Boeing's Flight to $220: Aerospace Recovery Fuels Momentum

Current Price: $201.02

Direction: LONG

Targets:

- T1 = $210.00

- T2 = $220.00

Stop Levels:

- S1 = $198.00

- S2 = $195.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds teaches us that collective evaluations from seasoned professionals often enhance decision-making by reducing biases and bringing clarity. Boeing has widespread attention among traders due to its strategic developments in commercial aviation and defense expansion, creating a bullish outlook.

**Key Insights:**

Boeing looks set to capitalize on the strengthening aerospace recovery in 2025, primarily driven by rebounding global travel and airline fleet modernization. Increased demand from emerging markets such as Asia-Pacific and the Middle East for new-generation fuel-efficient aircraft has been robust, supporting revenue projections. The company's proactive measures to alleviate production challenges surrounding the 737 MAX and 787 Dreamliner have positively impacted its operational efficiency, further amplifying investor optimism.

Additionally, Boeing's military aerospace division is benefiting from heightened global defense budgets and strategic deals, bolstering profitability. The company’s expanding backlog of orders and commitment to sustainable aviation has positioned it favorably for long-term growth. Its cash-flow projections for 2025 indicate potential increases in shareholder returns through share buybacks and dividend expansion, making it an appealing stock for institutional investors.

**Recent Performance:**

Boeing's stock has rallied in recent weeks, breaking out of the range-bound levels that persisted during challenging periods in 2024. Following positive earnings results and optimistic outlooks for 2025, the stock reached the psychologically important $200 mark. Volume spikes and improved sentiment from both institutional and retail investors have fueled momentum, with many seeing the current price as a launchpad for upside movement to critical resistance levels.

**Expert Analysis:**

Technical charts reveal strong bullish momentum for Boeing. A golden cross formation—where the 50-day moving average ($198) surpasses the 200-day moving average ($195)—has emerged, signaling further upward traction. The RSI is climbing steadily but remains below overbought levels, indicating that the stock still has room to appreciate. Key resistance levels are noted at $210 and $220, where profit-taking could occur, but traders are optimistic about longer-term upside beyond these thresholds as aviation rebounds into 2025.

Analysts believe Boeing's deep order backlog, easing supply chain constraints, and improving operational efficiency offer compelling fundamentals. If global demand continues to recover in line with predictions, Boeing’s stock has significant growth potential, making current levels a buying opportunity.

**News Impact:**

Recent developments in international travel recovery and aviation innovation have significantly boosted Boeing's stock outlook. News of a strategic partnership to supply modernized fleets to key carriers and the reaffirmation of timely aircraft deliveries has underscored confidence in the company's leadership capabilities. Additionally, its investment in sustainable aviation technology aligns with global environmental priorities, potentially attracting positive ESG-focused capital flows and further stabilizing growth projections.

**Trading Recommendation:**

Trade Boeing with a bullish outlook—current technical and fundamental conditions strongly support upside. With a marked improvement in earnings, operational efficiencies, and macro-trend tailwinds from a recovering aviation sector, Boeing can reach its short-term target of $210 and potentially $220 in subsequent quarters. Maintain cautious stop-losses at $198 and $195 to manage risks amid market volatility. Buyers should act on near-term dips as opportunities to acquire positions at reasonable levels for future gains.

Do you want to save hours every week? Register for the free weekly update in your language!

Trade ideas

Boeing (BA) – Final Leg of Macro Bull Run✈️ Boeing (BA) – Final Leg of Macro Bull Run | Wave 5 to 1.618 Extension ($1200) 🚀

📅 Timeframe: Monthly (Macro Cycle Outlook)

📍 Current Price: $217

🎯 Wave 5 Target : ~$1200 (1.618 Extension)

🌀 Wave Theory Structure

Boeing appears to be entering Wave 5 of a long-term Elliott Wave cycle:

✅ Wave 1: Multi-decade rise until the early 2000s

✅ Wave 2: Complex correction (W–X–Y) into 2009 lows

✅ Wave 3: Powerful rally through 2019, completed with an extended 5-wave subdivision

✅ Wave 4: A large-scale triangle correction (ABCDE) — now completed, as price has broken structure upward

🚀 Wave 5: Projected move toward the 1.618 Fibonacci extension (~$1200) from the 1–3 wave distance

This is a textbook impulsive wave structure playing out on the monthly macro scale — with a final bullish leg now unfolding.

