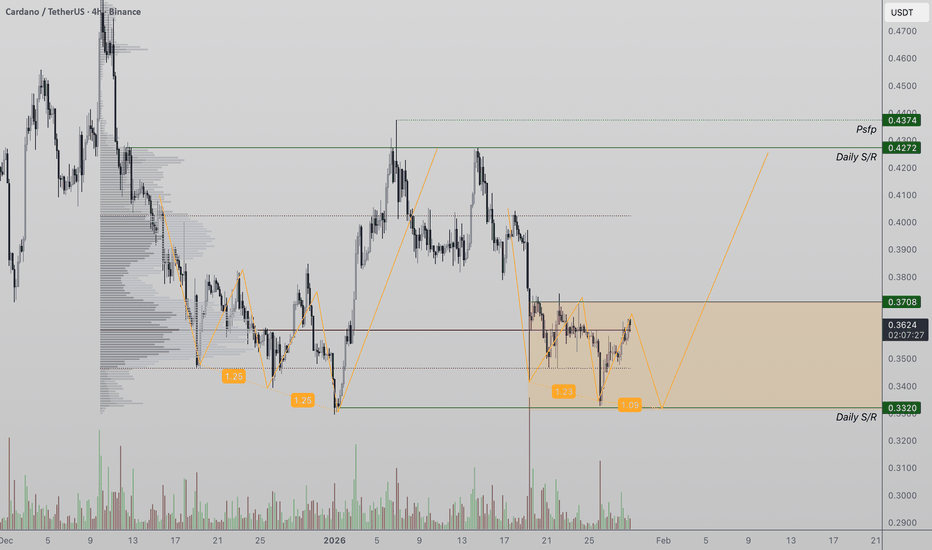

Cardano (ADA) Bullish Three Drives Pattern Emerges Cardano price action is currently stabilizing above $0.33 high-time-frame support, a level that previously marked a major bottom before a strong rally toward $0.42 resistance. The current structure is beginning to mirror that prior setup, with price forming what appears to be a three-drive fractal at the same support region.

After rejecting from $0.42, ADA has corrected in a controlled manner and is now consolidating around the point of control (POC) within the broader range. This area often acts as a decision point. A short-term rejection here would still align with the historical fractal, as the previous pattern also included consolidation before a successful retest of support.

As long as price continues to hold above $0.33, downside risk remains limited within the context of the current range. A successful defense of this level increases the probability of a higher low forming and opens the door for another rotation higher toward the upper range boundary at $0.42.

From a market structure perspective, ADA remains range-bound, but short-term structure is improving. Failure to hold $0.33 would invalidate the fractal and shift the bias back toward downside continuation. For now, support remains intact, keeping the bullish fractal scenario in play.

Wave Analysis

EURGBP Long Setup as ECB-Growth Outlook Supports EuroToday, I’d like to share a trading opportunity on the EURGBP pair( OANDA:EURGBP ), so stay with me!

Let’s start with a brief fundamental overview. EUR is likely to rise against GBP as the ECB may keep the rate unchanged, and euro growth may appear stronger compared to GBP, which is likely to decline or depreciate slowly.

Currently, EURGBP is hovering near a support zone(0.8664 GBP-0.8651 GBP).

From an Elliott Wave perspective, it seems that EURGBP has completed a zigzag corrective pattern(ABC/5-3-5), and we can now anticipate the next bullish wave.

I expect EURGBP to soon begin an upward trend and target the resistance zone. If that resistance zone(0.8698 GBP-0.8688 GBP) is broken, we can look for further upward movement toward the resistance lines.

First Target: 0.8697 GBP

Second Target: 0.87105 GBP

Stop Loss(SL): 0.8649 GBP(Worst)

Points may shift as the market evolves

Do you think EURGBP can resume its upward trend?

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Euro/British Pound Analysis (EURGBP), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Got back into $ONDS, on this headline: Got back into NASDAQ:ONDS , on this headline:

"On January 28, 2026, Ondas Holdings Inc. announced that its subsidiary, American Robotics, has received Blue List status for its Optimus drone from the Defense Contract Management Agency (DCMA). This listing places the Optimus drone on the Department of War's (DoW) authoritative directory of approved, secure, and NDAA-compliant commercial unmanned aircraft systems (UAS) and components."

