XAUUSD (GOLD) – 4-Hour Timeframe Tradertilki AnalysisGuys,

I have prepared a XAUUSD-Gold analysis for you on the 4-hour timeframe.

My friends, the levels of 4657.0 and 4599.0 are the best buy entry points.

When price reaches these levels, I will definitely open a buy position and aim for the following targets:

My targets:

1st Target: 4690.0

2nd Target: 4730.0

3rd Target: 4790.0

My friends, since the U.S. president has recently imposed tariffs on Europe, there is currently strong buying volume in XAUUSD-Gold. From a fundamental perspective, this is the biggest reason for gold’s upward movement.

NOTE – Since the U.S. president has not lifted these tariffs regarding Greenland and has opened a trade war against European countries, XAUUSD-Gold may rise even from these levels and reach my 3 targets.

My friends, I share these analyses thanks to each like I receive from you. Your likes increase my motivation and encourage me to support you in this way.🙏

Thank you to all my friends who support me with their likes.❤️

Wave Analysis

BTC • The Market Is Tired -And That’s Exactly Why It’s DangerousIf I had to describe the market right now with a single word,

it would be fatigue.

Fatigue mixed with hope.

Some participants have already left.

Some were liquidated.

Others are simply waiting - hoping their tokens will “eventually recover.”

Against this backdrop, we see movement in individual assets:

some tokens are leaving their lower ranges,

local manipulations appear,

and yes - money can still be made if you have information, experience, and emotional control.

But this is not the beginning of a new trend.

It looks far more like a phase of accumulation and waiting, not a regime shift.

____________________________________________________

Why a possible move to 100–105k is not a reversal

If BTC moves into the 100–105k area,

most people will see something there that doesn’t actually exist:

- strength

- confirmation of a reversal

- “finally”

- and of course, altseason

Retail traders are barely trading Bitcoin now.

Their attention is on altcoins - because the perceived risk/reward is higher.

And that’s true:

higher reward,

higher risk,

more manipulation,

more interesting price action.

But that is exactly why altcoins have become a perfect environment for illusions.

____________________________________________________

Altseason as a trap, not a strategy

Altseason stopped being a strategy the moment

people began to expect it by default.

Bitcoin is “too expensive” — so capital flows into alts.

Altcoins are “at the bottom” - so they are “supposed to rise.”

That’s not how markets work.

Many projects have spent years under pressure from:

-teams

-early investors

-funds

-unlock schedules

Yes, some tokens are now fully in circulation.

Yes, local moves are possible.

But this is not an environment for broad, sustainable growth.

It’s an environment for selective moves and manipulation, not for a “season.”

____________________________________________________

About confirmation of a reversal

To be honest - it doesn’t exist right now.

I don’t see any structural change that could sustainably push the market higher:

- not in cycles

- not in capital behavior

- not in participant psychology

If confirmation ever appears,

it won’t be a single level or candle.

It would require a global change in context —

possibly regulatory, political, or structural.

For now - it’s not there.

____________________________________________________

Where the crowd is now

The crowd is not in panic.

And that matters.

It is:

- disappointed

- tired

- partially out of the market

- partially “hoping to recover”

p- artially still trying to speculate

This is passive expectation , not capitulation.

Which means the market is not done yet.

____________________________________________________

What I’m doing differently

I’m not actively trading.

I’m working with limit orders.

Two positions have already played out — I took profits and stepped back.

For me, this phase is about:

- learning

- backtesting

- reassessment

- preparation

I’m updating the Academy — and in doing so,

I’m learning myself, stress-testing logic instead of emotions.

In markets like this,

the winners are not the fastest —

they’re the most prepared.

____________________________________________________

Why I’m still here if the market “owes nothing”

Because I need to keep my hand on the pulse.

I don’t disappear to “do something else.”

I observe.

I track changes.

I watch the environment.

If my view changes - I will say it publicly.

I can be wrong.

And I admit that upfront.

By publishing ideas, I take personal reputational risk,

without gaining any benefit other than responsibility.

This is not financial advice.

This is not prediction.

This is simply my honest view of the market as it is now.

