XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Xauusdidea

ANFIBO | XAUUSD - The week's last day, I'm bullish over $3800Hi guys, Anfibo's here!

OANDA:XAUUSD Analysis – Daily Trading Strategy

Overall Picture:

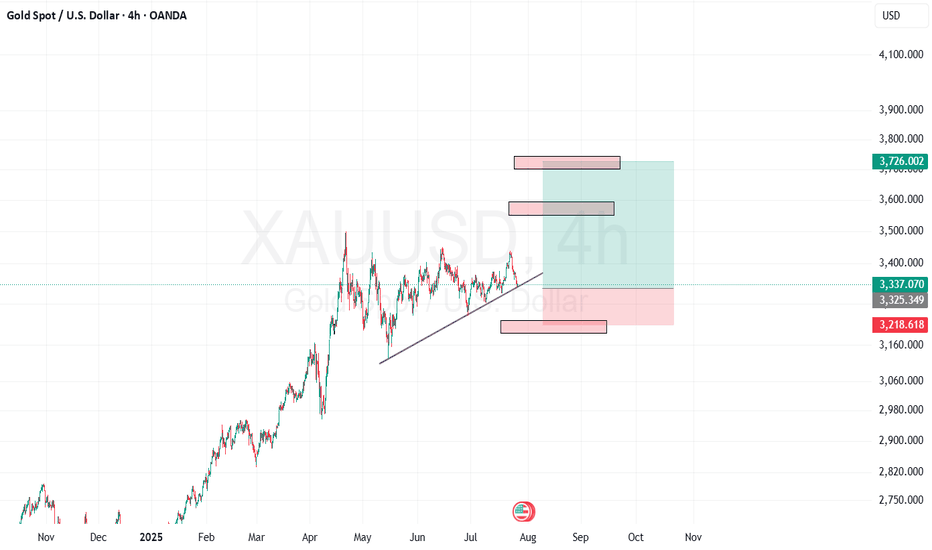

At present, gold (XAUUSD) continues to hold steadily within the H4 bullish channel, without any unusual volatility. The dominant uptrend remains intact, and the market structure still favors buyers. Personally, I remain optimistic that gold will soon head toward a new ATH above $3,800/oz in the medium term. However, in the short term, the market may continue to fluctuate around key support and resistance levels before confirming its next move.

Technical Outlook:

Short-term trend: Solidly bullish, though momentum is slowing; accumulation may form before the next breakout.

> SUPPORT KEY / BUY ZONES : 3740 - 3723 - 3713 - 3703

> RESISTANCE KEY / SELL ZONES : 3770 - 3777- 3788 - 3799 - 3836

Here's my Trading Plan today:

>>> SELL ZONE:

ENTRY: 3769 - 3775

SL: 3780

TP: 3740 - 3723

>>> BUY ZONE:

ENTRY: 3700 - 3705

SL: 3695

TP: 3760 - 3800 - 3836

Risk Management:

- Prioritize buy trades in line with the dominant trend, limit countertrend shorts.

- Maintain a R:R ratio of at least 1:2 on all setups.

- Manage capital strictly, avoid overtrading during sideways phases before breakout.

✅ Conclusion:

Gold is maintaining a stable uptrend on H4, with market structure still supporting buyers.

Main scenarios: Buy on dip around 3700 – 3705.

A clear move beyond 3780 would likely pave the way toward a new ATH above $3,800.

HAVE A NICE WEEKEND, GUYS!!!

Gold weekly setup for new athThis chart shows a 1-hour analysis of XAU/USD (Gold vs. US Dollar).

Price is currently around $3,759, slightly above the key support trend line.

Important support levels are marked near $3,755, $3,735, and $3,723, where buyers may step in.

The short-term bullish scenario points to a possible rebound from support toward the $3,800 target, with a continuation higher to a new all-time high at $3,817.

If the price fails to hold above the support zone, it could retest lower levels before resuming an upward move.

Overall, the outlook suggests bullish momentum remains strong, with buyers targeting $3,800–$3,817, but the market may experience pullbacks before continuing higher.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Elliott Wave Analysis XAUUSD – 28/09/2025

________________________________________

🔹 Momentum

• D1: Momentum is still declining → next week we may continue to see sideways movement or further downside following D1 momentum.

• H4: Momentum is also decreasing → on Monday, we expect a continuation of the downtrend.

• H1: Momentum is oversold and preparing to rise → during the Asian session on Monday, a short-term upward move is likely.

________________________________________

🔹 Wave Structure

• D1 timeframe:

o Price is still within wave 5 (yellow).

o If D1 momentum enters the oversold zone and then turns upward, but price remains sideways without reaching 3632, then wave 5 (yellow) may still extend toward the second target at 3887.

• H4 timeframe:

o A corrective WXY structure is forming.

o With H4 momentum turning down, it is likely that wave Y is unfolding.

