$SPY & $SPX — Market-Moving Headlines Thursday Jan 22, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Thursday Jan 22, 2026

🌍 Market-Moving Themes

🧠 Relief Rally Test

Markets face a reality check as growth and labor data hit after tariff-driven volatility

💻 Intel Earnings Focus

Intel reports after the close with AI server demand and data center share in focus

🏦 Consumer Credit Scrutiny

Capital One earnings test credit quality amid political pressure on card rates

⚡ Energy Infrastructure Spillover

Kinder Morgan earnings strength lifts attention on pipelines tied to AI power demand

🎮 High-Beta Aftershocks

Meme and media names remain volatile following insider buying and deal reactions

📊 Key U.S. Economic Data Thursday Jan 22 ET

8:30 AM

- Initial Jobless Claims Jan 17: 208K

- GDP Q3 first revision: 4.3%

10:00 AM

- Personal Income Nov delayed: 0.4%

- Personal Spending Nov delayed: 0.5%

- PCE Index Nov delayed: 0.2%

- Core PCE Index Nov delayed: 0.2%

- Core PCE YoY

⚠️ Disclaimer: For informational purposes only. Not financial advice.

📌 #SPY #SPX #Macro #GDP #PCE #Jobs #Earnings #AI #Energy #Markets #Stocks #Options

Wave Analysis

Sandisk - Final PushLooking at the chart, we see that we are drawing the 5th and final wave of the uptrend.

Remaining movement: 3-18 %.

Key targets:

395

454

After reaching these targets, we expect a correction

---

Please subscribe and leave a comment!

You’ll get new information faster than anyone else.

---

XAUUSD 30M: Parabolic Rally Rejection Targeting DemandOANDA:XAUUSD

Gold made a strong impulsive rally into the 4880–4890 area.

Historically, when Gold accelerates this fast on the 30-minute timeframe:

It attracts late breakout buyers

Volatility expands near highs

Continuation becomes statistically weaker, not stronger

Gold rarely keeps trending cleanly after a parabolic leg — it usually corrects back to structure first.

2. Rejection at Prior Highs (Distribution Zone)

The zone around 4875–4885 aligns with:

Prior session highs

Psychological resistance

Previous supply reactions

Historically:

Failure to hold above prior highs = distribution

Multiple upper wicks and choppy candles = sellers absorbing buy pressure

This is where institutions offload longs, not initiate new ones

That makes this area a sell-from-strength zone, not a breakout zone.

3. Entry Logic (4832 Area)

The short entry is not at the top, but after confirmation:

Price breaks short-term bullish structure

Pullback fails to reclaim previous support

Prior support flips into resistance

Historically, this sequence in Gold signals:

Trend pause → correction phase

Buyers losing control

Sellers gaining acceptance below structure

This avoids emotional top-picking and aligns with how Gold actually reverses.

4. RSI Confirms Regime Shift

RSI(14) rolls over from above 60 toward 40.

Historically in Gold:

RSI above 60 = bullish impulse

Failure to hold above 50 = trend exhaustion

RSI drifting toward 40 during pullbacks = bearish continuation phase

This confirms the move is distribution → correction, not consolidation.

5. Stop Loss Logic (Above 4878)

Stop above 4878–4885 is logical because:

A reclaim of highs invalidates the rejection

It would mean buyers absorbed supply successfully

Historical rejection thesis fails → exit immediately

This is structural invalidation, not random risk placement.

6. Target Logic (4779 Zone)

The target sits at:

Prior consolidation base

High-volume launch area of the impulse

Unfilled demand zone

Historically, Gold:

Retraces to the origin of the last impulsive move

Respects demand zones more than Fibonacci levels

Often corrects 50–70% of impulsive legs before continuing higher

This makes 4779 a historically favored reaction level.

7. Why the Correction Is Expected to Be Clean

Gold corrections tend to:

Start slowly (confusion phase)

Break structure

Accelerate into demand

This path traps:

Late buyers

Early dip buyers

Weak longs holding hope

Which fuels the continuation down into the target.

Summary (Historical Behavior Logic)

✔ Parabolic advance → exhaustion

✔ Rejection at prior highs

✔ Structure break + failed pullback

✔ RSI confirms regime shift

✔ Target at impulse origin

This is a classic Gold correction trade — trading how Gold has behaved historically, not predicting a top

XAGUSD Short — Rounded Top Distribution & Structure Failur????OANDA:XAGUSD

Silver has formed a rounded / arc-style top after a sustained push higher.

Historically, this structure signals distribution, not continuation.

