Psychedelic bulls offer sector some hopeYesterday I walked through the chart of each sector peer showing the shifting momentum and indicating what clues we would look for to say that deeper weekly consolidation is underway, or that consolidation is remaining healthy and perhaps finishing. ATAI started the day by confirming a daily downtrend, but CMPS comment at their investors conference that "We've spoken to the FDA" inspired the bulls to start buying and really saved the sector from some deeper weekly consolidation, at least for the time being. In this video I walk through the levels I'm watching to determine if this is merely a one-day pop before the sector resumes it's consolidation, or if we can anticipate consolidation to be finished and start looking forward to higher prices again in the near term future.

CMPS trade ideas

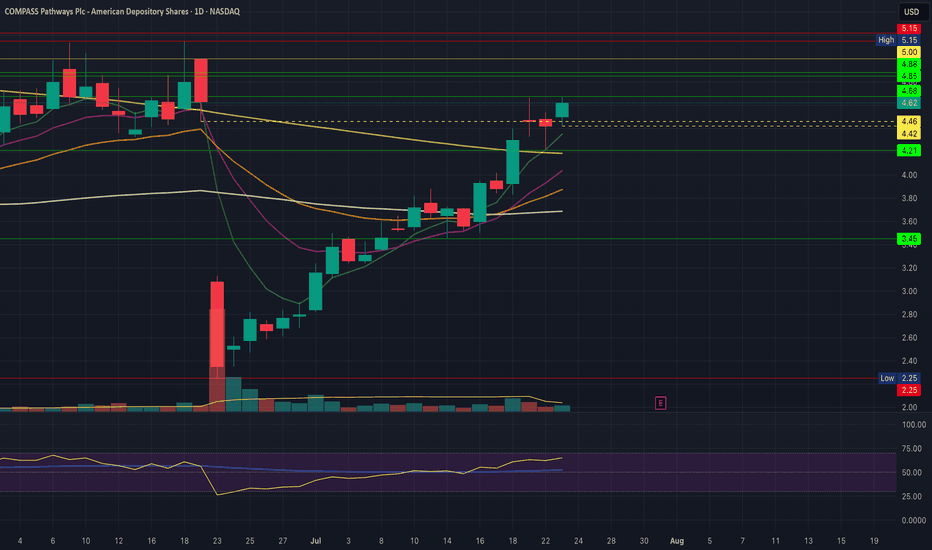

CMPS holds key weekly support - can bulls finally break out?CMPS confirmed an inverse head and shoulders pattern to change the hourly uptrend after holding key 3.92 weekly support just barely yesterday. We have not seen daily lower highs broke but we will be watching for this to happen tomorrow. Houlry uptrend will be our guide in determining when this push higher has topped out.

I publish regular technical analysis of the psychedelic sector. Be sure to like and follow to not miss an important update!

CMPS remains rangebound but still healthyCMPS remains rangebound and still fairly healthy consolidation. This consolidation is happing just below a very key long term resistance level so it's crucial to hold supports and start breaking lower high resistances if bulls have any hope of the monthly bull break in August or September.

I publish regular technical analysis of the psychedelic sector. Be sure to like and follow to not miss an important update!

CMPS daily inside bar watchCMPS is certainly stalling out far longer than the bulls would have liked, with 3 closes now below the daily EMA12 while still finding support above the daily EMA26. 4.22 is a daily double bottom of the last two days and breaking that level will increase odds we're going to start closing below the EMA26 which I certainly do not want to see happen, given where we are on the charts just under key resistance.

CMPS had a little bear break - does that change our outlook?A little daily downtrend has confirmed but bulls bought the dip and closed above the daily EMA12. Weekly timeframe is about to get an EMA bull cross and we're rangebound within 3.92 - 4.79. Within this range nothing really changes for me. After making this video I am slightly more bullish on this than I was at market close an hour ago.

CMPS weak bounce - is another leg down coming?CMPS weak bounce from the daily EMA12 could be setting up an hourly bear flag for another leg down. The hourly SMA50 and Daily SMA200 are important levels so I would look to those levels for support and hourly oversold RSI if today's low doesn't hold. Short term resistance on Thursday will be today's high.

I publish regular technical analysis of the shrooms sector, be sure to like and follow so you don't miss future updates!

CMPS healthy sideways consolidation Daily timeframe is just fine but I'm watching closely for clues as the weekly chart may be getting a little toppy just below our key resistances around 5.22. In the short tern, nothing changes as long as we are trading in Monday's range, we need to see a break of the high or the low of that candle in order to give us clues on direction and whether or not we can avoid further weekly consolidation and see the bounce continue.

