Post Flash-Crash BTC Despite such a large sell-off event, has the outlook on BTC actually changed? Structurally BTC remains very much rangebound with two clearly definable halves of the range. That is until Fridays move off the back of a Tariff Tweet from President Trump causing a liquidation event similar to that of Ap

Related pairs

Is the Bitcoin market bearish?📊 Bitcoin Market Psychology Analysis

Market psychology analysis is one of the most fascinating and practical approaches to understanding Bitcoin's current position! 🎯

🎭 Market Psychology Cycle Phases:

1. Hope Phase 🟦

Likely the current point for many assets

· 📈 Description: After a panic-driven

We are looking to go higher stillBitcoin is climbing a clean rising channel 📈 — higher highs and higher lows forming a short-term bullish structure. Watch for a breakout above 126K or a breakdown below 122K to confirm the next move. #BTC #CryptoTrading #TrendChannel

Breakdown:

The lower dashed line marks support, where buyers hav

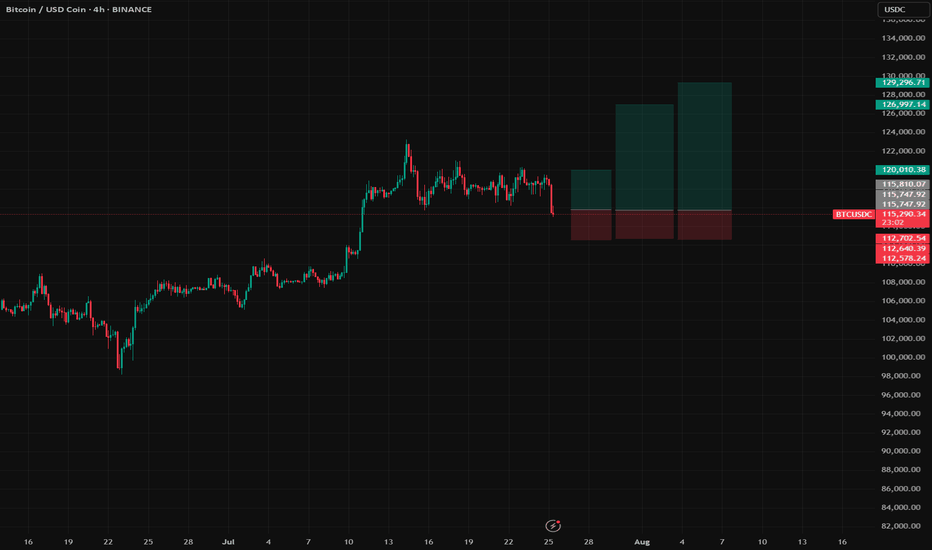

Long trade

Trade Journal Entry

Pair/Asset: BTCUSDC (Bitcoin / USDC, Perp)

Trade Type: Buyside trade

Date: Monday, 29th Sept 2025

Session: Tokyo Session AM (4:00 AM)

Trade Details

Entry: 112,051.5

Profit Level (TP): 115,828.0 (+3.41%)

Stop Level (SL): 111,561.0 (-0.97%)

Risk–Reward (RR): 8.42

Technical Narr

Bitcoin underperforms during unsettled conflictsSupport and Resistance Levels:

Major support appears to be around 111k–112k, which has held previously after a strong upward move.

Resistance levels marked at 123k and 124k indicate prior highs and significant selling pressure.

Price Action & Structure:

The price recently had formed an ascending

BitCoin - Is it heading for the Fib?This is a classic Entry Short for Weis Wave with Speed Index owners called " Exit from Range with a Plutus Signal" and in this case it was a PS. It looks that it's heading for the Fib, I will wait for some pullback on 1HR to confirm with Speed Index and the waves, as well as getting a better RR.

I

BTC Long Setup | Multi-target Swing Trade with Reasonable SL📝 Description:

Buy Bitcoin (BTC) based on continuation correction structure.

Entry: 115,800

Stop-Loss: 112,600

Risk: 1% per trade (position size adjusted accordingly, no leverage used trade spot only!)

🎯 Take-Profit Levels:

*Watch for a strong red candle at each TP zone.

If it happen, take full

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.