Trade ideas

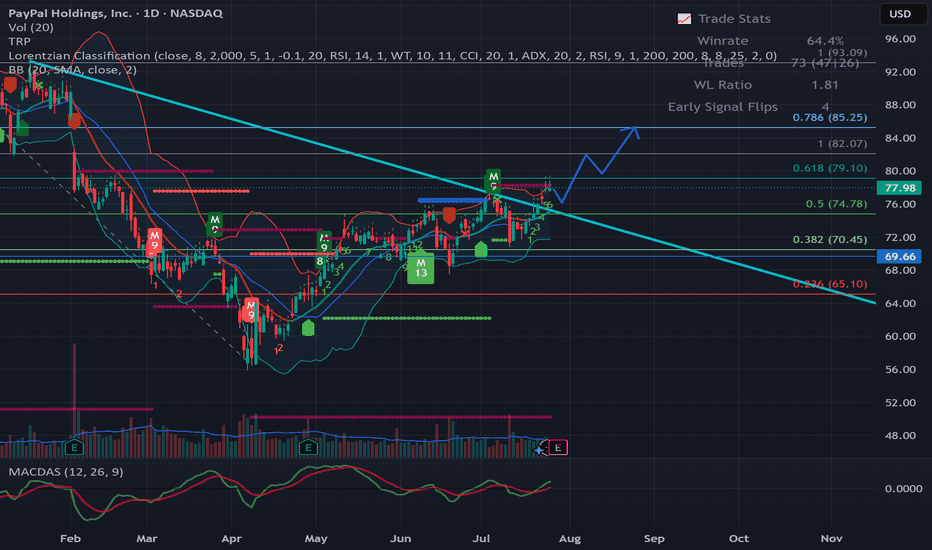

PYPL - Potential to 85.00Hello Everyone,

This week i will be busy on Sunday and not have time to work on Charts. Therefore today i spent some time and make some analysis.

PYPL is the first one.

Look like there is a break out to up trend and I am expecting it to reach 85 soon which is more than %10 .

It could re-test to 74.50 - 75.00 , if it will re-test then these price levels could be a good entry point to maximize profit. If not then maybe we can see some back off in 79.00.

Final target for me 85.00 / 86.00 . All in All trend is UP

This is just my thinking and it is not invesment suggestion , please do not make any decision with my anaylsis.

Have a good start a Weekend

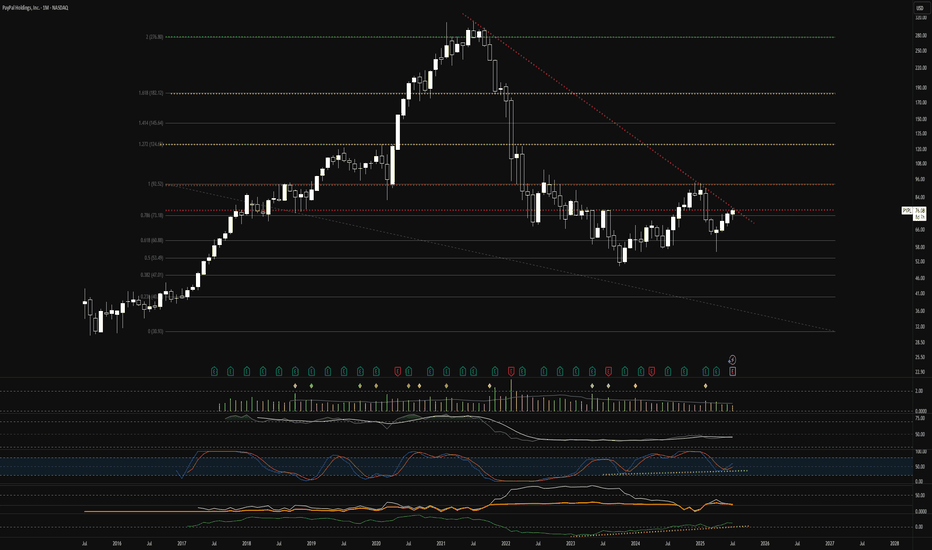

$PYPL should be in your kids kids accountNASDAQ:PYPL breaking out! PayPal forming solid base above $70 after 3-month consolidation. Recent upgrade from Seaport Global signals shifting sentiment. Chart shows golden cross with volume confirmation.