Why this matters in Silver:

Silver often tops slowly and visibly, unlike Gold

Rounded highs show buyers losing urgency

Smart money sells gradually into strength instead of dumping

This is classic late-stage bullish exhaustion.

2. Failure at Key High (Historical Rejection)

Price failed to hold above the 95.0–95.8 zone, which aligns with:

Prior swing highs

Psychological round-number resistance

Previous supply reactions

Historically:

When Silver fails multiple times near a major high,

The next move is usually a deep corrective leg, not a shallow pullback

This is not a breakout failure — it’s trend termination behavior.

3. Entry Logic (93.6 Area)

The entry comes after structure breaks, not at the top.

Historically preferred behavior:

First sharp drop = weak hands exit

Pullback = late buyers attempt “dip buy”

Failure to reclaim prior structure = high-probability short

The entry aligns with:

Lower high formation

Prior support turning resistance

Momentum shift confirmed by RSI

This avoids emotional top-picking.

4. RSI Confirms Distribution

RSI(14) is sitting around 35–44 and trending lower.

Historically in Silver:

RSI failing to hold 50 = bearish regime

Each RSI bounce below 50 = sell opportunity

RSI sliding toward 30 during price pullbacks = trend continuation, not reversal

This supports continuation lower, not consolidation.

5. Stop Loss Logic (95.0+)

Stop above 95.0–95.8 is structurally sound.

Historically:

If Silver reclaims the rounded-top highs,

Distribution thesis is invalid

Sellers are wrong → exit immediately

This is a behavioral invalidation, not arbitrary risk placement.

6. Target Logic (90.2 Zone)

The target aligns with:

Prior demand base

High-volume accumulation zone

Previous impulsive launch area

Historically, Silver:

Retraces deeply after topping

Often returns to the origin of the prior impulse

Does not respect shallow Fibonacci levels as much as raw structure

This makes 90.2 a realistic, behavior-backed target.

7. Why the Projected Path Makes Sense

Silver rarely drops in a straight line.

Historically after topping:

Sharp sell-off

Choppy pullbacks (false hope for buyers)

Final acceleration into demand

This path maximizes trapped longs and fuels continuation.

Summary (Historical Logic)

✔ Rounded top = distribution

✔ Rejection at major highs

✔ Lower high + structure break

✔ RSI confirms bearish regime

✔ Target aligns with prior accumulation

This is a classic Silver mean-reversion + trend-shift short, based on how Silver has behaved for years — not a prediction, but recognition.

It’s Executing a Clean Stair-Step Expansion Toward New ATHOn the Gold H4 timeframe, price action is displaying a highly constructive bullish expansion, not a blow-off move. The market has progressed through a clear three-phase cycle: Phase 1 accumulation after a sharp correction, Phase 2 re-accumulation with higher lows above the EMA, and Phase 3 compression beneath resistance before expansion. Each phase resolved higher, confirming strong demand absorption and trend continuation behavior rather than distribution.

The most important technical feature is the series of unfilled value gaps (GAPs) left behind during impulsive moves. These gaps represent inefficient price discovery and act as strong dynamic support zones. Notice how price respected each GAP perfectly before continuing higher this is classic institutional stair-step markup, where pullbacks are shallow, controlled, and corrective. The EMA continues to slope aggressively upward and remains well below price, reinforcing the strength of the trend and showing no signs of bearish divergence.

The recent breakout above the Phase 3 consolidation zone is critical. Price did not reject or stall instead, it expanded cleanly and accelerated, indicating acceptance above prior value. This behavior significantly increases the probability of continuation rather than mean reversion. As long as Gold holds above the upper GAP region (~4,628–4,650), any pullback should be viewed as trend continuation entry, not reversal risk.

From a projection standpoint, the measured expansion and momentum structure support a move toward the 5,000+ region, aligning with the marked NEW ATH / TARGET zone. Importantly, the projected path anticipates healthy pullbacks, not vertical price which is exactly what strong bull markets do before printing new highs.

Bottom line:

Gold is in a confirmed bullish expansion cycle with clean structure, strong EMA support, and no distribution signals. Unless price aggressively reclaims and closes below the upper GAP zones, the technical bias remains firmly bullish, with new all-time highs as the next logical objective, not an outlier scenario.

Intel - New Highs

Following up on the previous idea, where the projected targets have been completed.

Let’s revisit the chart.

Since price continued higher without entering a correction, this suggests that wave 3 of the larger move has begun.

Key levels:

62 - local correction within wave 3

74/81 - potential completion zone for wave 3 , followed by a correction

106/121 - potential completion zone for the entire move

Estimated upside potential from current levels:

35-50% for wave 3

96-124% for the entire move

---

Please subscribe and leave a comment!