Target still $18

TRB Holding Falling Wedge SupportTRB is trading inside a clearly defined falling wedge on the daily timeframe. Price is currently positioned near the lower boundary of the wedge, which has acted as support multiple times in the past. This area is important, as falling wedges often show slowing downside momentum near their base.

As long as price holds above this lower trendline, the structure remains constructive and allows for a potential rotation back toward the upper resistance of the wedge. A strong bounce from this zone would be an early sign of buyers stepping in, while a confirmed breakout above the upper trendline would signal a larger trend shift.

If price loses the lower wedge support decisively, the bullish structure would weaken and could open room for further downside toward the next demand zone. For now, TRB is sitting at a key support area where direction is likely to be decided.

$MDB: MongoDB Inc. – Data Dynamo or Overreaction Bust?(1/9)

Good evening, tech fiends! 🌙 NASDAQ:MDB : MongoDB Inc. – Data Dynamo or Overreaction Bust?

MongoDB’s Q4 crushed it with $548.4M revenue, but a soft FY2026 outlook tanked the stock. Is this a market meltdown or a golden buy? Let’s unpack the chaos! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Q4 FY2025: Revenue hit $548.4M, up 20% YoY 💰

• Earnings: EPS $1.28 smashed $0.66 estimate 📏

• Context: Stock dropped 16-20% post-guidance 🌟

It’s a rollercoaster—strong now, shaky later! ⚡

(3/9) – MARKET POSITION 📈

• Market Cap: No exact price today, but historically robust 🏆

• Core: MongoDB Atlas, 71% of revenue, up 24% YoY ⏰

• Trend: AI data demand’s sizzling, per market buzz 🎯

A leader in the database jungle! 🌐

(4/9) – KEY DEVELOPMENTS 🔑

• Earnings Beat: Q4 topped forecasts, Mar 5 release 🔄

• Guidance Flop: FY2026 revenue at $2.24-$2.28B, below $2.32B 🌍

• Bonus: Snagged Voyage AI for $220M, boosting AI play 📋

Thriving, yet spooked the herd! 🌈

(5/9) – RISKS IN FOCUS ⚡

• Guidance Woes: Non-Atlas demand fading 🔍

• Market Jitters: 16-20% after-hours plunge 📉

• Rivals: Cloud giants eyeing database turf ❄️

Rough seas, but storms pass! 🌧️

(6/9) – SWOT: STRENGTHS 💪

• Q4 Power: $548.4M revenue, $1.28 EPS 🥇

• Atlas Surge: 24% growth, debt-free balance 📊

• AI Edge: Voyage AI buy fuels future 🔥

A beast with brains and brawn! 🏋️♂️

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: FY2026 growth dips to 12.6% 📉

• Opportunities: AI boom, Voyage AI integration 📈

Can it turn panic into profit? 🧐

(8/9) – 📢MongoDB’s Q4 rocked, but guidance flopped—your vibe? 🗳️

• Bullish: Rebound to glory soon 🦅

• Neutral: Holding steady, wait it out ⚖️

• Bearish: More pain ahead, sell off 🐾

Drop your take below! 👇

(9/9) – FINAL TAKEAWAY 🎯

MongoDB’s Q4 flexes muscle at $548.4M 📈, but FY2026 gloom spooked the market 🌫️. Dips are our playground—DCA treasure awaits 💎. Snag ‘em cheap, rise like legends! Hit or miss?

BTC US$1.3k coming soonI believe that the price peak broken in 2013 will still be tested as support.

I like to play with improbable possibilities that everyone considers unthinkable, like a option bet but more easy of understand and operate. If it happened, would you be prepared?

What do you think ? Let your opinion bellow

GOLD UPDATED: FINAL GRAND CYCLE ANALYSIS – $5,131 Hit, NEXT?hey everyone — quick update on the GOLD Grand Supercycle Chart ( 2026 edition ).

