XAG/USD Key Zone Reaction – Are Bulls Ready to Take Control?🥈 XAGUSD: SILVER VS US DOLLAR 💰

Metals Market Opportunity Blueprint | Swing Trade Analysis

📊 MARKET STRUCTURE & SETUP

✅ Current Price Action: $48.34 | 52-Week Range: $28.16 - $54.50

✅ Technical Trend: Bullish Bias Confirmed

✅ Setup Type: Double Pullback Retest of 200 SMA

🎯 THE THIEF STRATEGY: LAYERED ENTRY APPROACH

This is NOT a single entry point strategy. We employ the THIEF LAYERING METHODOLOGY — multiple limit orders positioned at strategic support zones to maximize entry efficiency and reduce average entry price.

📍 ENTRY LAYERS (Buy Limit Orders):

Layer 1: $48.000 ⭐ (Immediate Support)

Layer 2: $48.500 ⭐ (Pullback Zone)

Layer 3: $49.000 ⭐ (Resistance Break)

Layer 4: $49.500 ⭐ (Extended Support)

💡 Pro Tip: You can increase/decrease layers based on your risk tolerance and position size. Accumulate, don't dump!

🛑 STOP LOSS MANAGEMENT

📌 Thief Original SL: $47.000

⚠️ This is MY suggested level based on technical structure

🔴 IMPORTANT: Dear Ladies & Gentlemen (Thief OG's) — Set YOUR OWN stop loss based on YOUR risk profile

💪 This is YOUR money, YOUR risk, YOUR decision

Adjust SL based on your strategy, account size, and risk/reward ratio

🚀 PROFIT TARGET STRATEGY

🎪 Target Zone: $54.000

📈 Technical Basis: 200 SMA acts as strong dynamic resistance

⚡ Market Structure: Overbought territory warning

🔔 Trap Alert: Potential sell-side liquidity trap at resistance

⚠️ Target Notes:

🔴 IMPORTANT: Dear Ladies & Gentlemen (Thief OG's) — Set YOUR OWN take profit target

📊 Don't just copy my TP blindly — analyze price action yourself

💼 You earn the profits, you manage the exit — YOUR choice, YOUR reward

Consider trailing stops or partial profit-taking strategy

🔗 CORRELATED PAIRS TO MONITOR (Key Dollar Pairs)

1️⃣ TVC:DXY (US Dollar Index)

Correlation: INVERSE ↔️ As DXY strengthens, XAG/USD weakens

Why Monitor: Strong dollar headwind for silver prices

Watch Level: DXY above 105.00 = bearish for silver

Strategy: If DXY rallies, reduce silver long positions

2️⃣ $XAU/USD (Gold vs Dollar)

Correlation: POSITIVE ✅ Silver follows gold's lead

Why Monitor: Gold is the "big brother" in precious metals

Watch Level: If gold breaks $2,100, silver likely follows

Strategy: Gold weakness = caution on silver longs

3️⃣ FX:EURUSD (Euro vs Dollar)

Correlation: INVERSE ↔️ Weak dollar = strong euro

Why Monitor: Dollar weakness supports precious metals

Watch Level: EURUSD above 1.1200 = bullish for silver

Strategy: Strong euro environment = tailwind for XAG

4️⃣ FX:USDJPY (Dollar vs Japanese Yen)

Correlation: INVERSE ↔️ Dollar weakness supports risk-on sentiment

Why Monitor: Risk appetite indicator (yen often "fear" currency)

Watch Level: USDJPY below 145.00 = risk-on (silver bullish)

Strategy: Lower USDJPY = better environment for commodities

5️⃣ SP:SPX / S&P 500 Index

Correlation: POSITIVE ✅ Risk-on markets support commodities

Why Monitor: Stock market rallies often lift precious metals

Watch Level: SPX new highs = bullish momentum for silver

Strategy: Market strength = broader bullish sentiment

📋 TRADE CHECKLIST BEFORE ENTRY

✅ Price action confirms double pullback on 200 SMA

✅ DXY showing weakness or neutral bias

✅ XAU/USD supporting bullish thesis

✅ No major macro events in next 4-6 hours

✅ Volume confirmation on breakout

✅ Risk/Reward ratio minimum 1:2

✅ Position size = % of account (YOUR decision)

⚡ KEY TRADING RULES

Layering ≠ Averaging Down Losers

Build positions at PRE-PLANNED levels only

Don't add to losing positions outside your strategy

Stop Loss is Sacred

NO moving stops to breakeven without reason

Protect capital first, chase profits second

Take Profits Strategically

Partial exits: Scale out at resistance zones

Don't go all-in, don't take all-out at once

Dollar Monitoring is Mandatory

Strong DXY = reconsider position

Weak DXY = stay long with conviction

Risk Management Over Everything

Your SL & TP = your rules

No trade is worth emotional decision-making

Xagusdtrading

Market Insight: Silver’s Next Move Hinges on MA Breakout!🎯 XAG/USD: The Great Silver Heist - Bearish Breakout Setup! 💰

