General Motors: Turning Headwinds into GrowthWhen the global auto industry was rattled by tariffs, regulatory uncertainty, and the volatile EV market, many would have expected General Motors NYSE:GM to struggle. Instead, the Detroit giant did something remarkable: it turned challenges into opportunities.

In a single day after reporting earn

Key facts today

General Motors (GM) announced a reduction of nearly 3,300 positions as part of its efforts to streamline operations and prioritize cost savings amid a challenging economic environment.

General Motors, alongside Tesla, Toyota, and Ford, has asked the U.S. government to extend the USMCA, highlighting its importance for U.S. auto production and industry cost savings.

1,000 ARS

5.50 T ARS

171.64 T ARS

About General Motors Company

Sector

Industry

CEO

Mary Teresa Barra

Website

Headquarters

Detroit

Founded

1908

ISIN

ARBCOM460408

FIGI

BBG018186K10

General Motors Co. engages in the designing, manufacturing, and selling of trucks, crossovers, cars, and automobile parts, and in providing software-enabled services and subscriptions. It operates through the following segments: GMNA, GMI, Cruise, and GM Financial. The company was founded by William C. Durant on September 16, 1908 and is headquartered in Detroit, MI.

Related stocks

GM Short 5M DayTrade Conservative CounterTrend TradeConservative CounterTrend Trade

+ short impulse

+ T2 level

+ resistance level

+ volumed 2Ut-?

+ weak test

+ first selling bar close entry

Calculated affordable stop loss

1 to 2 R/R take profit

I also bought puts at $4.91 for March 20th

1H CounterTrade

"- long balance

+ unvolumed expanding CREEK

+

General Motors (GM) Shares Hit All-Time HighGeneral Motors (GM) Shares Hit All-Time High

As shown on the General Motors (GM) stock chart:

→ During yesterday’s intraday session, the share price climbed above $67.40, surpassing the previous record high set in January 2022.

→ GM was among the top performers on the stock market, rising by aroun

General Motors Could Be AcceleratingGeneral Motors has pushed higher amid low volatility, and some traders may think the automaker is starting to accelerate.

The first pattern on today’s chart is the series of higher lows since mid-August. Prices mostly remained below $59 until last week, creating an ascending triangle. They now seem

GM Breakout Watch – Calls Ready to Pop🚀 GM Swing Trade – \$58 Calls in Play!**

**Moderate Bullish Bias | Aug 15, 2025**

**📊 Key Highlights:**

* **RSI:** 74.2 – Strong bullish momentum 🔥

* **Price Momentum:** 5D +6.0%, 10D +8.0% 📈

* **Volume:** Weak ⚠️ (1.0x avg vs 1.3x needed)

* **Options Flow:** Neutral – No strong institutional lea

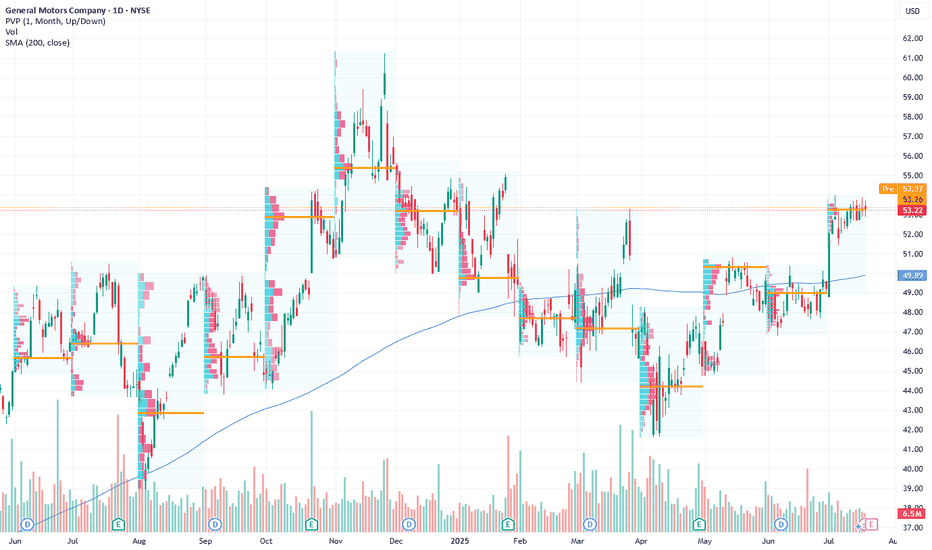

General Motors: Strong EV Strategy and Earnings Momentum Signal Current Price: $53.22