You’ll get new information faster than anyone else.

---

XAUUSD | Gold Signal |January 22,2026Gold's Long-Term Outlook: Resilience and Potential Risks Amid Uncertainty

Despite a short-term pullback, the long-term outlook for gold remains optimistic. As a safe-haven asset, gold continues to attract inflows amid heightened global economic uncertainty. The 64% gain in 2025 and the over 10% cumulative gain so far in 2026 are driven by multiple factors: inflation expectations, geopolitical conflicts, controversies surrounding Federal Reserve policy, and the potential escalation of the Arctic resource competition. Even though Trump's agreement framework appears stable, the unease among NATO allies and the upcoming EU summit suggest that the Greenland issue is far from resolved. Russia and China's ambitions in the Arctic, along with legal challenges to the Federal Reserve's independence within the US, could reignite safe-haven demand.

Investors should note that concerns about Japanese fiscal policy have made the yen precarious, potentially indirectly supporting the relative strength of the US dollar and gold. Experts suggest that while the gold sell-off may be temporary, the market should be wary of news-driven volatility. In the future, if details of the agreement are revealed or new variables emerge, gold may resume its upward trend. Overall, in a volatile geopolitical environment, gold's safe-haven appeal will continue, but a rational investment strategy based on macroeconomic data is necessary.

In conclusion, while Trump's retraction of his Greenland threat narrowed gold's gains, it failed to reverse its long-term upward trend. This event reminds us that financial markets are highly sensitive to headlines, but gold's inherent resilience stems from the persistent global uncertainty. Investors should remain vigilant when pursuing gold, paying close attention to subsequent diplomatic developments and economic indicators to seize genuine opportunities.

Today, continued attention should be paid to news regarding Trump's actions and geopolitical developments, as well as the performance of data such as the US November PCE and initial jobless claims

Light Crude Oil (CL) Looking for Larger Degree CorrectionThe short-term Elliott Wave outlook for Oil (CL) shows the cycle from the June 23, 2025 peak ended at the December 16, 2025 low of $54.98. After this completion, Oil began correcting the prior cycle in a larger degree, expected to unfold in either three or seven swings. From the December 16 low, wave ((i)) advanced to $58.88. The pullback in wave ((ii)) developed as a zigzag structure. Within this correction, wave (a) ended at $56.65, wave (b) reached $58.87, and wave (c) declined to $55.76. This sequence completed wave ((ii)) in higher degree.

Oil then resumed higher in wave ((iii)), subdividing into five waves. From wave ((ii)), wave (i) ended at $57.17, followed by a pullback in wave (ii) that concluded at $55.86. Wave (iii) advanced to $59.8, while wave (iv) corrected to $58.45. The final leg, wave (v), extended to $62.36, completing wave ((iii)) in higher degree. A corrective phase unfolded in wave ((iv)), again forming a zigzag. From wave ((iii)), wave (a) ended at $59.19, wave (b) advanced to $61.85, and wave (c) declined to $58.7. This completed wave ((iv)) in higher degree.

Oil has since turned higher in wave ((v)). From wave ((iv)), wave (i) ended at $60.68, while the pullback in wave (ii) concluded at $59.22. Near term, as long as the pivot at $55.76 remains intact, Oil is expected to continue higher.

BTCUSD | 30M – Bearish Structure with Relief BounceBITSTAMP:BTCUSD

Bitcoin experienced aggressive sell pressure, breaking previous intraday support and forming a bearish continuation leg. The current bounce is a reaction from a demand zone and should be treated as a pullback or mitigation move, not trend change. Unless price reclaims and holds above key resistance, sellers remain in control and upside is capped.

Key Scenarios

✅ Bullish Relief Case 🔄

Hold above 89,200 – 89,000

Upside reaction toward:

🎯 90,200

🎯 91,300 (supply / target zone)

❌ Bearish Continuation Case 📉

Rejection from 90,200 – 91,300

Continuation toward:

🎯 88,000

🎯 87,500 liquidity zone

Current Levels to Watch

Resistance 🔴: 90,200 – 91,300

Support 🟢: 89,200 – 89,000 | Major: 88,000 – 87,500

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice.

ETH — Price Slice. Capital Sector. 3158.18 BPC 9© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 22.01.2026

🏷 3158.18 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 9

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

Jan 22, 2026 - XAUUSD GOLD Analysis and Potential Opportunity📊 Summary:

Market sentiment is shifting rapidly, and today the downside has the upper hand. For now, 4800 is the key line separating bullish and bearish bias.

