Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

74.25 MXN

26.48 B MXN

285.93 B MXN

256.61 M

About Fidelity National Financial, Inc.

Sector

Industry

CEO

Michael J. Nolan

Website

Headquarters

Jacksonville

Founded

1984

ISIN

US31620R3030

FIGI

BBG01CBV6Z16

Fidelity National Financial, Inc. engages in the provision of title insurance and transaction services to the real estate and mortgage industries. Its services include title insurance, escrow and other title-related services, including trust activities, trustee sales guarantees, recordings and reconveyances, and home warranty products and technology and transaction services to the real estate and mortgage industries. The company operates through the following segments: Title, F&G, and Corporate and Other. The Title segment consists of the operations of title insurance underwriters and related businesses. The F&G segment consists of operations of annuities and life insurance related businesses. The Corporate and Other segment is involved in real estate brokerage businesses. Fidelity National Financial was founded by William P. Foley II in 1984 and is headquartered in Jacksonville, FL.

Related stocks

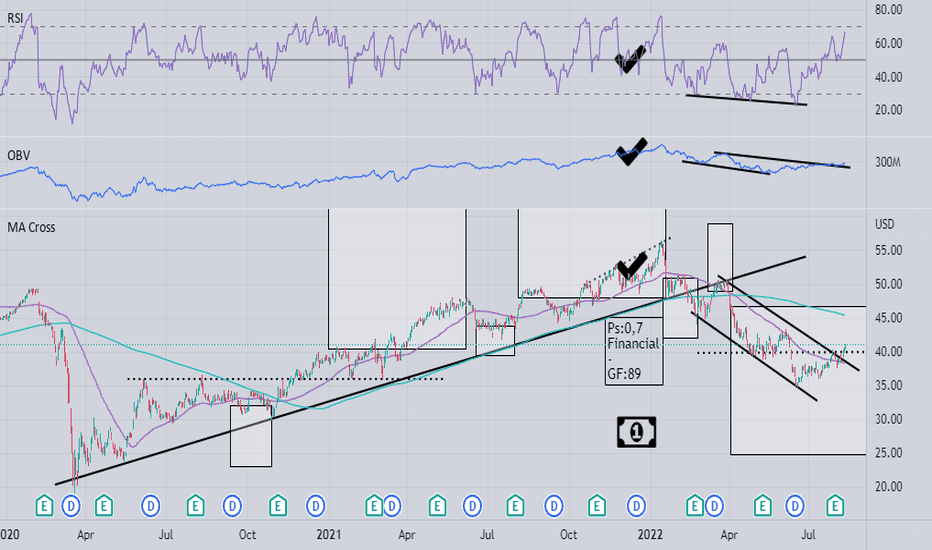

BUY to FIDELITY NATIONAL FINANCIAL OpportunityHello traders, FIDELITY NATIONAL FINANCIAL is in a fake bearish trend with a large past buy volume and an upside down hammer candle. By zooming in on the TIMEFRAME M1 we can appreciate a weak sell return negotiate, it is heading towards its last previous lower making its bearish swallow. Which corre