📊 ASSET OVERVIEW

Pair: XAG/USD (Silver vs U.S. Dollar)

Market: Precious Metals

Strategy Type: Swing/Day Trade

Bias: 🐻 BEARISH

🎭 THE HEIST PLAN (Trading Setup)

🔴 Entry Zone: The Breakout

Level: $49.50 (MA Breakout Zone)

Signal: Waiting for price to break below moving average support

Confirmation: Clean break with volume + momentum shift

🛑 Stop Loss: The Safety Vault

Level: $52.00

Purpose: Protection for potential pullback scenarios

Note: This SL accommodates a possible bounce before continuation down

⚠️ Risk Disclaimer: Fellow traders, this stop loss is MY risk tolerance. YOU decide your own risk parameters. Trade what YOU can afford to lose. Your money, your rules! 🎰

🎯 Target: The Escape Route

Primary Target: $47.00

Why This Level?

🚧 Strong resistance zone acting as support (role reversal)

📈 Overbought conditions on lower timeframes

Potential bull trap zone - perfect profit extraction point

⚠️ Profit Disclaimer: This is MY target based on MY analysis. YOU make your own profit decisions. Lock gains when YOUR strategy says so. Always secure the bag at YOUR comfort level! 💼

🔍 TECHNICAL ANALYSIS BREAKDOWN

Key Factors:

Moving Average Breakdown - Price rejecting MA as new resistance

Market Structure - Lower highs forming on H4/D1 timeframes

Resistance Cluster - Multiple confluences at $52 area

Volume Profile - Decreasing buy pressure

What I'm Watching:

📉 Sustained close below $49.50

📊 Volume confirmation on breakdown

🕒 Time alignment with USD strength cycles

💱 RELATED PAIRS TO MONITOR (Correlation Watch)

Metals Family:

XAU/USD (Gold) - Moves in tandem with silver ~70% correlation

GC1! (Gold Futures) - Leading indicator for precious metals sentiment

HG1! (Copper Futures) - Industrial metals correlation

USD Strength Plays:

TVC:DXY (Dollar Index) - Inverse correlation with metals

FX:EURUSD - Risk-on/risk-off sentiment gauge

FX:USDJPY - Safe haven flow indicator

Key Point: When DXY 📈 = Precious metals 📉 typically. Watch Fed policy signals and real yields for directional bias!

🎪 THE "THIEF STYLE" STRATEGY PHILOSOPHY

This setup follows the "steal profits when the market sleeps" approach:

🎯 Identify overextended moves

⏰ Wait for breakout confirmation

💨 Execute with precision

🏃 Escape before the reversal

It's all about timing, patience, and taking what the market gives!

Conduct your own research (DYOR)

Use proper risk management

Never risk more than you can afford to lose

Consider consulting a licensed financial advisor

💼 No Guarantees: No trading outcome is guaranteed. Markets are unpredictable. Trade responsibly!

📢 ENGAGEMENT FOOTER

✨ "If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!"

🏷️ HASHTAGS

#XAGUSD #Silver #PreciousMetals #BearishSetup #SwingTrading #DayTrading #ForexTrading #MetalsTrading #TechnicalAnalysis #BreakoutStrategy #SilverTrading #USD #DXY #ForexSignals #TradingIdeas #ChartAnalysis #PriceAction #RiskManagement #ForexCommunity #TradingView #MarketAnalysis

🎬 End of Analysis | Trade Safe, Trade Smart! 🎬

#XAGUSD(SILVER): Bears In Control Three Targets Swing SellSilver’s price dropped significantly yesterday, continuing a trend from last week’s Thursday when substantial trading commenced.

The data suggests an increase in bearish volume, indicating a potential selling opportunity. To identify a more precise entry zone, we should utilise smaller timeframes.

Once this is established, we can create a trading plan with strict risk management. Upon entry, we can select a suitable take-profit area based on our individual trading style and risk management preferences.

For further information, please like and comment on the ideas. Any questions comment down and we will happy to help.

