betting that $82 is $UPS' bottomStrengths and Weaknesses

• UPS strengths

• Global reach with deep cross-border expertise

• Strong B2B relationships and contract logistics capabilities

• Reliable on-time performance and premium services (e.g., UPS Express Critical)

• UPS challenges

• Higher unit costs in dense urban last-mile compared to DSP model

• Shrinking share of consumer-ecommerce volumes during labor negotiations

• Amazon strengths

• Seamless integration between e-commerce platform and delivery network

• Dynamic capacity scaling via DSPs and micro-fulfillment centers

• Ability to absorb lower margins to drive Prime retention

• Amazon weaknesses

• Limited third-party client focus beyond its own marketplace

• Regulatory scrutiny on preferential treatment and marketplace leverage

Strategic Pathways for UPS to Compete

1. Double down on niche, high-margin segments

• Healthcare and life-sciences cold chain logistics

• Industrial supply-chain services with SLAs

2. Forge partnerships for urban last-mile

• Collaborate with local courier networks for cost-effective deliveries

• Launch hybrid models combining UPS hubs with third-party micro-fulfillers

3. Accelerate digital transformation

• Enhance real-time visibility platforms and customer APIs

• Deploy advanced analytics for predictive capacity planning

4. Expand value-added services

• Offer fulfillment-as-a-service for DTC brands

• Integrate financial, insurance, and returns management solutions

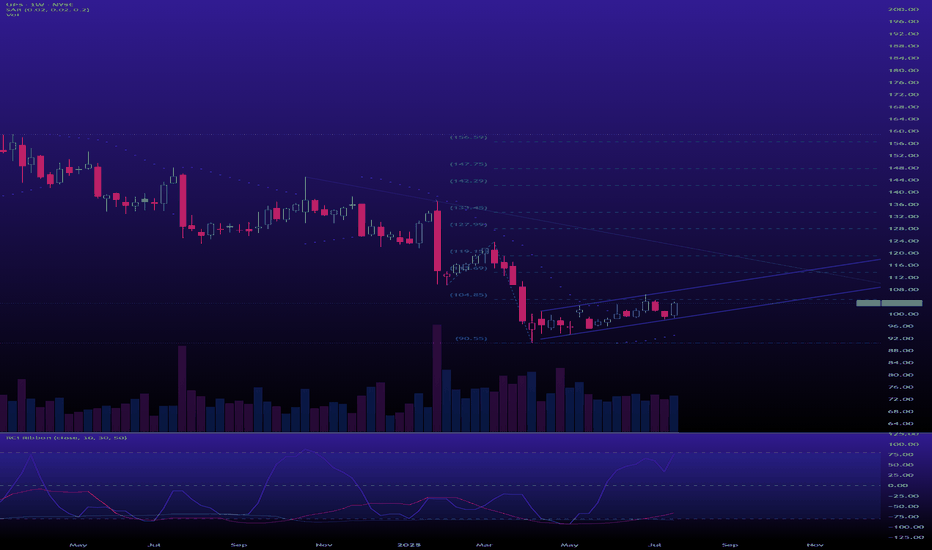

Trade ideas

UPS Support & Resistance Lines for September Month 2025This chart highlights September’s monthly support and resistance bands for UPS, built as “guardrails” around the month's price action. The outer bands mark the expected extremes, while the inner (half-step) lines act as intermediate pivot zones where price often pauses, flips, or accelerates. Think of them as a pre-mapped playbook for the month: upper band = supply, lower band = demand, with the midlines guiding targets and risk.

How I trade it

30-minute for 2–3 day swings

Setup: I wait for a 30-min close into a band (upper or lower) plus a clear reaction (wick rejection, momentum fade, or structure break).

Entry: Fade the move back toward the nearest midline when the reaction confirms; or ride a continuation if price accepts above/below a band and retests it from the other side.

Targets: First target is the nearest half-step line, second is the opposite half-step, final is the far band if momentum persists.

