscriminate pace, Turkish citizens holding lira and seeing their purchasing power get eroded away by the day and facing double digit inflation moved their assets in to anything other than the lira to preserve value - such at BTC. Unlike BTCUSD, BTCEUR, BTCJPY etc, BTCTRY is at all time record highs for this reason, and BTC’s July-Aug rally has also been supported by this reason.

The lira meltdown and horrendous monetary policy mismanagement has also obviously been killing the Istanbul stock market, as well as US listed Turkey ETF TUR.

Late last week, CBRT finally took steps to tighten credit conditions to local banks - and although nowhere near a sufficient solution, it put a temporary halt on the sell Lira → buy gold, silver, bitcoin, dollars, yen trend, and reversed its sentiment. And when the largest buyer of gold in the world stops buying after pushing prices to all time highs, gold falls, and when gold falls from all time highs, profit taking from record GLD inflows takes hold.

Though I bought puts on gold last week in light of developments in Turkey (which NOBODY is discussing, and therefore perfect - let consensus overlook and talk the usual nonsense explanations for market behavior), I’m not going to short gold on a temp pullback, any more so than I would short BTC for a near term downside view within a longer term bull view.

Instead, play the reversal by going long TUR. Buy (very cheap) calls for immediate term upside recovery, which for the time being should move inverse to gold.

Keep a very close eye on USDTRY breaking above 7.4 or below 7. And note the CBRT policy meeting later this month (Aug 20) for a potential inflection point for current trend to reverse again, and gold to continue upside.

USDTRY Why TRY has dropped so sharply and what to expect next?The trend of TRY is clear, in current situation

monetary policy is not enought to stabilize

situation. Turkey needs strong physical changes

and innovative solutions, because turism is not

relable and stable part of its economy. Not

anymore and this is the main reason

why lira has dropped sharply.

8.0000 - 7.0808 is the range of Lira for

next 12 months.

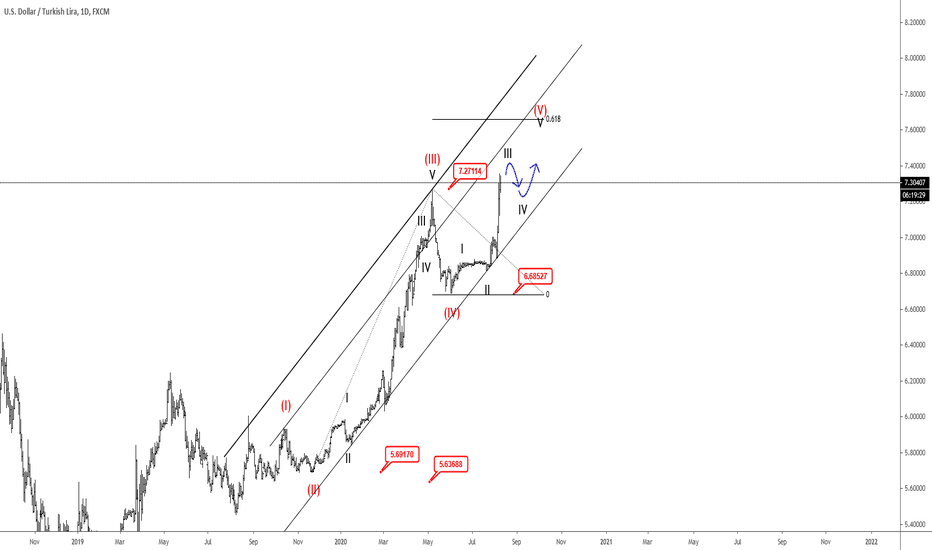

USDTRY In A Bullish Move! - Elliott wave analysisHello traders,

USDTRY is bullish, clearly in a five-wave move, up from 5.64 level. We can see waves (I), (II), (III) and (IV) as completed, so recovery from 6.68 can be part of a final wave (V). Wave (V) is an impulse itself, therefore five legs within is must be seen, before resistance, and a reversal in three legs may show up. Now there are only three legs seen, within a wave (V).

Possible resistance for wave (V) is at 7.5/7.8 level.

New Higher Highs For LiraAnalysis :

First time weekly close above the highest pinbar of 2018 devaluation

Correlated pairs (gbptry,eurtry) already closed above weekly top

Fundamentals :

Coronavirus :Jobless claims and inflation rates getting higher during pandemia.

low tourism income

Negative real interest in TR

TR Central Bank can not limited usdtry @ 6,86 and showed us they has negative deposit in real

Joe Biden's election winning almost accepted by everyone. Biden's foreign policys is not familiar for TR. That can cause sanctions applied for TR soon

Take Profit : Fibonacci extension and trend channel targets 8,20 - 8,40 area

Note : This strategy will not be valid if good news announces for Lira/TR Centeral Bank

Lira leads gold & BTCExplaining gold & BTC late July - early August upside price action:

(Hint: it’s not “US money printing” - that’s clearly not a sudden new phenomenon to explain why NOW)

Turkish Lira under attack from inflation mismanagement by President Erdogan & CBRT (Cent Bank Republic of Turkey). CBRT buys gold with dwindling FX reserves, citizens pile into crypto

Turk lira price action is ultimately the direct indicator of gov actions and faith in policy & currency, and therefore leads BTC & Gold