Thumzup Bets Big on XRP How $250 Million Could Be a Game-ChangerA New Crypto Strategy: Beyond Bitcoin

In 2025, one thing is clear: publicly traded companies are no longer limiting themselves to Bitcoin-only investments. A prime example is Thumzup Media Corporation, a Nasdaq-listed firm that recently approved a plan to allocate up to $250 million into crypto assets. Unlike past strategies, which were heavily BTC-focused, Thumzup is diversifying — prioritizing XRP, ETH, SOL, DOGE, USDC, and LTC. Among these, XRP stands out as one of the company’s largest bets.

Why XRP?

XRP is a token with a complex history and massive potential. Despite years of legal battles with the SEC, by 2025, XRP has solidified its position as a reliable asset for fast international transactions. Its widespread use among banks and financial institutions makes it unique compared to other altcoins.

Thumzup highlighted several reasons for putting XRP at the forefront:

High Liquidity: XRP trades on most major exchanges with significant volume.

Low Fees: The network enables quick, low-cost transfers of large sums.

Regulatory Progress: After Ripple’s partial victory over the SEC, XRP gained legal clarity in the U.S., making it far more attractive for public companies.

Adding to the momentum, XRP reached a new all-time high above $3.60 when Thumzup announced its strategic move — further boosting investor confidence.

$250 Million — The Source and the Strategy

In 2025, Thumzup’s board approved a major expansion of crypto holdings on its balance sheet. This investment is financed through a mix of free capital, new stock issuance, and partial bonds. The goal is not just to build an investment portfolio but to create an infrastructure-like crypto fund, similar to MicroStrategy’s approach — but with a broader basket of assets.

The company’s ambition goes beyond simply holding assets for price appreciation. Thumzup plans to integrate cryptocurrency into its advertising platform, where users get paid for posting content. XRP and other assets could serve as internal payment tools within this ecosystem.

Media Impact and Brand Boost

The move sparked massive media attention and market buzz. The excitement grew further when Donald Trump Jr. acquired company shares and joined as an advisor, creating a PR storm. As a result, Thumzup’s stock surged over 80% in a single month.

Such attention from political figures and traditional investors reinforces the notion that XRP — and other crypto assets — are evolving from “digital assets” to integral components of operational business models.

Risks to Consider

High Volatility: Significant crypto exposure could harm the company’s balance sheet in a bear market.

Regulatory Shifts: Despite progress, Ripple’s legal situation isn’t fully resolved.

Reputation Risk: Failure in crypto ventures could damage shareholder confidence.

Bottom Line

Thumzup Media has taken a bold step, positioning cryptocurrency — especially XRP — as a strategic growth tool rather than just a hedge. This move signals a paradigm shift: from “Bitcoin as a reserve” to multi-token integration into business models. If successful, this strategy could encourage other public companies to follow suit, marking the dawn of multi-asset corporate crypto treasuries.

ETHBTCZ2025 trade ideas

SEI vs Ethereum: Why Investors Are Betting on Accelerated GrowthBlockchain Market Enters a Phase of Differentiation

Following the overall recovery of the crypto market in Q2 2025, certain Layer 1 projects are attracting increased attention. One such emerging player suddenly in the spotlight is the SEI blockchain, which positions itself as a high-performance solution for trading, DeFi, and Web3 applications. While Ethereum continues to struggle with scalability issues and competition from its own Layer 2 solutions, SEI bulls claim:

“This is the project that can outpace ETH in growth rate as early as Q3.”

What Makes SEI Technologically Different?

Investor optimism around SEI is rooted not just in marketing, but in specific technological advantages. Unlike Ethereum, which prioritizes maximum decentralization even at the expense of speed, SEI leverages a parallelized transaction processing engine, achieving finality in under 500ms. This not only accelerates transaction processing but also scales the performance of order books and marketplaces.

Additionally, SEI has implemented an order-based DEX model, bringing decentralized exchanges closer to the user experience of centralized platforms like Binance. This is a key differentiator: unlike Ethereum, which requires additional protocols to implement limit orders, SEI has them built into its architecture.

Ecosystem and Activity

Since the beginning of the year, more than 80 applications have launched on SEI, ranging from NFT marketplaces to derivatives platforms. According to DeFiLlama, TVL (total value locked) has surpassed $1.2 billion, more than 5x its level at the start of the year. Major exchanges like Binance, KuCoin, and Bybit have confirmed support for the blockchain, while the project team actively expands into Asia and Latin America.

Investor Dynamics and Price Expectations

SEI entered Q3 2025 trading around $0.34, and analysts see growth potential up to $0.70–$0.80 if the positive trend continues. This represents over 100% upside from current levels, whereas Ethereum, according to most forecasts, is expected to post only 15–20% gains during the same period.

Some institutional reports already classify SEI as a high-growth potential asset, alongside Solana and Aptos. This signals a possible market shift in the coming months.

Risks: Realism Over Hype

However, key risks remain:

Competition from Ethereum L2: Solutions like Arbitrum and Base deliver high speed while maintaining ETH compatibility.

