SILVERS ANTICIPATED SELL OFF / EMOTIONS OF RETAILJust look ...🤦♂️

..................................................................................................................................................................................................................................................................................................................................................................

Wyckoff

Wyckoff Re-Distribution on Bitty [Phase B - D]Notes:

LPSY high can be set anywhere as long as its lower than the Upthrust at 93.8k

Phase A of Re-Distribution typically looks like accumulation and will be a separate published idea to reduce clutter

Technically wicks can be used but closes tend to provide more accurate results and are what is used in this idea

Possible Wyckoff accumulation in ETHUSDETHUSD appears to be in an accumulation phase now, I tried to make a self-explanatory chart here. It also corresponds with the sentiment quite well with all those institutional sells, while the news about them is spread across the net like a wildfire.

But what if I told you that those sell-offs are not "institutional". Well, they are, but not in a sense that "big money are up to something". All those funds just manage their clients' funds and sometimes Black Rocks and other big boys in the sand simply clear their positions to have neutral exposure.

Wait, those sell-offs were made by the general public, not big money insiders? Always have been .

As to the current situation, we might have plenty of time in store for us before we break the channel, however the movement is often swift.

Everything is on the chart already. Every piece of known information is already accounted for in the price chart.

Don't get into FOMO.

Do your own research.

GoldContext: The 5,000 Sentinel & The Structural Void

Related Tickers: COMEX_MINI:MGCG2026, COMEX:GC1!, CAPITALCOM:DXY

Weekly Recap (Jan 19 – Jan 23, 2026)

1. Market Context (Extreme Vertical Initiative)

The auction was a display of Vertical Initiative driven by geopolitical shocks.

• The Structure: MGC sliced through 4,700 and 4,800 with minimal horizontal development, leaving a Thin Profile with Single Print sequences.

• The Behavior: Pure Price Discovery . Friday ended with a Buying Tail , closing at 4,979.7 , confirming OTF buyers remained aggressive into the close.

2. Inventory & Nuance (Safe-Haven Structural Gaps)

• Inventory: Stretched Long . The lack of TPO density below current prices suggests a fragile structure.

• Structural Anomalies: Rapid moves left behind Low Volume Nodes (LVNs) . These are magnets for future Mean-Reversion if the safe-haven bid cools.

Week Ahead Analysis (Jan 26 – Jan 30, 2026)

1. Developing Profile (The 5,000 Battlefield)

• The Magnet: 5,000 is the primary sentinel. Acceptance above triggers a shift into uncharted distributions.

• The Pivot: 4,980 is the floor. Acceptance below suggests a Look Above and Fail .

2. Fundamental Catalyst (The FOMC Gauntlet)

• The Fed (Jan 28): Main event. FOMC rhetoric will decide if the auction continues its vertical search or rotates to find balance.

Daytrade Plan (Jan 26, 2026)

• Bias: Bullish Initiative above 4,980.

• Scenario A: Acceptance with Volume above 5,000 targets 5,050+.

• Scenario B: Rejection at 5,000 targets rotation to the 4,900 HVN .

• Invalidation: Value migration below 4,830 kills the immediate bull case.

Talk to you for the next update.

Bitcoin AnalysisIt’s been a while since I last shared an idea. Today, I want to talk about Bitcoin.

With all the uncertainty since Trump became president, I’m going to stay away from fundamentals for now. Instead, I’ll focus purely on the technical side—Wyckoff, chart patterns, and trend analysis.

1. Wyckoff (Weekly): I think we’re currently in a markdown phase following distribution.

2. Patterns: The last structure looked like a double top (a reversal signal), and right now it’s forming a potential bear flag, which could mean the downtrend continues.

3. Trendline: A key bullish trendline has already broken, which strengthens the case for a reversal.

Overall, I can’t deny there’s a strong chance we see more downside soon.

What’s next?

- I’m waiting for confirmation of a lower high , and I’ll take action from there.

- On the other hand, if Bitcoin shows strong signs of re-accumulation, I’m also ready to take the opposite trade.