Time will do the rest.

Best regards EXCAVO

GBPUSD: Bullish Reversal After Complex Price DevelopmentGBPUSD: Bullish Reversal After Complex Price Development

GBPUSD recently completed a complex corrective structure and has now found strong demand near the lower support area.

The sharp rejection from 1.3340 and the current consolidation suggest that selling pressure is weakening and a bullish reversal is starting to develop.

Price is forming a base inside this zone, and as long as the pair holds above this support, the probability favors a continuation to the upside.

Targets:

🎯 1.3440

🎯 1.3480

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

GOLD - Aggressive bullish trend. Test of the 4725 zone...FX:XAUUSD continues to update its historical maximum, currently testing the 4725 zone, against the backdrop of escalating geopolitical risks and declining risk appetite...

Fundamental situation

Trump's threats to impose new tariffs on goods from the EU and the union's retaliatory measures have heightened fears of a trade war.

Escalation of the Russia-Ukraine conflict

The economic backdrop is contributing to the decline of the dollar, which in turn is supporting gold.

The key events of the week will be the US PCE inflation data (Thursday) and the revised GDP report for the third quarter.

Gold continues to rise due to geopolitical uncertainty and the weakening of the dollar. Further dynamics will depend on US inflation data — weak figures could strengthen the upward momentum, while strong figures could trigger a correction.

Resistance levels: 4725, 4750

Support levels: 4707, 4700, 4691

Growth has been halted by the psychological resistance zone of 4725. Since the opening of the session, the market has exhausted its intraday potential and may form a correction (profit-taking) and test the key support zones of 4710-4700 before continuing to grow.

Best regards, R. Linda!

GOLD - Consolidation after the rally before the rally...FX:XAUUSD started the week with growth, hitting a new all-time high amid geopolitical risks and threats of new tariffs from the US, and is now consolidating around $4,700...

Fundamental situation

Trump threatened to impose tariffs on eight European countries over the issue of buying Greenland.

Escalating tensions around Ukraine and Iran.

Fed:

Expectations of policy easing are supporting gold, but the appointment of a new Fed chair could slow down aggressive rate cuts. The investigation into Powell continues...

This week, PCE inflation data (Thursday) and US GDP for the third quarter are important.

Gold's rise since the beginning of the year has been independent of the strengthening dollar, underscoring the strength of internal drivers. However, a confident breakout to $5,000 will require confirmation of lower inflation in the US and continued high demand for safe-haven assets. Corrections may be profitable against the backdrop of an aggressive bullish trend...

Resistance levels: 4678, 4691, 4700

Support levels: 4656, 4650, 4640

Within the current range, I focus on the zones 4656 - 4650 - 4639. There is a high probability of a long squeeze/false breakout of support. However, I do not rule out the possibility of a local correction due to the holiday in the US (low liquidity, profit-taking may trigger a correction) before growth.

Best regards, R. Linda!

