Reddit (RDDT): Technically Aligned, Risk Now DefinedReddit is one of the most recognizable platforms on the internet.

A place where retail investors, niche communities, and real-time sentiment collide.

From WallStreetBets to hyper-specific hobby forums, Reddit is not just social media - it’s a behavioral data engine powered by highly engaged users. That alone makes it an interesting name for retail investors to keep an eye on.

🔍 Why Reddit is on my radar now

Technically, the stock has pulled back into a high-confluence demand zone — an area where risk-taking starts to make sense again.

This zone is not based on a single indicator, but on multiple overlapping technical signals:

1. Trendline support

Clearly defines an uptrend, with price coming into a third touch after a clean pullback from a prior high and evenly spaced reactions.

2. Fibonacci Golden Ratio (61.8%)

A textbook retracement level... often where strong stocks find renewed demand.

3. Channel projection (blue lines)

Price is interacting with the lower boundary of a broader price channel.

4. Equal waves (yellow dotted lines)

The corrective move has completed a symmetrical structure, suggesting downside momentum may be exhausted.

5. ~50% decline from the ATH

Historically, this is a level where emotions reset, and risk/reward starts to improve.

6. Psychological round number: $150

This is not a buy signal by default.

It’s a “pay attention” zone.

For me, this is exactly the kind of area where technicals say:

Now is the time to open the numbers, so... let fundamentals do the talking.

If the business story supports the structure, this zone can matter.

Good luck,

Vaido

Reddit, Inc. Class A

No trades

What traders are saying

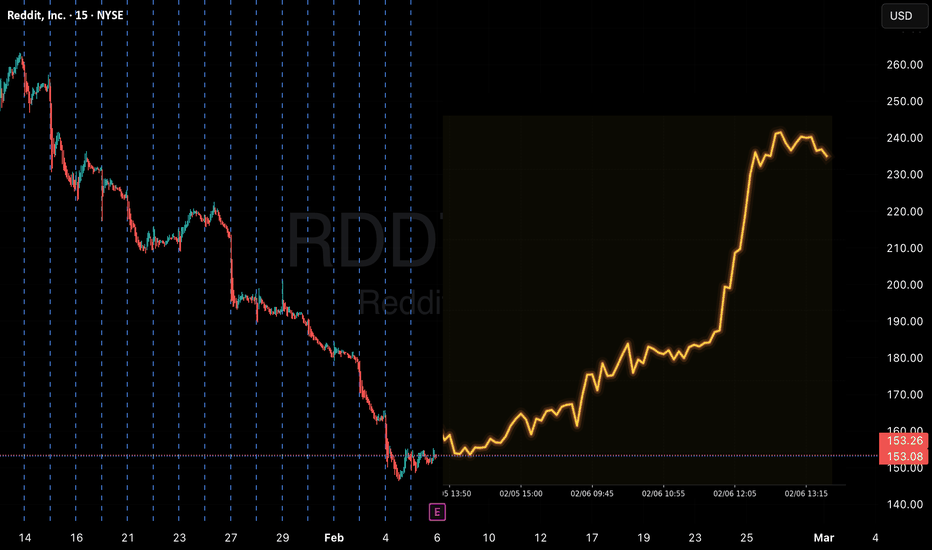

Event-Driven Alpha: RDDT Earnings Protocol ActivatedRDDT QuantSignals V4 Earning 2026-02-05

Style Fit: Swing / Momentum

Risk Profile: Medium-High (post-IPO growth stock behavior)

Signal Bias: 🟢 Short-term Bullish, Elevated Volatility

Style Fit: Swing / Momentum

Risk Profile: Medium-High (post-IPO growth stock behavior)

🔥 Core Catalyst

Reddit is expected to post ~47% revenue growth for Q4, driven largely by advertising demand and AI-related partnerships.

The company recently signed a data-licensing deal with Google, strengthening its position in the AI ecosystem.

Shares have surged over 240% since its IPO, showing strong institutional appetite despite volatility.

