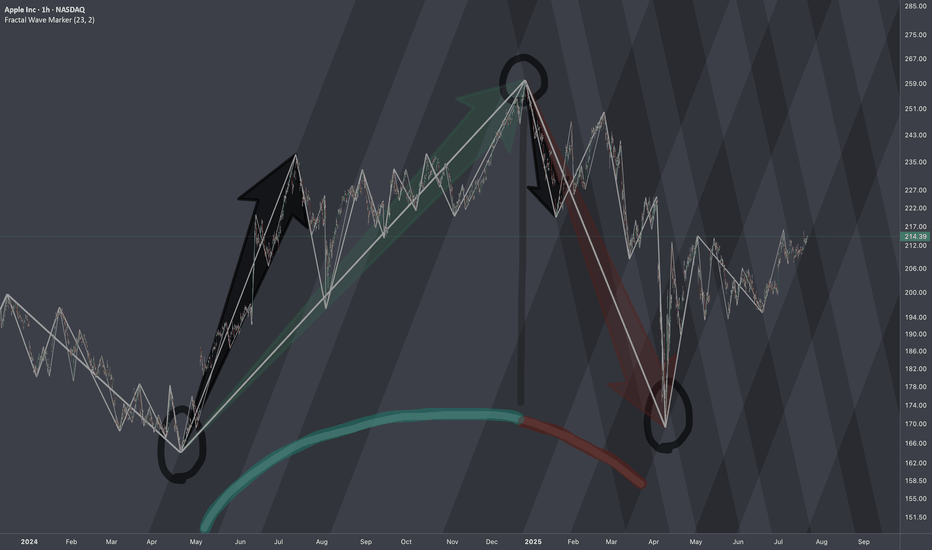

MARKET PROFILE🔸🔸🔸 1 - Back to the Roots: Learn the Theory, Improve Signal 🔸🔸🔸

Becoming a successful trader starts with building a strong foundation of knowledge. This foundation comes from time spent in the markets and real experience. While the basic idea is easy to understand, actually building this solid bas

Key facts today

Apple's services are growing, with four key segments, including Apple Pay, thriving. Strong iPhone demand is noted in China, along with double-digit sales growth at T-Mobile.

Apple's stock closed at $255.46, reflecting a decline of $1.41.

Apple has announced a projected $1.1 billion impact in the fourth quarter due to tariffs, following an $800 million impact reported in the June quarter.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

26,960 COP

395.51 T COP

1,649.94 T COP

14.82 B

About Apple Inc

Sector

Industry

CEO

Timothy Donald Cook

Website

Headquarters

Cupertino

Founded

1976

ISIN

US0378331005

FIGI

BBG001BHSV80

Apple, Inc engages in the design, manufacture, and sale of smartphones, personal computers, tablets, wearables and accessories, and other variety of related services. It operates through the following geographical segments: Americas, Europe, Greater China, Japan, and Rest of Asia Pacific. The Americas segment includes North and South America. The Europe segment consists of European countries, as well as India, the Middle East, and Africa. The Greater China segment comprises of China, Hong Kong, and Taiwan. The Rest of Asia Pacific segment includes Australia and Asian countries. Its products and services include iPhone, Mac, iPad, AirPods, Apple TV, Apple Watch, Beats products, Apple Care, iCloud, digital content stores, streaming, and licensing services. The company was founded by Steven Paul Jobs, Ronald Gerald Wayne, and Stephen G. Wozniak in 1976 and is headquartered in Cupertino, CA.

Related stocks

Apple Stock Supported by Earnings Strength and New ProductsApple Inc. (AAPL) is currently trading around $256.93, up 1.35% in the latest session. Following a strong rally, AAPL remains supported by both technical signals and macro factors. On the technical side, $257 is acting as a key resistance; a breakout above this level could open the way toward $260 a

AAPL Bullish Swing Setup – Buy the Dip for $289 Target1. Chart Type & Timeframe

Symbol: Apple Inc. (AAPL)

Timeframe: 4H (4-hour candles)

Platform: TradingView

This is a short- to medium-term analysis, not a long-term forecast.

2. Trend Analysis

The price is in a rising channel (marked in red), meaning the overall trend is bullish.

Currently, the

Watching for an opportunity to short AAPLI don't short often because (for me and most traders) it's a rather hard trade to execute properly and hold for a little bit.

I was going through quarterly stock charts for long ideas and couldn't help but see that in 2023 & 2024 AAPL could not hold "closing" support after what would have been cons

$AAPL: Structure SurgeryResearch Notes

Original Structure:

Altering structure for experimental purposes

Angle of fib channels that rises from cycle low, has been pushed into the past to the top of first major reaction. blue area resembles the change

Reason

The the angle of Fibonacci channels which cover th

AAPL at Dynamic Support: Trade the Bounce!🍎 AAPL Swing/Day Trade: The Great Apple Heist Plan 🚨

Asset: AAPL (Apple Inc. Stock)

Market: US Stock

MarketVibe: Bullish, sneaky, and ready to loot some profits! 💰

📜 The Master Plan: Bullish EMA Pullback Heist

🎯 Strategy: We're pulling off a slick Double Exponential Moving Average (DEMA) pullbac

Apple Shares (AAPL) Close to Reaching Record HighApple Shares (AAPL) Close to Reaching Record High

On 10 September, we noted that following the launch of new products — including the iPhone 17 — AAPL shares had fallen by approximately 1.5%, as analysts considered the model lacked the breakthrough appeal necessary to drive further growth.