Key resistance at $75 once broken, path to $85+ looks clear.

Long-term target: $141 .

Ultimate goal: reclaim ATH of $275.51! Digital payments growth story intact! #PayPal #Fintech #BullishBreakout

"PYPL Money Grab – Ride the Bull Wave Before the Reversal!"🔥 PAYPAL HEIST ALERT: Bullish Loot Grab Before the Trap! 🔥 (Thief Trading Tactics)

👋 Greetings, Market Bandits & Cash Pirates! 🏴☠️💰

This is not financial advice—just a strategic robbery blueprint for PayPal (PYPL).

🎯 THE MASTER PLAN (Day/Swing Heist)

🔑 Entry (Bullish Swipe):

*"The vault’s cracked—bullish loot is ripe! Enter at ANY PRICE or snipe pullbacks (15m/30m swing lows/highs)."*

🛑 Stop Loss (Escape Route):

Thief’s SL: Recent swing low candle body/wick (3H TF).

Your SL = Your Risk. Adjust for lot size & multiple orders.

📈 Target: 82.00 (or escape earlier if bears ambush!)

⚡ SCALPERS’ NOTE:

Longs ONLY. Hit quick profits? Run. Still hungry? Ride the swing heist!

Trailing SL = Your Getaway Car. 🚗💨

⚠️ DANGER ZONE (Yellow MA):

Overbought | Consolidation | Bear Trap | Trend Reversal Risk!

Take profits early—greed gets caught! 🏆💸

📡 FUNDAMENTAL BACKUP (DYOR!):

Check: COT Reports | Macro Trends | On-Chain Data | Sentiment Shifts 🔍🔗 (.Linnkkss. 👉 is there to read!)

🚨 NEWS ALERT (Volatility Warning!):

Avoid new trades during news.

Trailing SL = Survive the Chaos.

💥 BOOST THE HEIST!

👊 Smash "Like" & "Boost" to fuel our next robbery! More loot = More plans! 🚀

🔔 Stay tuned—next heist coming soon! 🤑🎉

PayPal: Bears Losing Control – AgainPayPal (PYPL) has faced renewed downside pressure since our last update, but the bears failed to maintain control for long. The stock quickly rebounded toward key resistance at $78.86. If this level is decisively breached, we will consider the broader correction complete with the alternative low of beige wave alt.II. This would position the stock in the early stages of a new bullish impulse – wave alt.1 – with a 45% probability assigned to this scenario. However, under our primary scenario, we still envision wave II reaching its regular low below support at $50.18. Thus, renewed selling pressure is expected to push the price beneath that level in the near term. Once the low is in place, we reckon with a new impulsive advance.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

PayPal: Rebound or Rerun?PayPal in 2025: A breakout with backbone or just another spineless fintech?

PayPal is still in the rehabilitation ward after its fall from grace in 2021. Management drama, growth slowdown — the full fintech fatigue package. But something has shifted behind the scenes. A new CEO is cutting costs, AI integration is being whispered about, and earnings have started to surprise again. Wall Street pretends not to notice — but volume tells a different story.

Technically, we’re looking at a well-formed inverse head and shoulders. The neckline stretches from $72.00 to $74.76, aligning with the 0.5 Fibonacci level. A confirmed breakout above this zone opens the path to a clear target at $93.66 — the 1.0 Fibonacci extension. Multiple EMA clusters and strong pattern symmetry reinforce the setup. But no fairy tales here: the real entry comes after a retest. Without confirmation, it’s just another pretty formation for chart enthusiasts.

PYPL: Strong Resistance Zone in Play – Watch 73.34 for EntryNASDAQ:PYPL is showing a potential triple top formation near the 73 level. If price breaks above the 73.34 resistance , there's room to move toward 74.15 – a medium-term swing high.

