AstraZeneca’s game of exit chess puts UK in check

By Aimee Donnellan

Pascal Soriot just ratcheted up the pressure on Keir Starmer. The AstraZeneca AZN CEO said on Monday he would list the $230 billion company's shares directly in the U.S., but stopped short of a full movement of his primary listing in New York. If this was a game of chess, he would now have the UK prime minister in check.

A cursory reading of Astra's Monday announcement would suggest little of a confrontational nature. The company reiterated its commitment to London, and says its New York listing plan is just about selling more shares to a wider volume of investors. At the moment, Astra uses American depository receipts (ADRs), which are less liquid due to a restricted pool of shareholders who can buy them.

Even so, the standoff is still there. Earlier this month, Astra pressed pause on a 200-million-pound investment in Cambridge that was set to create 1,000 jobs. That followed the scrapping of a 450-million-pound vaccine plant in January. Behind all this lies a spat over drug pricing. Astra wants the UK to spend more on innovative medicines like its breakthrough breast cancer drug, Enhertu.

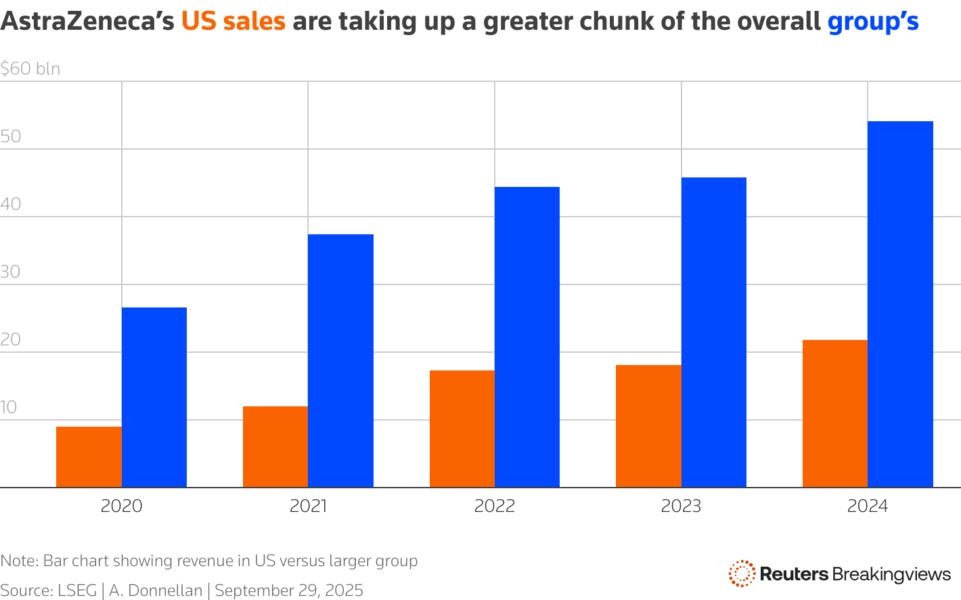

Starmer's problem is that there is a growing list of reasons for Astra to relocate across the Atlantic beyond share liquidity. Last year the drugmaker made 40% of its $54 billion sales stateside, but to reach Soriot’s 2030 revenue target of $80 billion the U.S. will need to account for 50% of sales, a source told Breakingviews. There's also a clear logic to investing more in the country: last week, President Donald Trump announced 100% tariffs on pharmaceutical imports but offered exemptions to companies that pledged to make large multi-billion-dollar investments in domestic drug manufacturing.

All that said, Starmer is not in checkmate. Unlike gaming group Flutter or Ireland's CRH CRH, who moved their primary listings to New York, the U.S. is still a minority of Astra's revenue. Soriot's fine words about its British ties aren't just talk: his company remains a global company that gains a lot from UK life sciences and academic institutions like the Universities of Oxford and Cambridge.

Still, ultimately Astra is the second most valuable company in the FTSE 100, and losing its primary listing would be a hammer blow to the London market. That leaves Starmer trying to fight a rearguard action with pawns rather than kings or queens. Some sort of concession now looks more likely.

Follow Aimee Donnellan on LinkedIn.

CONTEXT NEWS

AstraZeneca said on September 29 it plans to directly list its shares on the New York Stock Exchange, instead of its current depositary receipts structure. The drugmaker said it planned to attract more global investors but will remain listed and headquartered in London.

On September 12 the company paused a planned 200 million pound ($268.80 million) investment in its Cambridge research site.

AstraZeneca has also pledged to invest $50 billion in U.S. manufacturing by 2030, amid global drugmakers' efforts to avert hefty tariffs on pharmaceutical imports into the country, and will cut some direct-to-patient U.S. drug prices as demanded by President Donald Trump's administration.

Shares in AstraZeneca were up 0.7% by 0832GMT on September 29.