Hype Cyclicality: Surges in interest for new Layer 1s can be short-lived.

Dependence on DeFi: SEI is currently attractive for developers and traders but still lacks everyday applications.

Conclusion

SEI indeed has technological advantages that enable rapid scaling. Its architecture makes it especially promising in the context of growing DEX and Web3 adoption. While Ethereum remains the leader in terms of infrastructure and trust, SEI could outpace ETH in growth rate during Q3 2025, particularly if it sustains its expansion and avoids technical or market setbacks.

Ethereum Approaches $2,908 as Bullish Momentum FadesEthereum remains bullish, trading near $2,796 and approaching monthly resistance at $2,908. Stochastic shows an overbought reading of 81.0, suggesting short-term buying exhaustion.

Bearish Scenario : A pullback toward $2,651 is likely if $2,908 holds. Extended selling pressure could lead to a test of the anchored VWAP near $2,500.

Bullish scenario : A confirmed breakout above $2,908 would likely extend the rally toward $3,260.

Ethereum Bullish Bias Pauses After Reaching Weekly HighF enzo F x—Ethereum rose from $2,539.5, backed by VWAP and volume profile, but momentum eased after hitting the $2,651.0 weekly high. Stochastic signals overbought conditions at 87.0, hinting at possible consolidation or downside pressure.

Bullish scenario : The bullish trend remains intact above $2,500, with upside potential toward the bearish FVG at $2,741.0.

Bearish scenario : A close below $2,500 would shift focus to the $2,383 support zone.

Crypto Leading Markets HigherMarkets are having an interesting day after what could be considered a “bad” day in terms of economic data. Equities, Precious Metals, Energy, and Crypto markets all broadly traded higher today with crypto leading the way higher. Traders saw Bitcoin, Ether, Solana, and XRP all trade up over 4% on the session while Ether was up near 7.5% on the day. ADP Nonfarm Employment Change came in significantly worse than expected today at -33k while expecting 99k, which is the first negative print seen since February of 2022.

The equity markets traded higher on the session and continue to show resilience to the upside, and were led by the Russell trading up near 1.4% on the session. The Russell has been lagging the S&P and Nasdaq over the last few months, as those markets have been trading near or at new all time high prices this week. After the session today, the Russell hit a new higher high and is trading at a level not seen since February, which could indicate momentum to the upside moving forward. Wrapping up the week tomorrow we will see a big data day looking at inflation and jobs that will bring us into the long weekend.

If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme/

*CME Group futures are not suitable for all investors and involve the risk of loss. Copyright © 2023 CME Group Inc.

**All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

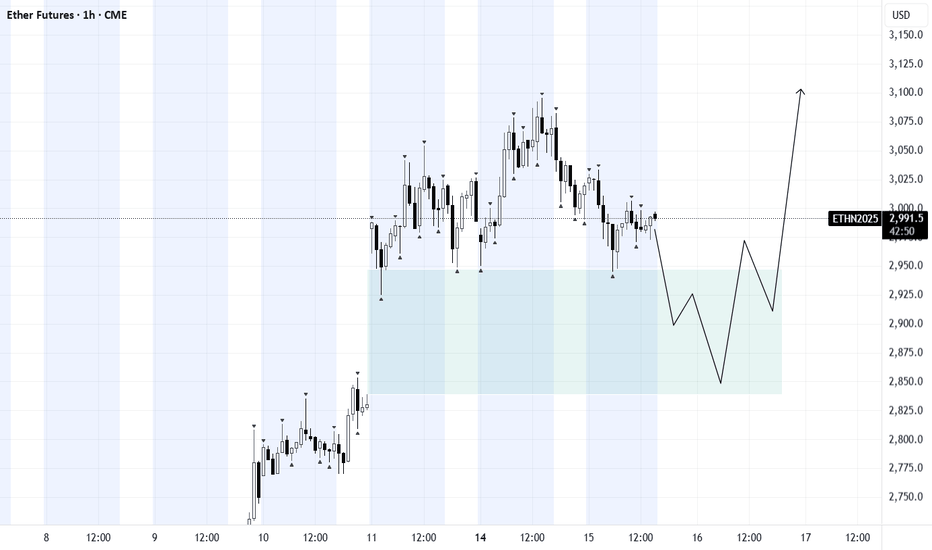

Ethereum - ETH - Heading towards the CME Gap - 3200 Target+ After a significant crash, Ethereum has shown a strong recovery.

+ A large CME gap exists between $2,880 and $3,270.

+ Historically, 90% of CME gaps tend to get filled sooner or later.

+ Current price action suggests Ethereum is heading directly toward this gap.

+ High probability that the CME gap will be filled during this move.

+ Next target for ETH: $3,200.

Stay tuned for more updates.

Cheers,

GreenCrypto

ETH Momentum Builds Above Key SupportFenzoFx—Ethereum bounced from the $2,397.0 support and swept liquidity below the level, backed by a bullish FVG on the 4-hour chart. ETH is currently testing resistance at $2,500.0, and a breakout could lead to a retest of $2,539.0.

