Majors Sync | QuantEdgeB

🔹Overview

🚀 Dynamic Rotation System for BTC, ETH & SOL

MajorsSync is a powerful, rotation-based strategy designed to systematically identify the leading cryptocurrency among the top three majors: Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

By analyzing inter-market strength, pairwise trend dominance, and individual trend quality, MajorsSync dynamically shifts exposure toward the asset with the highest potential for outperformance, while de-risking during unfavorable conditions.

✨ Core Objective

📌 To allocate capital to the strongest-performing major—BTC, ETH, or SOL—while avoiding underperformers and unnecessary exposure during uncertain market phases.

🧠 How It Works

Majors Sync uses a multi-tiered decision structure:

🔹 1. Individual Asset Trend Evaluation

Each asset is scored using a Trend Performance Index (TPI). These are proprietary models capturing medium-term momentum and structure for:

• BTC

• ETH

• SOL

🔹 2. Pairwise Relative Strength Matrix

Compute TPI values between the asset pairs:

• ETHBTC → Is ETH stronger than BTC?

• SOLETH → Is SOL stronger than ETH?

• SOLBTC → Is SOL stronger than BTC?

These relative TPI readings help construct a score matrix to rank assets 0–2.

🔹 3. Signal Confirmation

Only when the top-ranked asset has a positive TPI, a Long signal is triggered on that asset.

Otherwise, if no asset meets the threshold, the system remains in Cash/Neutral mode to protect capital.

🧮 Capital Allocation Logic

📊 Allocation always rotates to:

• ✅ The strongest asset with a positive trend

• 🛑 Otherwise, goes neutral/cash (no trade)

This ensures capital is placed in high-probability zones only.

💼 Equity System

🧮 An internal equity engine simulates dynamic capital rotation by reallocating to the top-performing major (BTC, ETH, or SOL) at each bar. This allows for transparent tracking of historical strategy performance.

• 💡 If BTC is the top asset → System follows BTC's price change

• 💡 If ETH becomes dominant → It reallocates to ETH

• 💡 If SOL takes over → Position shifts to SOL

• 📉 No asset qualified? → Strategy holds cash

You also get a Buy & Hold BTC benchmark for direct comparison.

⚠️ This simulation reflects past behavior and is not indicative of future results.

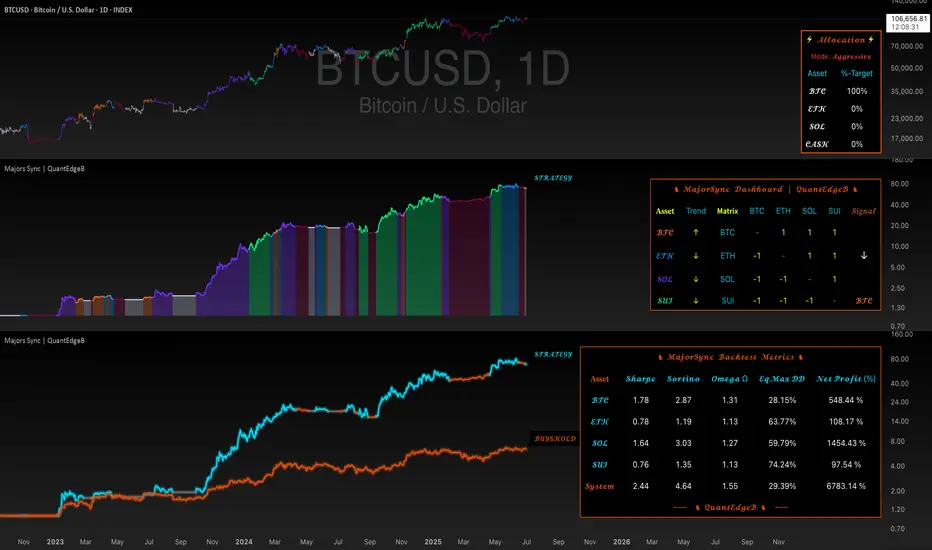

📊 Dashboard & Visuals

The built-in dashboard table displays:

• 🧠 Asset Trends (BTC, ETH, SOL)

• 🧩 Matrix values (e.g., ETH vs BTC, SOL vs ETH)

• 🏁 Final Signal Output (which asset is selected)

• 🔁 Real-time Strategy Equity vs Buy & Hold

💪 Why It Works

Majors Sync blends:

• ✅ Inter-market structure (pairwise dominance)

• ✅ Intra-asset momentum (standalone TPI)

• ✅ Position filtering (only acts on positive signals)

• ✅ Capital efficiency (rotates rather than overtrades)

This design reduces drawdowns, avoids stagnation, and seeks to capture medium-term leadership shifts among the top crypto majors.

📊 MajorSync Backtest Metrics

🔹 Sharpe Ratio

Shows the risk-adjusted return by comparing the strategy's return to its overall volatility. Higher is better — it means you're getting more reward per unit of risk.

🔹 Sortino Ratio

Similar to Sharpe, but focuses only on downside volatility (the bad kind). This makes it a better reflection of how the system handles losses specifically.

🔹 Omega Ratio (Ω)

Measures how often the system generates profitable returns versus unprofitable ones. A value above 1 means it wins more than it loses — and the higher it goes, the better.

🔹 Equity Max Drawdown (Eq.Max DD)

This is the deepest decline from peak equity during the test. Lower drawdown means less risk of big losses.