Direction: LONG

Targets:

- T1 = $54.45

- T2 = $55.54

Stop Levels:

- S1 = $52.34

- S2 = $51.10

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify

General Motors (NYSE: $GM) Reports 17% Y0Y in Q12025 Sales General Motors (NYSE: NYSE:GM ) opened at $44.46 on April 4th, 2025, down 3.91%. The stock declined $1.80 in early trading. This came a day after Trump’s new 25% auto import tariffs took effect. In a report released on April 2nd, GM delivered 693,363 vehicles in Q1 2025, a 17% year-over-year increa

GM Stock Chart Fibonacci Analysis 032125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 48/61.80%

Chart time frame: C

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E

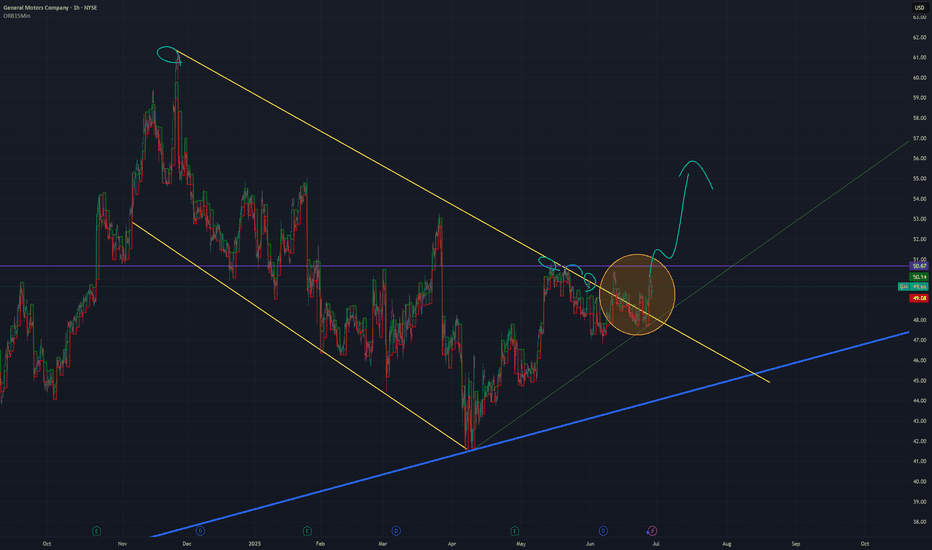

GM 1H Long Swing Conservative CounterTrend TradeConservative CounterTrend Trade

+ long impulse

+ volumed SOS test / T2 level

+ support level

+ 1/2 correction

+ biggest volume Sp

Calculated affordable stop limit

1 to 2 R/R above 1D T1 before 1/2 1M

Daily CounterTrend

"- short balance

- unvolumed expanding T1

+ volumed 2Sp+

+ test"

Monthly Trend

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

G

GM5502199

General Motors Financial Company, Inc. 6.75% 20-NOV-2028Yield to maturity

6.42%

Maturity date

Nov 20, 2028

G

GM5565379

General Motors Financial Company, Inc. 5.85% 20-APR-2029Yield to maturity

6.27%

Maturity date

Apr 20, 2029

G

GM5509429

General Motors Financial Company, Inc. 5.75% 20-DEC-2026Yield to maturity

6.07%

Maturity date

Dec 20, 2026

G

GM6006873

General Motors Financial Company, Inc. 5.7% 20-FEB-2033Yield to maturity

5.60%

Maturity date

Feb 20, 2033

G

GM6013226

General Motors Financial Company, Inc. 5.6% 20-FEB-2033Yield to maturity

5.58%

Maturity date

Feb 20, 2033

See all GM bonds

Curated watchlists where GM is featured.