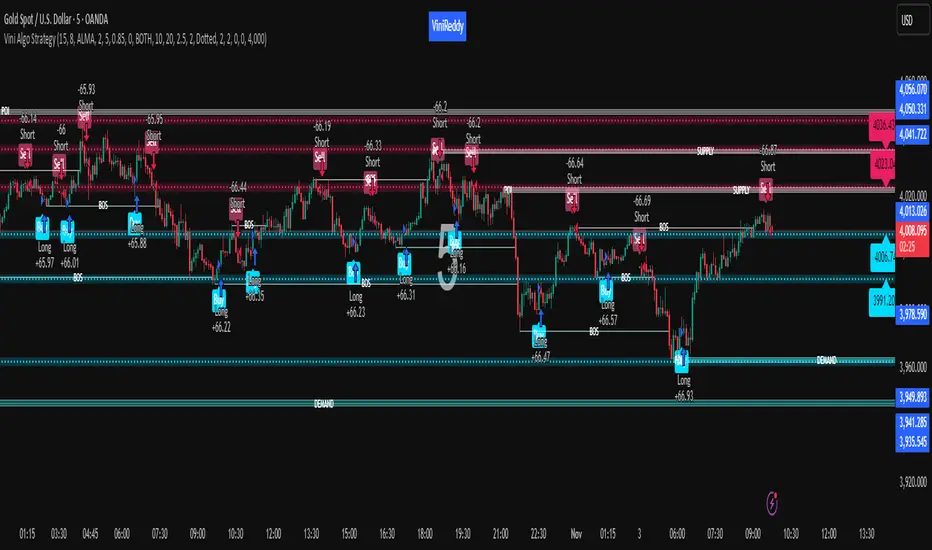

Vini Algo Strategy

I have spent quite a bit of time and I figured I would put it out to the community to share the work.

Ok, so let me say that I have spent some amount of time to make the indicator/Strategy not to repaint while still maintaining it's profitability. It has been a challenge so I am publishing.

What I have observed: the strategy will not repaint in real time.

Channel Balance

Bright Magenta Upper (Supply) side with Standard Deviation Interpretation +1σ, +2σ, +3σ above the mean — statistically “overbought” areas where price may reverse or slow down

Bright Cyan Lower (Demand) side with Standard Deviation Interpretation −1σ, −2σ, −3σ below the mean — “oversold” areas where buying interest may return

Supply Zone ---->> Resistance / Sell area

Demand Zone ------>> Support / Buy area

BOS ----->> Market structure break

Buy/Long markers ----->> Potential entry for long trades

Sell/Short markers ----->> Potential entry for short trades

Limitation on lower timeframe chart

That is, if you have the chart open and keep it open, the signals are the same as the ones that are sent out by the strategy. In certain cases, when I reload the chart- the signals might be off from what was sent. In some ways, that is repainting, but it is repainting based on losing the real time data and recalculating from a different set of bars- since I am running it on a one minute chart then the start becomes different when you refresh.

🧠 Price Action

Price action is the study of how price moves on a chart — without relying on indicators. If you master price action, you can trade confidently even without indicators — because you’ll understand what the market is telling you through structure, momentum, and liquidity.

How to Read Price Action Step by Step

Identify Market Structure

→ Are we trending or ranging?

Mark Key Levels

→ Swing highs/lows, supply/demand, liquidity zones.

Wait for Confirmation

→ BOS / CHoCH or rejection candles.

Align With Context

→ Where are we in the larger timeframe? (Top-down analysis)

Enter on Reaction

→ Wait for a clear rejection, engulfing candle, or BOS confirmation near your zone.

Manage Risk

→ Stop-loss below swing (for longs) or above swing (for shorts).

Having a good strategy is essential, but it’s only one piece of the puzzle. To be a consistently successful trader, you need a combination of psychology, risk management, discipline, and process — the things that keep you profitable when the strategy itself faces drawdowns.

1. Trading Psychology 🧠

2. Risk & Money Management 💵

3. Trading Plan & Strategy 📈

4. Discipline & Consistency 🧩

5. Continuous Learning & Review 🔍

💬 Final Thought

“Indicators follow price.

Price follows order flow.

To understand order flow — study price action.

⚠️ Disclaimer:

This indicator is intended for educational purposes only and should not be considered financial advice. Always use proper risk management.

"Trading involves risk. Trade responsibly.

No indicator gives 100% accurate signals."

Please forward test first and use at your own risk.

If you spot repaint issues, please Read the the Limitations again.

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact ViniReddy directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.

Author's instructions

Disclaimer

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact ViniReddy directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.