Key Risk You Should Respect

Reddit is not yet consistently profitable, which increases downside sensitivity if growth slows.

Some investors worry heavy reliance on Google traffic could become a structural risk.

RDDT Bearish: Breakdown Watch Toward $130 SupportRDDT is a textbook example of “good news, bad reaction.” Q4 2025 prints were strong (EPS $1.24 vs. $0.96, revenue $725.61M +69.7% YoY), paired with a $1B buyback and upbeat Q1 2026 guidance—yet price is still unwinding hard after the run-up, suggesting a sell-the-news reset rather than a fundamental collapse.

Technically, the dominant pressure remains bearish across the 1D and 1W. The daily “waterfall” has pushed price to ~$141.32, well under MA20 ($199.24) and MA60 ($214.40), with the 1D SuperTrend capping rallies near $169.54. The double top near ~$270 is already confirmed (neckline ~ $230), so until structure improves, rallies are still suspect.

The key inflection is the 4W SuperTrend at $130.21. A daily close below $130 turns this into a continuation breakdown setup, with the next magnet being psychological $100 (and an intermediate risk zone around $118–$120). If buyers defend $130 and price can reclaim $145 on a daily close, the higher-probability “relief” path opens toward $155–$160 first, then potentially $169.54 and $180 if momentum flips

Reddit Stock Declines Despite Strong Earnings and AmbitiousReddit Stock Declines Despite Strong Earnings and Ambitious $1 Billion Buyback Plan

Reddit Inc. (NYSE: RDDT) experienced a notable decline in its stock price following the release of its fourth-quarter earnings report, a market reaction that appeared to overlook several positive fundamental developments announced by the company. Despite delivering financial results that exceeded analyst expectations and authorizing a substantial new $1 billion share repurchase program, investor sentiment was tempered by a forward-looking strategy that includes a renewed and aggressive focus on mergers and acquisitions (M&A), particularly within the advertising technology (adtech) sector.

Strong Quarterly Performance Overshadowed by Strategic Ambitions

The company reported robust fourth-quarter results, underscoring its accelerating monetization trajectory. Revenue reached $726 million, with advertising sales constituting the vast majority at $690 million. User engagement remained a key strength, with global daily active unique users (DAUu) increasing by 19% year-over-year to 121.4 million. Most notably, earnings per share of $1.24 came in above consensus estimates, demonstrating improving profitability.

In a move signaling confidence in its financial stability and future cash generation, Reddit's board authorized a new $1 billion share buyback program. This capital return initiative is typically viewed favorably by investors as a mechanism to enhance shareholder value and signal management's belief that the stock is undervalued.

The M&A Mandate: A Strategic Pivot Towards External Growth

However, the dominant narrative emerging from the earnings call was Reddit's clear intention to pivot a portion of its capital allocation toward strategic acquisitions. Chief Financial Officer Andrew Vollero outlined a dual-pronged M&A strategy, indicating the company is actively seeking targets that can either:

Leverage Reddit’s Scale: Acquiring businesses whose products or technologies become significantly more impactful when deployed across Reddit's massive and engaged user base.

Accelerate User Growth: Purchasing companies that can directly help expand Reddit's audience.

Vollero emphasized that acquiring capabilities and technologies has been "one of the secrets of our success," particularly within the adtech domain. He highlighted the efficiency of this "tuck-in" acquisition model, where integrated technologies can save the company "six to twelve months to market" versus internal development, directly enhancing monetization capabilities. While adtech has been a historical focus—evidenced by past acquisitions like Spiketrap and MeaningCloud—Vollero clarified the company is "not ruling anything off the table," suggesting a broad mandate.

The AI Frontier: A Key Area for Future Investment and Potential M&A

A significant component of Reddit's future growth strategy is tied to artificial intelligence. Management pointed to a growing revenue opportunity from its AI-powered search products, raising questions about whether AI startups will be a primary target for the company's M&A ambitions. Reddit has already been actively building its AI arsenal through acquisitions, including Memorable AI in August 2024 for ad tools, and earlier deals for platforms like Spell to boost machine learning capabilities. This focus positions AI not just as a product feature but as a core competency Reddit is willing to buy to accelerate its development.

