PINE LIBRARY

CSCMultiTimeframeTools

Library "CSCMultiTimeframeTools"

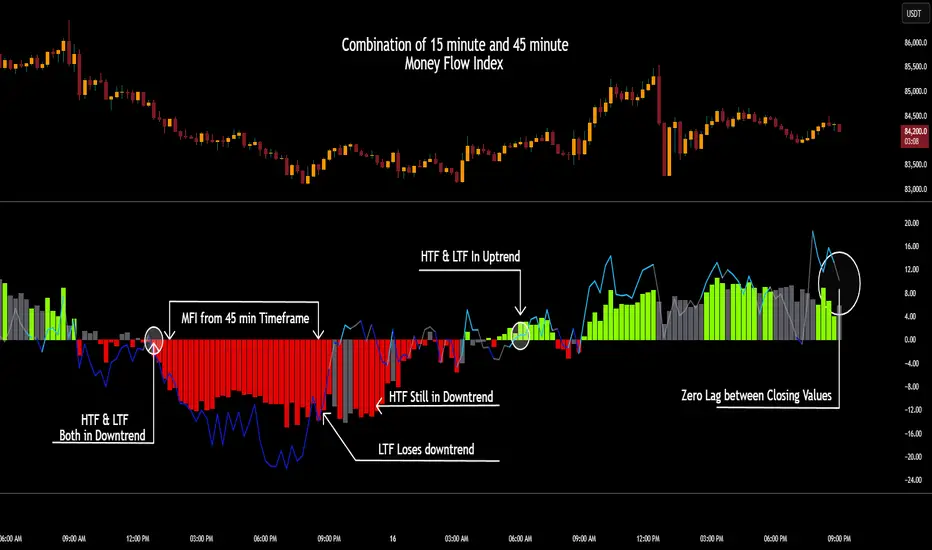

Calculates instant higher timeframe values for higher timeframe analysis with zero lag.

getAdjustedLookback(current_tf_minutes, higher_tf_minutes, length)

Calculate adjusted lookback period for higher timeframe conversion.

Parameters:

current_tf_minutes (int): Current chart timeframe in minutes (e.g., 5 for 5m).

higher_tf_minutes (int): Target higher timeframe in minutes (e.g., 15 for 15m).

length (int): Base length value (e.g., 14 for RSI/MFI).

Returns: Adjusted lookback period (length × multiplier).

Purpose and Benefits of the TimeframeTools Library

This library is designed to solve a critical pain point for traders who rely on higher timeframe (HTF) indicator values while analyzing lower timeframe (LTF) charts. Traditional methods require waiting for multiple candles to close—for example, to see a 1-hour RSI on a 5-minute chart, you’d need 12 closed candles (5m × 12 = 60m) before the value updates. This lag means missed opportunities, delayed signals, and inefficient decision-making.

Why Traders Need This

Whether you’re scalping (5M/15M) or swing trading (1H/4H), this library bridges the gap between timeframes, giving you HTF context in real time—so you can act faster, with confidence.

How This Library Eliminates the Waiting Game

By dynamically calculating the adjusted lookback period, the library allows:

Real-time HTF values on LTF charts – No waiting for candle closes.

Accurate conversions – A 14-period RSI on a 1-hour chart translates to 168 periods (14 × 12) on a 5-minute chart, ensuring mathematical precision.

Flexible application – Works with common indicators like RSI, MFI, CCI, and moving averages (though confirmations should be done before publishing under your own secondary use).

Key Advantages Over Manual Methods

Speed: Instantly reflects HTF values without waiting for candle resolutions.

Adaptability: Adjusts automatically if the user changes timeframes or lengths.

Consistency: Removes human error in manual period calculations.

Limitations to Note

Not a magic bullet – While it solves the lag issue, traders should still:

Validate signals with price action or additional confirmations.

Be mindful of extreme lookback lengths (e.g., a 200-period daily SMA on a 1-minute chart requires 28,800 periods, which may strain performance).

Calculates instant higher timeframe values for higher timeframe analysis with zero lag.

getAdjustedLookback(current_tf_minutes, higher_tf_minutes, length)

Calculate adjusted lookback period for higher timeframe conversion.

Parameters:

current_tf_minutes (int): Current chart timeframe in minutes (e.g., 5 for 5m).

higher_tf_minutes (int): Target higher timeframe in minutes (e.g., 15 for 15m).

length (int): Base length value (e.g., 14 for RSI/MFI).

Returns: Adjusted lookback period (length × multiplier).

Purpose and Benefits of the TimeframeTools Library

This library is designed to solve a critical pain point for traders who rely on higher timeframe (HTF) indicator values while analyzing lower timeframe (LTF) charts. Traditional methods require waiting for multiple candles to close—for example, to see a 1-hour RSI on a 5-minute chart, you’d need 12 closed candles (5m × 12 = 60m) before the value updates. This lag means missed opportunities, delayed signals, and inefficient decision-making.

Why Traders Need This

Whether you’re scalping (5M/15M) or swing trading (1H/4H), this library bridges the gap between timeframes, giving you HTF context in real time—so you can act faster, with confidence.

How This Library Eliminates the Waiting Game

By dynamically calculating the adjusted lookback period, the library allows:

Real-time HTF values on LTF charts – No waiting for candle closes.

Accurate conversions – A 14-period RSI on a 1-hour chart translates to 168 periods (14 × 12) on a 5-minute chart, ensuring mathematical precision.

Flexible application – Works with common indicators like RSI, MFI, CCI, and moving averages (though confirmations should be done before publishing under your own secondary use).

Key Advantages Over Manual Methods

Speed: Instantly reflects HTF values without waiting for candle resolutions.

Adaptability: Adjusts automatically if the user changes timeframes or lengths.

Consistency: Removes human error in manual period calculations.

Limitations to Note

Not a magic bullet – While it solves the lag issue, traders should still:

Validate signals with price action or additional confirmations.

Be mindful of extreme lookback lengths (e.g., a 200-period daily SMA on a 1-minute chart requires 28,800 periods, which may strain performance).

Pine library

In true TradingView spirit, the author has published this Pine code as an open-source library so that other Pine programmers from our community can reuse it. Cheers to the author! You may use this library privately or in other open-source publications, but reuse of this code in publications is governed by House Rules.

Discord = discord.gg/EAncX5TpfB

coffeeshopcrypto3@gmail.com

coffeeshopcrypto3@gmail.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Pine library

In true TradingView spirit, the author has published this Pine code as an open-source library so that other Pine programmers from our community can reuse it. Cheers to the author! You may use this library privately or in other open-source publications, but reuse of this code in publications is governed by House Rules.

Discord = discord.gg/EAncX5TpfB

coffeeshopcrypto3@gmail.com

coffeeshopcrypto3@gmail.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.