NU Holdings: A High-Growth Fintech LeaderNYSE:NU is the largest digital bank in the world, with over 100 million customers across Brazil, Mexico, and Colombia, and is expanding its base by 10–12 million users per year. Unlike most fintechs, NU is solidly profitable, consistently delivering ~20% net profit margins, supported by exceptiona

Key facts today

UBS has increased the price target for Nu Holdings Ltd. Class A (NU) to $18.40 per share, up from the previous target of $16.00.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2,060 COP

8.69 T COP

45.51 T COP

3.47 B

About Nu Holdings Ltd.

Sector

Industry

CEO

David Vélez Osorno

Website

Headquarters

George Town

Founded

2016

ISIN

KYG6683N1034

FIGI

BBG0185K5577

Nu Holdings Ltd. is a holding company, which engages in the provision of digital banking services. The company was founded by David Vélez Osorno, Cristina Helena Zingaretti Junqueira, and Adam Edward Wible on February 26, 2016 and is headquartered in George Town, Cayman Islands.

Related stocks

Nu Holdings (NU) AnalysisCompany Overview:

NYSE:NU is Latin America’s largest digital bank, offering mobile banking, credit cards, and investments—direct exposure to the region’s booming fintech market.

Key Highlights:

Scale & Growth: 123M customers (+18M YoY), adding ~1.5M/month.

Financial Momentum (Q2’25): Revenue $2

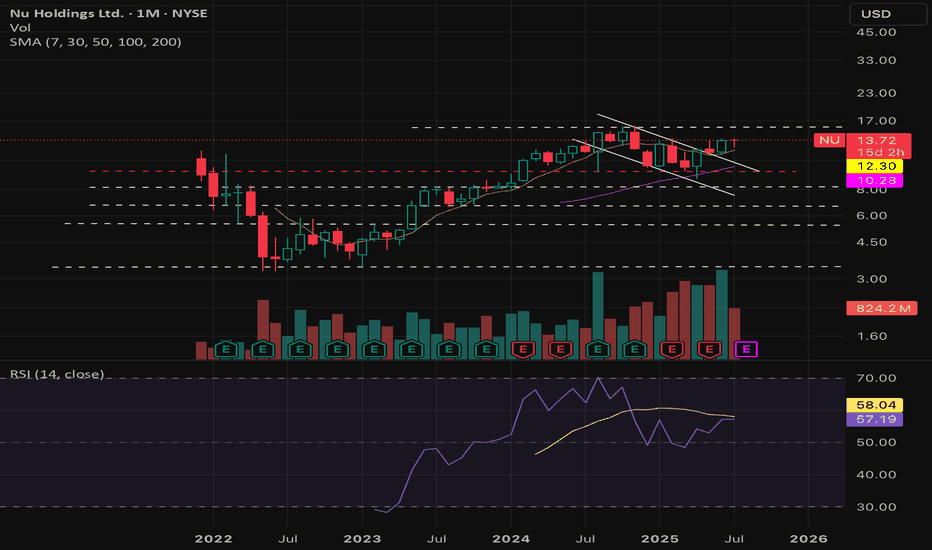

Cup n handle on Weekly and D/W Breakout watchFIrst OFF Lets say it aloud = Bigger the base, higher in space !

Secondly look at Monthly or weekly chart and see 42 months of Consolidation in that area?

See a cup and handle? see this sticking to the highs and banging its head at $14 w multiple tries,

Simple Rule is the more we hit on a resistance

Undervalued Fintech Just Hit 110M Users: Nubank ($NU)The Case for Nubank NYSE:NU

Nubank is a combination of growth and value in the fintech space. I personally like it when, as an investor, I find a stock that is a growth and value stock simultaneously.

Nu is trading at a P/E of 31.5x, and the company is a compelling story with upside potential

Simple Trading Analysis using Supply and DemandThis is the most basic chart I will ever draw to indicate how simple the all-important concept of supply and demand could be.

Let's begin with the initial move to all time highs that we saw in September 2024.

#1.

Strong bullish volume followed by relatively strong bearish volume.

#2.

