BUY trade ideas

BEST BUY - DAILY CHARTThe company braces itself for the busiest season for consumer spending that starts on the following weeks with the Black Friday, Cyber Monday and Thanksgiving, as today a survey showed that 82% of consumers have the intention to buy tech devices and accessories. These intentions might lift Best Buy results for next quarter and increase the speculation around the company.

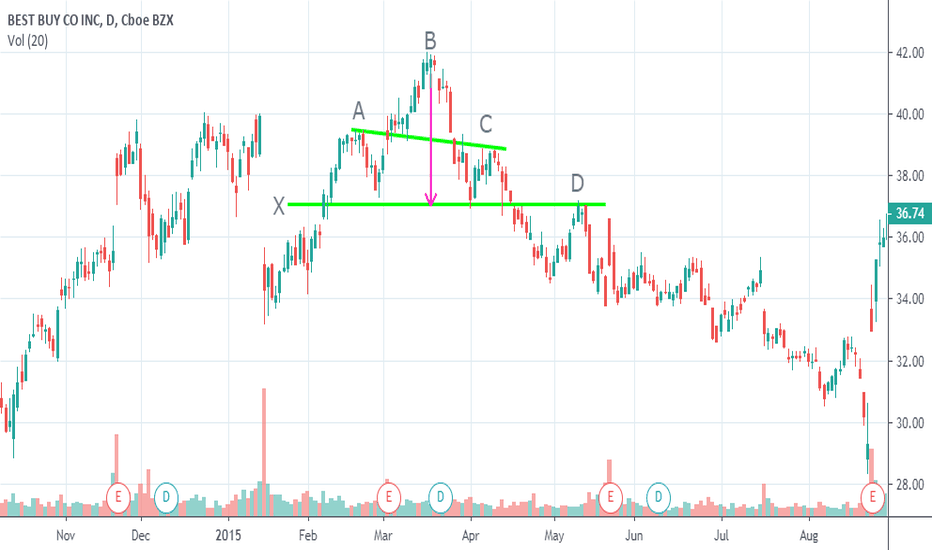

Head and shoulderThe graph shows an example of the head and shoulders for actions of Citigroup INC, where the shoulders (peak A and C) are of similar height, with peak B (head) being the highest. The distance between the head peak and the support line "X" and the Pull back at point D is shown with the purple arrow

O35.26, H35.70, L35.06 C35.40

Best Buy rated with Strong Buy and $100 targetBest Buy resumed with a Strong Buy at Raymond James. Raymond James analyst Matthew McClintock resumed coverage of Best Buy with a Strong Buy rating and a price target of $100. The analyst is positive on the transition of the company's business model from selling only consumer electronic products to offering a range of other services, which he expects will create a "much more dependable, re-occuring, and higher margin revenue stream." McClintock adds that Best Buy can generate at least a 10% earnings per share growth per year over the next 5 years, along with a low-single-digit sales increase and a 10bps expansion in gross margins.

Source thefly

P/e ratio 12.07 Good value

Yield 2.99%

Short 2.95%

Average target price $73.48 Overweight

Company profile

Best Buy Co., Inc. provides consumer electronics, home office products, entertainment products, appliances and related services. It operates through two business segments: Domestic and International. The Domestic segment is comprised of the operations in all states, districts and territories of the U.S., operating under various brand names, including but not limited to, Best Buy, Best Buy Mobile, Geek Squad, Magnolia Audio Video, Napster and Pacific Sales. The International segment is comprised of all operations outside the U.S. and its territories, which includes Canada, Europe, China, Mexico and Turkey. It also markets its products under the brand names: Best Buy, Audio visions, Best Buy Mobile, The Carphone Warehouse, Five Star, Future Shop, Geek Squad, Magnolia Audio Video, Napster, Pacific Sales and The Phone House. The company was founded by Richard M. Schulze in 1966 and is headquartered in Richfield, MN.

BBY Channel/TrianglesChannel on daily since about June 11 with a fake out to the down side. Potential Triangles forming (I'd like AT LEAST one more contact point on both the Purple and the Black to confirm triangle form, but it has potential. Right around where the Upper P/B triangle trend lines are has been weak the last 2 days. RSI is overbought and has been for a while. If these trend lines hold then we should see down side to at least the lower black TL which will be around 77 or high 76. At open it already reached around 77.05 before turning back. May not be much stopping a swift drop once all these time frames line up.