Risk: Stop goes just outside the band (for fades) or just back inside the band (for breakouts). If the 30-min closes back through my line, I’m out—no questions asked.

Management: Scale out at each line; move stops to break-even after TP1.

1–3 hour for weekly swings

Bias: I align 1h/2h/3h trend with where price sits relative to the monthly bands. Acceptance above a midline favors continuation to the next line; rejection at a band favors a mean-revert path.

Entry: Use a retest of the broken line on 1–3h candles for confirmation (close-through → retest → resume).

Targets: Next line on the map; let winners run to the next higher-timeframe band if structure holds.

Risk: Stop beyond the reclaimed line; I tighten weekly as soon as we tag the first target zone.

Playbook cues

Rejection at outer band → look for fades back to midline.

Acceptance and hold beyond a band → trade continuation into the next zone.

Stalls at half-step → take partials or tighten stops; these levels often “decide” the next leg.

Use the bands to plan entries, exits, and invalidations before the move. No predictions—just rules around predefined levels for September.

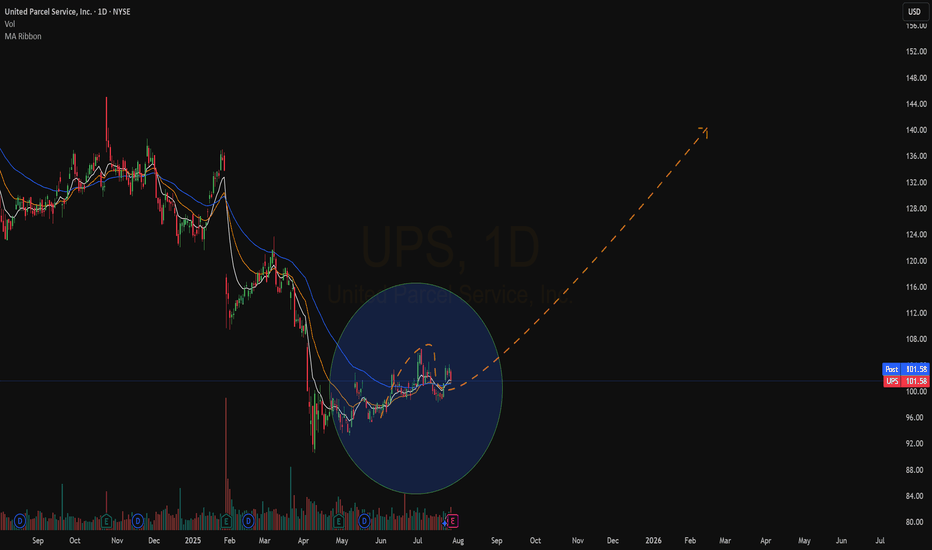

UPS - HTF Swing LongEntering previous demand and key level on UPS. Ideally a drop to 70-76 where we have a bit of confluence in terms of the HTF POC(most traded level). The negative 1 to 1 and Macro 0.618 retracement from ATL. Couple of ways to approach it. Either look for a reaction/setup between 70-76 IF given. Or look for a reclaim of the previous HTF low at 82. HTF upside targets would be 106ish which is the previous high and also the global VAH. Major target would be around 140 +-5 which is the ATH VAH and where anchored VWAP currently sits.

9/9/25 - $ups - LT buy, but not yet for me9/9/25 :: VROCKSTAR :: NYSE:UPS

LT buy, but not yet for me

- reading the last Q's transcript and a few conclusions

- this is a serious turnaround. typically that's not my jam.

- the amzn issue still not lapped, front and center highlights the crux of problems that need to be solved

- consumer/ parcels/ tariffs... still relevant overhang

investment wise

- we're entering tax loss sell off season

- this is either going to become "obvious" in the 70s if the market does a dunk tank in the coming weeks, or just pull a UNH... reversion, stall. that's where i'm targeting below $75 but *if/when and **why we get there. it has to be mkt related pullback

- 7% dividend yield probably not at risk, but again, i'm looking at fcf and we're about 6-7% on my figures. that's fine, but not enough

- could be something in a yield strategy for me into ye (rolling ITM covered calls e.g. the nov $80 strike for 8 and change caught my eye.

