Key facts today

Citi strategist Scott Chronert identified Microsoft as a key player in the megacap growth trade, representing about 20% of the S&P 500's market value.

Michael Burry identifies Microsoft as a major player in the AI sector, predicting nearly $3 trillion in AI infrastructure spending over the next three years.

Morgan Stanley analysts warn that major tech stocks like Microsoft could face declines due to possible shifts in Federal Reserve policy, which may lead to rate cuts.

525 ARS

105.44 T ARS

291.72 T ARS

About Microsoft Corp.

Sector

Industry

CEO

Satya Nadella

Website

Headquarters

Redmond

Founded

1975

ISIN

ARDEUT110285

FIGI

BBG000FSR733

Microsoft Corp engages in the development and support of software, services, devices, and solutions. It operates through the following business segments: Productivity and Business Processes; Intelligent Cloud; and More Personal Computing. The Productivity and Business Processes segment comprises products and services in the portfolio of productivity, communication, and information services of the company spanning a variety of devices and platform. The Intelligent Cloud segment refers to the public, private, and hybrid serve products and cloud services of the company which can power modern business. The More Personal Computing segment encompasses products and services geared towards the interests of end users, developers, and IT professionals across all devices. The firm also offers operating systems; cross-device productivity applications; server applications; business solution applications; desktop and server management tools; software development tools; video games; personal computers, tablets; gaming and entertainment consoles; other intelligent devices; and related accessories. The company was founded by Paul Gardner Allen and William Henry Gates III in 1975 and is headquartered in Redmond, WA.

Related stocks

MSFT 1HR 11/18/2025Description of the Chart

This analysis is shared strictly for educational purposes and is not financial advice. It is intended to illustrate chart-reading techniques, structure mapping, and scenario planning.

The chart is a 1-hour price chart of Microsoft Corp. (MSFT) with technical analysis marki

Microsoft Approaches Key Level, Expands Xbox Design Lab GloballyMicrosoft has announced a major expansion of its Xbox Design Lab through a new global partnership with ESW, significantly widening its international ecommerce footprint. Xbox Design Lab allows gamers to create personalized Xbox Wireless Controllers and Elite Series 2 controllers. With ESW now servin

MSFT WARNING!Here is a closer view of the chart I posted back on Oct 5, 2024, for a nice profitable -25% drawdown.

This time will be far more profitable.

Here is a breakdown of the chart.

- Up against a 38-year trendline.

- A rare 5-wave rising wedge.

- A H & S with a head test

- Big Ass Gap Below

- Doubl

Nvidia’s Pre-Earnings Harmonic Setup - Do Technicals Work?Coming off our recent conversation about technicals vs. fundamentals—and a great question from you guys about whether technicals work the same in every market—I wanted to take a minute to clear something up: Yes, technicals absolutely work across all markets. The same historical patterns have been r

MSFT at a Turning Point – Key Levels to Watch for Nov. 201-Hour Outlook

MSFT has been in a clean down-channel, but today's late-session recovery finally broke above the short-term lower trendline. Price is now pushing into a critical resistance zone around $502–$505, which has rejected multiple times this week.

Key levels from the 1-hour structure:

* Firs

MSFT Selling Pressure Activated — Time to Short!🔥 MSFT Bearish Profit Playbook — Thief-Style Layer Attack Activated! 🔥

Asset: MSFT — Microsoft Corporation (NASDAQ)

Style: Swing / Day-Trade Playbook 📉💼

📉 Plan: Bearish Pressure Play — Smart Sell-Side Thief Approach

Microsoft is showing potential exhaustion on the upside, and this setup focuses on

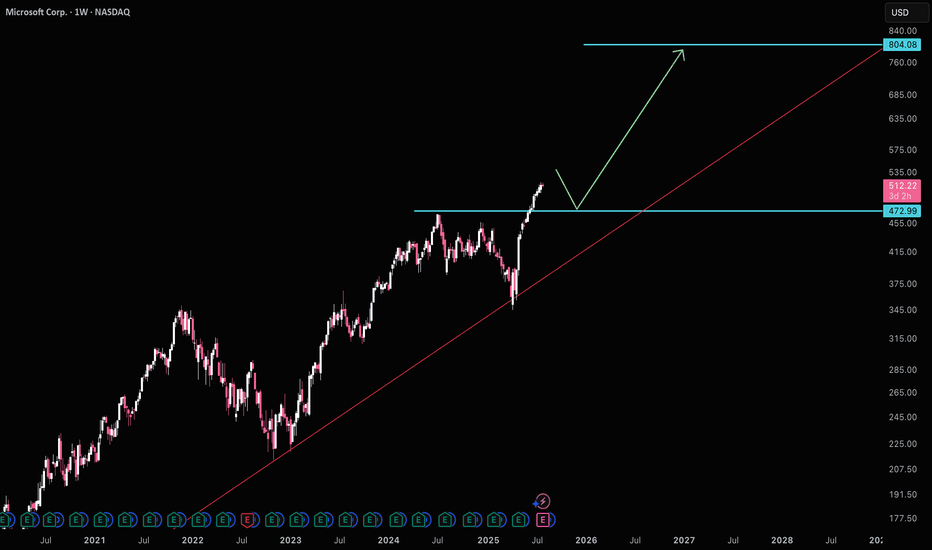

MSFT: Final Dip Before the Next LeapPrevious Idea:

Microsoft (MSFT) shows the stock is enduring a significant correction, which is the final pullback before a massive rally. This phase, labeled wave (4), is expected to find its bottom within a key support area. Traders are looking for this downswing to complete anywhere between the

Microsoft: Stuck in Sideways PatternMicrosoft shares have continued to show weakness recently, although the stock has shifted into more of a sideways pattern. In the near term, we anticipate another downward move, which should establish the low for wave (4) in magenta within our green Target Zone between $477.87 and $451.84. From our

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ATVI4499883

Activision Blizzard, Inc. 4.5% 15-JUN-2047Yield to maturity

6.87%

Maturity date

Jun 15, 2047

ATVI5026499

Activision Blizzard, Inc. 2.5% 15-SEP-2050Yield to maturity

6.03%

Maturity date

Sep 15, 2050

See all MSFT bonds

Curated watchlists where MSFT is featured.