We've been riding this beast hard, and it's delivering exactly as mapped. We smashed through that first big fib target at $5,131 ( nailed it perfectly today ), printed a fresh all-time high around $5,190 on the 3W, and now... yeah, we're seeing the classic pullback kicking in. This looks like the transition from the end of the 3rd minor wave into the 4th — a healthy, needed breather before the final 5th leg of this minor cycle.

Short-term roadmap right now: Expecting a correction down toward the $3,600–$3,500 zone (marked in red on the chart as that 3-to-4 wave dip). Could be sharp, could grind, but it's the shake-out most people miss or panic-sell. Support clusters there line up with prior structure, fib retraces, and the longer-term channel floor.

Once that 4th wave bottoms, boom — 3rd wave of the minor cycle fires up, targeting ~$9,419 ( 3.618% extension cluster — clean alignment).

After that? The chart tells the rest of the story: Micro 4th wave correction (probably multi-month, classic profit-taking / "gold is done again" vibes).

Then Micro 5th pushes the envelope higher potentially topping near $22,744 (3.618%) , feeding into the Macro Wave 3 climax.

Bigger picture stays unchanged: Macro Wave 3 potentially topping near $22,744 (3.618%), then deep Wave 4 shakeout, followed by the monster Wave 5 blow-off into $78,940+ (or way higher in full fiat-reset chaos — $100k–$250k not off the table if trust fully evaporates).

This isn't hype — it's the same Elliott + fib + PA structure that's respected every major turn since the '70s. We're deep in the "price discovery" phase of Macro Wave 3, where third waves get parabolic and make doubters look silly.

Smart money's been accumulating for years; now retail's piling in, central banks keep buying physical, and the fiat narrative keeps cracking. Dips like the one coming are the last real gifts before the next leg rips.

Plan: Watch for confirmation of the $3,500–$3,600 bottom (higher lows, volume dry-up, reversal candles).

Scale in on weakness if you're positioned — this correction is setup for the next impulse.

Don't fight the trend; third waves extend, corrections get ugly but end.

Stay sharp, manage risk, and let's see if we print $9k+ sooner than most think.

Drop your thoughts below — you calling this dip to $3,500 or shallower? Positions?

What a time to be watching gold... the system's hedge is waking up for real.

Disclaimer: Not financial advice — just sharing the chart structure and my read. Do your own homework, trade your plan.

UNH: adding into fear after a completed ABC correctionThesis

NYSE:UNH has completed its corrective ABC structure and is stabilizing within Wave 2, offering long-term accumulation opportunities in a proven cash-flow compounder.

Context

- Daily and weekly timeframes

- Deep corrective phase already completed

- Long-term uptrend remains intact on the weekly chart

- Dividend-paying, high free-cash-flow defensive name

What I see

- Yesterday’s selloff was headline-driven, not structural

- Price is holding inside the Wave 2 retracement zone

- Volatility is shaking out weak hands, not breaking structure

- This behavior is typical at the end of corrective phases

- I added to my long-term position yesterday, bringing my average into the $270s

What matters now

- The priority is stabilization and base-building

- A reclaim of the 50-day MA improves short-term structure

- Reclaiming the 200-day MA confirms the next impulsive leg

- Gap-filling narratives are noise, not a strategy

Buy / Accumulation zone

- Accumulation remains valid inside the current Wave 2 range

- I have no issue adding again once price stabilizes

- Risk is defined against the recent correction lows

Targets

- First major structural reference: 200-week MA near $460

- Wave 3 target remains the 1.618 Fib extension around $540

- Dividend yield (~2.6%) pays while waiting

Execution note

- This game isn’t for everyone — pressure exposes conviction

- I added at $250 and $240 when sentiment was darkest

- Buffett added at higher prices, yet fear returned instantly

- NYSE:UNH is my current safe-haven: strong FCF, cash-rich, defensive

This is a 3–5 year hold for me, not a short-term trade

JD: Final Wave 2 consolidation (patience before the breakout)Thesis

NASDAQ:JD is still compressing in the final stages of Wave 2, and the longer this base builds, the stronger the breakout typically becomes.