We re-en

$NU Holding Gap Fill IdeaNot only did Citi Bank give NU Holding an upgrade to $18. Since the end of April this stock has been itching to blast off. On top of massive expansion into "NU" territories (get it), and disrupting the standard financial institutions, NYSE:NU is positioning itself to become a Financial superapp. W

NU $12 Call – Earnings Play Incoming!

## 🚀 NU \$12 Call – Earnings Play Incoming!

**Sentiment:** 🟢 *Moderate Bullish (75% Confidence)*

* **TTM Revenue Growth:** 10.6% 📈

* **Operating Margin:** 57.7% 💰

* **RSI:** 34.3 (Oversold, potential reversal)

* **Options Flow:** Strong call interest at \$12.00/\$12.50 strikes

* **Macro:** Finte

$NU : 30% CAGR for your portfolio for the next 3-5 years!- NYSE:NU is a big name in the LATAM.

- LATAM is expected to grow significantly in next decade with digitalization as the strongest theme.

- Let's talk about fundamentals:

Year | 2025| 2026| 2027 | 2028

EPS | 0.56 | 0.77 | 1.05 | 1.45

EPS growth% | 31.99% | 37.71% | 36.05% | 38.58%

For a compa

Nu Holdings: Is Latin America's Fintech Star Sustainable?Nu Holdings Ltd. stands as a prominent neobank, revolutionizing financial services across Latin America. The company leverages the region's accelerating smartphone adoption and burgeoning digital payment trends, offering a comprehensive suite of services from checking accounts to insurance. Nu's imp

NU - One of my favorite long term holds. Loading up every chanceI believe this company is way undervalued and it is growing exponentially. Overlooked because of where it does business (mainly Brazil, Mexico) but the leader in those countries.

I am adding every chance I get for a long term hold here - and the algorithms are agreeing with me!

Happy Trading :)

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where NU is featured.

Frequently Asked Questions

The current price of NU is 66,880 COP — it has decreased by −2.22% in the past 24 hours. Watch Nu Holdings Ltd. Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BVC exchange Nu Holdings Ltd. Class A stocks are traded under the ticker NU.

NU stock has risen by 3.94% compared to the previous week, the month change is a 5.60% rise, over the last year Nu Holdings Ltd. Class A has showed a 29.86% increase.

We've gathered analysts' opinions on Nu Holdings Ltd. Class A future price: according to them, NU price has a max estimate of 82,706.77 COP and a min estimate of 42,481.20 COP. Watch NU chart and read a more detailed Nu Holdings Ltd. Class A stock forecast: see what analysts think of Nu Holdings Ltd. Class A and suggest that you do with its stocks.

NU stock is 3.05% volatile and has beta coefficient of 1.29. Track Nu Holdings Ltd. Class A stock price on the chart and check out the list of the most volatile stocks — is Nu Holdings Ltd. Class A there?

Today Nu Holdings Ltd. Class A has the market capitalization of 314.09 T, it has increased by 8.00% over the last week.

Yes, you can track Nu Holdings Ltd. Class A financials in yearly and quarterly reports right on TradingView.

Nu Holdings Ltd. Class A is going to release the next earnings report on Feb 19, 2026. Keep track of upcoming events with our Earnings Calendar.

NU earnings for the last quarter are 625.49 COP per share, whereas the estimation was 627.52 COP resulting in a −0.32% surprise. The estimated earnings for the next quarter are 717.17 COP per share. See more details about Nu Holdings Ltd. Class A earnings.

Nu Holdings Ltd. Class A revenue for the last quarter amounts to 16.36 T COP, despite the estimated figure of 13.82 T COP. In the next quarter, revenue is expected to reach 14.21 T COP.

NU net income for the last quarter is 3.07 T COP, while the quarter before that showed 2.60 T COP of net income which accounts for 18.05% change. Track more Nu Holdings Ltd. Class A financial stats to get the full picture.

No, NU doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Dec 4, 2025, the company has 8.72 K employees. See our rating of the largest employees — is Nu Holdings Ltd. Class A on this list?

Like other stocks, NU shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Nu Holdings Ltd. Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Nu Holdings Ltd. Class A technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Nu Holdings Ltd. Class A stock shows the buy signal. See more of Nu Holdings Ltd. Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.