ASHOKLEY - Very Strong but time to fall?

CMP: 205.87

TF: Multiple

Observation:

The script is extremely bullish, hence, dont try to short without confirmation (break of recent swing lows).

TIME CYCLE ANALYSIS:

27th Aug 2024 is when this stock made a top and declined significantly. Tomorrow (12th Feb 2025) marks the 365 bars (trad

Ashok Leyland Limited

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.64 INR

31.07 B INR

484.82 B INR

3.52 B

About Ashok Leyland Limited

Sector

CEO

Shenu Agarwal

Website

Headquarters

Chennai

Founded

1948

IPO date

Nov 3, 1994

Identifiers

2

ISIN INE208A01029

Ashok Leyland Ltd. engages in the manufacture and sale of commercial, defense vehicles, and power solutions. The company was founded by Raghunandan Saran on September 7, 1948 and is headquartered in Chennai, India.

Related stocks

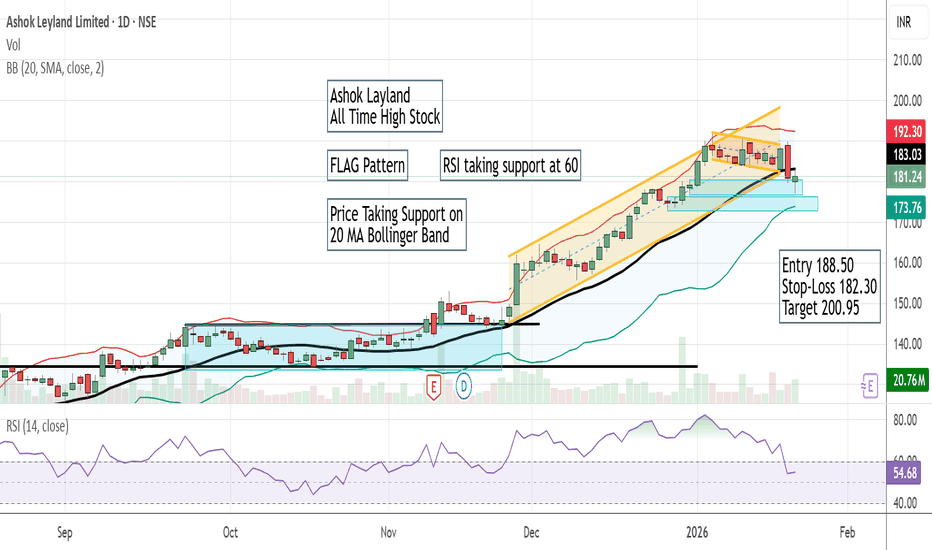

Ashok Leyland at New Highs – Can ₹190 Act as the Launchpad...?Ashok Leyland | ATH Breakout + Retest Setup 🚀

Ashok Leyland has delivered a clean breakout above its previous all-time high of ₹190 after three failed attempts, and has now printed a fresh high near ₹198, signaling strong bullish strength.

The stock is currently expected to retest the breakout zon

Ashok Leyland: Breakout or Bull Trap?Ashok Leyland has broken the ₹191.42 resistance and is now trading around ₹192–193.

Technically it looks like a breakout — but in context, this move looks suspect.

Why this may be a false breakout:

Breakout happened in a premium valuation zone

(P/E ~34.8 | P/B ~9.0)