Howeve

AAPL: The Rally Might Not Be OverWhile many tech giants have already reached new all-time highs, Apple is still lagging behind — NASDAQ:AAPL hasn’t yet broken out. This may represent both a risk and an opportunity for latecomers.

Investor caution remains due to potential tariffs on Apple products from China, with the decision no

APPLE made first 1D Golden Cross in over a year!Apple Inc. (AAPL) completed this week its first 1D Golden Cross in over 1 year (since June 13 2024). The price has posted a strong 1D candle today on positive iPhone 17 fundamentals and it appears that the price is extending the very same Channel Up it had in May - July 2024.

If the current pattern

Learn What a VOID is and how it Impacts Your Trading A void is a trading condition that occurs when small lot buyers and Odd Lot investors run out of capital to invest. These two retail groups tend to have very little savings to invest so they buy Odd Lots (under 100 shares for one transaction) or Fractional Shares, which is a fraction of ONE single

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

APCL

Apple Inc. 3.6% 31-JUL-2042Yield to maturity

5.53%

Maturity date

Jul 31, 2042

US37833DW7

Apple Inc. 2.65% 11-MAY-2050Yield to maturity

5.33%

Maturity date

May 11, 2050

US37833ER7

Apple Inc. 4.1% 08-AUG-2062Yield to maturity

5.31%

Maturity date

Aug 8, 2062

US37833EL0

Apple Inc. 2.85% 05-AUG-2061Yield to maturity

5.31%

Maturity date

Aug 5, 2061

US37833DQ0

Apple Inc. 2.95% 11-SEP-2049Yield to maturity

5.31%

Maturity date

Sep 11, 2049

US37833EG1

Apple Inc. 2.8% 08-FEB-2061Yield to maturity

5.30%

Maturity date

Feb 8, 2061

US37833EK2

Apple Inc. 2.7% 05-AUG-2051Yield to maturity

5.29%

Maturity date

Aug 5, 2051

US37833DD9

Apple Inc. 3.75% 12-SEP-2047Yield to maturity

5.29%

Maturity date

Sep 12, 2047

US37833EF3

Apple Inc. 2.65% 08-FEB-2051Yield to maturity

5.29%

Maturity date

Feb 8, 2051

US37833DZ0

Apple Inc. 2.4% 20-AUG-2050Yield to maturity

5.28%

Maturity date

Aug 20, 2050

US37833EQ9

Apple Inc. 3.95% 08-AUG-2052Yield to maturity

5.27%

Maturity date

Aug 8, 2052

See all AAPL bonds

Curated watchlists where AAPL is featured.

Frequently Asked Questions

The current price of AAPL is 994,700 COP — it has decreased by −0.50% in the past 24 hours. Watch Apple Inc stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BVC exchange Apple Inc stocks are traded under the ticker AAPL.

AAPL stock has risen by 5.82% compared to the previous week, the month change is a 6.39% rise, over the last year Apple Inc has showed a 4.98% increase.

We've gathered analysts' opinions on Apple Inc future price: according to them, AAPL price has a max estimate of 1,210,937.50 COP and a min estimate of 703,125.00 COP. Watch AAPL chart and read a more detailed Apple Inc stock forecast: see what analysts think of Apple Inc and suggest that you do with its stocks.

AAPL reached its all-time high on Aug 31, 2020 with the price of 1,904,000 COP, and its all-time low was 26,220 COP and was reached on Apr 23, 2013. View more price dynamics on AAPL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AAPL stock is 0.53% volatile and has beta coefficient of 1.18. Track Apple Inc stock price on the chart and check out the list of the most volatile stocks — is Apple Inc there?

Today Apple Inc has the market capitalization of 14,809.10 T, it has increased by 3.49% over the last week.

Yes, you can track Apple Inc financials in yearly and quarterly reports right on TradingView.

Apple Inc is going to release the next earnings report on Oct 23, 2025. Keep track of upcoming events with our Earnings Calendar.

AAPL earnings for the last quarter are 6.41 K COP per share, whereas the estimation was 5.87 K COP resulting in a 9.18% surprise. The estimated earnings for the next quarter are 6.88 K COP per share. See more details about Apple Inc earnings.

Apple Inc revenue for the last quarter amounts to 383.82 T COP, despite the estimated figure of 365.56 T COP. In the next quarter, revenue is expected to reach 396.98 T COP.

AAPL net income for the last quarter is 95.65 T COP, while the quarter before that showed 103.25 T COP of net income which accounts for −7.36% change. Track more Apple Inc financial stats to get the full picture.

Yes, AAPL dividends are paid quarterly. The last dividend per share was 1.05 K COP. As of today, Dividend Yield (TTM)% is 0.40%. Tracking Apple Inc dividends might help you take more informed decisions.

Apple Inc dividend yield was 0.43% in 2024, and payout ratio reached 16.11%. The year before the numbers were 0.55% and 15.32% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 27, 2025, the company has 164 K employees. See our rating of the largest employees — is Apple Inc on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Apple Inc EBITDA is 578.35 T COP, and current EBITDA margin is 34.44%. See more stats in Apple Inc financial statements.

Like other stocks, AAPL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Apple Inc stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Apple Inc technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Apple Inc stock shows the strong buy signal. See more of Apple Inc technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.