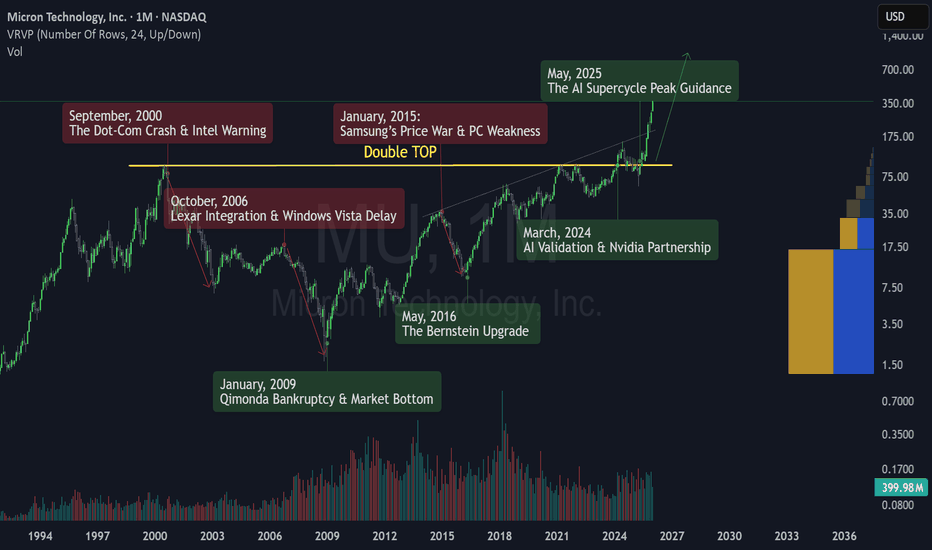

Why Micron’s 26,000% Legacy is Just the BeginningWhy Micron’s 26,000% Legacy is Just the Beginning

To learn how to operate in the stock market it is interesting to stop thinking about money for a while and start understanding what is actually happening.

Today I bring you an example with NASDAQ:MU a company that in less than 20 years has offered a 26,000% return and is now a global benchmark.

However this has not always been the case and certain events have determined market movements for months and years. Learning from these movements helps you better capture the long term essence of the market what is valued and what is not. Understanding that suffering is temporary if the company knows how to reverse it and that these drops can offer wonderful opportunities.

1️⃣ Micron did not start as a multinational. In fact it was 4 people with a consulting vocation in the 70s but they quickly pivoted to manufacturing DRAM the short term memory of a computer and became famous for being the scrappy low cost leader . While many American chipmakers quit when faced with fierce Japanese competition in the 80s Micron survived by being leaner and more efficient than anyone else.

2️⃣ From the year 2000 Micron was a slave to PC cycles . As seen in the 2000 Dot Com crash and the 2015 price wars if people stopped buying computers Micron’s profits vanished . But they transformed the company. During these winters Micron played a game of Last Man Standing . When competitors like Qimonda in 2009 went bankrupt Micron did not just survive they expanded . By acquiring rivals like Elpida in 2013 they helped turn a crowded chaotic market into a stable Oligopoly dominated by just three players Samsung SK Hynix and Micron .

3️⃣ Recently Micron has made one more masterstroke . It has no longer just achieved being part of a commodity oligopoly. They are now the architects of HBM or High Bandwidth Memory. Think of HBM as a super highway for data . This is CRUCIAL since AI chips like those from Nvidia are incredibly fast but they need memory that can keep up. Micron’s transformation into a specialized AI partner means they now command higher prices and stronger loyalty than ever before.

On the other hand I leave you a chronology of the most outstanding fundamental events and how they fit with the chart and the trend change points.

Key Historical Market Movers

🔴 September 21 2000 -> The Dot Com Crash and Intel Warning Intel issued a massive profit warning due to weak PC demand in Europe triggering a sector wide collapse . Micron’s stock plummeted as the era of irrational exuberance for hardware components came to a violent end.

🔴 October 4 2006 -> Lexar Integration and Windows Vista Delay Micron reported disappointing quarterly margins following the acquisition of Lexar Media. The market reacted negatively to the integration costs and the delayed launch of Windows Vista which stalled the expected PC refresh cycle.

🟢 January 23 2009 -> Qimonda Bankruptcy and Market Bottom German rival Qimonda filed for insolvency significantly reducing the global supply of DRAM . This event created a long term price floor for the industry and marked the start of a massive recovery for surviving players like Micron.

🔴 January 7 2015 -> Samsung’s Price War and PC Weakness Concerns peaked as Samsung signaled aggressive capacity expansion despite slowing PC sales. Investors fled Micron fearing a return to the race to the bottom in memory pricing leading to a sharp double digit decline.

🟢 May 23 2016 -> The Bernstein Upgrade , analysts at Bernstein upgraded the stock spotting a fundamental shift toward supply discipline among the big three. This call accurately predicted the end of the memory winter and the start of a multi year bull run .

🟢 March 20 2024 -> AI Validation and Nvidia Partnership Micron reported a surprise profit and confirmed that its high bandwidth memory HBM3E was sold out for the year. This solidified the company’s role as a critical pillar in the AI infrastructure alongside Nvidia.