📐 Fibonacci Confluence

Wave 2 retraced ~0.236 of Wave 1 (shallow, bullish corrective behavior)

Wave 4 retraced ~0.5 of Wave 3 — typical for triangle patterns and expanded flats

Wave 5 target at 1.618 Fib extension measured from Wave 1–3 aligns around $1200 , completing the 5-wave macro cycle 🔺

🧠 Smart Money Concepts (SMC)

🔹 Accumulation Phase (2020–2024): After COVID crash and multi-year consolidation, price has shown strong accumulation characteristics

🔹 Final Sweep of Lows (E leg) flushed out late longs and retail stops before institutional re-entry

🔹 Break of Structure (BOS) confirms transition from reaccumulation to markup phase 📈

🔹 Price is now in a reprice phase — a classic SMC trait where value is rapidly adjusted after institutional positioning completes

📊 Price Action Analysis

Bullish breakout from triangle structure

Monthly higher low established at E-wave base

Strong bullish candle from demand zone — early confirmation of trend continuation

Break above $260 would open clean skies toward the next major resistance at ATH ($446) and beyond 🧭

💼 Fundamental Outlook

Boeing is regaining strength after multiple challenging years:

✈️ Rebound in global aviation demand

📦 Growing defense & aerospace contracts amid rising geopolitical tensions

💰 Expected recovery in cash flows, backlog, and profitability

🌐 Expansion in space and unmanned systems (future growth verticals)

Although regulatory and delivery risks remain, Boeing’s turnaround story is gathering steam — aligning with the technical forecast of Wave 5 acceleration.

🔍 Summary

Boeing is entering what could be the final and most explosive leg (Wave 5) of its macro Elliott Wave cycle. Key confluences include:

✅ Elliott Wave triangle completion

✅ Fibonacci 1.618 extension to ~$1200

✅ Institutional accumulation confirmed

✅ Price Action breakout from multi-year structure

✅ Improving long-term fundamentals

This setup favors long-term swing positions , with pullbacks offering buying opportunities until the final cycle target is approached. 🧠📈

⚠️ Disclaimer: This is not financial advice. For educational purposes only. Always do your own due diligence and manage risk responsibly. 🛡️

#Boeing #BA #ElliottWave #SmartMoney #PriceAction #Fibonacci #Wave5 #TriangleBreakout #TechnicalAnalysis #LongTermInvestment #MacroTrading #StockMarket #BullishOutlook #Aerospace #WaveTheory #SwingTrading #AviationRecovery #FibonacciTargets #TradingStrategy

Boeing (BA) Technical Outlook: Is Downside Momentum Building?✈️ BA "BOEING COMPANY" | Cash Flow Management Strategy (Swing/Day Trade)

📉 Plan: Bearish Setup

This analysis follows the Thief Strategy 🕶️ — a layering method of multiple sell-limit orders across different levels.

🔑 Trade Plan

Entry (Layered Sell Limits):

220.00

218.00

216.00

214.00

(You can increase/decrease limit layers based on your own preference)

Stop Loss: 227.00 (⚠️ Thief SL)

Note: Dear Ladies & Gentleman (Thief OG’s) 🙌 this SL is just my own preference. Please manage your risk your own way.

Targets 🎯

TP1 → 207.00

TP2 → 197.00

Note: Targets are my reference points. You can book profits at your own choice, anytime.

📊 Key Points & Correlation

Boeing (BA) often reacts to aviation sector news ✈️ and macroeconomic cycles 📉.

Watch related pairs for correlation / sentiment clues:

AMEX:SPY (S&P 500 ETF) – BA is a Dow & SPX component.

TVC:DJI (Dow Jones Index) – Direct BA weighting.

NYSE:LMT (Lockheed Martin) – Sector peer correlation.