💡 Trade idea: Enter 1 tick above 73.34, set your target and SL based on the 5-minute chart.

Is PayPal's Dominance Built on Tech and Ties?PayPal strategically positions itself at the forefront of digital commerce by combining advanced technological capabilities with key partnerships. A core element of this strategy is the company's robust fraud prevention infrastructure, heavily reliant on sophisticated machine learning. By analyzing vast datasets from its extensive user base, PayPal's systems proactively detect and mitigate fraudulent activities in real time, providing a critical layer of security for consumers and businesses in an increasingly complex online environment. This technological edge is particularly vital in markets facing elevated fraud risks, where tailored solutions offer enhanced protection.

The company actively pursues strategic collaborations to expand its reach and integrate its services into new digital ecosystems. The partnership with Perplexity to power "agentic commerce" exemplifies this, embedding PayPal's secure checkout solutions directly within AI-driven chat interfaces. This move anticipates the future of online shopping, where AI agents will facilitate transactions. Furthermore, initiatives like PayPal Complete Payments demonstrate a commitment to empowering businesses globally, offering a unified platform for accepting diverse payment methods across numerous markets, optimizing financial operations, and reinforcing security measures.

PayPal also adeptly navigates regulatory landscapes to broaden its service offerings and enhance user convenience. Responding to directives like the EU's Digital Markets Act, PayPal has enabled contactless payments on iPhones in Germany, providing consumers with a direct alternative to existing mobile payment options. This ability to leverage regulatory changes to expand accessibility and choice, coupled with its foundational technological strength and strategic alliances, underpins PayPal's assertive approach to maintaining its leadership position in the dynamic global payments market.

PayPal: Upward PressurePYPL has remained under upward pressure, moving significantly closer to the important resistance at $78.86. If the price rises above this level directly, we will have to assume that it has already completed the beige wave alt.II —and thus the overarching corrective movement—with the last notable low. Consequently, in this 45% probable case, the stock would have already entered a new upward cycle, specifically the first wave alt.1 of a turquoise upward impulse. Primarily, however, we expect the stock to imminently reverse downward to complete the regular wave II below the support at $50.18. Only afterward should a new sustainable upward impulse begin—initially driving rises above $94.97.

Indicators that Warn of a Top or Bottom Before It HappensHybrid Leading Indicators use all 3 data sets from each transaction that occurs in the stock market. Today this lesson talks about Chaikin Oscillator and Chaikin MFI. Both are used on the same chart as the volume oscillator reveals the volume and price correlation to what the Dark Pool Buy Side institutions are buying or selling for long term holds. The oscillator also shows pro trader activity and indicates with a spike to the top or bottom of its chart a probable reversal of the trend the next day. When the Oscillator spikes to the top, then a profit taking day by pros or a run down is likely the next day.

When the oscillator hits a V shape at the bottom of the chart, the stock price is likely to move up the next day, warning those selling short to exit quickly. The oscillator also shows topping price and volume changes before the Flat Top forms. It also shows Bottoming development before the recent rebound in $NASDAQ:PYPL.

Money Flowing into or out of a stock is also a critical analysis for swing traders as it confirm whether you should continue swing trading to the upside OR if you should switch quickly to selling short. MFI in this chart is harmonious with the oscillator, both confirming a strong indication of the direction the stock will take over the next few days.

A bottoming formation starts well ahead of the actual final low. This is important to recognize early when selling short, to avoid a huge whipsaw day that can cause huge sell short losses.

When you can read the chart as easily as you read a book, your Spatial Pattern Recognition Skills are finely tuned and you can be proud to be a member of the semi-professional retail swing traders. Let that be your goal, along with consistent profits with minimal losses.

Raise your expectations.

