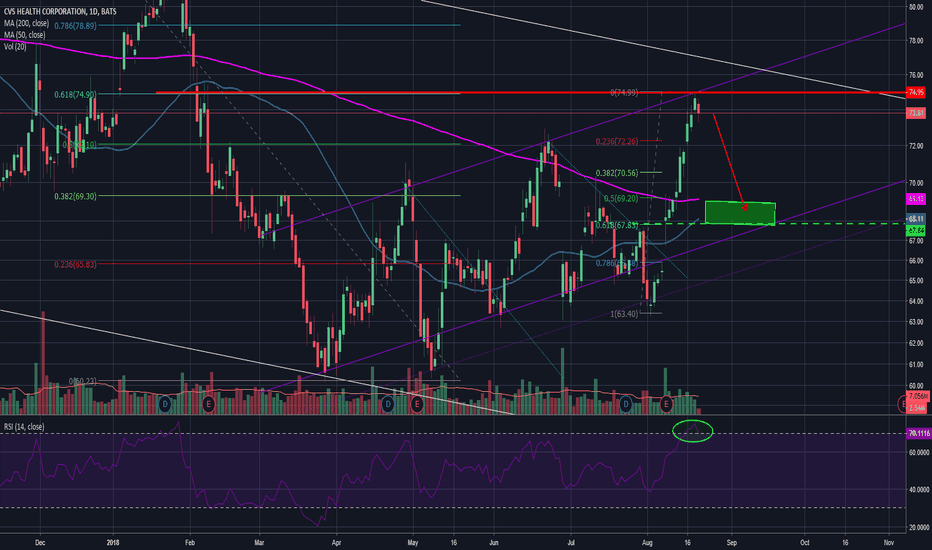

$CVS The Winner of Retail PharmacyAscending triangle in the making

RSI and MACD are sells right now

Look for a drop in the next few days to 77 within the ascending triangle range, then up and out from there

Fundamentally, CVS is one of my favorite companies. It will transform the healthcare space (overview below)

CVS officially closed on its Aetna deal over the last few weeks.

Most are unaware of the implications of such a deal. CVS now owns a health insurer, PBM, thousands of pharmacies, and quite possibly the most important piece that most are unaware of, their minute clinics located within stores.

When you need to see a health care professional, you can now walk into a CVS, get diagnosed, pick up your medication, and be billed through the same plan. Because of this one stop shop, CVS as a whole can begin to offer health packages for these conveniences at a much better rate than competitors since their costs will drop tremendously. They can pay their health care professionals a salary, rather than a diagnosis code that is much more expensive and variable to say the least. PBMs typically take a large cut, but CVS already owns Caremark .They own each piece of the healthcare chain that used to take a cut of profits. If CVS can get the internal workflow together, CVS will run the next generation healthcare space.

CVSCL trade ideas

CVS Long IdeaShould have posted this sooner, but have been shot down several times this year when getting constructive on this name

-CVS may finally be ready to break out

-The stocks been stuck for most of 2018; falling backwards each time it's attempted a run, usually due to some headline (Amazon getting in the space for example)

-Strong earnings and fundamental story; cyclically resilient business

- Still trading at less than half its historical PE

CVS Bounced Nicely Off Support, Potential To Rise Further! CVS bounced off its support at 63.28 (76.4% Fibonacci retracement, 100% Fibonacci extension x2, multiple swing low support) where it could potentially rise up to its resistance at 67.58 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal swing high resistance).

Stochastic (89, 5, 3) bounced off its support at 3.6% where a corresponding rise could occur.

CVS long following bottoming out, monthly bullish divergenceCVS has formed a descending triangle and daily appears to be closing above the upper triangle (break out). We have a monthly bull div on the RSI. A forming daily wedge will provide good stop for our trade. R:R lies in longing at break out confirmation.