SKILLING:AIR.PA (Airbus SE) – Competitive aviation stock in Europe.

A slowdown in air travel demand, defense spending shifts, or broad market weakness may enhance bearish momentum.

🧠 Strategy Style Reminder

This is the Thief Layering Strategy → scaling into positions step by step with multiple limit orders, not rushing into full size at once. It’s a patient cash flow management approach.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

⚠️ Disclaimer: This is Thief Style Trading Strategy — just for fun & educational purpose. Not financial advice. DYOR & manage risk.

#BA #Boeing #Stocks #DayTrading #SwingTrading #LayeringStrategy #ThiefStyle #SPY #DJI #LMT #Airbus #StockMarket

Boeing May Be StallingBoeing rallied sharply in the spring and early summer. But now some traders may think it’s stalling.

The first pattern on today’s chart is the $225.50 level, a weekly low from September 5. BA broke under that level the following week and has stayed there since. It tried to rebound last Wednesday and was rejected. Has old support become new resistance?

Second, the aerospace giant reported strong quarterly results on July 29. Buyers drove prices higher, but sellers turned the bullish open into a bearish engulfing day. That large outside candle is a potentially bearish reversal pattern.

Third, July’s high occurred near a gap from January 8, 2024. Old resistance may have been confirmed.

Next, the 8-day exponential moving average (EMA) is below the 21-day EMA. Last week’s high also occurred at the falling 50-day simple moving average. Those patterns may reflect new downtrends in the short- and intermediate-term.

Finally, BA is an active underlier in the options market. (It averages about 135,000 contracts per session, according to TradeStation data.) That could help traders take positions with calls and puts.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

Boeing's $210 Resistance Could Spark Major UpsideCurrent Price: $210.73

Direction: LONG

Targets:

- T1 = $218.50

- T2 = $225.00

Stop Levels:

- S1 = $205.50

- S2 = $202.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The aggregated view reveals consensus bullish momentum for Boeing based on improving fundamentals, technical resilience, and recovering demand in the aerospace sector. Traders highlight the recent stabilization above key support levels, suggesting a potential breakout scenario if resistance near $210 is decisively cleared.

**Key Insights:**

Boeing has been gaining traction due to strong tailwinds in the aviation sector. With global air travel demand nearing pre-pandemic levels, Boeing stands as one of the primary beneficiaries of increased airline revenue and fleet expansion. Analysts emphasize the significance of rising delivery figures for its commercial aircraft division in 2025, particularly the 737 MAX – which remains a cornerstone of fleet modernization programs worldwide. Moreover, the defense sector’s better-than-expected government contracts have helped offset prior concerns about geopolitical risks and cost overruns.

Technically, traders note that Boeing has established a higher-low structure over the past six months, signaling bullish consolidation. The 200-day moving average at $206 has held firmly as support, while the RSI has steadily climbed, confirming strengthening momentum. Volume over the past two weeks also indicates accumulation, further endorsing a breakout setup.

**Recent Performance:**

Over the past quarter, Boeing shares have gained over 9%, driven by optimistic forward earnings revisions. Despite soft results in the second quarter, the company’s improved guidance for fiscal 2025 impressed Wall Street. Investors continue to monitor the company’s free cash flow generation, which has shown resilience amid macroeconomic headwinds. Boeing's stock recently tested the $210 level for the fourth time this year, indicating it is primed for a robust upside move if buyers maintain control.

**Expert Analysis:**

Market experts remain bullish on Boeing’s medium to long-term outlook. JPMorgan recently upgraded its price target for the stock to $240, highlighting that Boeing is well-positioned to capture market share as airlines worldwide place new fleet orders. Improvements in supply chain constraints and enhanced production rate for the 787 Dreamliner further add to this optimistic narrative. Technicians note that a breakout above $210 could open the door toward $225 - $230 in the near term, with minimal overhead resistance.

**News Impact:**

Recent news about strong demand at airline trade conferences has buoyed sentiment. Industry leaders are committing to multi-year procurement contracts, indicating a steady stream of orders for Boeing's commercial aircraft. Additionally, the U.S. Congress's approval of increased defense spending has further strengthened Boeing’s outlook in its military aircraft and space systems lines. While past concerns linger over regulatory compliance and production consistency, the company has demonstrated measurable progress based on recent disclosures.

