Trade ideas

US30 Technical Breakdown – 10/09/2025📍 US30 Technical Breakdown – 10/09/2025

US30 consolidating near 46,650 after rejecting the 46,900 zone 🧱

Momentum slowing — EMAs flattening, signaling indecision between bulls and bears ⚖️

📊 Market Behavior:

🔹 Price ranging between 46,450 – 46,900

🔹 Multiple rejections at 46,900 resistance

🔹 Support holding around 46,500 area

📌 Key Levels:

🔹 Resistance Zones:

46,700 → intraday ceiling

46,892 → major resistance

46,900–47,000 → breakout zone 🚀

🔹 Support Zones:

46,533 → local support

46,440 → key demand area

46,250 → deeper support

45,837 → downside target

🧠 Bias:

Neutral–Bullish ⚖️

➡️ Above 46,700 → retest of 46,900 likely

⬅️ Below 46,440 → bearish move toward 46,250

DowJones Key trading levels ahead of FOMC minutesKey Support and Resistance Levels

Resistance Level 1: 46930

Resistance Level 2: 47060

Resistance Level 3: 47200

Support Level 1: 46420

Support Level 2: 46290

Support Level 3: 46190

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US30: Next Move Is Up! Long!

My dear friends,

Today we will analyse US30 together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 46,689.60 will confirm the new direction upwards with the target being the next key level of 46,759.66 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

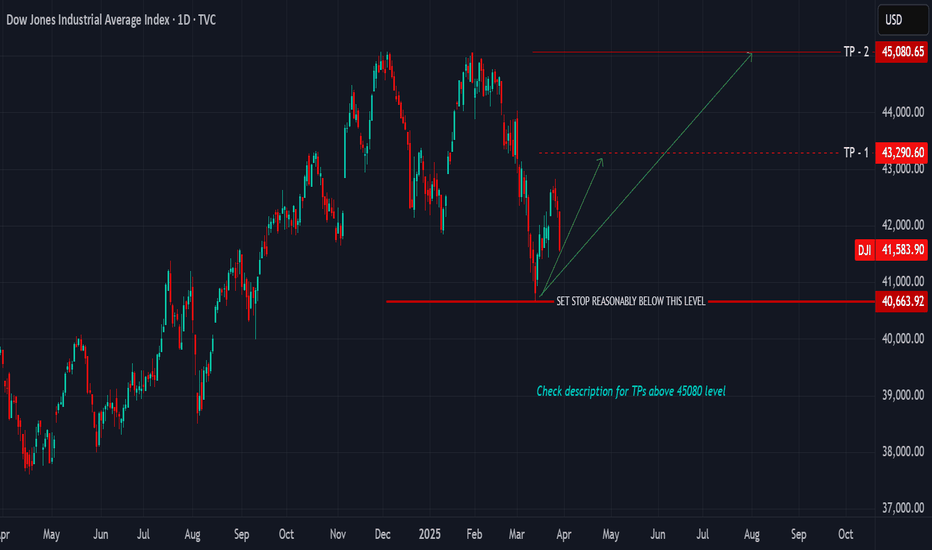

BUY EVERY DIP, HOLD FOR THE NEXT 7-MONTH CYCLE UNTIL OCTOBERThere are the current turmoil by tariffs and perceived recession, yet, the cycles strongly support a further advance from the March lows until October 2025. The bottom in March 2020 formed the base for the 5 year bull cycle nested within the larger 13 year cycle.

PRICE

The 2020 crash low formed at 18213.65, the decline in 2022 formed a bottom at 28660.94. We would have a price range Low - Low of (+10447.29 pts)

(28660.94 - 18213.65) = 10447.29 units

By projection if the range between the first two bottoms is 10447.29 we would expect the third bottom connecting three expanding points to be at 1.618 of 10447.29 points from 28660.94

28660.94 + (10447.29 x 1.618) = 45564.66

This makes the current top at 45073.63 through 45564.66 level a major support whereas its also a minor resistance for some correction and we expect price to move through this level.

TIME

Time connecting the three points 23/03/2020 - 03/01/2022 - 10/10/2022 with March 2020 as starting point would give us a time count (0.0 - 651 days - 931 days).

We find that between the two bottoms the top in Jan 2022 came in at 651 days. By projection we expect the next bottom to be at least 209 weeks or 1463 days from 10/10/2022 with a top located at a Phi variation of 651.

We would project a time range 1064 - 1099 days for a top and a decline into the third bottom 1463 days from 10/10/2022 and 2394 days from 23/03/2020. Trade safe, good luck.

THE BIG TOP ... THE MID-CYCLE CORRECTION COMES SOONTHE BULL IS NOT DEAD YET...

Alternate Cycle progression puts 1942 - 1947, 1982 - 1987. and 2022 - 2027 on the same phase of a larger 20-year cycle. This is the smallest growth cycle that completes in approximately five (5) years. It forms the first section of every alternate 20-year cycle and carves out a very identical fractal. This fractal remerges every 40 to 43 years. This is the basis of Gann's 43-year cycle repetition.

