Cisco Systems Stock Outlook: Still the Backbone of Modern Networks?

Cisco has played a central role in keeping the world online for decades, routing data, powering networks, and quietly enabling everything from video calls to cloud storage. But lately, it's been moving beyond its hardware roots. It's in the middle of a bigger transition, recasting itself as a company focused more on software, recurring revenue, and AI-powered tools.

That transition sets the stage for this piece. Cisco might not be grabbing headlines with big growth spikes, but it has something just as valuable: staying power. It's built on decades of customer trust, rising software sales, and dependable cash flow, yet its stock still trades as if it were yesterday's story.

Ahead, I will dig into recent results, compare Cisco's position against key rivals, and ask a simple question: does the current share price give Cisco credit for what it's building?

Financial Performance: Cash-Rich and Quietly Climbing

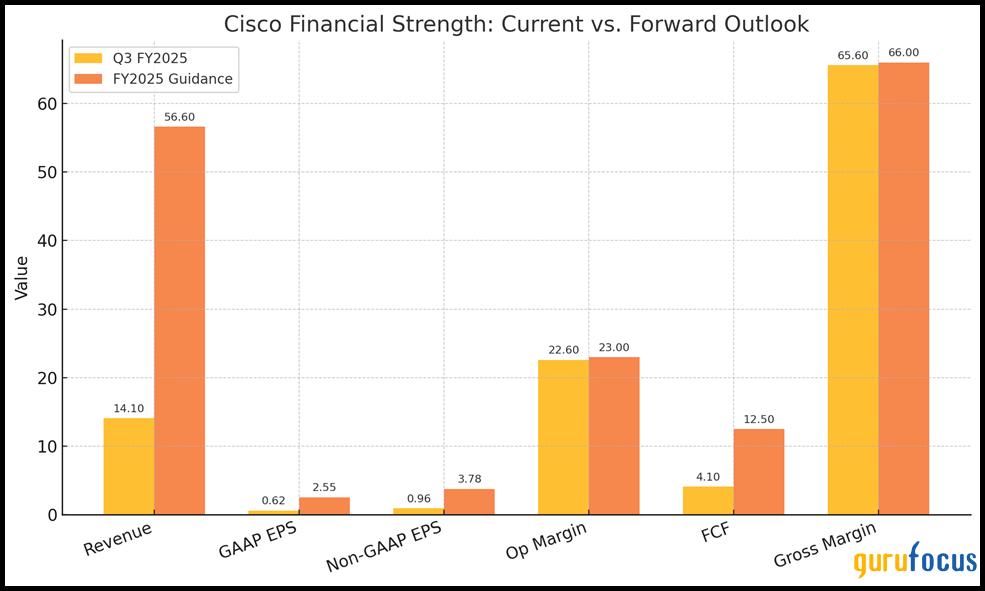

Cisco's most recent quarter proved what long-term investors already know: this company doesn't just survive industry cycles, it monetizes them. Q3 2025 came in strong, with $14.1 billion in revenue, up 11 percent year over year, and meaningful gains across key categories like networking, security, and observability.

As Q4 2025 approaches, Cisco has guided revenue between $14.5 to $14.7 billion, with non-GAAP EPS expected between $0.96 to $0.98. That would mark a continuation of its year-over-year momentum and place it right on track to meet full-year revenue between $56.5 to $56.7 billion. GAAP EPS for the full year is projected between $2.53 to $2.58, with non-GAAP EPS in the $3.77 to $3.79 range.

Cisco reports its Q4 earnings on August 13, the focus isn't just on beating estimates. It's on confirming whether Cisco's shift into a a more tech-forward business with better margins is taking hold.

Ownership Breakdown: Who's holding the shares?