Team Setupsfx

Silver Rally in Play – Prepare Layered Entries!🔥 Silver Heist: XAG/USD Day Trade Wealth Map 🤑💰

🎉 Ladies & Gentlemen, Welcome to the Thief’s Vault! 🚨 Get ready to swipe some shiny profits with this XAG/USD (Silver vs. US Dollar) bullish breakout plan! Our Metal Market Wealth Strategy Map is locked and loaded for a day trade adventure. Let’s dive into the heist with a polished, professional, yet sneaky fun vibe! 😎

📈 The Setup: Bullish Bandits on the Move! 🐂

🔍 Market Context: Silver (XAG/USD) is flashing bullish vibes 📡 with a confirmed Least Squares Moving Average (LSMA) pullback. The price has swept liquidity at the dynamic moving average support, giving bull traders the upper hand. 💪

🚀 Why It’s Hot: The bulls are charging as the price respects the dynamic support, signaling strength and a potential breakout. The market’s screaming, “Time to stack those silver bars!” 🪙

🏦 The Heist Plan: Thief-Style Layered Entries 🎯

🛡️ Entry Strategy: We’re using the infamous Thief Layering Strategy! 🕵️♂️ Place multiple buy limit orders to catch the price at key levels. Suggested entry layers:

$42.50

$43.00

$43.50

💡 Pro Tip: Feel free to add more layers based on your risk appetite! Stack those orders like a master thief. 😏

📝 Entry Note: You can enter at any price level within the bullish zone, but layering gives you the edge to scale in like a pro. 📊

🛑 Stop Loss: Protect the Loot! 🔒

🛑 Thief SL: Set your stop loss at $41.50 to keep your capital safe from market traps. 🕳️

📣 Note: Dear Thief OG’s (Ladies & Gentlemen), this SL is my suggestion, but it’s your heist, your rules! Adjust based on your risk tolerance and make those profits yours. 💸

🎯 Take Profit: Cash Out Like a Boss! 💼

🎯 Target: We’re aiming for $46.00, where strong resistance, overbought conditions, and potential traps await. 🪤 Lock in profits before the market pulls a fast one!

📣 Note: Dear Thief OG’s, this TP is my call, but you’re the master of your vault! Take profits at your discretion and secure the bag. 🤑

🔗 Related Pairs to Watch 👀

🔎 #XAUUSD (Gold vs. US Dollar): Gold and silver often move in tandem due to their precious metal correlation. A bullish XAU/USD could reinforce our XAG/USD setup. 🪙

🔎 USD Index (#DXY): A weaker US dollar typically boosts precious metals. Watch for DXY weakness to confirm bullish momentum in XAG/USD. 📉

🔎 #AUDUSD: The Aussie dollar has a positive correlation with silver due to Australia’s commodity-driven economy. A rising AUD/USD could signal strength in XAG/USD. 🇦🇺

🔑 Key Points & Correlations

🔔 Liquidity Sweep: The recent pullback to the LSMA support cleared out weak hands, setting the stage for a bullish surge. 🚀

🔗 Correlation Insight: Silver’s price action often mirrors gold (XAU/USD) due to their shared safe-haven status. A declining DXY or rising AUD/USD can amplify this setup’s potential. 📊

⚖️ Risk Management: Use the layered entry strategy to spread risk and maximize reward. Always respect your stop loss to avoid getting caught in a market trap! 🕵️♂️

⚠️ Disclaimer

This is a Thief-Style Trading Strategy crafted for fun and educational purposes. Trading involves risks, and I’m not a financial advisor. Always do your own research and trade at your own risk. 😎

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#️⃣ #XAGUSD #Silver #DayTrading #ThiefStrategy #Bullish #TradingView #SilverTrading #DayTrade #ThiefTrader #LSMA #ForexStrategy #MetalMarket #TradingIdeas #LayeredEntries #BullishSetup #TradingView

#SILVER: Will Price Momentum Take The Silver To $60?Metals is on the verge of reaching another record high after touching the $54 price point. It is highly probable that it will reach $60 or beyond. Currently, a smaller timeframe is suitable for minor corrections. Once a confirmation is obtained, a trade with strict risk management can be executed.

Best wishes and safe trading.

Team Setupsfx

Silver Price Hits 14-Year HighSilver Price Hits 14-Year High

As shown on the XAG/USD chart, today the price of silver has climbed above $43.60 per ounce for the first time since 2011.

This may reflect expectations that the recent Federal Reserve interest rate cut will provide a boost to the global economy, where demand for silver is strengthening due to the growth of sectors such as solar energy, electric vehicles, and electronics. In addition, XAG/USD gains further support from gold, which today set a new record high above $3,720.

Technical Analysis of the XAG/USD Chart

When analysing XAG/USD price movements earlier this month, we:

→ drew an ascending blue channel;

→ noted that silver had encountered a resistance block;

→ suggested a possible corrective scenario towards the psychological $40 level.

Since then, the black line (S) has:

→ proved itself as a strong support level, preventing a decline towards $40;

→ provided enough local pivot points to update the slope of the blue channel.

As of today, silver has broken above the upper boundary of this channel (highlighting strong demand). At the same time:

→ the RSI indicator is in overbought territory;

→ the price is positioned at the upper boundary of a steeper short-term uptrend, plotted from fluctuations over the past month (shown in orange).

Thus, we could assume that XAG/USD is currently vulnerable to a correction following a nearly 10% rally since the beginning of the month, as buyers are likely tempted to take profits.

Should a pullback occur in the near term, silver may find support:

→ around $42.35 – a level that has repeatedly switched roles between resistance and support;

→ at the lower boundary of the orange channel.