1942 - 1947 5-year cycle

1982 - 1987 Cycle

2022 - 2027 Cycle in progression

Putting the price and time advances into a cumulative progression suggests that we are getting closer to a first correction at 47200 level. It also suggests that the next time and price for the current cycle is measurable and quantifiable with a very slim margin for error.

27th October is a major timeline to watch

Beyond that we have March 2026

TRADE PLAN:

We will close all buy entries in October

We will buy again in May 2026 for another 2-year bull cycle.

Follow for more updates

Can the DJIA Maintain Its Momentum? A Strategic Long Setup📈 DJIA Money-Making Plan: Thief Strategy (Swing/Day Trade) 🕵️♂️

🚀 Swing/Day Trade Setup for Dow Jones Industrial Average (DJIA) CFD

Join the "Thief OG" crew with this bullish plan to navigate the market with precision! Using a layered limit order strategy, this setup targets smart entries and calculated exits while keeping risk management first. Let’s dive into the plan! 💥

📊 Trade Plan Overview

Asset: Dow Jones Industrial Average (DJIA) CFD 💰

Direction: Bullish 🐂

Current Price (Sep 10, 2025): 45,711 🟢 (+0.43% from previous close)

Strategy: Thief Layered Limit Order Strategy 🕵️♂️

Place multiple buy limit orders at key levels to "steal" entries during pullbacks.

Suggested Entry Levels: $45,400, $45,500, $45,600, $45,700 (or customize based on your analysis).

Note: You can add more layers or adjust levels to suit your risk appetite. Flexibility is key! 🔧

Stop Loss (SL): $45,100 (Thief OG’s starting point).

Important: Adjust your SL based on your strategy and risk tolerance. This is a suggestion, not a rule! ⚠️

Target Price (TP): $46,600 (Escape before the "police barricade"!).

Note: Set your own TP based on your goals. Take profits at your discretion—don’t follow blindly! 💸

Risk Disclaimer: Dear Traders (Thief OG’s), this plan is a guide, not a guarantee. Always trade at your own risk and adjust SL/TP to your strategy. Protect your capital! 🛡️

🧠 Why This Plan? Thief Strategy + Market Insights

The "Thief" strategy uses layered limit orders to capitalize on pullbacks in a bullish trend, backed by solid market data. Here’s why this setup shines:

Thief Technical Strategy 🕵️♂️:

Layered Entries: Multiple buy limit orders ($45,400–$45,700) allow you to scale into the trade during dips, maximizing entry precision.

Risk Management: Suggested SL at $45,100 protects against unexpected reversals. Customize to your comfort level.

Profit Potential: Target $46,600 aligns with resistance levels and recent momentum. Exit strategically to lock in gains.

Fundamental & Macro Score: 7/10 (Solid Foundation) 🟢

Earnings Growth: Expected 7-10% for 2025, driven by strong corporate balance sheets.

Sector Strength: 10/11 S&P sectors up YTD, with tech and industrials leading.

Macro Environment:

Cooling inflation (CPI ~3.1% YoY).

Fed rate cuts expected, supporting growth.

Mild headwinds from tariffs and global trade risks.

Resilient labor market (unemployment 4.3%) and consumer spending fuel upside.

Trader Sentiment Outlook 😊:

Retail: 51% Bullish 🟢 | 34% Bearish 🔴 | 15% Neutral ⚪

Optimism driven by dip-buying in tech and industrials.

Institutional: 45% Bullish 🟢 | 40% Bearish 🔴 | 15% Neutral ⚪

Cautious positivity, focusing on corporate fundamentals amid policy uncertainties.

Overall Mood: Mildly positive, but stay alert for volatility from trade talks or inflation data.

Fear & Greed Index: 51 (Neutral) ⚖️

Balanced emotions: Not too scared, not too greedy.

Steady momentum, but watch for volatility spikes with upcoming data (e.g., inflation reports).

Market Outlook: Bullish 🚀

Bullish trend intact with no recession signals.

Expect modest single-digit % gains, led by earnings.

Stay cautious of pullbacks from policy news, but avoid shorting for now.

🔗 Related Pairs to Watch (in USD)

S&P 500 CFD ( SP:SPX ): Tracks broader market trends, often moves in tandem with DJIA.

NASDAQ 100 CFD ( NASDAQ:NDX ): Tech-heavy index, great for confirming bullish momentum.

FX:USDJPY : Currency pair sensitive to U.S. economic data and Fed policy.

OANDA:XAUUSD (Gold): Safe-haven asset; monitor for risk-off moves if sentiment shifts.