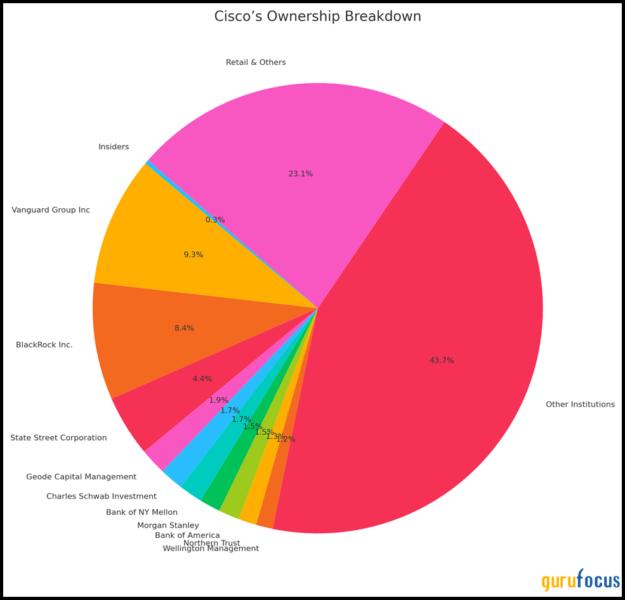

The ownership structure reflects the type of company it had become: steady, (strongly) capitalized, and widely owned by large funds. Its share is more than 77 percent owned by large institutional investors with Vanguard, BlackRock, and the State street heading the list. Such a high degree of support is usually indicative of a belief in long term fundamentals.

In contrast, they are insiders who have a low stake. Latest sales have been normal where top officers sold stocks in advance programmed schemes. It has not been buying strong, but, again, there has been no extraordinary dumping, which is a promise of stability.

It is not a speculation but an investment that the institutions holding the reins are betting on to generate cash as well as returning it to capital and maintain reinventions. That fits in like a glove to our thesis: Cisco is not a rocket ship. It is returning decent profits and in a strategic refreshing of the market that has not been completely achieved.

Valuation: Cisco Is Priced Like Hardware, But Acts Like a Hybrid

Cisco's valuation doesn't reflect what the company is becoming. It reflects what investors assume it still is: a legacy hardware vendor. But that assumption overlooks how Cisco has quietly reshaped its revenue mix, margin structure, and long-term cash profile. That's the real disconnect.

Cisco trades at 13.6x forward earnings, a multiple that suggests slow growth and hardware dependency. But this doesn't square with the company's evolving fundamentals. Recurring revenue now makes up more than 44% of Cisco's total and that number keeps climbing. With over $12B in annual free cash flow and a gross margin of 65.6%, Cisco generates returns that are more consistent with software firms than physical OEMs.

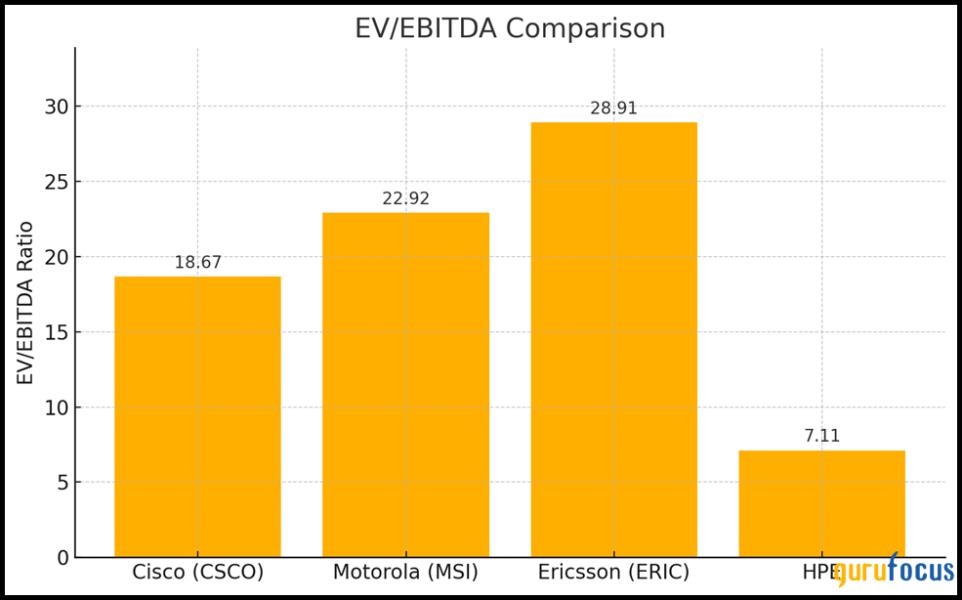

Now compare it to peers: Motorola Solutions (P/E 26.2x), whose product set is narrower and growth is heavily government-driven. HPE, with lower margins and greater execution risk, trades at 8.7x forward earnings. Ericsson, still reeling from cyclical pressure, holds a volatile multiple of 15.8x. Even against these backdrops, Cisco delivers steadier cash and stronger capital returns.