Looking further ahead, we may well witness fresh records for both silver and gold before year-end – particularly if the news flow continues to fuel trader expectations of additional Fed rate cuts and inflation concerns persist.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XAG/USD Technical + Macro Analysis ¦ Bullish Layer Strategy⚡ XAG/USD Silver Swing & Scalping Trade | Thief Layer Strategy

🛠️ Trade Plan (Bullish Pending Order)

Entry (Breakout Trigger): $41.400 ⚡

Layered Entries (Thief Strategy):

$41.000

$41.200

$41.400

(You can increase/reduce limit layers based on your own plan — confirm after breakout. Set TradingView alarms for alerts.)

Stop Loss (Thief SL): $40.600 (after breakout confirmation)

⚠️ Adjust your SL according to your own risk tolerance.

Target (Exit Zone): $42.200 🎯

Resistance + overbought + trap zone = take profit opportunity.

💡 Thief Strategy = Using multiple buy limit orders (layering style entries) to scale into position at breakout confirmation levels.

🔎 Why This Plan (Thief Style)

✅ Technical breakout aligned with resistance test.

✅ Fundamentals & sentiment confirm upside bias.

✅ Layering entries reduce risk & capture volatility.

✅ Plan respects upcoming macro events → CPI & Fed.

📊 XAG/USD Real-Time Data

Daily Change: +0.56% (▲ +0.23)

Day’s Range: $40.54 – $41.34

52-Week Range: $27.70 – $41.49

Year-to-Date Performance: +42.32% 🚀

😰😊 Fear & Greed Index

Stock Market Sentiment: Greed (53/100) 📈

Crypto Sentiment: Neutral (0/100)

Drivers:

Weak US labor data → boosting Fed rate cut expectations.

S&P 500 above 125-day MA → bullish momentum.

Low VIX → reduced fear.

📉📈 Trader Sentiment Outlook

Retail Traders:

Bullish (Long): 60% 😊

Bearish (Short): 40% 😰

Institutional Outlook:

Technical Bias: Strong Buy ✅

🌍📉 Fundamental & Macro Drivers

Fed Rate Cut Probability (Sep 2025): 100% ✅

US Dollar Weakness → supports precious metals.

Upcoming Events:

📅 Sep 11: CPI Report (volatility risk).

📅 Sep 16–17: Fed Meeting (critical rate decision).

Industrial Demand: Electronics + solar keeping silver in steady demand.

🐂🐻 Overall Market Outlook

Bias: Bullish (Long) 🐂

Score: 75/100 (Strong upside potential).

Why Bullish?

Technical indicators = Strong Buy signals.

Fed dovish stance → USD weakness.

Geopolitical risks → safe-haven demand.

Risks: Hot CPI data → possible USD rebound.

💎 Key Takeaways

Silver is up +42% YTD → momentum intact.

Breakout levels align with Thief Layer Strategy.

Fed meeting (Sep 16–17) = major catalyst.

CPI data (Sep 11) = short-term volatility watch.

🔗 Related Pairs to Watch

OANDA:XAUUSD (Gold)

TVC:DXY (US Dollar Index)

AMEX:SLV (Silver ETF)

COMEX:GC1! (Gold Futures)

COMEX:SI1! (Silver Futures)

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#Silver #XAGUSD #ThiefTrader #SwingTrade #Scalping #Commodities #Breakout #LayerStrategy #Fed #CPI #Metals

“Can This XAG/USD Setup Make You the Next Market Thief?”🏴☠️ Operation Silver Swipe — Thief Trading Heist Plan for XAG/USD 🪙💸

🚨 Target Locked: The Silver Vault 🧳🎯

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Market Hustlers & Chart Whisperers, 🕵️♂️💼📉💰

Step into the shadows with our stealth plan based on our signature Thief Trading Style—a mix of smart technicals and crafty fundamentals. Today, we’re eyeing XAG/USD (Silver) for a clean sweep. Here's how to gear up for the breakout job:

🎯 Entry Zone — “The Heist Is On!” 💥

📍Key Level: Break & Retest above 36.500 – that's your cue to act.

🔑Strategy:

Buy Stop Orders: Set above the breakout level

Buy Limit Orders: Use recent 15/30M swings for a sneaky pullback entry 🎯

🛑 Stop Loss — “Every Thief Has a Backup Plan” 🎭

Place your SL like a pro, not a panic button!

📌Recommended: Around 31.700 using the 4H swing low

⚠️Tip: Adjust based on your risk appetite, lot size, and number of entries. You’re the mastermind, not a minion.