Context

- Weekly timeframe

- Multi-year downtrend transitioned into a base

- Compression phase continues while peers already broke out (BABA, BIDU)

- 2026 remains the window for JD to catch up

What I see

- Standard late-stage consolidation behavior for a Wave 2 structure

- Volatility keeps compressing inside the wedge

- Support is still holding, while resistance is still capping price

- Nothing “broken” here — just time passing and pressure building

What matters now

- We need patience until the weekly breakout and hold above wedge resistance

- Until that happens, this is still a compression structure, not the breakout itself

- The longer this range holds, the better the breakout odds and follow-through

Buy / Accumulation zone

- Wedge floor / support zone remains the area of interest

- Risk stays clean as long as support holds

Targets

- Wave 3 target remains: 1.618 Fib at ~$71

- Higher extensions come later once Wave 3 plays out and Wave 4 support is confirmed

Risk / Invalidation

-Loss of the wedge floor support would delay the bullish catch-up thesis

SNT Approaching Breakout ZoneStatus(SNT) is currently trading inside a well defined falling wedge. Price is compressing near the upper half of the wedge, showing reduced volatility as buyers and sellers wait for a clear direction. This type of structure often appears near the later stage of a corrective move.

The upper trendline of the falling wedge remains the key resistance to watch. A clean break and hold above this level would signal a potential shift in momentum, opening room for a recovery toward higher resistance zones seen on the daily view. The smaller inset confirms that the larger trend is still corrective, but momentum is slowly stabilizing.

If price fails to break the wedge resistance, another dip toward the lower boundary of the structure is possible. This makes the current area an important decision zone where the next move is likely to develop.

XAUUSD Strong Bullish Breakout (1H)Gold has shown a strong bullish breakout on the 1-hour timeframe after multiple CHoCH confirmations, indicating a clear shift in market structure. Price is currently holding above a key support zone, which suggests buyers remain in control. The pullback into this area looks healthy and offers a potential continuation setup. If momentum continues, price is likely to move toward the weak high and higher resistance levels. Always follow proper risk management and wait for confirmation before entering trades.

GBP/USD Outlook: Upward Trajectory Amid Economic ShiftsGBP/USD Outlook: Upward Trajectory Amid Economic Shifts

The GBP/USD pair has shown resilience in recent sessions, climbing toward levels not seen since early October, currently hovering around 1.3435 after a rebound from lows near 1.3250.

This movement reflects a broader weakening in the US Dollar, influenced by ongoing federal government shutdown impacts estimated at $15 billion weekly in lost economic output, alongside dovish signals from the Federal Reserve hinting at potential rate adjustments amid cooling job market data.

On the UK side, the economy returned to modest growth with a 0.1% GDP increase in August, driven by a 0.4% rise in production despite flat services and a dip in construction. This data has bolstered the Pound, pushing it to its highest point in over a week against the Dollar.

Technical indicators support a bullish bias in the short term. The pair has broken above a descending trendline, signaling a potential reversal, with key resistance eyed at 1.3470 to 1.3500. Support remains firm around 1.3250-1.3265, where recent bounces have occurred, and a bullish divergence on the 4-hour chart adds to the upside momentum.

Market sentiment on platforms like X echoes this, with several analysts noting a shift toward bullish continuation if the pair holds above 1.3340, targeting 1.3480-1.3500. However, overbought conditions and resistance clusters near 1.3400 could prompt minor pullbacks before further gains.

Broader factors tilting the scales include the International Monetary Fund's outlook on a subdued global expansion, which may weigh more heavily on the US amid trade tensions and shutdown effects, while the UK's return to growth provides a counterbalance. Bank analyses highlight potential USD strengthening from policy divergences and protectionist measures, but current dynamics favor GBP appreciation in the near term.

Overall, the direction for GBP/USD today leans upward, with potential for extension toward 1.3500 if US pressures persist and no major reversals hit key supports. Traders should monitor upcoming US data releases and any UK budget updates for confirmation.

GOLD Buyers In Panic! SELL!