- usually these types of names can be canaries too, on tariff, consumer behavior etc. so that's why they're now front and center on my watchlist

- i'd not fault you for owning it here, maybe a good LT entry. just not my style at the moment. have a massive cash balance. i'm patient.

- a pew to the dome and i'd not be surprised to see mkt dump after fed cuts rates. just seen it too many times. then they come back to the table and light us up and we pay the bankers one more time into YE.

- so i'm in observation mode. scouting. position sizes comfy.

V

UPS: From Delivering Packages to Delivering ValueAs you probably know by now, my strategy consists of finding cheap, deep-value, beaten-up, underdog stocks. This is the strategy I've been using for the last 5 years and that allows me to consistently outperform the S&P 500 by 2x to 3x every year.

This does not guarantee that all my analyses are correct. But if I'm correct 6 or 7 times out of 10, then I'm a rich man!

Now back to UPS!

Over the last 3 years, the stock lost 64% of its value. But... did sales or income decline by the same account? Did margins decline? Did the company decrease its fleet by 60%?

The answer to all these questions is NO, and this is why I think the stock is undervalued.

Yeah, the tariff war and Amazon's slowing of the UPS agreement hurt sales, but these are transient.

Overview

UPS stock is down 64% since its ATH in 2022.

P/S ratio is at 0.8, the lowest since 2009.

P/E ratio is at 12.6, the lowest in the history of the stock

The P/B ratio is at 4.58, the lowest since 2006.

Dividend yield is at 7.8%.

The CEO recently bought $1 million worth of UPS stock.

This data gives us some clues. The stock is obviously underpriced, despite the fact that UPS is still one of the market leaders and the sales are stable.

Financial performance

Revenue: TTM $90.69 billion (+1.3% YoY); Revenue is improving, but still 10% down since the $100 billion in 2022.

Profitability: Operating margin 9.4% (TTM), net margin 6.4%;

EPS is now at $7.70, which is a similar level to what it was in 2020 and 2021, when the stock price was at $120. However, now the stock price is at $85.

Balance Sheet: Debt $26 billion, debt-to-equity 1.45x, which is totally fine.

Growth prospects

UPS is cutting costs and jobs, targeting $3.5 billion in savings by 2026 via automation/AI (5-7% annual cost reduction).

E-commerce will sustain long-term growth.

The company is innovating with AI-improved routes, self-driving trucks, and drones.

Technical Analysis

The stock price is right above the $85 resistance level, which has been a support/resistance level since 2005.

My target

Considering the prospects, estimates, etc, I can see UPS going to $110 to $130 range in mid-2026, providing an upside of 30% to 40%. This level also aligns with the Fibonacci 0.236 level.

If the stock continues to drop, I will simply average down. I don't think it can drop much more from here, and it will definitely not go bankrupt.

I'm gonna invest approximately 1% of my wealth into this stock.

Remember, I'm just sharing my journey and this is not financial advice! 😎

UPS Here’s the latest on **United Parcel Service (UPS)** stock:

## Stock market information for United Parcel Service, Inc. (UPS)

* United Parcel Service, Inc. is a equity in the USA market.

* The price is 88.82 USD currently with a change of 2.66 USD (0.03%) from the previous close.

* The latest open price was 86.47 USD and the intraday volume is 10230694.

* The intraday high is 89.295 USD and the intraday low is 86.3 USD.

* The latest trade time is Saturday, August 23, 03:58:32 +0400.

---

## UPS Stock — Key Overview

### Company Snapshot

**United Parcel Service, Inc. (UPS)** is a global leader in package delivery and supply chain management. Originally founded in 1907 as the American Messenger Company, it has evolved to become one of the largest logistics providers worldwide ( ).