📌 Disclaimer: Backtest results are based on historical data and past market behavior. Performance is not indicative of future results and should not be considered financial advice. Always conduct your own backtests and research before making any investment decisions. 🚀

🚀 Key Benefits

✔️ Trend-Following + Relative Strength Hybrid

✔️ Rotational Capital Efficiency

✔️ De-risking in Weak Conditions

✔️ Optimized for Swing and Medium-Term Positioning

✔️ Visual Clarity + Smart Allocation

🔧 Settings Overview

• Color Mode – Switch visual palette for the base Trend

• Trend Color – Toggle trend-based bar coloring

• Enable Backtest Table – Show historical performance metrics

• Start Date – Control backtest window

🏁 Conclusion

Majors Sync is your intelligent rotation engine for crypto majors.

Instead of guessing which coin to hold, let the system rotate for you—objectively, consistently, and visually.

📈 Be in BTC when it leads. Switch to ETH or SOL when strength shifts. Sit in cash when needed.

📌 Master the market with precision and confidence | QuantEdgeB

🔹 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

🔹 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

Custom Settings Added

🌀 Dyn.EMA

- Median Length

Controls the smoothing base for the dynamic EMA. Lower values increase responsiveness.

Default: 2

- Dynamic EMA Length

The main length used to calculate the exponential moving average dynamically.

Default: 8

- SD Bands Length

Determines the lookback window for calculating standard deviation bands around the dynamic

EMA.

Default: 30

% Bollinger

- Base Length

Length parameter used to compute the classic Bollinger Band percentage deviation.

Default: 30

🌊 Alma SD Settings

- SD Alma Length

Period used in the calculation of the standard deviation of the Arnaud Legoux Moving Average

Default: 14

- Normalized Alma Length

Longer window used to normalize the Alma-based volatility readings.

Default: 50

🧠 FRMA Settings

These parameters control two instances of adaptive moving averages and their volatility envelopes.

- FRMA 1 Parameters:

- First MA Length

The base length for calculating the first fractal MA.

Default: 60

- Lower Limit

Minimum responsiveness constraint — the smaller the number, the faster the MA reacts.

Default: 25

- Upper Limit

Maximum smoothing constraint — a higher value slows the MA further.

Default: 80

- FRMA 2 Parameters:

- First MA Length

Default: 30_

- Lower Limit

Adaptive responsiveness lower threshold for the second FRMA.

Default: 18

- Upper Limit

Upper boundary for the second FRMA's smoothing capability.

Default: 80

- Volatility Envelope Weights:

- Upper SD Weight

Determines the scaling factor applied to the upper deviation band.

Default: 0.94

- Lower SD Weight

Determines the scaling factor for the lower deviation envelope.

Default: 1.06

---

Would you like a version with UI-style tooltips for Pine Script's `input()` doc lines too?

🛠️ MajorSync New Feature: Dynamic Allocation Strategies

We are excited to announce the latest upgrade to MajorSync — introducing Dynamic Allocation Modes to better match your risk appetite and market conditions.

🔹 Aggressive Mode

100% allocation into the strongest-performing asset. Perfect for traders seeking maximum exposure to momentum.

🔹 Semi-Aggressive Mode

An optimized 80/20 split between the leading asset and the second-best performer. This method captures upside while reducing concentration risk.

🔹 Conservative Mode

A 60/30/10 distribution, spreading risk across the top three assets. Designed for more cautious traders aiming for stability and steady growth.

Highlights:

• Allocation is updated dynamically based on MajorSync’s internal trend signals.

• Full support for new assets like SUI alongside BTC, ETH, and SOL.

• Customizable settings inside the system dashboard with real-time updates.

• Built for both high-volatility and trending market conditions.

Whether you're an aggressive momentum trader or prefer a balanced approach, MajorSync now automatically adapts for you.

📉 Problem: During crypto-wide weakness, the protocol previously defaulted to Cash Mode.

💡 Solution: Gold is now introduced as an alternative low-risk allocation, allowing exposure to a traditionally risk-off asset when crypto fails to show strength.

🧠 Why Gold?

• Crypto and stocks are both risk-on assets.

• Gold behaves as a macro hedge — often leading or offsetting crypto performance.

• While BTC ≠ Gold, their correlation is cyclical, not constant.

📊 The behavior is observable in the BTC/Gold ratio, and now reflected directly in allocation logic.

🧬 How It Works

If no crypto asset passes the universal strength filter:

→ Instead of going 100% cash, the system can rotate into Gold, maintaining productive exposure.

This change improves:

✅ System productivity during downturns

✅ Alignment with macro cycles

✅ Optional defense without full risk-off in cash

🧮 Allocation Logic

• 🥇 Always allocate to strongest filtered asset (Crypto or Gold)

• 🧾 If none qualify → system defaults to cash

• 🛡️ Gold enters as a strategic bridge between full exposure and full neutrality

⚠️ Important Notes

• This is not a signal to buy Gold directly — it’s an allocation option within the framework.

• Best use case: Medium-term rotation, macro-conscious portfolios, or risk-balanced exposure during sideways crypto phases.

🔹 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

🔹 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact QuantEdgeB directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.

Author's instructions

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

Disclaimer

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact QuantEdgeB directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.

Author's instructions

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only