Market Reaction: Balancing Growth Investment Against Shareholder Returns

The stock's negative reaction post-earnings can be interpreted as a classic market response to a shift in capital allocation priorities. While the $1 billion buyback is immediately accretive, the explicit emphasis on a potentially expensive and integration-heavy M&A strategy may have introduced uncertainty. Investors might be weighing the near-term certainty of share repurchases against the longer-term, higher-risk bet of strategic acquisitions. Concerns could include the potential for overpaying for targets, integration challenges, and a dilution of focus from Reddit's core advertising business.

Technical Analysis: Key Levels to Monitor

For traders navigating this fundamental crosscurrent, key technical levels provide a framework for assessing price action:

Support Zones:

Primary Support: $140 – This level represents a critical near-term floor. A hold above this zone would suggest the post-earnings sell-off is a consolidation within a broader uptrend.

Major Support: $100 – A deeper, long-term support level that would represent a more significant correction but could serve as a strong value-based entry area.

Fibonacci Retracement Resistance/Take-Profit Targets (measured from a prior significant high):

Initial Recovery Target: $171.52 – Corresponding to the 0.236 Fibonacci retracement level. A move to this zone would indicate a reclaiming of lost ground.

Secondary Bullish Target: $192.81 – Aligning with the 0.382 Fibonacci level. Achieving this target would signal a stronger recovery momentum and validate the bullish long-term growth narrative.

Conclusion: A Story of Conflicting Signals

Reddit's post-earnings narrative presents a dichotomy. On one hand, the company is executing superbly on its core business, beating earnings estimates, growing users healthily, and initiating a major buyback. On the other hand, it is signaling a strategic pivot toward an aggressive and potentially costly external growth strategy via M&A, with a keen eye on adtech and AI. The stock's decline reflects the market's process of recalibrating risk and reward: balancing the proven momentum of the existing business against the uncertainty and capital demands of the new acquisition-focused chapter. The path forward will depend heavily on Reddit's ability to communicate the strategic rationale for future deals and to demonstrate that its "tuck-in" acquisition model can continue to deliver outsized returns on invested capital without disrupting its operational momentum.

RDDT — Swing Trade Idea💰 RDDT — Swing Trade Idea

🏢 Company Snapshot

• Reddit operates a large-scale social discussion platform with growing ad and data-licensing revenue streams.

• Matters now: post-IPO price discovery has transitioned into a tradable uptrend with orderly pullbacks holding higher timeframe support.

📊 Fundamental Context (Trade-Relevant Only)

• Valuation: Premium vs legacy social peers — market pricing continued growth optionality.

• Balance Sheet: Clean balance sheet post-IPO, no leverage risk over the swing horizon.

• Cash Flow: Improving trajectory as monetization scales.

• Dividend: N/A.

Fundamental Read: Fundamentals are not a catalyst but do not conflict with a technically driven swing in an established uptrend.

🪙 Industry & Sector Backdrop

• Short-Term (1–4 weeks): Internet & content platforms showing relative strength vs SPX.

• Medium-Term (1–6 months): Growth / platform names holding higher lows post-Q4 rotation.

• Macro Influence: Rates stable → supportive for growth multiples short-term.

Sector Bias: Bullish

📐 Technical Structure (Primary Driver)

• Trend: Price remains above rising 200-SMA; currently testing the 50-SMA from above.

• Momentum: RSI(2) reset into oversold territory — typical mean-reversion zone within trend.

• Pattern: Higher-high / higher-low structure since November; current pullback into dynamic support.

• Volume: Pullback occurring on declining volume → corrective, not distribution.