UPS operates through three main segments:

* U.S. Domestic Package

* International Package

* Supply Chain & Freight services ( ).

On the stock front, UPS Class B shares (ticker: UPS) are publicly traded on the New York Stock Exchange (NYSE). Class A shares carry greater voting power (10 votes each) but are **not publicly traded** and are primarily held by employees and retirees ( ).

---

### Performance & Valuation

* On **August 22, 2025**, UPS closed at **\$88.82**, up about **+3.10%**, though it still underperformed peers like FedEx (+5.11%) ( ).

* The stock remains approximately **39% below** its 52-week high of about **\$145** ( ).

* Financially, in 2024 UPS posted **\$91 billion** in revenue (flat year-over-year) and net earnings of **\$5.78 billion** (down \~14%) ( ).

* Valuation-wise, analysts maintain an average recommendation of **“Buy”**, with a **12-month target price** of around **\$112.11**, suggesting \~26% upside ( ).

According to **Bernstein** (as of January 2025):

* Target increased to **\$179**, citing improving cost visibility and expected margin expansion to \~12% by 2026 (up from below 10% in 2024) ( ).

* **Wolfe Research** also upgraded UPS to Buy, setting a target of **\$147**, based on anticipated margin improvements ( ).

---

## Recent Highlights & Challenges

### Earnings Miss & Guidance Concerns

* In **Q2 2025**, UPS missed expectations with **adjusted EPS of \$1.55** (vs. \$1.56 forecast), while revenue came in at **\$21.2 billion**—slightly above estimates but down \~2.8% year-over-year ( ).

* The company **did not issue full-year guidance**, citing uncertainty from low U.S. consumer sentiment and macroeconomic pressures, including tariffs and weak demand in the small-package segment ( ).

* As a result, UPS shares plunged over **10% in a single trading session** ( ).

### Insider Buying as a Confidence Signal

* Following the Q2 downturn, CEO **Carol Tomé** and Chairman **William Johnson** **personally purchased shares** at prices around \~\$85–86, signaling continued belief in UPS’s long-term potential ( ).

* The shares were acquired despite the stock being down \~30% year-to-date, continuing a multi-year decline that included significant drops in 2022, 2023, and 2024 ( ).

---

## Summary Table

| Category | Highlights |

| ---------------------- | ------------------------------------------------------ |

| **Current Price** | \~\$88.82 (as of Aug 22, 2025) |

| **52-Week High Gap** | \~39% below peak of \~\$145 |

| **Revenue & Earnings** | \$91B revenue, \~\$5.8B earnings in 2024 |

| **Analyst Sentiment** | “Buy”; targets range from \$112 to as high as \$179 |

| **Q2 2025 Results** | Missed EPS, revenue slight beat—but no guidance issued |

| **Insider Buying** | CEO & Chair purchased shares after earnings miss |

---

## Final Thoughts

UPS is navigating through a challenging period, marked by weak consumer sentiment and soft demand in key delivery segments. While near-term results have disappointed and guidance is lacking, management’s recent insider buying is a bullish signal that they believe in a turnaround. Analysts remain optimistic, projecting meaningful upside over the next 12–18 months if margin improvements materialize.

UPS Momentum Trade: Buy $88C → Target 100%+ Return by Friday

# 🚚 UPS Weekly Options Setup (8/18 – 8/22)

🔥 **Institutional Flow Signals a Bullish Week** 🔥

All major AI reports (xAI, DeepSeek, Google, Anthropic) are calling **MODERATE BULLISH**, backed by:

* 📊 **Call/Put Ratio = 3.47** → Strong institutional bias

* 📉 **VIX < 22** → Premiums favorable for long calls

* ⚠️ **RSI Bearish** → Risk of reversal, so keep stops tight

---

## 🎯 Trade Setup

* **Instrument**: UPS

* **Direction**: CALL (LONG)

* **Strike**: \$88.00

* **Expiry**: 2025-08-22

* **Entry**: \$0.92

* **Stop Loss**: \$0.46 (-50%)

* **Target**: \$1.38 – \$1.84 (+50% to +100%)

* **Confidence**: 65%

* **Timing**: Enter at open → Exit by Thursday (avoid gamma burn!)