My dear followers,

I analysed this chart on GOLD and concluded the following:

The market is trading on 5088.9 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 5049.0

Safe Stop Loss - 5114.5

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

FLOCK Near Resistance After Long DowntrendFLOCK is currently trading near the upper trendline of a falling wedge structure. This area acts as a key resistance, as price has respected the wedge boundaries throughout the downtrend. The recent push higher shows improving momentum, but the structure is still intact until a breakout is confirmed.

If price manages to break and hold above the upper trendline, it would signal a potential trend reversal, with room for a stronger recovery toward higher resistance levels. Falling wedges often resolve to the upside, especially when price compresses near resistance like this.

If price fails to break the upper trendline and gets rejected, a pullback toward the lower boundary of the wedge remains possible. This makes the current zone critical for short term direction.

EURJPY On The Rise! BUY!

My dear followers,

This is my opinion on the EURJPY next move:

The asset is approaching an important pivot point 182.48

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 183.75

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURGBP Expected Growth! BUY!

My dear subscribers,

EURGBP looks like it will make a good move, and here are the details:

The market is trading on 0.8677 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 0.8697

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EUR/JPY: Wave 5 Completed, ABC Correction AheadEUR/JPY has completed a strong bullish impulsive move, finishing a full five-wave Elliott Wave structure to the upside. The recent highs suggest that Wave 5 is likely complete, which often signals the end of a trend phase. After such a move, the market usually shifts into a corrective phase, and the chart shows the start of an A-B-C correction. Price is expected to move lower first into Wave (A), followed by a bounce in Wave (B), and then another decline in Wave (C). As long as price remains below the recent high near 186.9, the bias is short-term bearish, with downside targets around the 179–176 zone. This pullback would be a normal and healthy correction after a long rally, not a trend reversal yet.

Targets

Wave (A) target: 179.5 – 178.0

Wave (C) target (if correction extends): 176.0 area

Stop-Loss

Above recent high: 186.90

Invalidation Level

Daily close above 186.90

Stay tuned!

@Money_Dictators

Thank you :)

Bitcoin (BTC) Potential Bottom Forming? Bitcoin price action is currently showing early signs of stabilization after responding from the channel low, an area that aligns closely with the value area low, making it a key region of technical support. The initial bounce from this zone has been constructive, suggesting that downside momentum is beginning to slow.

One of the more important developments is the reclaim of the point of control (POC). The POC represents the price level where the highest volume has traded within the recent range and often acts as a pivot for short-term direction. Holding above this level shifts near-term bias back in favor of buyers and opens the door for a rotational move higher.

As long as Bitcoin maintains acceptance above the POC, the probability increases for a continuation toward the value area high, which now acts as immediate resistance. A clean reclaim and close above this level would strengthen the case for a move toward the upper boundary of the channel, where higher-time-frame resistance is located.

From a market structure perspective, this move is best viewed as a relief rally within a broader range, rather than a confirmed trend reversal. Failure to hold above the POC would invalidate the bullish rotation and expose price to renewed weakness toward the channel low. In the short term, holding reclaimed levels remains critical for upside continuation.

GOLD (XAUUSD) — Price Discovery-Wave 3Gold remains in strong price discovery, printing higher highs consistently with no meaningful bearish structure on the higher timeframes. Momentum is accelerating, confirming that bulls are fully in control.

From an Elliott Wave perspective, price is currently developing Major Wave 3, and more precisely, we are advancing through the final sub-wave (Wave 5) of this impulsive leg. This phase is typically marked by aggressive expansion and emotional buying—exactly what we are witnessing now

EUR/USD: Extreme Overextension and Bearish Reversal OutlookThe EUR/USD pair is currently exhibiting signs of a major parabolic climax on the 15-minute timeframe. After a vertical ascent that bypassed previous consolidation zones, the price has reached an overextended state near the 1.19887 level. This technical setup focuses on the anticipated "Mean Reversion" as the market seeks to rebalance the recent aggressive buying pressure.

Technical Deep-Dive:

Parabolic Expansion: The sharp, near-vertical move from the 1.18400 region suggests that the market is in a "blow-off top" phase. This type of price action is often unsustainable and precedes a significant corrective move.