The disconnect becomes more obvious on an EV/EBITDA basis: Cisco trades at 18.7x, below Motorola's 22.9x, despite delivering better cash conversion and stronger product diversification. HPE trades cheaper at 7.1x but that gap reflects margin weakness and integration risks post-Juniper.

| Company | P/E (TTM) | EV/EBITDA | P/B Ratio | Forward P/E |

| Cisco | 27.7 | 18.7 | 4.7 | 13.6 |

| Motorola (MSI) | 34.7 | 22.9 | 62.3 | 26.2 |

| Ericsson (ERIC) | 159.2 | 10.1 | 2.2 | 15.8 |

| HPE | 10.2 | 7.1 | 1.1 | 8.7 |

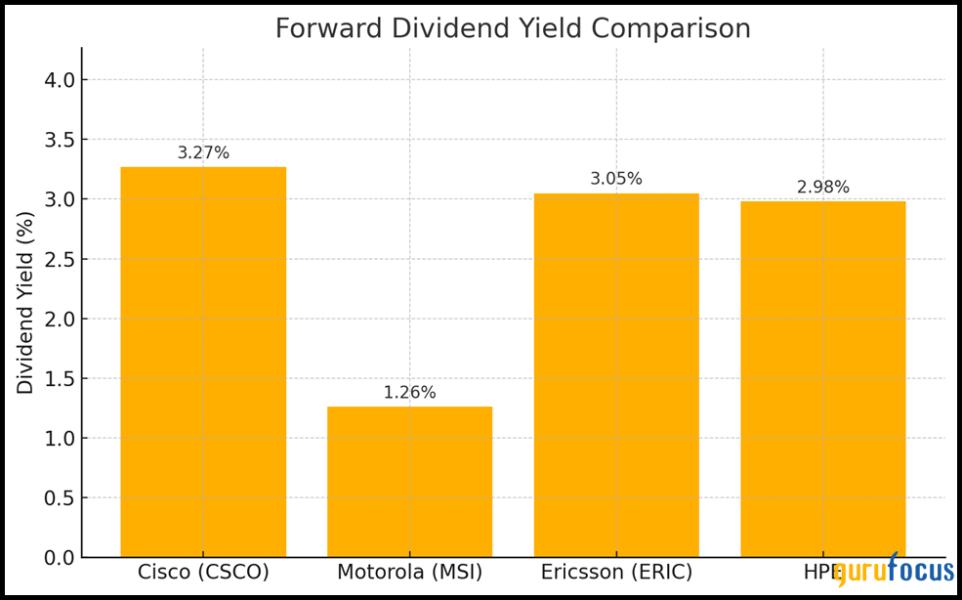

Importantly, Cisco returns most of its earnings to shareholders. The dividend yield of 3.27%, funded by stable cash flow, is more reliable than many peers. It's not a startup, but it's a machine. That consistency matters, especially in a market looking for durable returns.

Yes, the company isn't leading in every segment and that's priced in. But the market is ignoring how the company is building a higher-quality revenue base, anchoring itself more in software, and investing in long-term visibility. If it succeeds in continuing that pivot, then Cisco doesn't need to outperform Palo Alto or Arista to justify a higher multiple. It just needs to be recognized for what it already is: a mature tech platform with predictable margins and evolving upside.

Competitive Landscape: Not the Fastest, But Maybe the Most Resilient

In high-performance switching, Arista is setting the pace with faster growth and cleaner execution. In security, pure-play leaders like Palo Alto Networks, CrowdStrike, and Check Point are moving faster, innovating deeper, and commanding richer valuations. And in collaboration, WebEx has long been outflanked by Microsoft Teams and Zoom in terms of user experience, integration, and adoption.

But here's where Cisco differs, it doesn't rely on one segment to justify its future. It's not trying to be best-in-class in one narrow vertical. It's building an integrated enterprise stack across networking, observability, and security, all wrapped into recurring offerings.

Take Arista: it's fantastic in cloud switching, but it's also narrowly concentrated. Palo Alto is a standout in cloud-native security but lacks the broader enterprise footprint that Cisco already has inside Fortune 500 IT stacks. Even Microsoft Teams, a superior product to WebEx wins largely on integration, the same edge Cisco is now leveraging across its own software bundle.

Cisco's strength isn't velocity, it's gravity. It's embedded deeply in enterprise infrastructure. Customers don't just buy routers or firewalls; they buy an architecture. That gives Cisco room to cross-sell security into its installed base, bundle WebEx with infrastructure contracts, and integrate telemetry across the stack through platforms like ThousandEyes and AppDynamics.