🎯 Target — “Escape Route” 🏃♂️💸

📌 First checkpoint: 37.700

📌 Or take your loot early if the heat rises! (Overbought zones, trend traps, or reversal zones)

💡 Scalper's Shortcut 💡

Go only long for safety. If you’ve got the cash stack, jump in fast. If you’re more of a sneaky swing trader, follow the roadmap and trail your SL to secure that bag 🧳📈

🔍 Market Status

Silver’s in a Neutral Phase – but signs point to an upward getaway 🚀

Fueling this momentum:

Macro & Fundamental trends

COT Positioning

Intermarket Clues

Sentimental Signals

🔗 Read the full breakdown check there 👉🔗🔗🌏🌎!

📢 Trading Alert — News Release Caution ⚠️

Don’t get caught mid-escape during news bombs! 💣

✅ Avoid fresh entries during high-impact events

✅ Use trailing SL to lock in your gains and cover your tracks

💖 Smash the Boost Button if you vibe with this plan 💥

Support the crew and help keep the charts hot and the loot flowing. Your boost powers up our next big heist 🚁🔥

📡 Stay tuned for more street-smart setups... we rob the charts, not the rules! 🐱👤💸📊💎

Silver Price Retreats from 2012 HighsSilver Price Retreats from 2012 Highs

As shown on the XAG/USD chart, the price of silver climbed above $37 per ounce yesterday — a level not seen since 2012. However, this morning, the price has dropped by approximately 2.5% from yesterday’s peak.

The bullish driver behind the rally has been fears that the US could become involved in a military conflict between Israel and Iran. Concerns in financial markets intensified after media reports stated that US officials are preparing for a potential strike on Iran.

Another factor influencing silver's price was the Federal Reserve’s decision to keep interest rates unchanged and maintain a cautious policy stance. Yesterday, Jerome Powell warned that President Trump’s tariffs could fuel inflation (a bullish signal for silver) and complicate the economic outlook.

Technical Analysis of the XAG/USD Chart

In our previous analysis of the XAG/USD chart, we identified an upward channel. This channel remains relevant, though its configuration has shifted.

The price of silver remains in the upper part of the channel (a sign of strong demand). However, two signals suggest a potential correction may develop:

→ A bearish divergence on the RSI indicator;

→ A sharp decline from the channel’s upper boundary (marked with a red arrow), breaking through the local line that divides the upper half of the channel into quarters.

Nevertheless, given the scale of geopolitical risks, there is a chance that the bears may struggle to significantly shift the trend — especially with markets nearing the weekend closure.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Silver Price Hits Year-to-Date HighSilver Price Hits Year-to-Date High

As shown on the XAG/USD chart, silver prices rose on Monday, surpassing the previous high of the year, which was set on 28th March at around $33.50 per ounce.

Why Is Silver Rising?

A bullish driver came from statements made by the White House. According to media reports:

→ US President Donald Trump announced on Friday evening plans to double tariffs on steel and aluminium imports to 50%, starting 4th June. This intervention in the global metals market may have also impacted silver prices, given silver’s significant industrial value.

→ Trump's claims that China violated the trade agreement reached in Geneva last month further cast doubt on the prospects of a phone call between Trump and Chinese President Xi Jinping.

Technical Analysis of the XAG/USD Chart

Today’s bearish candlestick (marked with a red arrow) indicates that sellers are becoming active, willing to open short positions near the 2025 high. From a technical analysis perspective, there are signs of:

→ a bearish engulfing candlestick pattern forming;

→ a false breakout above the March high (trapping bullish traders).

However, the bulls may attempt to keep the price in the upper half of the emerging ascending channel (shown in blue), relying on support from the former resistance level at $33.67.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XAG/USD "The Silver" Metals Market Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metals Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (31.800) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 34.400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸XAG/USD "The Silver" Metals Market Heist Plan (Day / Swing Trade) is currently experiencing a bullishness🐂.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAG/USD "The Silver" Metal Market Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Pink MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 1 Day timeframe (32.000) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 27.000 (or) Escape Before the Target

⚙💿XAG/USD "The Silver" Metal Market Heist Plan (Swing/Day Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness),., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

Detailed Point Explanation 📋

Fundamentals 🌟: Silver’s dual role ensures resilience, but USD and rates cap gains ⚖️.

Macro 📊: Inflation aids 🔥, but growth and policy risks create volatility ⚡.

Geopolitics 🌐: Safe-haven demand helps 🛡️, though trade wars hurt industrial use 🚨.

Supply/Demand ⚖️: Deficit is a strong bullish driver 📉, despite short-term fluctuations ⚡.

Technicals 📉: Near-term weakness 🐻 within a broader uptrend 🐮.

Sentiment 😊: Balanced ⚖️, with cautious optimism prevailing 🌟.

Seasonal 🍂: Neutral ⚖️, with minor weather-related disruptions ❄️.

Intermarket 🔗: Gold supports 🥇, USD resists 💵 – a tug-of-war ⚔️.

Investors/Traders 👥: Long-term bulls 🐮 vs. short-term bears 🐻 reflect split views ⚖️.