PFE 1M Long Trend TradeNo set up

- neglected one bar rule for the 1Y context

+ long impulse

+ 1/2 correction

Calculated affordable stop limit

1 to 2 R/R take profit

1Y Trend

"+ long impulse

+ 1/2 correction

+ SOS level

+ support zone

- exhaustion volume too big"

1D Situation

"+ long impulse

- neutral zone 1

+ above consolidation volume"

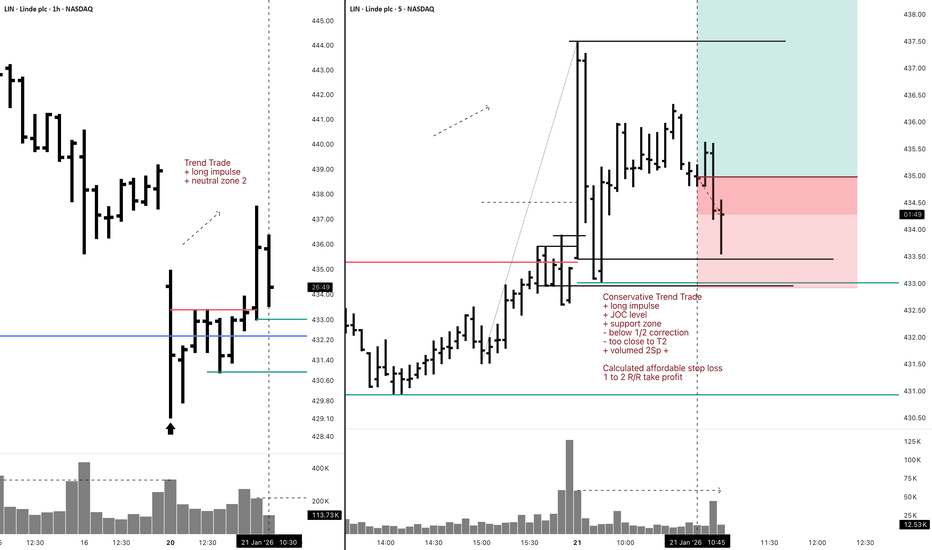

LIN 5M Long Conservative ConterTrend TradeConservative Trend Trade

+ long impulse

+ JOC level

+ support zone

- below 1/2 correction

- too close to T2

+ volumed 2Sp +

Calculated affordable stop loss

1 to 2 R/R take profit

1H Trend

"+ long impulse

+ neutral zone 2"

1D Trend

"+ long impulse

- SOS above JOC

+ support zone

- above 1/2 correction

- unvolumed manipulation bar"

1M Trend

"+ long balance

- below 1/2 correction

+ expanding ICE

+ biggest volume 2Sp+

- neutral zone 1"

1Y Trend

"+ long impulse

+ neutral zone 2

- far beyond rotation point

? exhaustion volume"

FANG 5M Short Aggressive Trend DayTradeAggressive Trend Trade

- long impulse

+ biggest volume T1

+ exhaustion volume Ut

+ resistance zone

+ weak test

+ above first bearish bar close entry

Calculated afforable stop loss

1 to 2 R/R take profit beyond 5M and 1H range

1H Trend

"+ short impulse

+ volumed BUI test / T2 level

+ resistance zone

- weak approach ?

+ volumed manipulation bar"

1D Trend

"- long impulse

+ volumed TE / T1

+ resistance zone

- strong approach

+ volumed no result breaking bar"

1M Trend

"+ short impulse

- resisting bar below BUI level

+ resistance zone

- strong approach

+ 1/2 correction

+ volumed Ut

+ test"

1Y CT

"- long impulse

+ correction

- neutral zone 2

- 1/2 correction"

SOL - you won’t like this idea.Greetings! You’re looking at the analysis from Financier Monitors, which means you’re in for some high-quality analytics.

Today we’ll take a look at SOL.