In short, Cisco may not be the fastest innovator in every field, but it's the most anchored. And in a world of growing IT complexity, that kind of platform-wide integration gives it a competitive edge that's harder to measure in standalone product comparisons but easier to monetize at scale.

Cisco + Splunk: From Infrastructure to Intelligence

By investing $28 billion in the Splunk acquisition, Cisco did not purchase another security company, but a new brain of its network.

Splunk offers the next-level data observation, log analysis, and incident response tools that can create a significant gap in Cisco. Cisco, alone, provided routers, switches and firewalls the infrastructure. Splunk will be able to give itself a unified picture of how the data flows through that infrastructure, what threats are attacking it, and what business processes rely on it. This is what makes a vendor and a platform different.

And this is also a deal of leverage. Cisco is not learning new stuff with Splunk. It has already integrated it with the existing products such as AppDynamics and ThousandEyes. That provides an entire full-stack observability solution one that stretches all the way up and down the stack, between network performance, application behavior, and cybersecurity response. To IT teams in enterprises that are just grappling with the challenge of dealing with hybrid environments, this degree of integration is no longer a nice-to-have but the need of the hour.

And it fills the recurring revenue machine. The observability and SIEM (security information and event management) are sticky products, based on subscriptions. They increase wallet share as well as software mix -all of which drives margins up.

More importantly, Splunk accelerates the AI story at Cisco as well. Security is becoming so swift and complicated that it can no longer be handled with rules. Splunk data lake and machine learning backbone enables Cisco to go a step further and train AI on how and what to predict, detect and respond to anomalies in real-time across infrastructure, apps, and endpoints.

Will this revolutionize Cisco tomorrow? No. However, it makes the discussion go away hardware legacy to software intelligence. And it is precisely this type of long-term, multi-faceted wagering of the kind that shifts the investment estimate of a company within the marketplace.

Strategic Growth Levers Position Cisco for a Revaluation

Cisco is in motion to reposition itself as a software company, first and AI-enabled platform. It has already surpassed its 1 billion dollar AI infrastructure sales goal, led by Silicon One chip and AI-native networking. Its 28 billion dollar purchase of Splunk is being added to AppDynamics and ThousandEyes, bundling visibility of security and systems into a single stack. Security revenues in Q3 increased by 54 percent compared to the previous year.

Another interesting trend that Cisco is pursuing is the further expansion worldwide, particularly in India, and the investments in Webex, SD-WAN, and SASE. These tools assist the hybridized enterprise and generate recurring revenues which augur well with its high-margin core. It has been lean and has reduced low-performing divisions and invested in innovation. This translation has been already witnessed in the increasing interest in products

The company continues to trade at a premium that is representative of a hardware past. And, to investors, that is the opportunity, a company that is making impact now, but also building toward the future.

Risks and Headwinds That Could Challenge Cisco's Re-Rating Potential

Cisco's global supply chains make it at risk if supply chains hit turbulence. If disruptions arise, margins and deployment timelines could suffer. Its AI-native networking relies heavily on hyperscaler demand. If capital expenditures slow or shift to in-house alternatives, momentum might slow down.

HPE's acquisition of Juniper introduces direct competition in AI networking. Ericsson and Nokia continue to pressure Cisco in service-provider markets, while Arista Networks is becoming more competitive in advanced switching. The security landscape is shifting fast. Cisco must prove it can keep up, especially after investing heavily in AI-driven products.

There's genuine execution risk tied to the Splunk acquisition. At 28 billion dollars, any misstep could dilute margins or slow adoption. The risks don't invalidate the plan, they help explain the stock's current pricing. If Cisco manages them well, the A re-rating may not just be possible, it could be overdue.

Conclusion

Cisco isn't chasing headlines. It's executing a disciplined transformation. While the market still views it through a hardware-first lens, the numbers and strategic moves suggest otherwise. With strong margins, steady cash flow, growing AI infrastructure demand, and deep enterprise roots, Cisco is quietly evolving into a high-margin, software-centric platform. Its valuation doesn't yet reflect this shift. For investors seeking stability with upside, Cisco stands out as a rare tech stock: dependable, cash-rich, and fundamentally undervalued. If execution continues on its current path, the market will have to rethink what Cisco's truly worth and soon.