• H1 timeframe:

o A declining ABC (blue) structure appeared, followed by a rising ABC (blue) structure toward 3784.

o Within this, wave B formed a triangle abcde (red).

o This shows two ABC (blue) corrective structures developing within the adjustment, suggesting multiple possibilities for wave Y:

1️⃣ Flat 3-3-5: Wave Y may unfold as a 5-wave sharp decline, with an ideal target around 3713 → this is the expected Buy zone.

2️⃣ Triangle: Price may consolidate sideways above 3718 → patience is required to wait for the pattern to complete.

3️⃣ Large-scale Triangle: If the entire correction is a triangle, price will also sideway above 3718 → wait for completion before acting.

• Note: If price breaks above 3792, it may confirm that the corrective structure is complete → next upside target would be 3810.

________________________________________

🔹 Trade Plan

• Buy Zone: 3714 – 3711

• SL: 3703

• TP: 3733

________________________________________

👉 Conclusion:

The optimal approach is to wait for confirmation:

• Either the triangle structure completes,

• Or price declines into the 3713 – 3711 zone to set up a Buy entry.

Gold Trade Setup - 27/Sep/2025Hi Traders,

I am biased for further upside in Gold.

The first trade that I will be looking for is from the highlighted zone and the price is already testing it.

If price corrects here , then I will expect it to drop further to the next marked POI.

Please follow me and like if you agree or this idea helps you out in your trading plan.

Disclaimer : This is just an idea. Please do your own analysis before opening a position. Always use SL & proper risk management.

Market can evolve anytime, hence, always do your analysis and learn trade management before following any idea.

Gold Roadmap: Breakout Confirmed –New ATH or Another Correction?Gold ( OANDA:XAUUSD ) as I expected in the previous idea (Short and Long positions hit the target).

First of all, I should say that this analysis is for the short term and on a 15-minute time frame.

Gold seems to have managed to break the Resistance lines, Resistance zone($3,763-$3,750), and the upper line of the symmetrical triangle in the past few minutes.

I expect Gold to rise to at least $3,779, and then there are two scenarios for Gold: creating a new All-Time High, OR re-correcting.

Stop Loss(SL): $3,741.7

Please respect each other's ideas and express them politely if you agree or disagree.

Gold Analyze (XAUUSD), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Gold Pauses: PCE Inflation Report is the Next Battleground.Hello, investors!

Gold saw only a slight 0.1% gain, closing at $3,739.42/oz on September 25, after encountering resistance from better-than-expected US jobs data (weekly jobless claims dropped sharply). This news slightly pared back expectations for a Fed rate cut in October (down to 85%).

However, gold remains supported by dovish Fed comments and potential political instability (like Trump's proposed 100% drug tariff). The market's focus is now entirely on today’s (Sept 26) PCE Inflation Report.

Expert Warning: If PCE is hotter than expected, gold could face sharp, temporary downward pressure.

Technical Analysis & Strategy

Gold is currently consolidating within a triangle pattern and has yet to break the $375x resistance. While further selling pressure is possible before the PCE data, the long-term trend remains bullish.

Outlook: Prioritize Buy positions if the price stays above the Key Level $373x. If the news causes the price to break $373x, be ready to flip the strategy to Sell.

Key Resistance: $3755, $3768, $3778

Key Support: $3738, $3727, $3712

Suggested Trading Strategy (Strict Risk Management):

BUY SCALP

Zone: $3739 - $3737

SL: $3733

TP: $3742 - $3747 - $3752 - $3757 - $3767

BUY ZONE

Zone: $3704 - $3702

SL: $3694

TP: $3712 - $3722 - $3732 - $3742 - $3762

SELL ZONE

Zone: $3776 - $3778

SL: $3786

TP: $3768 - $3758 - $3748 - $3728 - $3708

The market is at a crossroads. What's your strategy today? 👇

#Gold #XAUUSD #PCE #Fed #Inflation #TradingView #ATH

ElDoradoFx PREMIUM 2.0 – GOLD FORECAST (26/09/2025)🔍 Multi-Timeframe Technical Analysis

Daily (D1)

• Gold is trading at 3,752, holding above the 10EMA and the 3,732 pivot support.

• Momentum remains bullish overall after the rally from early September, but candles show hesitation under 3,791 high → signs of consolidation before a potential new breakout.

• As long as 3,732 holds, the structure remains bullish.

⸻

1H (Intraday Structure)

• Price has broken above the descending trendline resistance (~3,748), now retesting this area.

• Support cluster: 3,745–3,740 (aligned with EMA + structure lows).

• Resistance zone: 3,752–3,755 (capping upside before 3,764).

• MACD: momentum just flipped positive, but histogram is shallow → momentum still fragile.