🟢 May 22 2025 -> The AI Supercycle Peak Guidance Capitalizing on the insatiable demand for AI servers Micron issued record breaking guidance for the second half of the year. This news triggered a massive rally as the stock broke through major psychological resistance levels.

🧑💻 Taking advantage

This transformation can make MU prices go to levels never before seen or imagined but we also have the support of the charts.

Recently we have broken a Double Top to the upside and this usually implies very very significant increases in the long term.

It seems that NASDAQ:MU can easily exceed 1,000 dollars in the coming years as it has such important technology for the new era of AI. I will not go into the technical part but almost 75 percent of cases of a double top breakout send the price to the equivalent of a 700 percent rally from the breakout of this double top.

That is why it is vital to be attentive to chart patterns to catch these types of operations where the fundamental and technical parts match perfectly. Furthermore knowing this about the long term it is very easy to find bullish entries in the short term and take advantage of the small rallies that arise within a rally of so many years like this one for MU.

👇 WANT MORE?

Hit the rocket , read my profile or follow so we can find each other again.

AAVEUSDT - Bear market. Breakdown of support at 162.0BINANCE:AAVEUSDT is testing the support of the range amid a market decline. Bulls are reversing their positions due to weakening fundamentals. Focus on support at 162.0

Bitcoin is falling due to the deterioration of the fundamental background. The altcoin market is reacting aggressively and entering a short zone. AAVE is breaking out of the range, and if it closes below 162.0, the decline may intensify

A pre-breakout base is forming relative to 162.0. Before the fall, a retest of the local liquidity zone at 165.9 is possible. However, closing below the support at 162.0 will be a signal for a further decline to 157.0 - 148.0.

Support levels: 162.0, 157.23, 148.06

Resistance levels: 165.9, 169.1

The price breaking out of the range suggests readiness for further movement. A breakout of support indicates that the movement will be downward. Closing below 162.0 could trigger a sell-off to 157 - 148 - 145.

Best regards, R. Linda!

ES Weekly Levels: Reversal Zone 6865–6875 → Target 6950/6955🔱 ES WEEKLY SNAPSHOT — EXECUTIVE SUMMARY (NEW WEEK | JAN 2026)

✨ Bull reversal setup is the focus — but weakness remains until key sell-side is reclaimed

🧲 Fresh overhead sell-side liquidity / bear FVG: 6950 plus key level 6955

📌 Context: ES gapped down at the open → signals continued weakness into the week

🧲 Bull FVG + preferred reversal zone: 6865–6875 = best area to scale into longs

🛡 Failure zone / risk-off trigger: loss of 6865–6875 opens downside to 6795 → 6790

🎯 Bull target: 6950 fresh liquidity pocket overhead

🏦 Core play: scale buys 6865–6875, manage risk if the zone fails, take profit into 6950–6955

🗳️ ES Weekly Scenarios — What’s Your Play?

Which path do you have for ES next week?

🅰️ Hold 6865–6875 → reversal works → rotation into 6925 → tag 6950

🅱️ Sweep below 6875 → reclaim 6865–6875 → squeeze into 6950–6955

🅲 Drive into 6950–6955 → rejection from sell-side → pullback toward 6925 → 6865

🅳 Break/hold below 6865–6875 → weakness confirms → downside opens to 6795 → 6790

Your key levels: 6955 / 6925 / 6865 / 6795 / 6790

Your FVGs: 6950 (bear sell-side) / 6865–6875 bull reversal

GOLD - A long squeeze of support could trigger growthFX:XAUUSD continues to consolidate, Friday's long squeeze (false breakdown) of support provides an opportunity for growth amid geopolitical issues...

The dollar is strengthening against the backdrop of Thursday's economic data and Trump's geopolitical actions, but against this backdrop, gold is behaving quite cautiously and looks quite strong.

Trump said that tariffs on eight European countries could rise to 25% if Greenland is not sold to the US - more tariffs and an escalation of the trade war could lead to a strong market reaction.

In the new trading week, we are awaiting Trump's speech (high volatility possible), US GDP, Core PCE, and PMI. The data may set the medium-term tone for the market...