1) The asset has been truly impressive this cycle. Not even so much in terms of its price growth as a coin, but in terms of growth as a project. All these memes, tons of projects, and overtaking ETH — that’s significant.

It also started growing together with Bitcoin, and for 749 days it managed to do this quite successfully. However, the ATH may be nothing more than a possible last high for Solana over the next 1.5–2 years.

2) Sentiment.

So far, I don’t see bearish scenarios. Either people lost money on 11.10 and are hoping to recover it and sell their spot altcoins, or they simply didn’t get the multiples (x’s) they were expecting — overall, who knows.

The verdict is simple: the crowd and major influencers have been deep in alts since 2021, deep in longs, believing in altseason, etc.

We have no right to judge them, because there’s always a chance that I’m the one who’s wrong. For now, I’ll base my view purely on the chart, so let’s move on to it.

3) Chart.

On the weekly timeframe, SOL has entered a range. But is it just a range? No. In the PSY and BC zones, the first volume spikes appeared — position profit-taking.

Next, we see a not entirely classic Wyckoff distribution, because it lacks a UTAD (another higher high after the UT). However, this is normal when buyers simply don’t have enough strength to counteract selling from large investors.

A nice rise within an ascending channel in LPSY, followed by a breakdown of that channel.

Overall, I’ve attached the schematic, so this is roughly what I expect.

Subscribe.

Gold needs a correction after the ATH!Greetings!

If you see me at the charts, it means a fresh dose of solid analysis is coming.

Today my focus is on XAUUSD.

Yesterday we updated the ATH at 4642. Congrats to all holders and bullish traders. 🔥

This move happened amid global uncertainty. Greenland, Cuba, Iran, Trump is actively talking about all of this after what happened in Venezuela.

Because of that, investors are rushing into safe-haven assets to protect capital from a potential crisis.

And gold is the #1 safe-haven asset of all time.

Now to the chart:

The local uptrend started with Wyckoff accumulation. After that, at the top of the channel, price went sideways and formed a Wyckoff distribution.

For those who don’t know:

Accumulation → potential reversal up

Distribution → potential reversal down

At the highs, smart money distributes, so I’m expecting the start of a correction (for now, local).

There are 2 key zones where we could potentially see a reversal.

Profits to everyone! 💰

Follow for more 🚀

AMD Short Swing 1H Conservative CounterTrend TradeConservative CounterTrend Trade

+ short impulse

+ SOS level

+ resistance zone

+ 1/2 correction

- strong approach

+ exhaustion volume Ut?

- incomplete test

+ above Ut close entry

Calculated affordable stop loss

1 to 2 R/R take profit within 1H range

1D CT

"- long impulse

+ volumed TE / T1

+ resistance zone

- strong approach

+ volumed no result breaking bar"

1M CT

"- long impulse

+ volumed T1

+ resistance zone

+ weak approach

+ exhaustion volume 2Ut-

+ weak test"

1Y CT

"- long impulse

- unvolumed T1 level

+ resistance zone

= unvolumed manipulation bar without result"

GOLD Shorts idea, from 4,640.My outlook on this pair is that price spent last week distributing at premium levels. Despite major news events, there wasn’t a strong bullish expansion, which suggests buying pressure is weakening. This is further supported by a change of character (CHOCH).

From here, I’ll be waiting for price to retrace back into supply and look for a bearish reaction from that area.

Confluences for GOLD Sells:

• Price has been consolidating at premium levels

• A clean supply zone at the extremes that previously caused a strong drop

• Unfilled imbalance sitting below current price

• DXY strength, which aligns with downside pressure on gold

P.S. If price continues to drop without a pullback, I’ll wait for a clear break of structure to the downside before looking for sell opportunities. That said, my higher-time-frame bias remains bullish, so a reaction from the 5hr demand zone is still a valid long-term buy area.

