Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4,241.15 INR

18.69 B INR

281.45 B INR

2.26 M

About MRF Limited

Sector

Industry

Website

Headquarters

Chennai

Founded

1946

ISIN

INE883A01011

FIGI

BBG000CVV6Y2

MRF Ltd. engages in the manufacture, distribution, and sale of rubber products. The firm's products includes tires, tubes, flaps, tread rubber, and conveyor belt. It also manufactures paint, coats, pretreads, and sports goods. The company was founded by K. M. Mammen Mappillai in 1946 and is headquartered in Chennai, India.

Related stocks

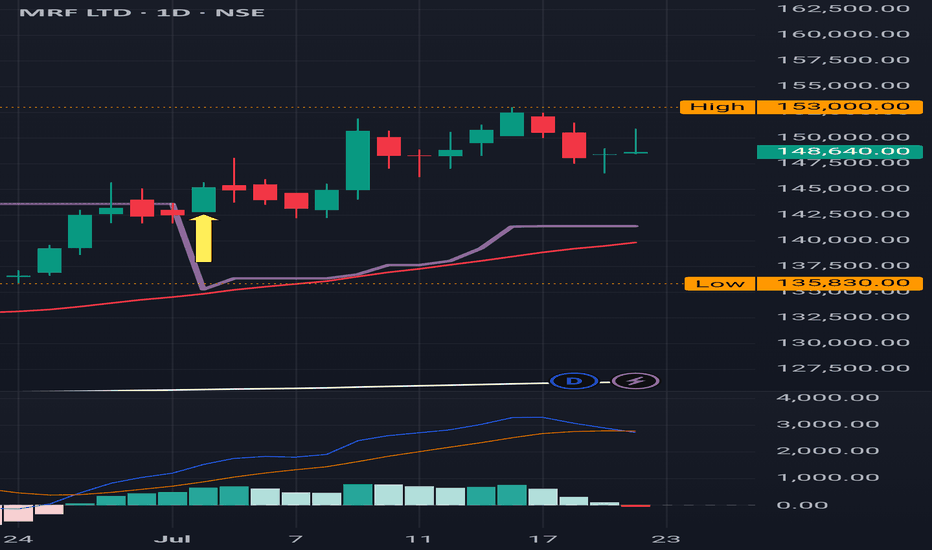

MRF Trend Based Fibonacci Extensions (Daily And Weekly)Step-by-Step Approach

1. Analyze Structure First

Check for market structure: Higher Highs (HH), Higher Lows (HL), Lower Highs (LH), and Lower Lows (LL).

Only proceed if price action aligns with your desired trade direction.

2. Use Demand Zone for Buys

Watch for entries near 142,181.45 an

#MRF- Are we ready to see ₹30,000 Swing?#MRF has achieved the previous targets perfectly. Now are we going to witness any another rally of 30,000 points? Please be clear, I am not advocating for any particular direction, but it is going to be movement on any side.

Current Price: ₹ 140420

Mid-point: ₹ 1,36,500.00

Upside Lelvels: ₹ 1,

MRF : Bulls are Back It's above 200 SMA MRF : Bulls are Back It's above 200 SMA

Back to back Greens from 105000 .

Resistance band is clearly visible on the chart

MACD is on a fly .

Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

MRF Ltd. – High Potential Trade Setup & Market Analysis🚀 MRF Ltd. – Monthly Chart Analysis 📊

🔍 Key Observations:

📌 Current Price: ₹107,202.95 📉

The stock is down almost 67% from all time high

📌 Trade Setup:

🎯 Target Price: ₹151,110.25 (+60.72%)

⚠️ Stop Loss: ₹83,228.20 (-11.46%)

💡 Risk/Reward Ratio: 5.3 (Highly favorable setup!)

📌 Best Buying

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of MRF is 152,339.95 INR — it has decreased by −0.46% in the past 24 hours. Watch MRF Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange MRF Limited stocks are traded under the ticker MRF.

MRF stock has risen by 2.16% compared to the previous week, the month change is a 1.11% rise, over the last year MRF Limited has showed a 10.95% increase.

We've gathered analysts' opinions on MRF Limited future price: according to them, MRF price has a max estimate of 170,000.00 INR and a min estimate of 105,820.00 INR. Watch MRF chart and read a more detailed MRF Limited stock forecast: see what analysts think of MRF Limited and suggest that you do with its stocks.

MRF stock is 1.99% volatile and has beta coefficient of 1.20. Track MRF Limited stock price on the chart and check out the list of the most volatile stocks — is MRF Limited there?

Today MRF Limited has the market capitalization of 649.21 B, it has decreased by −5.14% over the last week.

Yes, you can track MRF Limited financials in yearly and quarterly reports right on TradingView.

MRF Limited is going to release the next earnings report on Nov 7, 2025. Keep track of upcoming events with our Earnings Calendar.

MRF earnings for the last quarter are 1.14 K INR per share, whereas the estimation was 1.38 K INR resulting in a −17.48% surprise. The estimated earnings for the next quarter are 1.31 K INR per share. See more details about MRF Limited earnings.

MRF Limited revenue for the last quarter amounts to 75.60 B INR, despite the estimated figure of 76.28 B INR. In the next quarter, revenue is expected to reach 74.82 B INR.

MRF net income for the last quarter is 5.00 B INR, while the quarter before that showed 5.12 B INR of net income which accounts for −2.27% change. Track more MRF Limited financial stats to get the full picture.

MRF Limited dividend yield was 0.21% in 2024, and payout ratio reached 5.33%. The year before the numbers were 0.15% and 4.08% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Oct 6, 2025, the company has 17.85 K employees. See our rating of the largest employees — is MRF Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MRF Limited EBITDA is 39.96 B INR, and current EBITDA margin is 14.73%. See more stats in MRF Limited financial statements.

Like other stocks, MRF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MRF Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MRF Limited technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MRF Limited stock shows the strong buy signal. See more of MRF Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.