I publish regular technical analysis of the shrooms sector, be sure to like and follow so you don't miss future updates!

What's the CMPS setup post earnings?Very strange week for CMPS after a weekly resistance bullbreak then an immediate pullback into testing key weekly support. It's not clear from the charts where we will go from here, but these are the clues I am watching in the short term to help me shift probabilities of the direction we head next.

CMPS

S: 4.14, 3.92 (KEY!)

R: 4.53, 4.78

Wild action on CMPS earnings day. What's next?CMPS Weekly bull flag into new low of day is a short term red flag, but is there cause for concern in the longer outlook? Click to watch the free video for more details

I provider regular chart analysis of the psychedelics sector. Be sure to Like and Follow, and Subscribe to future updates so you don't miss a post!

Support: 3.92

Resistance: 4.60, 4.78

CMPS potential daily bullflag setting upCMPS very healthy sideways consolidation after 100% bounce from the lows. 4hr downtrend is our guide and lower lows aren't seeing much followthrough, giving clues there may be a daily bullflag pattern shaping up. EARNINGS THIS WEEK!

I post regular analysis of the psychedelics sector, please like and follow to make sure you don't miss my next update!

Support: 4.25, 4.09, 3.83

Resistance: 4.41, 4.53, 4.68

CMPS bulls trying to confirm the daily bullflagCMPS bulls attempting to confirm the daily bullflag and keep the very impressive bounce going, If we reject tomorrow anticipate a 4hr equilibrium and we'll look for a higher low above 4.21 and a tightening range for the next few days.

Support: 4.42, 4.21

Resistance: 4.68, 4.85, 4.88, 5.00

CMPS bulls are very pleased with todayCMPS had a very modest 1% pullback today after a huge 10% bull move yesterday to confirm the daily uptrend. Bulls are very happy to have seen most of those gains kept and not taken as profit.

Resistance: Daily 200 SMA, 5.15, 5.22 -> numerous weekly tops in the 5.20s

Supports: 3.50, 3.45, 3.24, 2.25

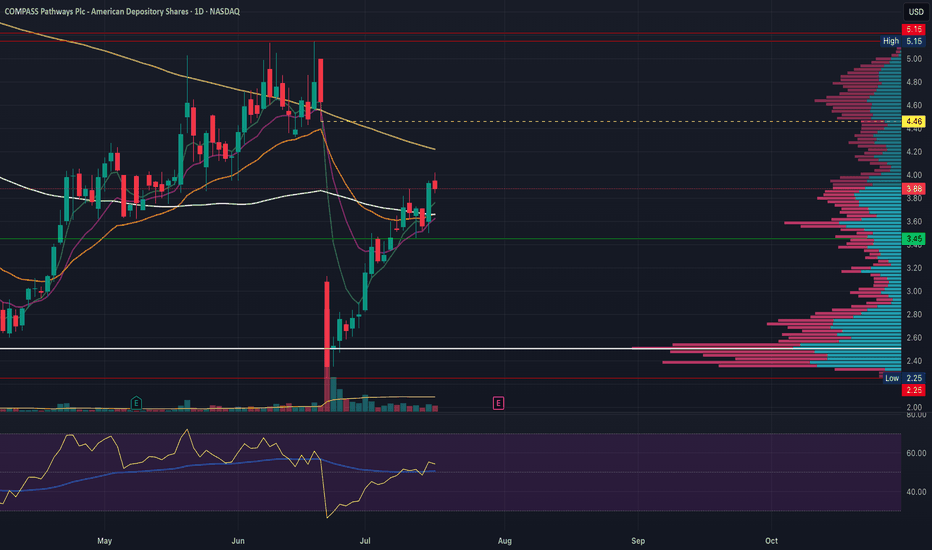

CMPS Bulls Keeping Control of 4hr UptrendThe 4hr uptrend is our guide on CMPS as it sets a series of higher lows riding EMAs as support. Eventually we will lose the 4hr uptrend, signalling that daily consolidation is underway. Having bounced 70% from the fear dump low, we are anticipating a daily higher low above 2.25 and the size of that pullback will let us know the likelihood of continuation vs a need to chop around in equilibrium while the market finds a new balance.

4hr RSI just touched 70 today for the first time since the dump.