**Trading Recommendation:**

Boeing's strong technical setup combined with improving fundamentals makes this an attractive long trade opportunity. A decisive breakout above $210.73 could lead to a rally toward $218.50 (Target 1) and potentially $225.00 (Target 2) with stop-losses effectively managed below $205.50 and $202.00 for risk control. Robust demand tailwinds and proven recovery momentum suggest buyer conviction remains intact. Position sizing should factor in Boeing's relatively high volatility, but the reward-to-risk profile is compelling at current levels.

Do you want to save hours every week? Register for the free weekly update in your language!

Boeing: Target Zone AheadOver the past two weeks, Boeing shares have seen several upward moves, but each rally was quickly met with selling pressure. In our primary scenario, we anticipate further declines as part of turquoise wave 2, which is expected to conclude within our turquoise Target Zone of $184.84 to $151.76. Looking ahead, wave 3 offers potential for gains above resistance at $254.22. A direct breakout above this level would initially signal a higher high within turquoise wave alt.1 before the anticipated correction occurs (probability: 33%).

BA setting up for potentially strong move

- BA's EMAs have crossed bullishly and are developing angle and separation.

- Its RSI has popped above 50, suggesting a shift to positive momentum.

- Its stochastic is on the borderline to cross through 70. A move above, will add to the positive momentum argument. The longer it maintains above 70, the greater the likelihood of further price appreciations.

- Overhead resistance is at 238. A break above will be regarded as a bullish development.

Boeing Poised for Recovery: Key Levels for a Bullish Move Current Price: $221.26

Direction: LONG

Targets:

- T1 = $235.00

- T2 = $250.00

Stop Levels:

- S1 = $215.00

- S2 = $208.50

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds suggests that aggregated market perspectives from experienced professionals reveal overlooked opportunities, reduce emotional biases, and highlight consensus outlooks for Boeing. This stock, often considered a bellwether for the U.S. aerospace and defense industry, presents a nuanced risk-reward profile as we head into the fourth quarter of 2025.

**Key Insights:**

Boeing benefits from an improving macroeconomic environment, specifically the resurgence of global air travel and an accelerating demand for military contracts. The company recently announced multiple major commercial orders from international airlines, solidifying its position as a market leader. With the pandemic-induced hangover on travel easing further, Boeing's backlog of unfulfilled aircraft orders provides strong visibility for future revenue that could support share price growth.

On the technical side, Boeing’s stock is currently consolidating above $220—a critical support level—with an ascending triangle pattern on the daily chart. This bullish formation often signals an upcoming breakout. Volume has modestly increased, suggesting accumulating positions, and the Relative Strength Index (RSI) stands at 55, leaving room for price action to extend higher without entering overbought territory.

**Recent Performance:**

In 2025, Boeing's shares have seen a moderate recovery, up 12% year-to-date but still down significantly from its pre-2019 highs. After dipping as low as $185 earlier this year, the stock has rebounded and is now focused on reclaiming higher resistance at the $230-$235 zone. September trading has been relatively stable, with price oscillating between $215 and $225, largely reflecting uncertainty about production challenges and potential supply chain constraints.

**Expert Analysis:**

Wall Street analysts are generally optimistic about Boeing’s longer-term outlook. Several firms have recently upgraded targets on expectations of free cash flow growth in 2025, led by a steady ramp-up in 737 MAX deliveries and 787 Dreamliner production. The company's financial guidance for the year highlights cautious optimism, though concerns remain about persistent supply chain bottlenecks. Moreover, Boeing's exposure to government contracts through its defense business provides a degree of revenue stability.

Technically, indicators confirm a favorable near-term bullish sentiment. Moving averages show bullish alignment, with the 50-day moving average ($216) crossing above the 200-day moving average ($212) earlier this month—a golden cross formation. Breaking above $235 could lead to significant momentum as the stock moves toward $250.

