USDTRY

USD/TRY: Still In Channel! But Non-LinearHello dear Turkish Lira traders, merhaba arkadaslar!

The last time we were looking at this analysis:

=> We can see that the bulls couldn't break the horizontal resistance at 5.78, so we broke the bottom at 5.67 and since then we're still in a downtrend, albeit that the market doesn't respect it much with linear trendlines.

=> Non-linear moves happen very often in charts, especiall after expontential moves: it is something that I'm personally very interested in observing.

Have a look at this example from the stock world that I just analyzed:

Conclusion: We're still trending downward, and sometime we will see a breakout coming to the upside: When this happens, we will further tighten, as you can seee best on the Weekly chart:

If you had some value from my analysis, give it a thumbs-up & comment it, because the mechanism shows my analysis to other people then. Make also sure to follow me so you get notified on my analyses! I wish you a good trading! :)

Selamlar, Deniz from Edgy

Edgy is providing online education only. We are not a financial advisor, nor do we hold any formal qualifications in this area. You're trading at your own risk. No matter what you do, please set your stop loss. Please be aware, that you can lose all your money on the online exchanges.

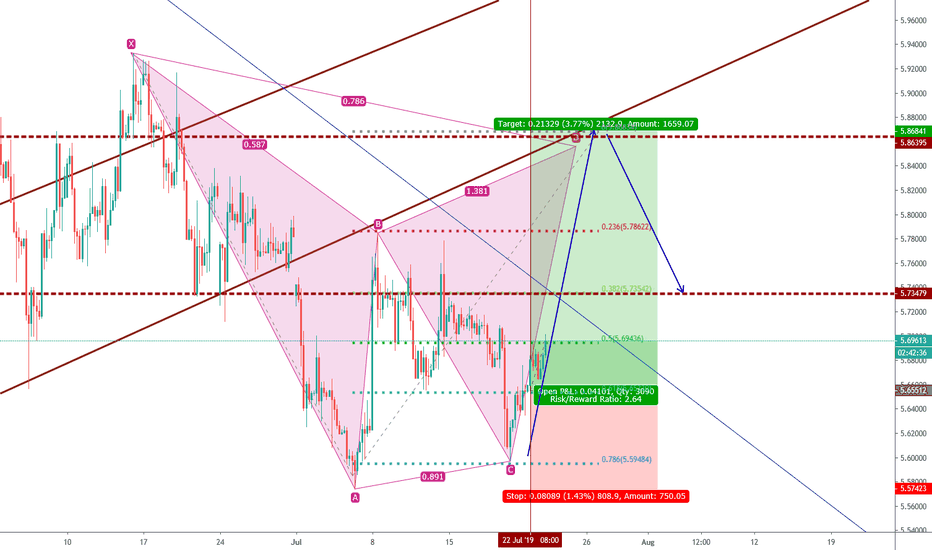

USDTRY long setup Dolar / TL1ST ENTRY- 5.6020

STOP - 5.5549

Optional PT: 5.6495

PT:5.7395

Ahead of CB meeting in 2 days, market is already priced some easing from the Bank. Consensus is about 300 basis points. This won`t shake the market, more easing will send the pair down, i will buy into the weakness.

XU100, Profit Taking Takes Investors to USDThe rhetoric in XU100 is irrespective of valuations in the last week or so.

Turkish investors have been taking profits and allocating towards USD. This is totally a psychological issue, locals see the USDTRL as an actual investment vehicle, rather than a currency pair. This week the USDTRL pair saw lows of 5.50, this insinuated a sell signal for stock (along with some savings accounts).

Currently, locals prefer a long USDTRL position over holding common stock.

Hence there could be a downtrend in XU100 in th short-term due to this phenomenon.

USD/TRY Take a Step Back - Higher Timeframe AnalysisThis post is for educational purposes only. Trade at your own risk. Please refer to my previous analysis today (below). This gives a high level overview of long term what we can see happen in the market with this pair. We have a descending wedge forming, alongside trendline confluence, and a bounce off the 61.8 fib level. Trade at your own risk. As this is high level outlook there is a lot of price action that goes on in the lower time frame. Most retail traders have to drill into lower time frame to capture pips on short price action. (see previous trade idea below)

USDTRY WATCH PRICE ACTIONFor educational and demonstration purposes only. Study purposes only. As we study, we see that Price is being contained within an ascending channel. We should focus our attention on price action within this channel,. Watch for price action. If price does not compromise ascending channel look to buy to key supply zone. If price compromises ascending channel look to short to demand zone.

USD/TRY: Double Bottom If you had some value from my analysis, give it a thumbs-up & comment it, because the mechanism shows my analysis to other people then. Make also sure to follow me so you get notified on my analyses! I wish you a good trading! :)

Edgy is providing online mentorship & trading metrics only. We are not a financial advisor, nor do we hold any formal qualifications in this area. You're trading at your own risk. No matter what you do, please set your stop loss. Please be aware, that you can lose all your money on the online exchanges.

USDTRY confluence to go longVery similar idea to my EURTRY idea posted yesterday. You can find the link in this post.

The price is hitting an ascending trendline (green) dating from February. That is a very strong support. It is also supported by the fact that it is a double bottom and we are seeing bullish signals. RSI confirms this view with a bullish divergence and the pair is very close to an important area of horizontal support and MA200.

All that makes me think that price will rebound to the next resistance at 5.812 where it will face resistance by MA50 too.

The problem I see in this pair is the 4H chart:

First thing we see is that the price action is not very clean and that always concerns me a little bit. We also see that the price is below the MA50 and below the descending trendline (green line) that is pretty much following the MA200. That is a lot of resistance and if we wait to see if it breaks them it will probably be too late to enter the trade as we will be approaching a horizontal level.

So what do we do???

We can stay in the sidelines or we can buy at the actual price level (supposing there is no gap on Monday) and place a SL at around 5.589. This level is important because it would mean that the price broke below the ascending trendline and that it broke the closing price of the lowest point on the 5th of July.

This is a risky trade but what is life without risk and excitement!

Trade safe and share your views in the comments below!