TROW Long Investment 1D Conservative CounterTrend TradeConservative Trade

+ long balance

+ volumed T2

+ support zone

+ 1/2 correction

+ weak approach

+ biggest volume 2Sp-

Calculated affordable stop limit

1 to 2 R/R take profit

1M CT

"'- short balance

+ volumed expanding ICE

+ support zone

+ weak approach

+ biggest volume 2Sp+

+ weak test

+ 1/2 correction"

1Y T

"+ long impulse

+ 1/2 correction

- strong approach

+ T2 level

+ supporting zone

+ volumed interaction bar"

TROW Long Investment 1M Aggressive TradeAggressive Trade

- short balance

+ volumed expanding ICE

+ support zone

+ weak approach

+ biggest volume 2Sp+

+ weak test

- first bullish bar close above entry

+ 1/2 correction

Calculated affordable stop limit

1 to 2 R/R take profit

1T Trend

"+ long impulse

+ 1/2 correction

- strong approach

+ T2 level

+ supporting zone

+ volumed interaction bar"

The XRP chart is like from a textbook! Wyckoff tutorialWelcome! When finance professionals are watching, you can expect solid analytics and real education.

Today we’re going to break down Wyckoff market cycles using the XRP chart in real time.

Wyckoff cycles are not just theory - they are an established concept that works in all markets. This is a model of price behavior based on the actions of large players ("smart money"). It shows how professionals accumulate positions, drive the market, and distribute assets, creating repeating phases of growth and decline.

Any market moves cyclically. Wyckoff identified two major cycles:

Bull market cycle (Accumulation → Markup → Distribution → Markdown)

Bear market cycle (the mirror reflection of the first)

Each cycle consists of four phases:

-Accumulation

-Markup (Growth)

-Distributio

-Markdown (Decline)

Phase 1. Accumulation

This is the phase when "smart money" buys the asset in large volumes while trying not to push the price too high. Conditions are created where regular market participants do not want to buy the asset, and may even sell it near market lows. Usually during this period there is bad news, lack of confidence, etc. Large players quietly buy up all this negativity.

Phase 2. Markup (Growth)

An impulsive upward movement begins - a trend that everyone notices when it is already too late. The crowd starts to wake up and enters the market at high prices.

Phase 3. Distribution

The price again enters a trading range, but now major participants sell their positions to retail traders who come in euphoric after the rise. Usually, the news is excellent here, everyone expects further growth, there is general euphoria, people load into the asset to the maximum while large players quietly unload their positions.

Phase 4. Markdown (Decline)

Professionals have sold everything they wanted, and now the market goes down almost without resistance. Retail - back to the factory.

FANG 5M Aggressive Short DayTradeAggressive Trade

- long impulse

+ volumed T1

+ resistance zone

+ weak approach

+ biggest volume 2Ut-

+ weak test

+ very strong resumption?

+ first bearish bar close entry

Calculated affordable stop loss

1 to 2 R/R take profit

1H CounterTrend

"- long impulse

+ volumed TE / T1

+ resistance zone

+ weak approach

+ volumed manipulation bar"

1D Trend

"+ short impulse

- manipulated T2 level

+ resistance zone

+ 1/2 correction"

1M Trend

"+ short impulse

- resisting bar below BUI level

+ resistance zone

- strong approach

+ 1/2 correction

+ volumed Ut

+ test"

1Y CounterTrend

"- long impulse

- neutral zone 2

- 1/2 correction"

XOM 5M Short Aggressive DayTradeAggressive Trade

- long impulse

+ volumed T1

+ resistance level

+ biggest volume irregular 2Ut+

+ weak test

- below first bearish bar close entry

Calculated affordable stop loss

Less than 1/2 R/R take profit

1H CT

"- long impulse

- unvolumed TE / T1

+ resistance zone

+ weak approach

+ biggest volume Ut

+ test"

1D CT

"- long impulse

+ volumed T1

+ weal approach

+ resistance zone"

1M CT

"- long balance

+ expanding CREEK

+ resistance level"

1Y CT

"- long impulse

+ neutral zone 2"

ACN Short 5M Aggressive DayTradeAggressive Trade

- long impulse

+ volumed T1

+ resistance zone

+ volumed irregular 2Ut-

+ weak test

+ first bearish bar close entry

Calculated affordable stop loss

1 to 2 R/R take profit

1H T

"+ short impulse

+ impulse 1/2 correction

+ SOS test level

+ resistance level

+ weak approach"

1D CT

"- long balance

+ expanding biggest volume CREEK

+ resistance zone

+ biggest volume 2Ut-

+ weak test"

1M T

"+ short impulse

- exhaustion volume SOS level

+ resistance level

- strong approach?