**News Impact:**

Recent agreements with airlines in Southeast Asia and the Middle East signal a firm recovery for Boeing's commercial aircraft business. Additionally, positive developments in Pentagon contract negotiations could bolster the defense unit's revenue stream. However, investors are cautiously monitoring potential repercussions from higher raw material prices due to geopolitical risks.

**Trading Recommendation:**

We recommend a LONG position on Boeing as it appears poised for a breakout. Our analysis suggests entering at the current price of $221.26 with targets of $235.00 and $250.00. Place stop levels at $215.00 and $208.50 to manage downside risk effectively. Boeing’s improving fundamentals, coupled with a bullish technical setup, offer an attractive opportunity for upside gains as the stock approaches key resistance levels.

Do you want to save hours every week? Register for the free weekly update in your language!

Another fake news on orders from Turkish AirlinesAnother round of “fake news”?

Headline: Boeing receives a major order from Turkish Airlines for up to 225 aircraft.

Reality check: Turkish Airlines currently operates just 387 aircraft in its fleet. Earlier this year, we saw the same script play out when reports claimed Pegasus Airlines — the low-cost arm of Turkish Airlines — placed “hundreds of orders.”

Once again, the numbers don’t add up...

Boeing poised for recovery as record order pipeline builds momenCurrent Price: $215.65

Direction: LONG

Targets:

- T1 = $224.50

- T2 = $230.00

Stop Levels:

- S1 = $211.75

- S2 = $208.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives favor Boeing’s long-term upside as major contract wins and demand for aviation bolster confidence among seasoned traders. While caution persists due to ongoing supply chain challenges, traders broadly agree that current price levels represent an attractive entry point to capitalize on future growth trajectories.

**Key Insights:**

Boeing has reported strengthened demand for both commercial airplanes and defense contracts following the aviation sector’s rebounding growth post-pandemic. Traders emphasize its remarkable $441 billion backlog as a key factor supporting future revenue generation, helping insulate the company from near-term fluctuating demand. Additionally, renewed focus on efficiency within its production systems indicates Boeing’s commitment to resolving past delays, improving delivery schedules, and mitigating supply chain bottlenecks. Regulatory approval for additional models, namely the 737 MAX, in key international markets is expected to further catalyze future growth.

However, Boeing must proceed cautiously as margin pressure persists due to rising material costs. Professional analyses suggest that its strategy of increasing production rates to 50 planes monthly by 2025 should drive economies of scale, supporting profitability in the long term. Traders highlight substantial tailwinds from global fleet modernization efforts, favorable airline travel forecasts, and Boeing's positioning to benefit from shifts towards sustainable aviation technologies, which are expected to impact sentiment positively.

**Recent Performance:**

Boeing's share price has consolidated near the $215 level following strong Q3 earnings and CEO confirmation of record commitments from major airline customers worldwide. Despite a brief pullback in August due to supply chain concerns, the stock has rebounded steadily, supported by improved delivery rates of its 737 and 787 aircraft models. Traders note that technical support around $210–215 has held firm, with upside momentum indicated by increasing trading volumes and bullish investor sentiment.

**Expert Analysis:**

Technical analysts emphasize that Boeing's current price action forms a compelling base for upward movement, supported by its 50-day moving average acting as support near $213. Oscillators like the RSI show bullish divergence, while MACD indicators hint at continued positive momentum. Experts also point to Boeing’s strategic wins with international markets like India and Southeast Asia, noting growing reliance on Boeing’s fleet for long-haul travel as a structural advantage against rival Airbus.

While Boeing has faced litigation risks and mid-term debt challenges, credit analysts underscore the firm’s liquidity position as stable, with repayment schedules aligned to operational cash flow projections for 2025. Recent upgrades by Moody’s further enhance confidence in the firm’s fiscal management, helping to justify bullish medium-term sentiment.

**News Impact:**

Boeing announced a key $10 billion multi-year defense contract with the U.S. government last week, accelerating optimism surrounding its increasing non-commercial revenue streams. Further, its delivery ramp-up aligns with FAA approval for additional 737 MAX variants in Asian markets, where demand growth is projected to outpace global averages. Recent geopolitical concerns have slightly impacted sentiment regarding supply chain disruptions, but overall news flow highlights enduring strength in Boeing's near-term outlook, ensuring continued investor interest.