---

## 📈 Breakeven @ Expiry

👉 \$88.92 (Strike + Premium)

UPS must close above **\$88.92 by 8/22** for profit at expiry.

But plan is **exit early** on IV move → don’t hold into Friday risk!

---

## 🧠 Key Risks

* Macro shock headlines 📰

* RSI weakness → possible fakeouts ⚠️

* Volatility spike → premium whipsaw 🎢

---

# ⚡ UPS 88C WEEKLY PLAY ⚡

🎯 In: \$0.92 → Out: \$1.38–\$1.84

🛑 Stop: \$0.46

📅 Exp: 8/22

📈 Flow > RSI → Betting with the whales 🐋

Warren Buffet and UPSHello I am the Cafe Trader.

There have been some wild days, and it's not over. Amidst all the stormy seas, and the major successes, I wanted to bring to your attention a stock that I think is becoming of great value.

UPS has been getting beat down for over three years, why?

Beatdown

- Trump Tariffs contributing to China slowdown. (35% of deliveries comes from China).

- Guidance downgraded due to uncertainties with the macroglobal scale, "spooking investors".

- UPS cutback dealings with amazon to increase profitablity (but also reducing volume and revenue.)

Just to name a few...

If such bad news, why buy?

Fundamentally their business model is strong, and the dividend is PAYING.

Dividends and Warren Buffett.

Buffett is still known to use a model by his mentor, Benjamin Graham. (if you don't know, take a little youtube shallow dive).

This has been used to build a large portion of how buffet evaluates a stock. Using his formula, the Maximum intrinsic value of UPS is $69.87

As of writing this article, UPS sits roughly 21% higher than that number. If we get close, even the fundamentalists may have a hard time passing this up.

Dividends

At 1.68 Dividend a quarter, that put's UPS at almost 7.91% yield!

So my thought process is; even if you lose 8% from Graham's buy price, you make up on the dividend in a year. (although I would be surprised if it touched that golden zone).

TLDR LONG TERM

Aggressive buy: $88 (we are below that right now)

Great Price: $75.50 - 80.50

Graham's STEAL: $71 or Below.

NOTE: Graham took other things about a stock into consideration as we, as you should as an investor. This article is meant to assist your own DD.

-Since this is charted on a weekly chart I have charted a probable 4-6 month swing. (almost 50% gain).

-It really does depend on where this bounces, we have already broke through some major levels.

-I have a feeling UPS drivers might be cashing out their 401k and panic selling.

That's all for UPS!

I hope you enjoyed the article, thank you for your time.

If you enjoyed please consider a follow and a boost!

@thecafetrader

UPS is currently in the Wyckoff Accumulation Phase### **Wyckoff Phase: Accumulation**

1. **Prior Downtrend:** The weekly chart (left) clearly shows a prolonged and significant downtrend through 2024 and into early 2025. This fulfills the "Markdown" phase that precedes accumulation.

2. **Stopping Action and Base Formation:** The daily chart (right) shows that the steep decline halted around March-April 2025. The price then rallied automatically and has since been consolidating sideways. This sideways trading range, following a major downtrend, is the hallmark of the Accumulation phase, where "smart money" may be absorbing shares and building a cause for a future rally.

3. **Confirming Indicators:** The "Neutral" rating from the technicals gauge confirms the current lack of a strong trend. Furthermore, the positive performance in the last week (+1.45%) and month (+3.62%) shows that selling pressure has subsided and short-term demand is emerging, which is consistent with the early stages of accumulation.