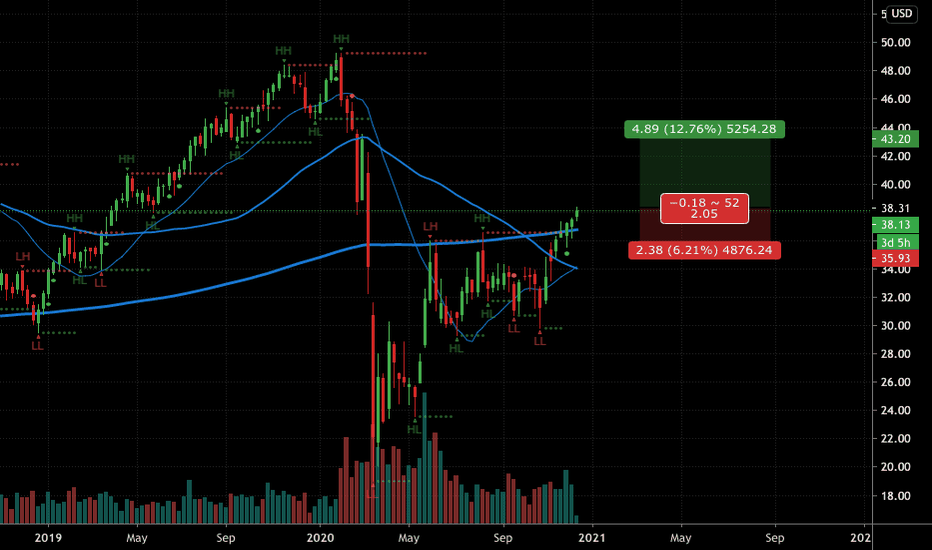

$FNF with a neutral outlook after earning releaseWith a Negative under reaction after earnings, $FNF has been place in Drift D with the PEAD projecting a neutral outlook for the stock.

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

FNF5259157

Fidelity National Financial, Inc. 3.2% 17-SEP-2051Yield to maturity

5.79%

Maturity date

Sep 17, 2051

FNF5044029

Fidelity National Financial, Inc. 2.45% 15-MAR-2031Yield to maturity

4.60%

Maturity date

Mar 15, 2031

FNF4999868

Fidelity National Financial, Inc. 3.4% 15-JUN-2030Yield to maturity

4.46%

Maturity date

Jun 15, 2030

FNF4848547

Fidelity National Financial, Inc. 4.5% 15-AUG-2028Yield to maturity

4.11%

Maturity date

Aug 15, 2028

See all FNF bonds

Curated watchlists where FNF is featured.

Frequently Asked Questions

The current price of FNF is 1,023.76 MXN — it has decreased by −4.80% in the past 24 hours. Watch Fidelity National Financial, Inc. - FNF Group stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange Fidelity National Financial, Inc. - FNF Group stocks are traded under the ticker FNF.

We've gathered analysts' opinions on Fidelity National Financial, Inc. - FNF Group future price: according to them, FNF price has a max estimate of 1,417.53 MXN and a min estimate of 1,178.20 MXN. Watch FNF chart and read a more detailed Fidelity National Financial, Inc. - FNF Group stock forecast: see what analysts think of Fidelity National Financial, Inc. - FNF Group and suggest that you do with its stocks.

FNF stock is 5.04% volatile and has beta coefficient of 0.70. Track Fidelity National Financial, Inc. - FNF Group stock price on the chart and check out the list of the most volatile stocks — is Fidelity National Financial, Inc. - FNF Group there?

Today Fidelity National Financial, Inc. - FNF Group has the market capitalization of 276.29 B, it has decreased by −5.13% over the last week.

Yes, you can track Fidelity National Financial, Inc. - FNF Group financials in yearly and quarterly reports right on TradingView.

Fidelity National Financial, Inc. - FNF Group is going to release the next earnings report on Nov 11, 2025. Keep track of upcoming events with our Earnings Calendar.

FNF earnings for the last quarter are 21.76 MXN per share, whereas the estimation was 25.66 MXN resulting in a −15.20% surprise. The estimated earnings for the next quarter are 26.10 MXN per share. See more details about Fidelity National Financial, Inc. - FNF Group earnings.

Fidelity National Financial, Inc. - FNF Group revenue for the last quarter amounts to 68.19 B MXN, despite the estimated figure of 66.37 B MXN. In the next quarter, revenue is expected to reach 65.40 B MXN.

FNF net income for the last quarter is 5.21 B MXN, while the quarter before that showed 1.70 B MXN of net income which accounts for 206.67% change. Track more Fidelity National Financial, Inc. - FNF Group financial stats to get the full picture.

Yes, FNF dividends are paid quarterly. The last dividend per share was 9.15 MXN. As of today, Dividend Yield (TTM)% is 3.63%. Tracking Fidelity National Financial, Inc. - FNF Group dividends might help you take more informed decisions.

Fidelity National Financial, Inc. - FNF Group dividend yield was 3.46% in 2024, and payout ratio reached 41.70%. The year before the numbers were 3.59% and 95.92% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Oct 17, 2025, the company has 23.53 K employees. See our rating of the largest employees — is Fidelity National Financial, Inc. - FNF Group on this list?

Like other stocks, FNF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Fidelity National Financial, Inc. - FNF Group stock right from TradingView charts — choose your broker and connect to your account.