- before 1/2 correction"

1Y "- long impulse

- 1/2 correction

- exhaustion volume?"

EURJPY smart money is here!Hi! A financier is at the screens - today I’ll show you the trade I entered.

In front of us is the EURJPY chart.

First, it’s worth noting that the inverse chart JPYEUR looks very weak. This tells us that the euro is indeed stronger now, and we may see growth.

Second, in mid-December we had a similar structure. I’ve highlighted these structures with a blue rectangle.

Inside these rectangles, an accumulation schematic based on Wyckoff formed. This suggests that we have potential for a reversal and solid upside. It’s also worth noting that the structures are similar to each other and exhibit fractality.

So overall, I opened a long position, aiming to trade it up to the high where we have a liquidity shelf.

The Wyckoff Trading MethodThe Wyckoff Trading Method

The Wyckoff Method is a classical approach to market analysis designed to help traders understand trend development, market cycles, and potential reversals. Despite being developed over a century ago, it remains highly relevant in modern financial markets and is widely used across stocks, forex, and cryptocurrencies.

What Is the Wyckoff Method?

The Wyckoff Method is a form of technical analysis created in the early 20th century by Richard D. Wyckoff, a pioneering trader and market analyst. The core idea behind this method is that price movements are governed by supply and demand, and that large institutional participants (often referred to as “composite operators”) leave identifiable footprints on the chart.

Wyckoff believed that by studying price, volume, and time, traders could anticipate future price behavior rather than react to it.

Core Principles of the Wyckoff Method

The Wyckoff methodology is built around several foundational concepts:

1. Supply and Demand

Price rises when demand exceeds supply and falls when supply exceeds demand. Observing how price responds to changes in volume helps traders identify who is in control of the market.

2. Market Structure and Phases

Markets move in recurring cycles, typically broken down into:

- Accumulation

- Markup

- Distribution

- Markdown

Recognizing these phases allows traders to align with institutional activity rather than trade against it.

3. Price and Volume Relationship

Volume acts as a confirmation tool. Strong price movement with weak volume often signals exhaustion, while strong volume supports trend continuation.

4. Liquidity and Institutional Behavior

The method emphasizes how large players accumulate or distribute positions over time, often through range-bound price action designed to absorb liquidity.

The Market Cycle

The Wyckoff Market Cycle

The Wyckoff methodology describes market behavior as a repeating four-phase cycle driven by supply and demand. These phases help traders understand where the market is in its process, rather than simply reacting to price movements.

Accumulation Phase

Accumulation typically appears as a range-bound market after a decline. During this phase, large institutional participants quietly build long positions while price remains relatively stable. To most traders, the market appears directionless, but in reality, buying is taking place without pushing price higher. The true intent of the market is concealed until accumulation is complete.

Markup Phase

Once sufficient long positions have been accumulated, institutions begin to drive price higher. This phase is characterized by a clear uptrend as increased demand attracts additional buyers. Breakouts from accumulation ranges often trigger momentum traders and breakout strategies, reinforcing the trend. Markups may include re-accumulation phases, where price pauses and consolidates before continuing higher.

Distribution Phase

Distribution occurs after an extended advance, when upward momentum begins to slow. During this phase, large players gradually offload long positions and build short exposure. Price often moves sideways in a range, giving the illusion of stability, while smart money exits positions. This phase prepares the market for the next directional move lower.