• RSI: mid-zone (~55) → suggests potential to expand higher if resistance breaks.

⸻

15M (Short-Term View)

• Price consolidating 3,745–3,752.

• Higher lows forming since Asian session → bullish micro-structure.

• MACD showing bullish divergence after last sweep of lows near 3,734.

⸻

5M (Scalping View)

• Strong sweep earlier at 3,751, rejection but held 3,747–3,745 base.

• Micro ascending channel → scalpers eyeing breakout confirmation.

• Momentum picking up, but volume still thin → London likely decides breakout direction.

⸻

📌 Fibonacci Golden Zone

Swing High 3,791 → Swing Low 3,732:

• 38.2% = 3,754

• 50% = 3,761

• 61.8% = 3,767

➡️ Golden retracement lies at 3,754–3,767 → exactly where London session resistance sits. A break into this zone will decide continuation vs. rejection.

⸻

🎯 Scalping Setups (Max 60 Pips SL)

✅ Buy Setup (Preferred if bullish momentum holds)

• Entry: Above 3,752–3,754 breakout & retest.

• SL: 3,746 (≈ -60 pips).

• TP1: 3,761

• TP2: 3,767 (Fib 61.8%).

• Reasoning: Break above golden zone support confirms bullish continuation.

✅ Sell Setup (If rejection at resistance)

• Entry: Rejection at 3,754–3,755 or confirmed break below 3,740.

• SL: 3,760 (≈ -60 pips).

• TP1: 3,734

• TP2: 3,722.

• Reasoning: Failure to hold golden zone leads to pullback toward London lows.

⸻

⚠️ Key London Session Levels

• Bullish Breakout: 3,754 → opens 3,761–3,767.

• Bearish Breakdown: 3,740 → exposes 3,734 then 3,722.

• Pivot Level: 3,745 (control zone for scalpers).

⸻

✅ Summary:

Gold sits at a decision point. If 3,752–3,754 breaks and holds, expect bullish continuation into 3,761–3,767 (golden zone). If rejected, scalpers can look for shorts back toward 3,734–3,722. London open will likely provide the breakout.

Elliott Wave Analysis XAUUSD – September 26, 2025

________________________________________

🔹 Momentum

• D1: Currently decreasing → the corrective trend is likely to continue. It may take about 2 more D1 candles for momentum to enter the oversold zone, after which a reversal could occur.

• H4: Momentum is rising → today we may see a bullish move or sideways range.

• H1: About to enter the oversold zone → a short-term bullish reversal is likely.

________________________________________

🔹 Wave Structure

• D1:

o As analyzed previously, wave 5 (yellow) has already reached its first target at 3789.

o It may take around 2 more D1 candles for momentum to enter oversold → showing that the bearish leg is weakening.

o Considering depth and time, the market is likely within wave 4 of wave 5. Once the correction completes, the uptrend should resume toward the second target.

• H4:

o A WXY corrective structure is developing.

o The ABC (blue) has completed wave W → the market may now be in wave X, followed by a Y-wave decline to finish the correction.

• H1:

o Wave X appears to be forming a triangle, currently in the final wave e.

o However:

If price rises sharply above 3762, it would suggest the corrective phase is already completed.

The target area for wave e is around 3752 → potential Sell zone.

If price breaks below 3729, it confirms wave Y is in play, targeting 3713 and 3698 → potential Buy zones.

⚠️ Note: If the Buy target is reached first, the Sell setup will be canceled.

________________________________________

🔹 Trading Plan

🔻 Sell Zone

• Entry: 3751 – 3753

• SL: 3761

• TP: 3729

________________________________________

🔺 Buy Zone 1

• Entry: 3714 – 3712

• SL: 3704

• TP: 3751

________________________________________

🔺 Buy Zone 2

• Entry: 3699 – 3696

• SL: 3686

• TP: 3751

Gold Price Outlook – Trade Setup (XAU/USD)📊 Technical Structure

Gold (XAU/USD) is trading near $3,740, consolidating below the descending trendline resistance. The support zone lies at $3,723 – $3,719, while the resistance zone is around $3,761 – $3,765. The price structure shows a “buy-the-dip” bias as long as support holds, but near-term pressure remains capped by the downtrend line. A breakout above $3,765 could open the path toward $3,785.

🎯 Trade Setup

Entry: $3,719 – $3,723 (support retest)

Stop Loss: $3,715

Take Profit: $3,764 / $3,785

Risk/Reward (R:R): ~1 : 5.4

🌍 Macro Background

Markets await the US Core PCE Inflation data later today – the Fed’s preferred inflation gauge. Stronger-than-expected PCE could strengthen the USD and pressure gold lower. On the other hand, a softer reading may revive rate cut expectations, supporting gold. Additionally, Trump’s new tariffs (100% on pharmaceuticals, 50% on cabinets, 30% on furniture, etc.) and ongoing geopolitical risks with Russia provide safe-haven flows that keep gold attractive. Despite the USD holding at three-week highs, investors continue to see gold as a hedge amid policy uncertainty and trade tensions.

