BAT/USDT , 1W BAT has moving same as previous moves , so it will give nearly 85 % UP move very strong if it breaks the upper trendline in Weekly and strong candle close .

Main important points are

1. BTC Dominance is falling Daily

2. ETH Dominance is increasing

3. Altcoins Dominance is Increasing

Means V

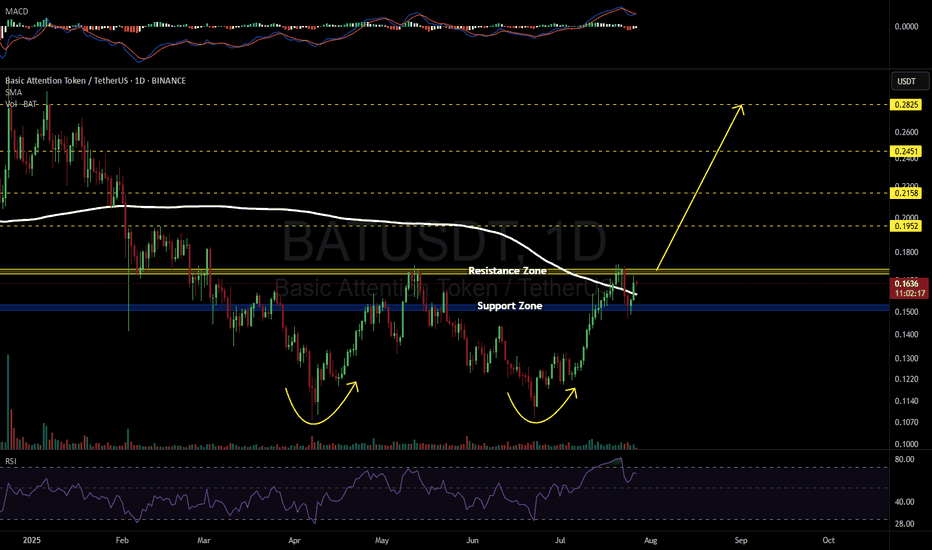

BAT/USDT — Critical Zone: Breakout or Breakdown Ahead?Summary:

BAT is currently consolidating at a critical support zone after a prolonged downtrend. Price action is being squeezed between a descending trendline from late 2024 highs and a strong horizontal support area at 0.1438–0.1512 (Fibonacci 0.618 & 0.5). This structure has formed a descending tri

BAT. Currency of the most used browser in the world.There are targets on the chart that look key - they have influence on price like a magnet and medium-term for BITMEX:BAT looks 120% coded. But we shouldn't forget about long-term either, when euphoria smoke settles - utility will ultimately be key here unless it's viral cult memes.

BATUSDT 1D#BAT has formed a double bottom pattern on the daily chart. It recently bounced off the support zone and broke above the daily SMA200, which is a bullish signal. Now, all eyes are on the resistance zone.

In case of a breakout above it, the upside targets are:

🎯 $0.1952

🎯 $0.2158

🎯 $0.2451

🎯 $0.282

BAT/USDT Golden Zone: Massive Rebound Potential from Historical 🔶 1. Strong Support Zone (Highlighted in Yellow):

A key demand zone lies between $0.080 – $0.1212.

This area has acted as strong support multiple times since 2020, showing signs of institutional accumulation or whale interest.

🔼 2. Bullish Reversal Scenario:

A recent bounce from this golden supp

batusdt next move?🚀 BAT Coin Opportunity Alert

If BAT touches the 0.134 USD level — don’t miss the opportunity to enter! 📈

Even if BAT doesn’t hit 0.134,

✅ You can still enter if Bitcoin (BTC) drops to 90K, as the setup will remain strong.

Stay ready, manage your risk, and take advantage of the move!

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.