Trends 🔮: Short-term dip 📉, medium/long-term rally potential ⬆️.

Outlook 📝: Mildly bullish ⭐, favoring longs over 6-12 months 🐮.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAGUSD Silver: Navigating Transition from Rally to Correction.Technical Analysis: XAGUSD (Silver)

📈 Silver (XAGUSD) is displaying bullish momentum following a significant rally. The precious metal has pushed into higher territory, creating an overextended condition on the price chart.

💹 Currently trading at a premium level, Silver appears ripe for a potential retracement. This elevated positioning suggests buyers may be exhausting their momentum, creating favorable conditions for a corrective move.

🔄 From a Wyckoff perspective, we're observing a classic distribution pattern with price action ranging sideways after the strong upward move. This horizontal consolidation often precedes a change in direction, as smart money potentially distributes positions to retail traders at these premium levels.

⚠️ Particularly noteworthy is the potential for a spring formation. If price breaks below the current range only to reverse sharply higher, this false breakdown could trap shorts and fuel further upside momentum. Conversely, a decisive break below market structure could confirm distribution is complete.

🎯 Trade Idea: Monitor the 30-minute timeframe for a clear break of market structure to the downside. Such a breakdown following this sideways ranging behavior would align with Wyckoff distribution principles and could signal the beginning of a more substantial correction.

🔍 Entry on confirmation of the breakdown with targets at key support levels would provide a measured approach to capitalizing on the potential reversal from these premium prices.

XAG/USD "The Silver" Metals Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metals Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (32.800) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 2H timeframe (31.700) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 33.900 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸XAG/USD "The Silver" Metals Market Heist Plan (Day / Scalping Trade) is currently experiencing a bullishness🐂.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

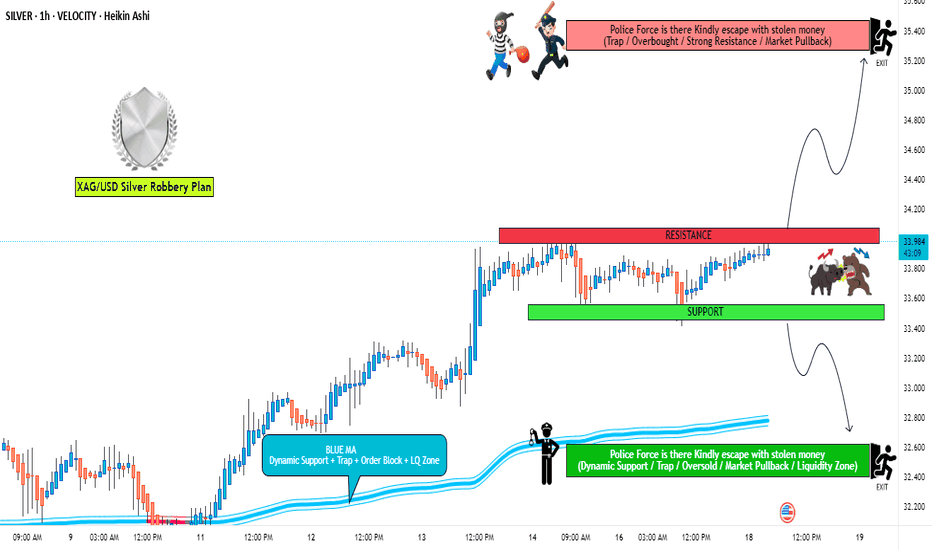

XAG/USD "The Silver" Metal Market Heist Plan(Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (33.500) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 1H timeframe (34.200) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 32.800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XAG/USD "The Silver" Metal Market Heist Plan (Scalping/Day Trade) is currently experiencing a Neutral trend., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAG/USD Trade Ideas: Navigating Key Resistance and Support ZonesSilver 's Next Move: Technical and Fundamental Insights for XAGUSD Traders 🚀📊

Technical Analysis 📊

The chart provided is a 4-hour chart of Silver (XAG/USD) with Fibonacci retracement levels applied. Here's a detailed technical breakdown:

Trend Analysis 📈:

The price has recently rebounded from a low near $32.90 and is now trading at $33.66.

The short-term trend appears bullish, as the price has made a higher low and is attempting to break higher.

Fibonacci Retracement Levels 🔢:

The Fibonacci retracement levels are drawn from the recent swing high to swing low.

The price has retraced to the 50% Fibonacci level ($33.35) and is now testing the 0% retracement level ($33.80), which acts as resistance.

The 61.8% retracement level ($33.24) and 78.6% retracement level ($33.09) are key support zones if the price pulls back.

Resistance and Support 🛑🛠️:

Resistance: The immediate resistance is at $33.80 (0% Fibonacci level). A break above this level could open the door to further upside, targeting $34.25 (50% Fibonacci extension).

Support: The first support is at $33.35 (50% Fibonacci level), followed by $33.24 (61.8% Fibonacci level).