Structural Distribution: As indicated by the black forecast path, we anticipate the formation of a distribution top. The market is expected to create a series of lower highs as it struggles to maintain these premium prices.

Targeting Historical Supply-Turned-Support:

Primary Objective: 1.19000 – This purple zone was previously a major resistance barrier. In technical analysis, broken resistance often becomes the first significant support target during a retracement.

Secondary Objective: 1.18250 – A deeper correction toward the original accumulation base if the bearish momentum intensifies.

Risk Management: The bearish thesis remains valid as long as the price does not establish a new sustained high above 1.20000. A break and hold above the psychological 1.20k level would invalidate the reversal setup.

Trading Strategy: This setup favors a "Sell the Exhaustion" approach. Traders should look for bearish confirmation, such as a "Shift in Market Structure" (breaking the last minor 15-minute low), before targeting the retracement toward the 1.19000 value area.

XAG/USD: Strategic Breakdown and Bearish Trend Shift AnalysisSilver (XAG/USD) is currently undergoing a significant technical transition on the 15-minute timeframe. After a sustained period of trading within an aggressive ascending channel, the price action has reached a point of exhaustion at the premium resistance levels. This setup focuses on the breakdown of the established bullish structure and the subsequent shift in market momentum.

Technical Insights:

Channel Failure & Resistance Rejection: The price has repeatedly failed to breach the upper boundary of the parallel ascending channel, encountering heavy institutional selling pressure near the 112.500 - 114.833 zone. This rejection has resulted in a decisive break below the primary ascending support line.

Market Structure (ChoCh): The breakdown of the lower trendline confirms a "Change of Character" (ChoCh). The market is now transitioning from an impulsive bullish phase into a distribution phase, followed by a projected bearish expansion.

Bearish Forecast Path: As indicated by the black forecast trajectory, the market is expected to perform a "Break and Retest" sequence. We anticipate a series of lower highs as the pair seeks to rebalance the previous rapid upward move.

Key Targets:

Primary Objective: 108.126 – A major structural support level where the first significant pool of sell-side liquidity resides.

Major Target: 100.543 – The ultimate goal for this bearish cycle, representing a full retracement into the deep demand zone.

Risk Management: The bearish outlook is maintained as long as the price remains below the recent swing high of 114.833. A sustained close above this level would invalidate the current reversal thesis.

Trading Strategy: This setup favors a "Sell on Strength" approach. Traders should monitor the retest of the broken trendline or previous minor support levels for bearish confirmation before targeting the deeper downside objectives.

XAU/USD: Bearish Continuation and Liquidity Hunt PhaseGold (XAU/USD) continues to show signs of structural weakness on the 15-minute timeframe. Following a strong rejection from the institutional supply zone (upper purple box), the price action is now confirming a transition into a deeper corrective cycle. The market is actively seeking out lower liquidity levels to rebalance the recent impulsive upward move.

Technical Breakdown:

Trendline Breakdown: The price has decisively lost its primary ascending support, turning the previous bullish structure into a series of lower highs and lower lows. This shift confirms that sellers are now in control of the intraday trend.

Supply Zone Defense: The resistance zone near 5,110 - 5,120 has proven to be a formidable barrier. Each attempt to reclaim this area has been met with aggressive selling pressure, reinforcing the bearish sentiment.

Forecasted Path: As indicated by the black forecast lines, we anticipate a "Break and Retest" sequence. The market is likely to consolidate or minorly pull back before a sharp expansion toward the downside.

Key Targets:

Primary Objective: 4,912 – This remains the main target for take-profit, aligning with a significant structural demand zone (lower purple box).

Secondary Objective: 4,880 – A deeper extension to clear out the remaining sell-side liquidity resting at the base of the previous rally.

Risk Management: The bearish setup is invalidated if the price produces a strong 15-minute candle close above the 5,154 peak. Until then, any rallies should be viewed as potential selling opportunities.

Conclusion: This setup is a classic example of market distribution. Traders should remain patient and look for bearish confirmation near the minor resistance levels to join the move toward the major demand zones below.