Key Levels

• Support: 210.00 – 214.00 (50-SMA + prior range support)

• Resistance: 245.00 – 255.00 (January swing highs / supply zone)

🎯 Trade Plan (Execution-Focused)

• Entry: 212.00 – 216.00

(Reversion into 50-SMA with RSI(2) reset inside a broader uptrend)

• Stop: 204.50

(Daily close below support = structure failure)

• Target: 250.00

(Retest of prior highs / range extension)

• Risk-to-Reward: ~2.6R

Alternate Scenario:

If price loses 210 on a closing basis, stand aside and reassess near the 200-SMA (~185–190) for a higher-quality trend continuation entry.

🧠 Swing Trader’s Bias

Price is in a confirmed uptrend, pulling back into the 50-SMA with momentum reset. Looking for buyers to defend the 212–216 zone for a push back toward January highs. A daily close below 204 invalidates the setup.

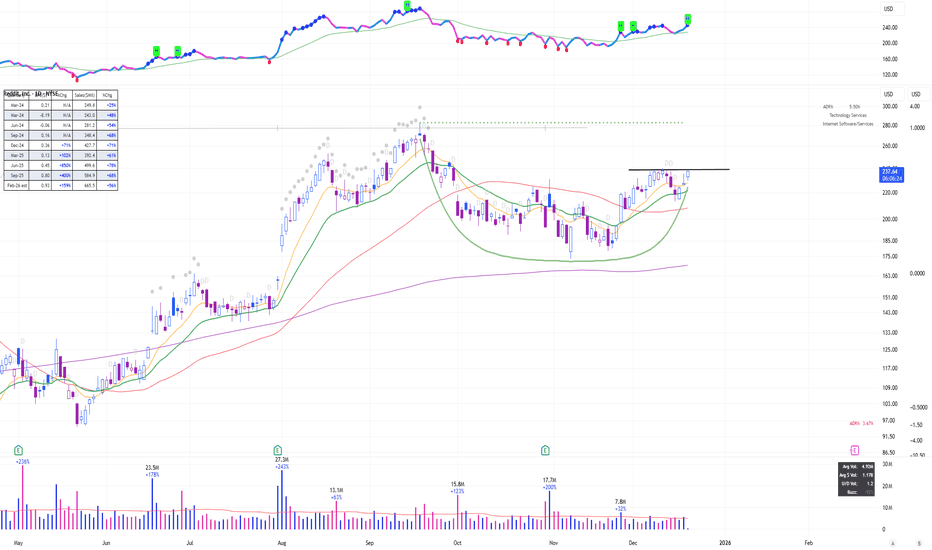

RDDT: Massive Monthly Cup & Handle (Long Term)Reasoning:

Strong Industry/Sector (Social Media / AI Data Licensing)

Monthly Cup and Handle (Major long-term structural setup)

Leveraged Option: NASDAQ:RDTL available for amplified exposure

If Labelled a Swing trade(2-6 Week Holds)

Entry: Full position on breakout (See Chart)

Profit Taking: Sell 1/3 at Goal 1

Final Exit: Remainder at Goal 2

If labelled a long term trade (3-12 Month Holds)

Entry: Full position on breakout (See Chart)

Profit Taking: Sell 1/4 to 1/5 at Goal 1

Exit Signal: Close below 20-day EMA (your trend guide) or 50EMA

Why: Strong moves are hard to time at the top, but the 20EMA acts as a reliable trend filter

Note:

Remember: Every long-term investment alert can also be played as a swing trade.

I normally use half the risk that I show here, this is because I am okay re-entering if it fails and it gives a better R/R ratio

RDDT: Fractal Cup & Handle with a "Cheat" EntryReasoning:

Strong Industry/Sector (Social Media / AI Data Licensing)

Fractal Setup: Cup & Handle visible on both Monthly and Daily charts

Mid Cheat entry: Forming a low-risk pivot within the base

If Labelled a Swing trade(2-6 Week Holds)

Entry: Full position on breakout (See Chart)

Profit Taking: Sell 1/3 at Goal 1

Final Exit: Remainder at Goal 2

If labelled a long term trade (3-12 Month Holds)

Entry: Full position on breakout (See Chart)

Profit Taking: Sell 1/4 to 1/5 at Goal 1

Exit Signal: Close below 20-day EMA (your trend guide) or 50EMA

Why: Strong moves are hard to time at the top, but the 20EMA acts as a reliable trend filter

Note:

Remember: Every long-term investment alert can also be played as a swing trade.