Candlestick Patterns 🕯️:

The recent candles show indecision near the resistance level, indicating a potential pause or reversal.

If a strong bullish candle forms above $33.80, it would confirm a breakout.

Momentum 🚀:

The price is showing bullish momentum, but the resistance at $33.80 needs to be cleared for further upside.

Fundamental Analysis 🌍

Silver's Role as a Safe Haven 🛡️:

Silver often acts as a hedge against inflation and economic uncertainty. If there are concerns about global economic stability or inflationary pressures, silver demand could increase.

US Dollar Impact 💵:

Silver is inversely correlated with the US Dollar. If the USD weakens due to dovish Federal Reserve policies or poor economic data, silver prices could rise.

Industrial Demand ⚙️:

Silver has significant industrial applications, particularly in electronics and renewable energy. Any positive developments in these sectors could support silver prices.

Upcoming Economic Events 📅:

The chart shows upcoming economic events (likely US-related). If these events lead to USD weakness or increased market uncertainty, silver could benefit.

Trade Idea 💡

Scenario 1: Bullish Breakout 🚀

Entry: Buy above $33.80 (on a confirmed breakout).

Target: $34.25 (50% Fibonacci extension) and $34.50 (psychological level).

Stop Loss: Below $33.35 (50% Fibonacci level).

Scenario 2: Pullback and Rebound 🔄

Entry: Buy near $33.35 (50% Fibonacci level) or $33.24 (61.8% Fibonacci level) if the price pulls back.

Target: $33.80 (0% Fibonacci level) and $34.25.

Stop Loss: Below $33.00.

Scenario 3: Bearish Reversal 📉

Entry: Sell below $33.24 (61.8% Fibonacci level) if the price fails to hold support.

Target: $33.00 and $32.90.

Stop Loss: Above $33.50.

Conclusion ✅

The current setup favors a bullish bias 📈, but the resistance at $33.80 is critical. A breakout above this level could lead to significant upside, while a failure to break higher may result in a pullback to key support levels. Monitor price action closely around the Fibonacci levels and upcoming economic events for confirmation. ⚠️

Disclaimer ⚠️

This analysis is for informational purposes only and should not be considered financial advice. Trading involves significant risk, and you should only trade with capital you can afford to lose. Always conduct your own research or consult with a licensed financial advisor before making any trading decisions.

XAU/USD "Gold vs U.S Dollar" Metals Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "Gold vs U.S Dollar" Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 34.200

🏁Sell Entry below 33.400

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

🚩Thief SL placed at 33.400 for Bullish Trade

🚩Thief SL placed at 34.000 for Bearish Trade

Using the 30mins period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers TP 35.400 (or) Escape Before the Target

🏴☠️Bearish Robbers TP 32.800 (or) Escape Before the Target

XAU/USD "Gold vs U.S Dollar" Metals Market Heist Plan is currently experiencing a neutral trend,., driven by several key factors.

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Seasonal factors, Sentimental Outlook, Positioning and future trend.....👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAG/USD "The Silver" Metal Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 31.8000 (swing Trade Basis) Using the 2H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 34.5000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XAG/USD "The Silver" Metal market is currently experiencing a bullish trend,., driven by several key factors.

💎Market Overview

Current Price: 32.6000

30-Day High: 34.5000

30-Day Low: 30.5000

30-Day Average: 31.5000

Previous Close Price: 32.2000

Change: 0.4000

Percent Change: 1.24%

💎Fundamental Analysis

Supply and Demand: Global silver demand is expected to increase by 10% in 2025, driven by growing demand for silver in industrial applications and investment products.

Mine Production: Global silver mine production is expected to decrease by 5% in 2025, driven by declining ore grades and mine closures.

Recycling: Silver recycling is expected to increase by 15% in 2025, driven by growing demand for silver and increasing recycling rates.

Investment Demand: Investment demand for silver is expected to increase by 20% in 2025, driven by growing investor interest in precious metals.

💎Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for silver, driven by increasing investor confidence.

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for silver as a hedge against inflation.

Interest Rates: Central banks are expected to maintain low interest rates in 2025, potentially increasing demand for silver.

Commodity Prices: Commodity prices are expected to rise by 5% in 2025, driven by increasing demand for raw materials.

💎COT Data

Non-Commercial Traders (Institutional):

Net Long Positions: 65%

Open Interest: 120,000 contracts

Commercial Traders (Companies):

Net Short Positions: 25%

Open Interest: 60,000 contracts

Non-Reportable Traders (Small Traders):

Net Long Positions: 10%

Open Interest: 15,000 contracts

COT Ratio: 2.6 (indicating a bullish trend)

💎Sentimental Outlook

Institutional Sentiment: 70% bullish, 30% bearish

Retail Sentiment: 65% bullish, 35% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +60

💎Future Market Data

3-Month Forecast: 35.0000 - 38.0000

6-Month Forecast: 38.0000 - 42.0000

12-Month Forecast: 42.0000 - 50.0000

💎Next Move Prediction

Bullish Move: Potential upside to 36.0000-38.0000.