Markdown Phase

The markdown is the declining phase that follows distribution. Selling pressure overwhelms demand, leading to a sustained downtrend. As price falls, traders are encouraged to enter short positions, further accelerating the move. Similar to markups, markdowns may include redistribution phases, where price consolidates before continuing lower.

Why the Wyckoff Model Works

Large financial institutions must execute trades of significant size, which requires liquidity. Liquidity is often found around stop losses, breakout levels, equal highs and lows, and key support or resistance zones. By intentionally pushing price into these areas, institutions can fill large orders efficiently without excessive slippage. This interaction between liquidity and market psychology forms the foundation of the Wyckoff model across all asset classes.

Core Principles of the Wyckoff Method

A key concept in Wyckoff theory is the Composite Man, a symbolic representation of institutional or “smart money” participants. Traders are encouraged to analyze price action as if a single, highly informed entity is controlling the market. The Composite Man accumulates or distributes positions strategically before allowing price to trend.

The Law of Supply and Demand explains that price rises when demand exceeds supply and falls when supply exceeds demand. The Law of Cause and Effect states that the size and duration of accumulation or distribution determine the magnitude of the subsequent price move, with higher-timeframe structures producing larger effects. The Law of Effort versus Result compares volume (effort) with price movement (result), highlighting potential trend continuation or exhaustion when these two factors diverge.

Wyckoff Schematics

Wyckoff schematics visually represent accumulation and distribution structures. Although these patterns may appear complex at first, they are mirror images of each other, with accumulation and distribution sharing identical phases and logic—only inverted. Studying these schematics helps traders recognize institutional behavior and align their trades with the dominant market process.

Type 1 Schematics

Accumulations

Phase A: Stopping the Downtrend

Phase A marks the transition from a markdown to the beginning of accumulation, where selling pressure starts to weaken.

- Preliminary Support (PS): After a prolonged decline, initial buying emerges and temporarily halts the downtrend. Volume increases as early demand appears, signaling that selling pressure is no longer dominant.

- Selling Climax (SC): Panic selling accelerates as long positions are stopped out and breakout traders enter short positions. At this point, the Composite Man absorbs this excess supply. The SC often leaves long lower wicks, reflecting strong buying interest.

- Automatic Rally (AR): Once selling pressure is exhausted, price rebounds quickly as shorts cover and new buyers step in. The high of the AR establishes the first resistance boundary of the accumulation range.

- Secondary Test (ST): Price revisits the SC area to test remaining supply. This test may form equal or slightly higher/lower lows, usually with reduced volume, confirming that selling pressure has diminished.

Phase B: Building the Cause

Phase B is where accumulation develops over time. The Composite Man continues to build long positions while price fluctuates within a range.

- Sign of Strength in Phase B (SOS(b)): In some cases, price rallies above the AR, creating a higher high within the range. This move suggests improving demand but still remains below preliminary resistance.

- Secondary Test in Phase B (ST(b)): A sharp decline follows, designed to trigger stop losses below prior lows and attract breakout sellers. This “liquidation” move provides the liquidity institutions need to continue accumulating, forming the underlying cause for the next trend.

Phase C: The Final Shakeout

Phase C is the critical phase that distinguishes accumulation from continuation lower.

- Spring: Price makes a final push below established support, sweeping remaining stop losses and trapping late sellers. This move briefly violates the range before quickly reversing.

- Test: After the Spring, price retests the area to confirm that supply has been fully absorbed. These tests typically form higher lows and occur on lower volume, signaling reduced selling interest.

Phase D: Transition to Markup

Phase D confirms that accumulation is complete and the market is ready to trend higher.

- Last Point of Support (LPS): Following the test and a rally, price pulls back shallowly, forming a higher low. This pullback reflects strong demand and is often the final opportunity before markup.

- Sign of Strength (SOS): Price breaks above the accumulation range with expanding volume, confirming bullish control. After this breakout, the market enters the markup phase, where the effect of prior accumulation is realized through sustained upward movement.

Distributions

Phase A: Stopping the Uptrend

Phase A marks the transition from an uptrend into distribution, where demand begins to weaken and supply quietly enters the market.