Trade Wisely,

Martha Stokes CMT

PayPal: Slight Recovery!In recent days, PYPL shares showed a significant recovery, raising the central question of whether the price will indeed dive into deeper territories once more, as assumed in our primary scenario. In this case, we expect the stock to fall below the support at $50.18. There, the stock should form the final low of the overarching beige wave II, thus laying the foundation for a sustainable trend reversal. Alternatively, the overarching low may have already been settled at the beginning of the month. In this 45% likely scenario, the recovery would imminently gain momentum, allowing PYPL to sustainably rise above the resistance levels at $78.86 and $94.97.

PAPL - Good epxectation for earnings, collect potential?Hi guys we would be looking into Paypal Today

Analysts maintain a "Moderate Buy" consensus on PYPL, with 17 buy, 17 hold, and 2 sell ratings. The average 12-month price target is $84.69, suggesting a potential upside of about 29.6% from the current price. Price targets range from $49 to $125.

Earnings Performance

In the most recent quarter, PayPal reported adjusted earnings per share (EPS) of $1.20, a 22% year-over-year increase, surpassing expectations. However, revenue grew by 6% to $7.85 billion, slightly below forecasts. Notably, PayPal has exceeded EPS estimates in each of the last four quarters.

Growth Initiatives and Strategic Outlook

Branded Checkout Enhancements: Efforts to improve user experience and competitiveness against rivals like Apple Pay

Venmo Monetization and Debit Card Expansion: Initiatives to increase revenue through Venmo and broader payment options.

Fastlane Guest Checkout: A new feature aimed at streamlining the checkout process, with significant monetization expected in 2025.

Valuation and Future Prospects

PayPal's current valuation at 14 times forward 2025 earnings is below its five-year average P/E of 50.5, indicating potential for multiple expansion. Forecasts suggest revenue could reach $35.1 billion in 2025, with EPS around $4.93.

Our Conclusion

Given its strategic initiatives, consistent earnings performance, and favorable valuation, PayPal appears poised for growth. While challenges like competition in digital payments persist, the company's focus on innovation and user experience may drive its stock price upward in the coming years.

📌 Trade Plan

📈 Entry: 65.50

✅ Target: 75.50 - Targeting the weak resistance

❌ SL: 55.50 - protecting the trade above the bottom zone

PYPL Building a Base or Faking a Bounce? All Eyes on This CHoCH!Market Structure & Price Action

PayPal (PYPL) is showing early signs of a potential reversal after forming a CHoCH (Change of Character) near the $66 level following a prior BOS (Break of Structure) and key demand reaction around $63.38. The price is now trading inside a retest range from a previous order block and pushing higher with a bullish structure of higher lows. A clean ascending trendline supports the move, with price respecting the diagonal base.

MACD is showing light momentum to the upside, and Stoch RSI is coiled just under overbought — signaling possible short-term consolidation before continuation or a breakout.

Key Levels to Watch:

* Resistance Zone (Supply): $71.50 – $72.00

* Support Zone (Demand): $63.38 – $64.57

* Breakout Trigger: Over $66.50 with volume

* Breakdown Trigger: Below $63.38 BOS zone

GEX & Options Flow Sentiment

* GEX Walls (Gamma Exposure):

* Highest Call Wall / Resistance: $72.00

* Put Wall / Support: $63.00

* Options Oscillator (Pro):

* IVR: 39.7

* IVx avg: 45.3

* Call$: 12.6%

* GEX: 🟢🟢🟢

* Bias: Slightly Bullish into resistance, volatility could expand above $67.

Trade Setup Ideas

Bullish: If price holds above $65.50 and breaks $66.50, we may see a squeeze toward $69 and eventually $71.

* Entry: $66.50

* Stop: $64.70

* Targets: $69 / $71.50

Bearish: Failure to break $66.50 with rejection + bearish divergence may offer a put opportunity toward $63.

* Entry: $65.70 rejection or breakdown below $64.50

* Stop: $66.60

* Target: $63.50 / $62.80

Conclusion

PYPL is bouncing within a consolidating range, and the CHoCH suggests possible accumulation. A breakout above $66.50 confirms strength; otherwise, it’s a fade back to support. Watch the trendline and volume closely this week.

Disclaimer

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and trade responsibly.