CMPS riding 4hr EMAsCMPS continues it's slow grind uptrend riding the 4hr 12EMA which hasn't been lost since reclaiming it a few days after the news dump. The daily chart is a stair-step (a higher low each consecutive candle) since the low of the dump and while notable, for me the guide is when the 4hr chart no longer rides the EMA12 upwards. Bottom to top of the bounce is now 66% and counting, and we know that healthy daily consolidation will come sooner or later.

Safe Entry Zone CMPSStock Recovering from steep drop from bad news (which we don't care).

Blue Zone is Sell Zone.

Green Zone is Buy Zone.

since stock already rallied. its Risky to follow we wait price to re-test Green Zone.

Also My Beloved CAthie Wood BEST INVESTOR All Time (based on statics better than Warren Buffet Entire Histroy) Is BUYING!

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock:

On 1H TF when Marubozu/Doji Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu/Doji Candle, because price will always and always re-test the

CMPS big 55% bounce after big crash on partial read outCMPS crashed two weeks ago down 50% on market reaction to initial readout for an ongoing trial, and has since bounced 55%. I bought the dip at 2.61 inside an hourly equilibrium with a close by stop and now just letting this position play out, hopefully for months as I anticipate hype to return to the sector now that ATAI gave the GO signal we've been waiting years for.

Entry: 2.61

50% stop loss: 2.55

50% stop loss 2.05

CMPS Trend Reversal?CMPS has been struggling to gain the 4.80 Resistance Level on the higher timeframes, but has recently closed above this level and has since confirmed support at the 4.00 level, making long positions reasonable to take. Nothing is guaranteed, but I have bought 100 shares at 4.42 based off this analysis.

Follow Your Compass $CMPSThe next hype narrative after crypto has its bull run and seems “tapped out” will be psychedelics having a clinical use case and the runway for approval lines up perfectly. Compass has established itself as the best positioned player in the game and the shares have never been more reasonable. I am a continued buyer on anything 6 or below just because this is a long term play and cash could always be needed so I’m not seeing the true recovery take place for maybe another year or so but will definitely take it if it were to happen sooner. Long term price targets could be previous ATH and even higher if it gains the right momentum and gets the necessary approval with great evidence. Long term hold for me. Will continue to update and add if price goes lower, I think the bottom will be between 4-6 but we would be lucky to see 4’s. Other players I am dabbling into are NASDAQ:ATAI (owns roughly 20% of Compass) and $CYBN.

CMPS - one more move up before big selloffBullish shark completed and bearish 5-0 potential formation

Trendlines and line breaks all support the move. Anticipating a false breakout of the falling wedge before big selloff and new all time lows.

Long term I like the idea of this. People will be moving away from typical medicine and will want to explore these and other alternative medicines.

Compass Pathways Wave Analysis: Huge Moves aheadCompass Pathways appears to have completed an impulsive 5-wave move to the upside, signaling significant strength in its recent price action. The peak of this move, reaching $12.75, is notably identified as the B wave within an extended flat correction, potentially forming part of a larger 5-wave pattern.

In anticipation of a corrective phase, I anticipate a retracement towards the 0.618 - 0.65 Fibonacci ratio. This level coincides with a point of demand established in May 2022, which has historically served as a robust support level. Therefore, I am targeting a correction to the range of $6.86-7.06, presenting a compelling buying opportunity. This represents a potential decrease of approximately 30.7% to 29.1% from the current price of $9.90.

Looking ahead, my projections for subsequent waves are as follows:

Low: $21.07 (+112.8%)

Medium: $29.68 (+199.8%)

High: $41.80 (+322.2%)

Moonshot: $120 (+1,111.1%)

It's essential to note that the realization of these targets will be contingent upon the outcome of Compass Pathways' significant psilocybin phase 3 trial, slated for release by year-end. Regardless of the trial's results, I anticipate a substantial increase in price leading up to the release date, driven by market anticipation and sentiment.

In summary, while Compass Pathways demonstrates considerable strength in its recent price movements, caution is advised as the stock may undergo a corrective phase towards identified support levels before potentially resuming its upward trajectory, influenced by the impending trial results.

CMPS is starting to raise its head, pay attention!!The stock has positive momentum, breaking out a long shuffle

Caution is required... According to the SEC, there have recently been sales by insiders.

Oscillators in positive territory

$12.3 critical level (Note that the volume supports the resistance breakout)

You will find target price (first) in the attached picture

Full disclosure I am in a position from about $10

Not a recommendation of course...

Don't forget an important rule... the only way to trade the stock market... look at my signature below

Otherwise it won't work...

Keep in mind that I always update my analysis and stop losses but don't always post it NASDAQ:CMPS