The bullish setup remains valid above $2,397.0; below that, $2,317.0 becomes the next support.

Ethereum Faces Resistance at $2,539.0Ethereum was rejected at the $2,539.0 resistance, a high-volume supply zone. If this level holds, ETH could drop toward $2,397.0, and a break below it may trigger further downside toward $2,192.0.

The bearish outlook is invalidated if ETH/USD closes above $2,539.0.

Bearish Wave Builds Below Key ETH Supply ZoneFenzoFx—Ethereum failed to break above $2,813.0 and is now trading around $2,430 after trimming nearly 5.0% of recent losses.

The $2,687.0 area, backed by the 50-period SMA, acts as a premium supply zone. A bearish wave could follow, targeting $1,779.0, supported by prior monthly lows and RSI divergence.

The bearish outlook is invalidated if ETH/USD closes above $2,813.0.

Ethereum Rejected By Strong Resistance, A Bearish OutlookFenzoFx—Ethereum is consolidating around $2,525 after being rejected by the $2,813.0 resistance, a strong supply zone. Immediate support lies at $2,446.0. If ETH closes below this level, a move toward $2,080 is likely.

The bearish outlook is invalidated if ETH stabilizes above $2,813.0.

Ethereum Consolidates: A New Bearish Target Could Be on the HoriFenzoFx—Ethereum faced rejection at $2,813, triggering a downtrend before stabilizing near the bullish FVG. ETH/USD now trades at $2,566, recovering some losses.

Immediate resistance is at $2,395, but liquidity sweeps make it fragile. A rise toward $2,700 could precede another bearish wave.

If selling pressure persists, ETH may drop to $2,395 or further to $1,910.

Ethereum's Monthly High Rejection: Is a Bearish Wave Coming?FenzoFx—Ethereum tested and swept the monthly highs at $2,813 but failed to sustain its bullish momentum. The 1-hour chart formed a bearish fair value gap, signaling increasing selling pressure.

Currently, Ethereum trades slightly below the monthly high at approximately $2,806, with immediate resistance at $2,813. If this level holds, ETH/USD could target the 50.0% retracement zone near $2,640.

Ethereum's Downtrend Pauses—Reversal or Further Drop?FenzoFx—ETH/USD currently trades around $2,480, ranging between $2,336.0 support and $2,797.0 resistance. Given the recent break of structure, the bearish trend may resume, targeting $2,336 as the next liquidity trap.

This level may offer a discounted entry for long positions. Traders should watch for bullish signals like candlestick patterns and fair value gaps on lower timeframes (M5, M15) during the NY session.

MET1! Sets Up for Continuation Rally After Strong Reversal

Price is now trading above the 20-day and 50-day SMAs, which suggests bullish momentum continuation.

Immediate support lies around $2,400–$2,500, near the 20-SMA and recent swing lows.

Resistance is near the $2,800–$2,850 zone, which is a previous high from the current range.

The recent candles are small-bodied, suggesting low volatility and indecision, typical before a breakout.

Important Support and Resistance Area: 2572.5-2783.5

Hello, traders.

Please "Follow" to get the latest information quickly.

Have a nice day today.

-------------------------------------

(MET1! 1D chart)

The current price range of 2572.5-2783.5 is an important support and resistance area.

If it falls in this section, it is likely to fall to the support section of 1693.5-1933.0.

If it rises,

1st: 3293.0-3448.0

2nd: 3902.0-4141.5

You need to respond depending on whether there is support near the 1st and 2nd above.

-

I think that in order to rise above 2783.5, OBV needs to rise above the High Line and remain there.

Therefore, you need to have a relaxed mind and check whether there is support.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

Ethereum is on Bullish TrackFenzoFx—Ethereum resumed its bullish trend after testing last week's low at 2,340. Price action and candlestick patterns support the current momentum.

The Stochastic Oscillator at 65.0 suggests the market is not overbought, indicating a likely continuation of the uptrend. The next bullish target is last week's high at 2,755.

Bearish Scenario : If ETHUSD falls and holds below 2,340.0, the downtrend from 2,755 may extend to 2,130.0.

Trade ETH/USD at F enzo F x

Ethereum: 96% of Hedge Funders Were Short on Monday!FenzoFx—Ethereum is trading bearishly, having broken below the 50-SMA. Currently, 96.0% of hedge funders are short, while 52.0 percent of institutional traders were long at the beginning of the week.

If ETHUSD remains under the 50-period moving average, the downtrend may persist, with a potential dip toward the 2,420-dollar support. Retail traders should watch for bullish signals, such as a candlestick pattern, near this level.

Ethereum has exploded, we called this moveFound the article speaking about a coming move in $ETH.

CRYPTOCAP:BTC was the largest position in the account until we increased our CRYPTOCAP:ETH position. We made it the largest position in the account a few days ago.

We had also increased our Crypto holdings, we added CRYPTOCAP:SOL & CRYPTOCAP:XRP , leveraged ETFs.

We stated, not long ago, that ALTCOINS were waking up! Ethereum has moved November lately.