**Trading Recommendation:**

Boeing is a strong candidate for a long position at current levels, given the structural recovery of global aviation markets and Boeing's dominant market share in key growth regions. Traders should look to capitalize on upward price movements driven by increasing demand for its aircraft and defense contracts, while maintaining prudent stop-loss levels in case of unexpected macroeconomic developments. With key technical indicators supporting bullish sentiment, and a backlog pipeline securing strong revenue generation into 2026, Boeing remains a stable yet opportunistic investment for medium-term growth.

Do you want to save hours every week? Register for the free weekly update in your language!

$BA Rolling over again?After a push higher BA has recently run out of steam and looks like its rolling over. The last few weeks has failed to follow through higher after the Bearish Engulfing Candle. Last week we saw a move down and a close below the 20MA. I expect a reaction higher, initially, and then we see a further move down to wards $200.

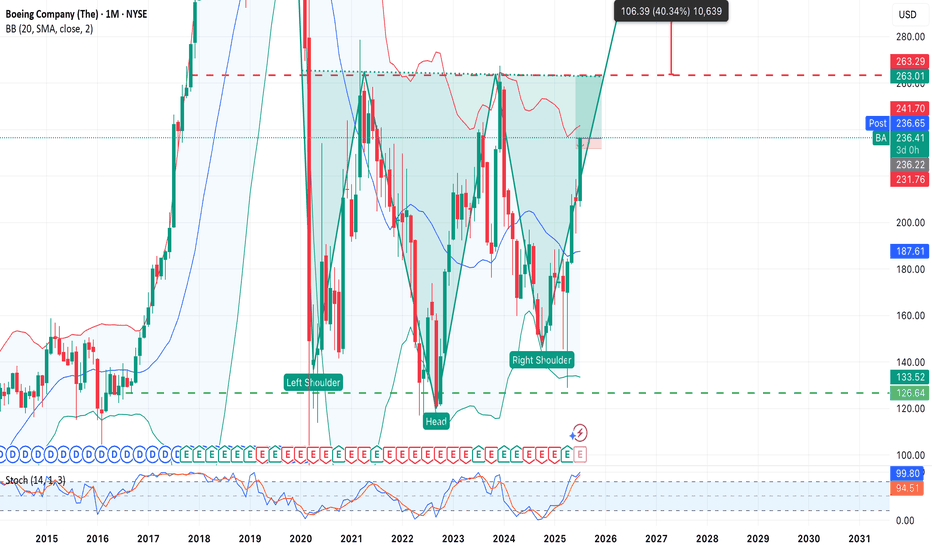

An adventure? Yes. But technically — beautiful. Boeing.Adventure Idea: The Return of Boeing NYSE:BA

An inverted “Head and Shoulders” pattern is forming on the BA (Boeing) chart — one of the most reliable bullish formations in technical analysis. The price is confidently approaching the neckline around $235–241, and a breakout above this level could mark the beginning of a new upward momentum.

Pattern Parameters:

• Left Shoulder: ~$126

• Head: ~$99

• Right Shoulder: ~$126

• Neckline: ~$235

• Breakout Target:

➤ $235 + $136 = $371 (long-term)

➤ Nearest resistance: $263

Action Plan (if entering long):

• Entry: On breakout above $241 or on a retest of $235

• Stop: Below the right shoulder — $126–133 (depending on risk tolerance)

• Targets:

1. $263 — first technical target

2. $280+ — if the trend develops

3. $371 — full target based on the pattern (textbook scenario)😄

Professional Analysis of Boeing (BA) Stock – Daily TimeframeOn the daily chart, Boeing (BA) has entered a descending channel after a strong rally from the $175 lows up to around $240 highs.

Bullish Scenario:

The price is currently around $215, near the channel’s lower boundary.

If this support holds and the stock reclaims the 50-day moving average (yellow line around $220), a rebound toward the channel’s upper boundary at $228 – $230 is likely.