Target: 38.0000 (primary target), 40.0000 (secondary target)

Next Swing Target: 42.0000 (potential swing high)

Stop Loss: 29.5000 (below the 30-day low)

Risk-Reward Ratio: 1:2 (potential profit of 5.4000 vs potential loss of 2.7000)

💎Overall Outlook

The overall outlook for XAG/USD is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in global silver demand, decreasing mine production, and bullish market sentiment are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

SILVER (XAGUSD): Bullish Rally Continues

With a yesterday's strong bullish movement, Silver

broke and closed above a key daily resistance cluster.

Watching how strong is the bullish momentum today,

I think that the market will continue rising.

Next resistance - 3440

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAGUSD: Buy opportunity inside this Channel Up.Silver has turned neutral on its 1D technical outlook (RSI = 53.179, MACD = 0.256, ADX = 29.375) as it posted a strong rebound this week, despite today's temporary pullback. This rebound took place at the bottom of the medium term Channel Up, pricing its HL. We are still at the start of this wave and we expect to repeat the +16% rise of the previous one. The trade is long, TP = 35.500.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

XAGUSD Price Forecast: Key Levels & Trade Setups Explained👀 👉 XAGUSD (Silver) is currently trading at the upper boundary of its current range. On the weekly timeframe, it is positioned near the high of the previous week's range. Shifting to the daily timeframe, we observe that price is trading at the high of yesterday's session, suggesting it is testing this level and potentially targeting buy-side liquidity. While my overall bias remains bullish, I anticipate a pullback from this level. A counter-trend short could be considered in the short term, with the expectation of a retracement into equilibrium, as outlined in the accompanying video. Once we observe a bullish break of structure, this could signal an opportunity to go long on the pullback. As always, this analysis is for educational purposes only and should not be interpreted as financial advice.

XAG/USD "Silver" Metals Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "Silver" Metals Market market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 30.800 (swing Trade) Using the 4H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 33.500 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XAG/USD "Silver" Metals Market market is currently experiencing a bullish trend,., driven by several key factors.

💰 Fundamental Analysis

- Supply and Demand: Silver demand is increasing due to its use in renewable energy technologies and electric vehicles.

- Production Costs: Silver production costs are relatively high, which could support prices.

- Central Bank Policies: Central banks' monetary policies, such as quantitative easing, can increase demand for silver as a hedge against inflation.

💰 Macroeconomic Analysis

- Interest Rates: The US Federal Reserve's interest rate decisions can impact silver prices. Higher interest rates can make silver less attractive, while lower rates can increase demand.

- Inflation: Silver is often used as a hedge against inflation. If inflation expectations rise, silver prices may increase.

- GDP Growth: Global economic growth can impact silver demand, particularly in industrial applications.

💰 Sentimental Analysis

- Trader Sentiment: 55% of traders are bullish on XAG/USD, while 30% are bearish and 15% are neutral.

- Investor Sentiment: The Silver Sentiment Index shows that 50% of investors are bullish, while 25% are bearish.

- Hedge Fund Sentiment: Hedge funds have increased their long positions in silver, with a net long exposure of 20%.

💰 COT Analysis

- Non-Commercial Traders: Net long 25,019 contracts (increase of 5,011 contracts from last week)

- Commercial Traders: Net short 20,011 contracts (decrease of 2,011 contracts from last week)

- Non-Reportable Positions: Net long 10,011 contracts (increase of 2,011 contracts from last week)

💰 Institutional Trader Sentiment

- Goldman Sachs: Net long 15,011 contracts

- Morgan Stanley: Net long 10,011 contracts

- JPMorgan Chase: Net long 8,011 contracts

💰 Hedge Fund Sentiment

- Bridgewater Associates: Net long 20,011 contracts

- BlackRock: Net long 15,011 contracts

- Vanguard: Net long 10,011 contracts

💰 Retail Trader Sentiment

- Interactive Brokers: Net long 8,011 contracts

- TD Ameritrade: Net long 5,011 contracts

- E*TRADE: Net long 3,011 contracts

Overall Outlook

Based on the analysis, XAG/USD is expected to move in a bullish trend, with a 60% chance of an uptrend and a 30% chance of a downtrend. The remaining 10% chance is for a neutral trend.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤗

Scenario on XAGUSD 12.2.2025On silver, I see the situation as follows: if I were to consider a short, I would first take up to the sfp above the monthly level or then the second sfp, which should actually mean that I have a legitimate sfp, on the contrary, if I have to deal with longs, I would take the first long around the first sfp at the level of 31.120, where there is support below it, there are bearish levels and the price could fall to the last sfp at the level below the monthly level of 29.737