Resistance levels: 4593, 4621, 4639

Support levels: 4581, 4561, 4550

The long squeeze has shifted the market imbalance towards buyers. Locally, we are seeing consolidation in the 4581-4593 zone. A close above 4593 or a retest of 4581 could trigger further growth within the current trend

Best regards, R. Linda!

Bitcoin Drops as Trade War & Geopolitical Risks EscalateBitcoin( BINANCE:BTCUSDT ), as I expected in the previous idea , has moved as anticipated and reached its first target (full target).

Currently, after a fake breakout above the resistance zone($94,970-$92,910), Bitcoin has fallen back below it, and this decline has come with strong momentum.

The reasons behind Bitcoin’s recent drop include concerns about a trade war between the U.S. and Europe, particularly threats from Trump imposing new tariffs on Europe over Greenland. Another factor is the potential escalation of tensions in the Middle East, which can make investors more cautious about high-risk assets.

Additionally, the recent global market declines, including the drop in indices like the S&P 500 index( FX:SPX500 ), which I had predicted , have also contributed to the bearish sentiment.

Furthermore, delays in the passing of the CLARITY Act in the U.S. and Coinbase’s withdrawal of support have added a negative sentiment to the crypto market.

From an Elliott Wave perspective, it seems that Bitcoin is currently completing wave 4, and we should expect a potential move toward the support lines. There is also a possibility that wave 5 may be truncated due to the strong momentum of wave 3.

I expect Bitcoin to decline from the Potential Reversal Zone(PRZ) and move toward the support lines.

Cumulative Long Liquidation Leverage: $91,720-$91,200

Cumulative Long Liquidation Leverage: $89,920-$88,760

Cumulative Short Liquidation Leverage: $96,340,125-$96,020

Cumulative Short Liquidation Leverage: $94,360-$93,300

First Target: Support lines

Second Target: $91,833

Third Target: Potential Reversal Zone(PRZ)

Stop Loss(SL): $94,433(Worst)

CME gap: $88,720-$88,120

What’s your view on Bitcoin?

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Elise | XAUUSD · 30M – Break & Hold Above DemandOANDA:XAUUSD

The impulsive bullish candle from demand confirms strong buyer presence. Current price action shows acceptance above the reclaimed zone, suggesting continuation toward the next high-liquidity area rather than immediate reversal.

Key Scenarios

✅ Bullish Case 🚀 → Sustained hold above 4650–4645:

🎯 Target 1: 4690

🎯 Target 2: 4720

🎯 Target 3: 4740

❌ Bearish Case 📉 → Breakdown back below 4640:

🎯 Downside Target 1: 4615

🎯 Downside Target 2: 4590

Current Levels to Watch

Resistance 🔴: 4690 – 4720 – 4740

Support 🟢: 4650 – 4640

⚠️ Disclaimer: This analysis is for educational purposes only. Not financial advice.

Bitcoin Hits PRZ — Short-Term Reversal in PlayBitcoin( BINANCE:BTCUSDT ), as I expected in the previous idea , continued its bearish trend and reached its target (full target).

Currently, Bitcoin is approaching a support zone ($90,590-$89,310) and is within the Potential Reversal Zone (PRZ) , near the Cumulative Long Liquidation Leverage($89,920-$88,760) and the support line.

From an Elliott Wave perspective, it seems that Bitcoin is completing wave 5, and this wave 5 may conclude within the Potential Reversal Zone (PRZ) .

Additionally, we can observe a positive Regular Divergence between(RD+) two consecutive valleys, indicating potential bullish momentum.

I expect that Bitcoin will experience a short-term bullish move and potentially rise at least to the $91,597. This upward movement could act as a pullback to the broken support lines.

First Target: $91,597

Second Target: Cumulative Short Liquidation Leverage($92,630-$91,988)

Stop Loss(SL): $89,117(Worst)

New CME gap: $93,060-$92,940

CME gap: $88,720-$88,120

Cumulative Short Liquidation Leverage: $94,389-$93,325

What’s your view on Bitcoin?