- Preliminary Supply (PSY): After a sustained advance, large operators start unloading positions, causing the first noticeable pause or pullback in price.

- Buying Climax (BC): Buying pressure reaches an extreme as late buyers enter aggressively, often accompanied by very high volume. This is where smart money sells into strength.

- Automatic Rally (AR): Once buying is exhausted, price pulls back sharply as demand fades. The AR typically forms below the BC and defines the first support boundary of the distribution range.

- Secondary Test (ST): Price revisits the BC area to test remaining demand, usually failing to make a new high. Volume is generally lower, indicating reduced buying interest and building liquidity for later phases.

Phase B: Building the Distribution

Phase B is where the Composite Man continues distributing positions while price fluctuates within a range.

- Sign of Weakness in Phase B (SOW(b)): A decline below the AR signals that supply is beginning to dominate. This move does not always appear, but when it does, it establishes a second support boundary.

- Upthrust (UT): Price briefly breaks above resistance to trigger buy stops and attract breakout buyers. This false breakout allows institutions to sell into increased demand and build short exposure.

Phase C: The Final Liquidity Grab

Phase C completes the distribution process by targeting remaining demand.

- Upthrust After Distribution (UTAD): Similar to a Spring in accumulation, UTAD is the final false breakout above resistance. It is designed to capture the last wave of liquidity before the true bearish move begins.

- Test: Price often revisits the UTAD area to confirm that demand has been fully absorbed. These tests typically occur on lower volume, signaling weakening bullish participation.

Phase D: Transition to Markdown

Phase D confirms that distribution is complete and bearish control is established.

- Last Point of Supply (LPSY): After price begins to decline, weak rallies attempt to test demand. These rallies are shallow and usually represent the final bullish reactions before the markdown.

- Sign of Weakness (SOW): Price breaks decisively below the range, confirming a bearish structure. Additional LPSYs may form, but this phase marks the final transition into the markdown.

Type 2 Schematics

Type 2 Wyckoff schematics contain the same structural components as Type 1, but without a Spring (in accumulation) or a UTAD (in distribution). In these cases, the market does not perform a final liquidity sweep before trending.

A Type 2 schematic can be identified by observing a direct transition into trend confirmation:

- In accumulation, price forms a Secondary Test (ST) and possibly an ST(b), then proceeds directly into a Sign of Strength (SOS) followed by markup.

- In distribution, price forms an ST or Upthrust (UT), then transitions directly into a Sign of Weakness (SOW) followed by markdown.

If markup or markdown begins without a Spring or UTAD, the structure should be classified as Type 2. Importantly, Type 2 schematics are traded using the same principles and execution logic as Type 1 structures.

The Five-Step Wyckoff Trading Strategy

Richard D. Wyckoff proposed a structured five-step approach to applying his methodology in real market conditions. This framework helps traders align with market structure and institutional intent.

1. Determine the Market Trend

Identify whether the broader market environment is bullish or bearish. Trading in alignment with the dominant trend increases probability.

2. Select a Suitable Market

Choose an asset or trading pair that clearly reflects the identified market trend and shows strong structural clarity.

3. Identify Accumulation or Distribution

Focus on assets that are currently forming a Wyckoff accumulation or distribution structure rather than those already trending.

4. Assess Readiness for a Move

Analyze the current Wyckoff phase and volume behavior. Events such as a Spring, UTAD, SOS, or SOW help confirm whether the market is prepared for markup or markdown.

5. Execute the Entry

Entries are commonly taken on Tests, Last Points of Support (LPS), or Last Points of Supply (LPSY), where risk can be controlled and structure is clear.

Does the Wyckoff Method Still Work?

- Despite being developed nearly a century ago, the Wyckoff Method remains highly relevant in modern markets. Its core principles supply and demand, market structure, volume analysis, and liquidity behavior are universal and apply across forex, stocks, commodities, and cryptocurrencies.