Growth has decelerated (EPS ~2

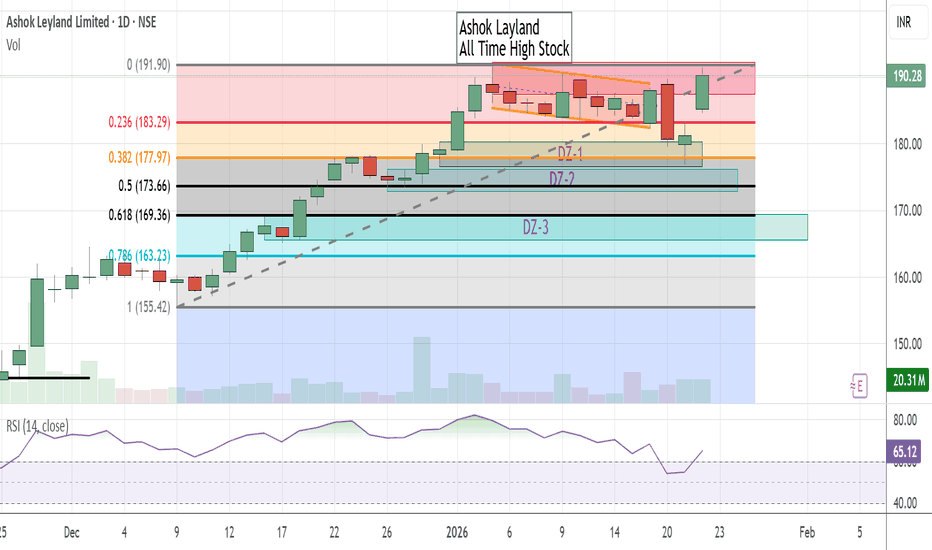

Ashok Leyland Demand ZoneIn our last idea share on Ashok Leyland we have guessed that price may travel above the LAST STRONG GREEN CANDLE or it may breach its low. on 20th Jan 2026 it breached its low.

Below this Flag Pattern we can observe two Demand Zones which are Level over Level. Today price has reached first Demand Zo

Ashok Leyland Demand ZoneIn our last idea share on Ashok Leyland we have guessed that price may travel above the LAST STRONG GREEN CANDLE or it may breach its low. on 20th Jan 2026 it breached its low.

Below this Flag Pattern we can observe two Demand Zones which are Level over Level. Today price has reached first Demand Zo

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of ASHOKLEY is 204.63 INR — it has decreased by −2.19% in the past 24 hours. Watch Ashok Leyland Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Ashok Leyland Limited stocks are traded under the ticker ASHOKLEY.

ASHOKLEY stock has risen by 2.43% compared to the previous week, the month change is a 11.44% rise, over the last year Ashok Leyland Limited has showed a 85.52% increase.

We've gathered analysts' opinions on Ashok Leyland Limited future price: according to them, ASHOKLEY price has a max estimate of 250.00 INR and a min estimate of 150.00 INR. Watch ASHOKLEY chart and read a more detailed Ashok Leyland Limited stock forecast: see what analysts think of Ashok Leyland Limited and suggest that you do with its stocks.

ASHOKLEY reached its all-time high on Feb 4, 2026 with the price of 205.19 INR, and its all-time low was 0.69 INR and was reached on Apr 28, 1999. View more price dynamics on ASHOKLEY chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ASHOKLEY stock is 4.45% volatile and has beta coefficient of 0.92. Track Ashok Leyland Limited stock price on the chart and check out the list of the most volatile stocks — is Ashok Leyland Limited there?

Today Ashok Leyland Limited has the market capitalization of 1.24 T, it has increased by 2.98% over the last week.

Yes, you can track Ashok Leyland Limited financials in yearly and quarterly reports right on TradingView.

Ashok Leyland Limited is going to release the next earnings report on May 22, 2026. Keep track of upcoming events with our Earnings Calendar.

ASHOKLEY earnings for the last quarter are 1.36 INR per share, whereas the estimation was 1.57 INR resulting in a −13.56% surprise. The estimated earnings for the next quarter are 2.32 INR per share. See more details about Ashok Leyland Limited earnings.

Ashok Leyland Limited revenue for the last quarter amounts to 115.93 B INR, despite the estimated figure of 113.86 B INR. In the next quarter, revenue is expected to reach 141.26 B INR.

ASHOKLEY net income for the last quarter is 8.13 B INR, while the quarter before that showed 7.56 B INR of net income which accounts for 7.64% change. Track more Ashok Leyland Limited financial stats to get the full picture.

Ashok Leyland Limited dividend yield was 3.06% in 2024, and payout ratio reached 59.07%. The year before the numbers were 4.06% and 82.17% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 13, 2026, the company has 34.87 K employees. See our rating of the largest employees — is Ashok Leyland Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Ashok Leyland Limited EBITDA is 104.28 B INR, and current EBITDA margin is 19.14%. See more stats in Ashok Leyland Limited financial statements.

Like other stocks, ASHOKLEY shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Ashok Leyland Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Ashok Leyland Limited technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Ashok Leyland Limited stock shows the buy signal. See more of Ashok Leyland Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.