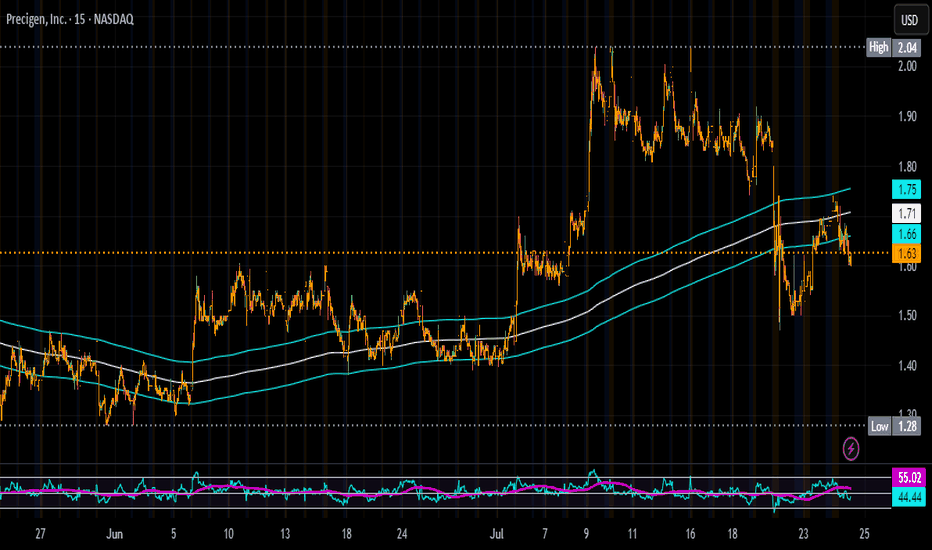

strong move up encounters area of sell off *suspected* :pullback1-> 2 :

- we switch from a smooth running flow into a high

volitility uptrend, with little to no structure showing

an overwhelming buyer interest

2: sellers step in, we see the first bearish bars, and the first

lower low in terms of a bar closing below the low of the previous

* what do I think will happen

* an interesting phenomenon is occuring , after a period of high volitility,

there is often a slowdown and calming period , this is obvious as

no single party can expend themselves forever

*the question is, has the buyers really expended themselves as much

as they wanted to ? or is this just a brief profit take, from which

buyers will enter at the 'cheaper' prices.

*it's hard to know, but in my experience, a downtrend to the gap or

even the genesis of the uptrend could be possible

* over the past 2,500 bars, if a bar closed under a zone, we have a 64% chance

of a follow through to the end, in this case it would only be midway

* so maybe a break even there, but aim for the end would be a logical play

* we have a bearish divergence on MFI and RSI , as well as overbought on both, even if it is a profit take, it could help

us hit TP with the added confluence signaling more sellers to enter

PGEN trade ideas

Buying More PGEN on all DipsThe market is overreacting to the NASDAQ:REPL news, and I think it’s a mistake to lump NASDAQ:PGEN in with it. Yes, PRGN-2012 is also a single-arm gene therapy trial, but it’s for an ultra-rare disease—not a broad indication like cancer. The FDA’s tougher stance seems to be focused on common diseases (like NASDAQ:REPL ’s melanoma drug), not niche, high-unmet-need therapies like Precigen’s.

Here’s why I’m loading up on this pullback:

PRGN-2012 has incredible data: 51% complete response rate, 86% reduction in surgeries (from 4 per year to zero). These patients suffer through painful, repeated procedures—this drug could be life-changing.

FDA loves it: Breakthrough Therapy, Orphan Drug, Fast Track, and Priority Review with a PDUFA date of August 27, 2025. If approved, it’ll be the first-ever treatment for RRP.

Commercial upside: Rare disease drugs have high margins, and there’s zero competition.

The sell-off is shortsighted. I’m treating this as a fire sale and buying more before the August 2025 catalyst. NASDAQ:PGEN is a high-conviction play for me.

PGENBiotech sector needs some love, this stock right here has had significant insider buying within the last 3 months. Although the right idea is to wait for profitability, regular investors should keep an eye on this t enter a long position if the price were to drop to $ 1.33 USD again in value. Anything less id be adding even more as I see potential LONG term see some potential as a short term swing.

its its going to break out past 1.43 that would be great very soon.

good luck

PGEN earnings beat, 9 breakout of daily flagPGEN is a pretty beaten up stock, had a recent surprise ER and looking over the past it performs decent in the days following a beat. As well a long daily flag has been created and was broken on a Friday of last week. The continuation did not hold on Friday but it was Friday and they suck for breakout confirmations. Watching close over 9 for a pop to 10. If can close above 10 will hold a few shares for a swing with an 11 target

Precigen, Inc On watch-list Precigen, Inc. is a biotechnology company, which engages in the research and development of synthetic biology technologies. The firm focuses on programming biological systems to alleviate disease, remediate environmental challenges, and provide sustainable food and industrial chemicals. It operates through the following segments: PGEN Therapeutics, ActoBio, MBP Titan, Trans Ova and All Other. The PGEN Therapeutics segment is advancing the next generation of gene and cell therapies using precision technology to target urgent and intractable diseases in immuno-oncology, autoimmune disorders and infectious diseases. The ActoBio segment involves in pioneering a proprietary class of microbe-based biopharmaceuticals that enable expression and local delivery of disease-modifying therapeutics. The MBP Titan segment comprises of Methane Bioconversion Platform, and associated technologies, personnel, and facilities The Trans Ova segment includes provides advanced reproductive technologies. The company was founded by Thomas David Reed in 1998 and is headquartered in Germantown, MD.