- When combined with complementary tools such as support and resistance, indicators, or pattern analysis, Wyckoff can form the foundation of a robust and disciplined trading approach. Its enduring value lies in teaching traders how markets move, not just where price is going.

Educational Disclaimer

This material is provided for educational purposes only. It reflects a general interpretation of the Wyckoff methodology and should not be considered financial advice, investment recommendations, or an offer to trade. Traders should always conduct their own analysis and manage risk responsibly.

MGC Context: Intra-Period Development & BCOM Absorption AnalysisRelated Tickers: COMEX_MINI:MGCG2026, COMEX:GC1!, CAPITALCOM:DXY

Analysis

1. Market Context (Developing Profile Period)

We are observing the development of the Current Profile Period above the previous session’s value.

• The Structure: Auction is exhibiting Initiative Activity above the Value Area High (VAH) . OTF participants are finding value at higher levels despite BCOM rebalancing.

• The Behavior: No "Look Above and Fail" yet; the market is Building Value at elevated levels, shifting the perception of "fair price."

2. Inventory & Nuance (BCOM Money Flow & Acceptance)

• Mechanical Pressure: Tracking ~$1.4 billion in mechanical sell-side flow in the current profile.

• Absorption Signature: Market is Accepting Price above the 4,600 pivot . High-volume nodes near the range top confirm buyers are absorbing the robot selling.

• Inventory: Long-Stretched inventory. Lack of an Excess Tail at highs suggests the upside auction is incomplete.

3. Fundamental Catalyst (CPI Decision Point)

• Upcoming Profile Impact: US CPI Data (20:30 WIB) will dictate the next Directional Move .

• Scenario A: Weak CPI targets a Trend Day profile toward the next Distribution above ATH.

• Scenario B: Hot CPI triggers Range Extension to the downside, testing the Friday POC at 4,480 .

Plan & Execution

• Bias: Bullish Initiative .

• The Play: Monitoring for Acceptance with Volume above the 4,612 Initial Balance High .

• Invalidation: Failure to maintain trade above the 4,580 High Volume Node signals BCOM flow has gained control.

Talk to you for the next update.

Note :

BCOM = Bloomberg Commodity Index

MGC Context: NY Open Absorption & The 4,600 Line in the SandRelated Tickers: COMEX_MINI:MGCG2026, COMEX:GC1!, CAPITALCOM:DXY

Analysis

1. Market Context (Vertical Initiative vs. Extreme Absorption)

The auction is a textbook case of Vertical Initiative colliding with massive mechanical Absorption .

• The Structure: Gold hit a historic ATH of 4,612.7 today. Price is currently hugging 4,600 . This initiative is fueled by the Fed Independence Crisis after the DOJ served subpoenas to Chair Powell.

• The Behavior: Massive volume at highs indicates a "Transfer of Ownership" from BCOM index sellers to aggressive safe-haven buyers.

2. Inventory & Nuance (BCOM vs. The Fed Bid)

• Mechanical Flow: We are in the peak of BCOM rebalancing (Jan 9–15), which mechanically unloads ~$7 billion (2.4m oz) of gold.

• Absorption Signature: Holding 4,600 against this supply dump is a signal of extreme strength. A weak market would have flushed 2.5–3.0% by now.

• Inventory: Ultra-Long but absorbed. OTF buyers are providing liquidity for every ounce the index robots sell.

3. Fundamental Catalyst (The 24-Hour Outlook)

• Today (Monday): Watching 4,580–4,600 . Acceptance above 4,600 post-mid-day signals the safe-haven bid has exhausted the BCOM sellers.

• Tuesday (Jan 13): US CPI Data . A hot print could break the absorption and launch MGC toward 4,700 .

Plan & Execution

• Bias: Ultra-Bullish Initiative .

• The Play: Watch for a "Look Below and Fail" at 4,580 . If 4,600 holds into the close, target is 4,660 .

• Invalidation: A close below 4,518 implies BCOM selling has finally overwhelmed the buyers.

Talk to you for the next update.