📝 Final Notes

This DJIA setup combines the tactical "Thief" layered entry strategy with robust market data to guide your trades. Stay disciplined, manage risk, and adapt the plan to your style. Let’s make smart moves together! 💪

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#TradingView #DJIA #SwingTrading #DayTrading #ThiefStrategy #Bullish #TechnicalAnalysis #MarketAnalysis

Dow Jones Bullish Strategy! Can the Market Break Higher?🚀 US30 Index Money-Making Plan (Swing / Day Trade) 📊

🧠 Trading Plan & Strategy (Thief Layer Style)

🚀 Approach: Bullish Hull Moving Average pullback plan — “bulls reloaded” for the next wave.

🎯 Entry (Layering Strategy): Multiple buy-limit layers → 45,200 • 45,300 • 45,400 • 45,500 (flexible to add more based on your own plan).

🛡️ Stop Loss: Reference point at 45,000. Adjust SL responsibly to match your personal risk tolerance & style.

💰 Target: Potential resistance zone (the “police barricade”) sits near 46,300. That’s where traders may consider taking profits.

📢 Note: This is an illustrative plan based on technicals — every trader should adapt TP/SL to their own strategy and risk appetite.

📊 US30 Market Report – September 4, 2025

📈 Current Price Snapshot

Trading near 45,000 points, up 0.05% today.

Strong monthly performance (+2.4%) and robust yearly gains (+17%).

Market showing resilience despite trade tensions.

😊 Retail Traders’ Sentiment

60% long vs 40% short → Tilted bullish.

Optimism driven by hopes for earnings growth & Fed rate cuts.

Caution remains due to tariff risks.

🏦 Institutional Traders’ Outlook

Cautiously bullish positioning.

Demand for equities continues, but with moderated exposure.

Buybacks + foreign inflows supporting price action.

🌡️ Overall Investor Mood

Neutral to positive tone.

Economic resilience balanced against policy uncertainty.

Healthy breadth across sectors, not just tech.

😨 Fear & Greed Index

Currently at 52 (Neutral).

Suggests balance — no extremes dominating.

Neutral setups often precede steady gains.

💹 Fundamental Score → 8/10

Strong corporate earnings (+12–13% growth projected next year).

Balance sheets remain solid.

AI & tech themes boosting key components.

Tariffs still a drag, but diversified exposure helps.

🌍 Macro Score → 7/10

US GDP growth cooling to 1.5%, but global rebound supports outlook.

Inflation ~2.9%; Fed rate cuts expected later.

Labor market stable, policy clarity could add upside.

🐂 Overall Market Outlook: Bullish Bias 📈

If support at 45,000 holds, potential move higher toward 46,000+.

Drivers: Strong earnings, Fed easing, broad rally.

Watch: Trade news headlines remain a key risk factor.

🔎 Why This Plan?

Hull MA pullback indicates momentum continuation.

Layered entries provide flexibility & better risk distribution.

Market sentiment + fundamentals align with bullish bias.

Resistance at 46,300 offers a clear take-profit zone.

📌 Related Pairs to Watch

CAPITALCOM:US30

FOREXCOM:SPX500

EIGHTCAP:NDQ100

TVC:VIX

TVC:DXY

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#US30 #DowJones #Indices #SwingTrading #DayTrading #TechnicalAnalysis #StockMarket #TradingPlan #HullMA #LayeringStrategy

DOW JONES ANALYSIS💸 DOW JONES 💸

Chart: 1H

Overall Trend: Bullish

Current Market Structure: Short-Term Bearish

After the initial gap up & bullish push, price has been ranging in a tight consolidation zone with small candles — indicating indecision.

Scenario 1:

Bullish Continuation (Preferred if Demand Holds)

• Price retraces into the GAP UP demand zone (≈ 46,770–46,730).

• Bullish reaction here (strong wick / engulfing candle) could provide a buy setup targeting:

• First target: 46,910–46,960 (recent high)

• Final target: New ATH zone (47,051–47,088)

Scenario 2:

Deeper Pullback

• If price fails to hold the gap demand zone, expect a deeper retracement toward 46,600–46,560, which is the next structural support.

✅ Summary:

The bias remains bullish, but a short-term retracement to fill the gap demand zone is likely before a push toward new highs. A clean rejection or bullish engulfing in that zone would offer a high-probability long setup.

$DJI📊 Key Market Predictions This Week

1️⃣ NY Fed Inflation Data (Tuesday): Prices in NY are already climbing inflation is back in the market.

2️⃣ Fed Meeting Minutes (Wednesday): Expect signals that the Fed is trying to better manage the economy. With the government shutdown, money and policy are being rearranged.

3️⃣ Powell Speaks (Thursday): His tone could set the stage for how aggressive or cautious the Fed will be moving forward.

4️⃣ MI Consumer Data (Friday): Sentiment may look steady as “buy now, pay later” options continue to keep spending alive.

5️⃣ Jobs Report (Friday, if shutdown ends): We could see a pickup, reflecting that investments are still entering the market despite uncertainty.