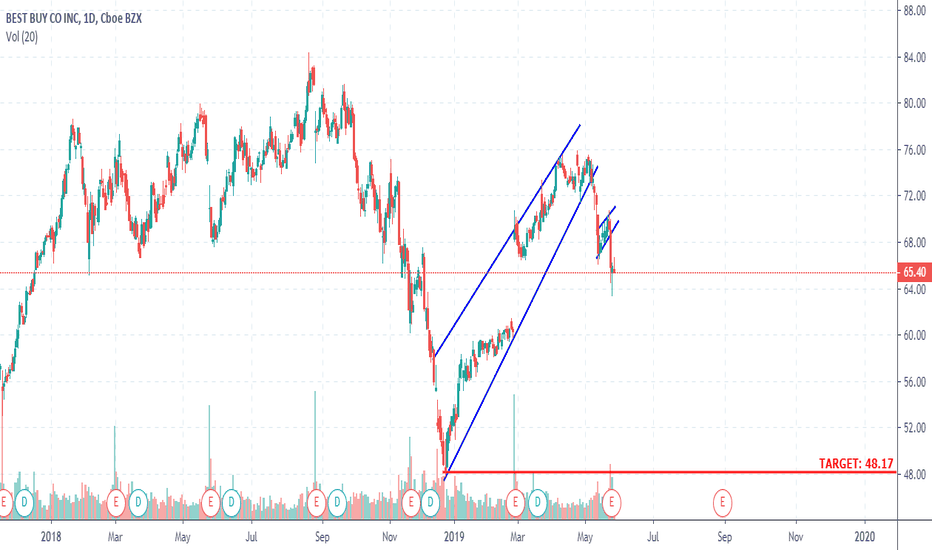

BEST BUY DAILY TIMEFRAME SHORTPrices dropped sharply before forming an ascending wedge, which topped out at the 76 price level. Now, price has already broken out of this corrective structure to the downside and is making a continuation move, with two opportunities to scale in already gone. But you can still jump in with proper risk management and target the bottom of the corrective structure, at the 48.17 price level. May the bears pounce on unsuspecting buyers lol!!

$BBY IS BEST BUY REALLY A BEST BUY NOW, PRE EARNINGS ?RETAIL HAS BEEN A NESS THIS WEEK WITH SOME REAL WIDOWMAKER DECLINES IN STOCKS, NYSE:TGT AHS BEEN THE EXCEPTION AND AS NYSE:BBY IS REPORTING TOMORROW MORNING INTO A NEGATIVE MARKET AND A NEGATIVE SECTOR, IT IS A STAY CLEAR FOR THE LONGS SIDE. THE STOCK HAS LOST SOME STEAM AND DESPITE BUYING VOLUME CONTINUING INTO THE REPORT, IT IS OUR OPINION A RISK NOT WORTH TAKING.

AVERAGE ANALYSTS ESTIMATE $76.91

AVERAGE RECOMMENDATION OVERWEIGHT

COMPANY PROFILE

Best Buy Co., Inc. provides consumer electronics, home office products, entertainment products, appliances and related services. It operates through two business segments: Domestic and International. The Domestic segment is comprised of the operations in all states, districts and territories of the U.S., operating under various brand names, including but not limited to, Best Buy, Best Buy Mobile, Geek Squad, Magnolia Audio Video, Napster and Pacific Sales. The International segment is comprised of all operations outside the U.S. and its territories, which includes Canada, Europe, China, Mexico and Turkey. It also markets its products under the brand names: Best Buy, Audio visions, Best Buy Mobile, The Carphone Warehouse, Five Star, Future Shop, Geek Squad, Magnolia Audio Video, Napster, Pacific Sales and The Phone House.

BBY approaching resistance, potential drop! BBY is approaching our first resistance at 66.19 (horizontal overlap resistance, 100% Fibonacci extension, 50% Fibonacci retracement) where a strong drop might occur below this level pushing price down to our major support at 56.93 (horizontal swing low support, 50% fibonacci retracement).

Stochastic (89,5,3) is also approaching resistance where we might see a corresponding drop in price.

Bestbuy Breakout Looking at this chart we are able to see an ascending triangle. With the rising support and same resistance there can only be two outcomes, if the resistance is broken we can look to ride the momentum to the .618 fib mark before taking profits. IF RESISTANCE IS UNBROKEN set a close stop loss; we can only sustain price level hitting the resistance few times before losing support levels.