🔑 Key Technical Levels

Resistance: $3,764 / $3,785

Support: $3,723 / $3,719

📝 Trade Summary

The overall structure favours a buy-the-dip strategy near support zones, with upside potential toward $3,764 – $3,785 if US PCE comes in softer. However, a stronger inflation print may trigger a deeper pullback below $3,719. Traders should stay alert for volatility around the data release.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Trading involves significant risk, and proper risk management is essential.

9/25: Buy at Lows, Watch Resistance at 3758–3763Good morning everyone!

Yesterday, gold rebounded from support but failed to break resistance, then continued its decline to around 3720, completing the divergence correction on the 30M chart. This downside move was well captured.

Currently, price is in a rebound phase:

3752–3758 is the key resistance zone. A clean breakout and consolidation above would give the bulls stronger momentum.

3733–3726 is the key support area. If price retests without breaking lower and forms bullish candles (especially strong bullish candles without long upper wicks), the probability of another upward move increases.

If volume supports a breakout, watch the 3770–3780 resistance area, as it may trigger further upside.

📌 Trading Outlook:

Trend setups:

Long opportunities below 3710;

Short opportunities above 3780;

If price breaks above 3770 and retests near 3760 without losing 3752, this could present another long entry.

Range setups:

Consider swing trades within the 3766–3726 range.

⚠️ Reminder: If your account condition is not favorable, avoid unnecessary trades. Focus on higher-probability setups to steadily grow profits while controlling risk.

GOLD Breakout Done , Short Setup Valid To Get 200 Pips !Here is My 30 Mins Gold Chart , and here is my opinion , we finally Below 3750.00 With 4H Candle ! and we have a 4H Candle closure below it And Perfect Breakout and this give us a very good confirmation , so we have a good confirmation now to can sell after the price go back to retest the broken area 3750.00 , and we can targeting 100 to 200 pips . if we have a daily closure above this area this mean this idea will not be valid anymore .

Reasons To Enter :

1- Perfect Touch For The Area .

2- Clear Bearish Price Action .

3- Bigger T.F Giving Good Bearish P.A .

4- Over Bought .

5- Perfect 30 Mins Closure .

Gold Trade Set Up Sep 25 2025Last night we caught a buy from 15m demand securing 300 pips followed by a sell at 1m supply securing 100 pips then now another sell from 15m supply currently running 200 pips aiming for 350 pips at 15m demand

overall im bearish for now until it hits a 4h demand at 3658-3644 to continue its bullish move back to ATH

The trend has not changed, continue to shortAfter yesterday's high-level fluctuations, gold prices retreated significantly in the US market due to news, hitting a low near 3717.

Yesterday's daily gold price closed in the red, with the MA5 moving average near 3735. If today's daily closing price falls below the MA5 and reaches the MA10, bears will regain control of the market. Looking at the 4-hour Bollinger Bands, after breaking below the middle line, the price has fluctuated, briefly stabilizing near 3735. Currently, it is consolidating sideways, but if the European/US session breaks below 3735-3720, further declines to 3710-3700 are possible. The short-term downward trend is still under pressure and the market is in a weak state. Therefore, intraday gold trading is still mainly short selling, with long buying as an auxiliary.

The main pressure range above is 3750-3765. If the rebound touches the upper resistance range without breaking it, you can continue to short gold. The short-term support is at 3735-3720 below. If it falls back but does not break through, you can go long with a light position. Strong support focuses on the previous top and bottom conversion of 3710-3700.

Gold: Opportunities for both longs and shorts.Gold still pulled back downward overnight, which is the time window we reminded everyone to pay attention to yesterday. On the daily timeframe, the price has started to approach MA5. After a relatively large short-term gain, it is facing correction pressure. Today, focus on the support from MA10; there is also a need for a pullback on the weekly timeframe. However, note that there will still be an upward move after the correction—fundamentals have not changed, and the main trend remains intact.

After the strong one-way trend shifted to consolidation, short positions can also be traded; there are opportunities for both short-term long and short positions, but it is necessary to seize the right levels. Pay attention to shorting on rebounds near the 3765/3770 resistance, and look to go long near the 3710 support and the daily MA10 level. Currently, price volatility is relatively high, so be sure to control risks properly.

Buy 3730 - 3740 TP 3750 - 3760 - 3770 SL 3725

Sell 3760 - 3770 TP 3770 - 3775 SL 3758

Daily-updated accurate signals are at your disposal. If you run into any problems while trading, these signals serve as a reliable reference—don’t hesitate to use them! I truly hope they bring you significant assistance