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

AUUSD Breaks New Highs – Bulls in ControlGold is currently consolidating just above the 4710 level, indicating a potential bullish setup. If the price breaks above this entry, it may aim for the target of 4778, capturing a favorable upward momentum. It’s important to monitor the support level and maintain the stop loss at 4595 to manage risk in case of a pullback.

USDJPY 30-Min — Volume Sell Reversal Triggered⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

✈️ Technical Reasons

/ Direction — SHORT / Reversal 157. 900 Area

☄️Bearish rejection confirmed through sharp candle body.

☄️Lower-high forming beneath resistance supply region.

☄️Volume decreasing confirms exhaustion in price rally.

☄️Sellers regained imbalance with heavy top rejection.

☄️Algorithm detects fading demand and shift to control.

⚙️ Hanzo Alpha Trading Protocol

The Alpha Candle defines the day’s real control zone — the first battle of momentum.

From this origin, the Volume Window reveals where the next precision strike begins.

⚙️ Hanzo Volume Window / Map

Window tracked from 10:30 — mapping true market behavior.

POC alignment exposes institutional bias and breakout potential zones.

⚙️ Hanzo Delta Window / Pulse

Delta window monitors real buying vs. selling power behind each move.

Tracks volume aggression to expose who controls the candle — buyers or sellers.

When Delta aligns with Volume Map, momentum becomes undeniable.

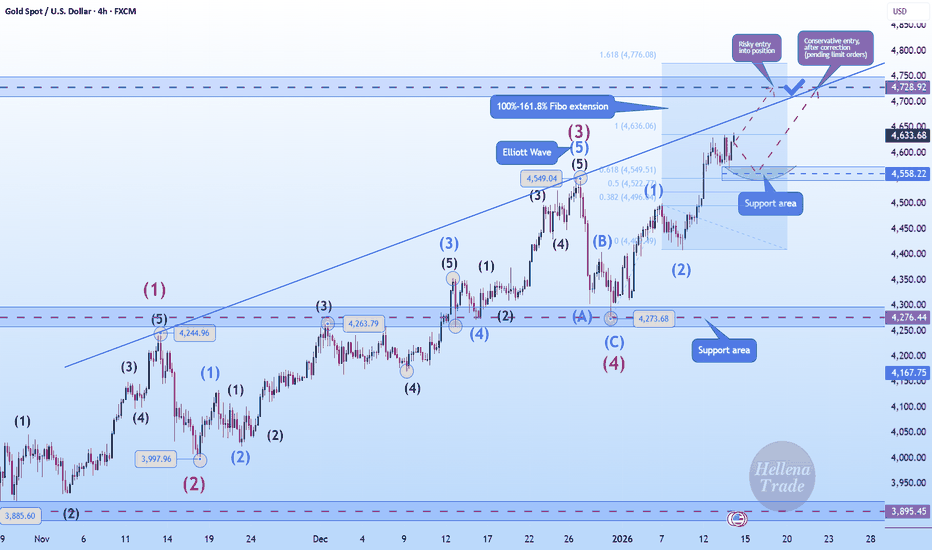

Hellena | GOLD (4H): LONG to 161.8% Fibo 4728 .Colleagues, the price is updating its maximum, and I think we shouldn't stop there.

After re-marking the waves, I realized that it would be more correct to place wave “3” at the 4549 level, since 5 waves fit well into it.

This means that the price is now in wave “5,” which can be quite unpredictable, but if we look at the blue waves, we can assume that there is now a medium-term impulse wave “3,” which means we can apply Fibonacci extension levels and see the 161.8% level as the target.

But I don't want to take such a risk and will set a slightly lower target - in the 4728 area. At the moment, we need to be very careful.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Gold 30-Min — Volume Buy Reversal Triggered⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

Technical Reasons

/ Direction — LONG / Reversal 4675 Area

☄️Bullish momentum confirmed through strong candle body.

☄️Structure shifted with higher-low near key demand base.

☄️Volume expanding confirms order-flow alignment upward.

☄️Buyers reclaimed imbalance with sustained clean break.

☄️Algorithm detects rising momentum under low liquidity.