I normally use half the risk that I show here, this is because I am okay re-entering if it fails and it gives a better R/R ratio

Technical Analysis is All About Pattern RecognitionNYSE:RDDT : The Cup-and-Handle and VCP Breakout Setup

RDDT has established a clear "rhythm": after a two-month consolidation, it consistently reclaims the 20-day SMA (Red Line), followed by a volatility contraction phase where the price stops making new lows.

The stock just completed a Cup-and-Handle pattern, forming a 1 to 1.5-month Volatility Contraction Pattern (VCP) before breaking out, signaling that supply has been fully absorbed.

The recent +5.23% move on expanding volume successfully cleared the $240 psychological level, marking a fresh breakout from the consolidation high. This "breakout within a base" confirms that the trend is ready for its next leg higher.

Summary: By reclaiming the SMA 20 and breaking out of the tightest part of the pattern, RDDT is showing a high-probability continuation signal. As always, manage your risk and keep stops below the previous swing low.

$RDDT showing relative strength One of the strong stocks that has defined the market volatility over the past couple weeks. It has formed a nice handle which shows that institution do not want to get out of this stock and are waiting for new highs to add to their position. This looks like a key leader to me to watch as market figures out what it wants to do over the next month

Reddit (RDDT) – Daily AnalysisReddit (RDDT) – Daily Analysis

RDDT is respecting the bullish structure perfectly. Price bounced strongly from the demand zone (160–175) and is now pushing upward along the red bullish trendline.

The green bearish trendline was broken to the upside, and the retest held, confirming a shift back into bullish momentum.

Right now, price is heading directly toward the major resistance level at 286.98, which is the next key liquidity area where previous buyers/sellers interacted heavily.

Why upside momentum is favored:

Bullish trendline intact: Price is respecting both red ascending trendlines, showing strong structure support.

Break of green bearish line: Confirms bearish momentum is over and bulls are back in control.

Clean path to 287: No major resistance between current price (236) and 286.98.

Market structure forming higher lows: Classic continuation pattern.

Likely Scenario

As long as price remains above 220–225, RDDT is expected to continue this bullish leg toward the 286.98 target zone.

Invalidation

A daily close below 200 would signal trendline break and weaken the bullish outlook.

Summary

Reddit is showing strong bullish continuation after breaking the bearish trendline. The structure supports a likely push toward 287 in the upcoming sessions.

— Avo.Trades.

$RDDT Long Setup - $280 Target During Q1 2026Reddit is one of those gifts that keep on giving since the IPO. Right now, support seems strong and it doesn't seem to be going away, at least from some current indicators. As always, none of this is investment or financial advice. Please do your own due diligence and research.

$RDDT – Larger Head & Shoulders + Bear Flag = Trouble AheadReddit ( NYSE:RDDT ) is showing a bigger-picture head & shoulders pattern combined with a near-term bear flag, and the downside risk is real if the market continues to weaken — especially if NASDAQ:NVDA disappoints on earnings.

🔹 The Bigger Structure:

Head: The peak around $280

Right Shoulder: Forming around $230

This entire pattern is stretched over months — a structural topping pattern with heavy implications.

🔹 Near-Term Structure:

Between $180–$190, NYSE:RDDT is building a tight bear flag.

This is exactly the kind of setup that resolves to the downside when market sentiment turns.

🔹 Downside Levels:

First real support sits around $202, and that’s where sellers likely target first.

A breakdown of the flag could send it there quickly, especially in a risk-off tape.

🔹 Macro Risk:

If NASDAQ:NVDA misses earnings, this market is sitting on a cliff.

Momentum names and high-beta IPOs like NYSE:RDDT tend to get hit the hardest when liquidity dries up.

Combine macro weakness + a topping pattern + a bear flag… and you have a real setup for further downside.