If price holds above 4800, the strategy focuses on buying pullbacks into support.

If price breaks below 4785, the strategy shifts to selling rallies where resistance holds.

🔍 Key Levels to Watch:

• 4828 – Resistance

• 4815 – Resistance

• 4810 – Resistance

• 4802 – Resistance

• 4785 – Support

• 4766 – Support

• 4755 – Support

• 4747 – Support

📈 Intraday Strategy:

SELL: If price breaks below 4785 → target 4780, with further downside toward 4774, 4770, 4766

BUY: If price holds above 4802 → target 4805, with further upside toward 4810, 4815, 4821

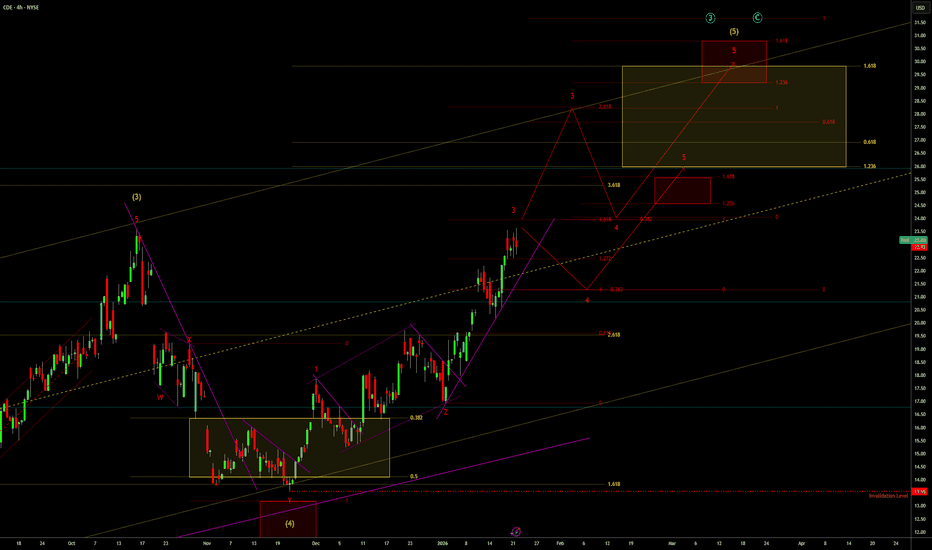

Coeur Mining (CDE) Elliott Wave Outlook - Count 1 Alt1 (4H)This is an alternate outlook which sees that NYSE:CDE is already in the red wave 3 which again is approaching a typical wave 3 target at the 1.618 extension. I prefer the red wave 2 as a running flat on this outlook compared to the expanding leading diagonal count previously used, and with silver approaching $100, this outlook allows for the completion of this 5 wave sequence quicker than the previously posted 4H outlook.

That last comment suggest I have one eye on a reaction at $100 silver (I suppose I can’t rule it out also Gold approaching $5K), and that I’m preparing for a larger pull back. Well once I anchor red wave 5, yellow (5), and cyan 3 or C this does suggest a larger pullback. I am going to review this count based on my higher timeframe outlook on silver, but looking at CDE in isolation, I think this leg potentially completes a 5 wave sequence higher and the potential for pull back still exists. A pull back that I may not want to hold all of my current holding through, so may trim a little more from CDE and other miners based on correlation as this wave progresses.

The situation is of course fluid, and something could happen tomorrow that changes that sentiment.

Wave Counting for potential upcoming EURO/USD move downward.We see 4th wave pending completion, if we break above major lines with consolidation we may see moves up, however with direction lines matching for 1st and 5th wave projection, with 1 over 2 Fibonacci retracement landing on major trend lines. I post this idea with confidence.

Bitcoin - Creating another -30% correction!🤬Bitcoin ( CRYPTO:BTCUSD ) is still in a bearish market:

🔎Analysis summary:

Just a couple of months ago, Bitcoin created its expected bullmarket all time high. Since then, we already witnessed a correction of about -30%. But looking at higher timeframe structure, this correction is not over and we might see a final push of -30% lower soon.

📝Levels to watch:

$60,000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

PFE 1M Long Trend TradeNo set up

- neglected one bar rule for the 1Y context

+ long impulse

+ 1/2 correction

Calculated affordable stop limit

1 to 2 R/R take profit

1Y Trend

"+ long impulse

+ 1/2 correction

+ SOS level

+ support zone

- exhaustion volume too big"

1D Situation

"+ long impulse

- neutral zone 1

+ above consolidation volume"