### **Suggested Option Strategy: Poor Man's Covered Call (PMCC)**

Given the analysis that UPS is building a base in an Accumulation phase (implying a neutral to bullish long-term outlook), a **Poor Man's Covered Call (PMCC)**, also known as a long call diagonal debit spread, is a suitable strategy.

This strategy allows you to establish a bullish position with less capital than buying 100 shares, while potentially generating income during the expected consolidation period.

**How it Works:**

This is an advanced strategy and should be approached with a full understanding of the risks.

1. **Buy a Long-Term, In-the-Money (ITM) Call:** Instead of buying 100 shares of UPS, you buy a single call option with a long time until expiration (e.g., 6-12 months). Choosing an in-the-money strike (a strike price below the current stock price) makes the option behave more like the stock.

2. **Sell a Short-Term, Out-of-the-Money (OTM) Call:** Against your long call, you sell a call option with a near-term expiration (e.g., 30-45 days) and a strike price that is above the current stock price.

**Goal of the Strategy:**

The objective is for the short-term call you sold to decrease in value faster than your long-term call due to time decay (theta). Ideally, the short call expires worthless, and you keep the premium. You can then repeat the process by selling another short-term call, continuously reducing the net cost of your long-term bullish position while you wait for the stock to potentially begin its "Markup" or uptrend phase.

***

*Disclaimer: This information is for educational purposes only and is not financial advice. Options trading involves significant risk and is not suitable for all investors. You should consult with a qualified financial professional before making any investment decisions.*

Things are looking UPSUnited Parcel Service served as one of our canaries in the coal mine, signalling that the real economy was much weaker than what the Biden administration was reporting. The figures presented were positively skewed, masking the harsh reality that we were all facing difficult times.

We recognized the head and shoulders topping pattern and warned that an economic disaster was approaching us. This ultimately led to the Trump tariff panic that caused the collapse of equities.

The thesis indicated a lack of confirmation regarding rising index prices; however, consumers were feeling the pressure, which manifested in reduced consumption and, consequently, fewer deliveries.

A modern Dow Theory if you will.

As we near new peaks in the stock market, I am convinced that our economy is on a much more solid foundation, poised to benefit Main Street instead of just a handful of monopolistic tech giants. Since equities are forward-looking, stocks are anticipating an exhilarating 2026!

I believe UPS will confirm this economic recovery as we head towards my long anticipated and forecast DOW JONES price of 64,000 likely by 2030.

$UPS going UP : FY25 FORECAST 147% +++in the wake of the potential end of the US 🇺🇸 assets market

I want to continue this post i made last year

If it breaks the trendlines I'm higher for longer till my target

For now I'm long till it breaks that point is it doesn't its going down

With the rest of the country

Whats the Chinese ups?

United Postal Service | UPS | Long at $92.00The United Postal Service NYSE:UPS finally closed out the last remaining price gap on the daily chart (since 2020) and entered my "crash" simple moving average zone. With a P/E of 15x, earnings forecast growth of 8.12% per year, and a dividend over 6%, NYSE:UPS "may" be a good buy and hold through these tumultuous economic/trade war times. I wouldn't place a continued price drop near $75-$85 out of the question, but I'm not in the game of calling bottoms.

At $92.00, NYSE:UPS is in a personal buy zone. Word of caution: if this stock really tanks due to trade issues and massive recession, $50s...

Targets:

$108.00

$120.00

$133.00

OptionsMastery: In a MONTHLY demand on UPS!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

UPS looking DOWNSNice head and Shoulders on the United Parcel Service

#UPS and FEDEX are the new dow transport indicator.

An underlying determinant of how the consumer is faring

Since the US is a consumer economy and Online shopping is the majority of retail

if we see new highs on the Indicies, and the home delivery carriers continue to deteriorate

it would give your non confirmation Top

Similar to Dow theory of new High's in the Industrials , but the transports lagging and indeed falling.