🔹 My Trade View:

1️⃣ Bias: Bearish while under the 9 EMA.

2️⃣ Trigger: Breakdown under the bear flag ($180–$190 zone).

3️⃣ Target: $202 first, and potentially lower depending on market conditions.

4️⃣ Stop: Above the flag highs / 9 EMA.

Why This Matters:

You don’t often see a multi-month topping pattern line up cleanly with a short-term continuation short setup.

NYSE:RDDT has room to fall if the broader market unwinds.

This is one of the cleanest momentum breakdown candidates on the board.

Phenonmenal company about to give a good entryReddit has completed its 5 waves up move since its IPO and is on a healty correction part to reach 145$

I expect it to bottom somewhere between 25th to 28th Nov after completeing the gap fill and restart its upward trajectory.

Short positions should wait for 210-215 levels to make money on the down move. I expect that a good short opportunity will come this week on 19th Nov (Wed) or on 20th Nov (Thu)

Small Cap QuantSignals AI Screener 2025-11-01Small Cap QuantSignals AI Screener 2025-11-01

💥 EXPLOSIVE SMALL CAP PLAYS DETECTED

AI Analysis of High-Leverage Options Opportunities

🎯 TOP 5 EXPLOSIVE SMALL CAP PLAYS

NYSE:SOC - Score: 95/100

• Explosive Setup: Extreme volatility (126% IV) with heavy distribution (-21.7% 5d) and accelerating volume pointing to capitulation.

• Options Play: $7.5 PUT exp 2025-11-21

• Catalyst: Continued sector weakness and potential breach of key $8 support level triggering algorithmic selling.

• Potential: Target stock move -35% and option return 800-1200%

• Risk: Extreme volatility could cause whipsaw. Position size 1% max.

NASDAQ:RIOT - Score: 81/100

• Explosive Setup: Crypto miner with massive float turnover (131%) and oversold bearish momentum at critical technical breakdown level.

• Options Play: $17.5 PUT exp 2025-11-21

• Catalyst: Bitcoin price volatility and miner operational updates creating binary outcomes.

• Potential: Target stock move -25% and option return 500-800%

• Risk: Bitcoin rebound could spark short squeeze. Position size 1.5% max.

NASDAQ:MSTX - Score: 79/100

• Explosive Setup: Failed rally setup (+11% 1d after -14% 5d) with extreme 129% IV and bearish gap fill rejection potential.

• Options Play: $12.5 PUT exp 2025-11-21

• Catalyst: Biotech catalyst disappointment and technical breakdown below $13 support.

• Potential: Target stock move -30% and option return 600-900%

• Risk: Unexpected positive news could trigger massive short squeeze. Position size 1% max.

NASDAQ:CLSK - Score: 73/100

• Explosive Setup: Clean energy/bitcoin play at inflection point with 102% IV and bullish bias despite recent weakness.

• Options Play: $20 CALL exp 2025-11-19

• Catalyst: Infrastructure bill developments and bitcoin momentum shift creating explosive upside potential.

• Potential: Target stock move +25% and option return 400-700%

• Risk: Dual exposure creates heightened sensitivity to both sectors. Position size 1.5% max.

NASDAQ:MARA - Score: 72/100

• Expl

Image

osive Setup: High-volume bitcoin miner at technical pivot with 90% IV and bullish momentum divergence.

• Options Play: $20 CALL exp 2025-11-19

• Catalyst: Mining efficiency updates combined with bitcoin volatility creating leveraged upside.

• Potential: Target stock move +20% and option return 300-600%

• Risk: Bitcoin correlation makes this highly dependent on crypto market moves. Position size 1.5% max.

⚠️ Risk Warning: These are ultra-high-risk plays. Position size 1-2% max per trade. Binary outcomes expected.

RDDT Reddit Options Ahead of EarningsAnalyzing the options chain and the chart patterns of RDDT Reddit prior to the earnings report this week,

I would consider purchasing the 210usd strike price Calls with

an expiration date of 2025-11-7,

for a premium of approximately $11.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.