A confirmed breakout above the channel could open the way toward $240.

Bearish Scenario:

If the $215 – $210 support zone breaks, the stock could slide down to the channel floor around $200 – $198.

A deeper breakdown below that may trigger further downside toward $185.

Conclusion:

Boeing is in a corrective channel. The $210 – $215 zone is a decisive level:

Holding it = potential rebound and short-term upside.

Breaking it = further weakness and extended downside risk.

Breaking: Boeing's $215.94 Price Tests Crucial Upside ResistanceCurrent Price: $215.94

Direction: LONG

Targets:

- T1 = $225.00

- T2 = $235.00

Stop Levels:

- S1 = $210.00

- S2 = $205.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives often highlight consensus opportunities, pointing towards potential upside momentum in Boeing. With Boeing currently trading at $215.94, expert commentary aggressively focuses on its fundamental and technical factors which align for bullish continuation.

**Key Insights:**

Several factors contribute to optimism around Boeing's price trajectory. First, demand recovery in the airline sector has picked up momentum, with airlines increasing fleet purchases and accelerating orders for Boeing's popular commercial jets, such as the 737 MAX. Additionally, the company’s defense and aerospace divisions are benefiting from consistent government contracts and geopolitical tensions, providing a stable revenue stream. Boeing's financial restructuring efforts have also started showing signs of improving balance sheet dynamics, reducing debt levels and increasing free cash flow—key catalysts for investor confidence.

Technical indicators reveal a bullish trend forming after prolonged consolidation. Boeing's moving averages are aligning, with the 50-day MA approaching a crossover above the 200-day MA—a golden cross signal that historically indicates strong upward momentum. The RSI currently sits at 58, suggesting the stock is not overbought yet but has room for additional upside in response to positive momentum.

**Recent Performance:**

Boeing has rallied over 5% in the past month after holding a firm base around the $200 level earlier this quarter. The stock’s ability to breach the critical $210 resistance last week has triggered renewed interest among large institutional investors and retail traders alike. A recent pullback to $215 also revealed strong buying pressure, signifying resilience at this level.

**Expert Analysis:**

Professional analysts are bullish on Boeing due to an ongoing transformation in its operational efficiencies and the long-term macro tailwinds bolstered by global fleet upgrades. Market technicians highlight that Boeing has successfully broken out of its downward resistance trendline, a clear indication of buyers stepping in. Furthermore, investment reports suggest the stock is undervalued relative to its 2025 revenue expectations, as many analysts project EPS growth to compound significantly over the next fiscal year.

**News Impact:**

Recent reports about Boeing’s strong Q3 outlook, combined with increased aircraft delivery projections for the remainder of the fiscal year, are creating additional catalysts for the stock's upside. Additionally, announcements regarding key partnerships and contracts—including a multi-billion-dollar defense deal—have further strengthened investor sentiment. Geopolitical developments, especially in the Asia-Pacific region, may lead to increased orders for defense-related projects, which Boeing is well-positioned to capitalize on.

**Trading Recommendation:**

Based on the technical and fundamental outlook, taking a LONG position on Boeing at $215.94 presents a high-probability trade setup. The price targets of $225 (T1) and $235 (T2) are realistically achievable given the strong bullish momentum and improving macroeconomic factors. Stops should be set at $210 (S1) and $205 (S2) to manage downside risks effectively, while maintaining favorable reward-to-risk parameters. Investors should monitor upcoming earnings reports and delivery numbers closely, as these could provide further validation for the stock's movement above key resistance levels.

Do you want to save hours every week?

Levels to watch during $BA bear momentumLabor Strike at Boeing Defense

• 3,200 Boeing Defense workers in St. Louis have rejected a third contract offer, extending a strike that began on August 4.

• The rejected offer included a 45% average wage increase and a $4,000 signing bonus, but union members felt it fell short compared to other Boeing contracts.

• Boeing is now hiring permanent replacement workers to maintain operations, especially for assembling F-15 fighter jets and missile systems

777X Certification Delays

• Boeing’s 777X wide-body jet is facing further delays in FAA certification, potentially pushing deliveries from late 2026 into 2027.