⚙️ Hanzo Alpha Trading Protocol

The Alpha Candle defines the day’s real control zone — the first battle of momentum.

From this origin, the Volume Window reveals where the next precision strike begins.

⚙️ Hanzo Volume Window / Map

Window tracked from 10:30 — mapping true market behavior.

POC alignment exposes institutional bias and breakout potential zones.

⚙️ Hanzo Delta Window / Pulse

Delta window monitors real buying vs. selling power behind each move.

Tracks volume aggression to expose who controls the candle — buyers or sellers.

When Delta aligns with Volume Map, momentum becomes undeniable.

**GOLD H1 — Bullish SMC Continuation | BOS, FVG & Order Block toMarket Context

Gold is trading in a strong intraday bullish structure, showing clear momentum continuation after a clean impulsive move. Price respected higher lows and remains supported above key demand, favoring upside continuation toward premium levels.

Key SMC Concepts

Clear Break of Structure (BOS) confirming bullish market intent.

Strong displacement leaving a well-defined Fair Value Gap (FVG).

Price originated from a valid Bullish Order Block, acting as demand.

Price is respecting an ascending channel, supporting trend continuation.

Trade Idea

Look for pullbacks into the FVG or channel support for long entries.

Target previous highs and projected premium liquidity.

Disclaimer: This analysis is for educational purposes only and not financial advice. Always manage risk and confirm setups with your own strategy before trading

Natural Gas – Trend Shift in Progress?After being bearish bearish for a while, Natural Gas has broken out of the descending red trendline, signaling a clear shift in momentum from bearish to bullish.

What stands out here is how price reacted after the breakout. Instead of selling off again, it held above the recent support zone and started building higher structure.

As long as this new bullish structure holds, the bias remains to the upside, with room for continuation toward higher levels. Any pullbacks that stay above support are, for me, opportunities to watch.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

BTCUSDT Price Action Tightens at Key SupportBTCUSDT continues to trade within a broader corrective structure after reacting from the main supply zone near ATH. Price is currently respecting a rising support trendline while compressing below the weak supply zone, forming a higher-low sequence within a corrective channel.

As long as base support holds, a continuation toward the weak supply zone around the 108K region remains viable. However, failure to hold this structure opens the door for a deeper bearish extension toward the projected demand area near 76.5K.

Market direction from here will be dictated by acceptance or rejection at current levels, making this a critical decision zone for the next major move.

Elise | BTCUSD – 30M | Bearish Continuation After DistributionBITSTAMP:BTCUSD

Bitcoin failed to hold above the mid-range supply and experienced aggressive selling, signaling strong seller control. The impulsive downside move was not retraced with strength, showing lack of bullish demand. Price is currently consolidating below the breakdown zone, which favors continuation lower rather than reversal. This is a textbook bearish continuation environment.

Key Scenarios

❌ Bearish Case 📉 (Primary Bias)

Rejection below 93,200 – 93,500

🎯 Target 1: 91,800 – 91,600

🎯 Target 2: 90,300 – 90,200

✅ Bullish Case 🚀 (Invalidation Only)

Strong acceptance above 95,600

Would negate bearish structure and signal range recovery

Current Levels to Watch

Resistance 🔴: 95,300 – 95,600

Support 🟢: 91,800, then 90,200

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice.

Bitcoin (BTC) – 4-Hour Timeframe Tradertilki AnalysisGood morning my friends,

I have prepared a Bitcoin analysis for you on the 4-hour timeframe.

My friends, Bitcoin is currently moving in an HH-HL structure. Never forget: markets always move rhythmically in waves. Every rise has a correction, and every drop has a rebound. This rhythmic wave never breaks.

Since we are in an HH-HL structure, if Bitcoin reaches the levels of 90,847.0 - 89,361.0 on the 4-hour timeframe, I will open a buy position.

My targets:

1st Target: 92,500

2nd Target: 95,000

3rd Target: 102,000

My friends, I share these analyses thanks to each like I receive from you. Your likes increase my motivation and encourage me to support you in this way.🙏

Thank you to all my friends who support me with their likes.❤️