• CEO Kelly Ortberg acknowledged the “mountain of work” still needed, though test aircraft and engines are reportedly performing well.

Boeing Wave Analysis –5 September 2025- Boeing reversed from the resistance area

- Likely to fall to support level 222.00

Boeing recently reversed from the resistance area between the resistance levels 240.00 (which stopped impulse wave (C) in July), 235.40 (top of the previous wave A) and the upper daily Bollinger Band.

The downward reversal from this resistance area stopped earlier medium-term ABC correction (2) from the end of July.

Boeing can be expected to fall toward the next support level 222.00 (low of the previous minor correction B from last month).

Boeing (BA) Share Price Could Reach 2025 HighsBoeing (BA) Share Price Could Reach 2025 Highs

As the Boeing (BA) stock chart indicates, the price rose by 3.5% yesterday, while the S&P 500 index (US SPX 500 mini on FXOpen) gained only 0.4%. Boeing’s stronger performance reflects optimism driven by news (and market rumours) reported in the media suggesting that:

→ Korean Air has purchased more than 100 aircraft during the newly elected South Korean president’s visit to the White House;

→ Boeing is negotiating the sale of 500 aircraft to China;

→ the Trump administration may acquire stakes in companies linked to the defence sector (Palantir, Boeing, Lockheed Martin).

Technical Analysis of BA Stock Chart

BA’s price fluctuations have formed an upward channel (shown in blue). However, at the end of July, the rally encountered resistance around the $235 level:

→ following a volatility spike at the end of July (triggered by the quarterly earnings release), the price retreated towards the lower boundary of the channel;

→ in mid-August, the price turned downwards again from this level.

At the same time, we can observe a sequence of higher lows (1-2-3), emphasising that the lower boundary of the channel is acting as key support, setting the pace for BA’s growth trajectory in 2025.

It is worth noting that the stock’s oscillation between support (the lower boundary) and resistance around $235 is creating bullish patterns such as an Ascending Triangle and a Cup and Handle.

Should reports of a potential Boeing share purchase by the US government be confirmed, the BA stock price could advance to new annual highs. In such a scenario, several factors could be important:

→ the price may subsequently consolidate around the channel’s median;

→ historically, the $250–260 zone has acted as significant resistance during 2021–2023;

→ the $235 level may switch roles to become support, similar to the way $218 previously did.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Boeing Breakdown? $210 LEAP Put Trade Could Explode🚨 BA LEAP Put Play – Bearish Setup Into 2026 🚨

📉 Boeing (BA) is setting up for a long-term downside move. With monthly RSI < 45, negative momentum, and a macro headwind backdrop, this is a high conviction bearish LEAP trade.

📊 TRADE DETAILS 📊

🎯 Instrument: BA

🔻 Direction: PUT (SHORT)

🎯 Strike: $210.00

💵 Entry Price: $19.30

🎯 Profit Target: $45.00

🛑 Stop Loss: $11.28

📅 Expiry: 2026-09-18

📈 Confidence: 75%

⏰ Entry Timing: Market Open

🔥 Why This Works

✔️ Bearish momentum confirmed 📉

✔️ RSI < 45 = weakness 🚨

✔️ LEAP structure avoids rapid time decay ⏳

✔️ Macro headwinds = pressure on BA 🌍

⚠️ Risk: Macro or sector rebound could limit downside.

BA (Boeing Co.) – Trade Setup Alert🚀✈️ A major new defense contract is on the horizon — and if confirmed, it could skyrocket BA’s valuation to new heights. This could be the catalyst that propels the stock far beyond its current range.

Boeing is showing renewed strength with a bullish setup developing. With multiple entry points and solid upside targets, this trade offers compelling potential for swing traders and long-term investors alike.

📌 Entry Points:

1️⃣ Market Price

2️⃣ $162

3️⃣ $147

🎯 Profit Targets:

✅ $200

✅ $230

✅ $260

⚠️ Disclaimer: This is not financial advice. All trading involves risk. Please do your own research or consult a licensed financial advisor before making investment decisions.