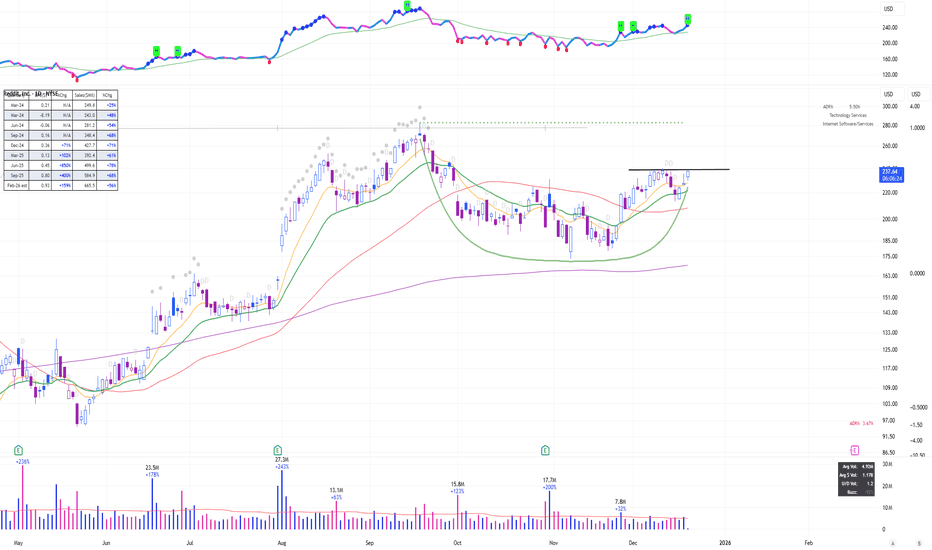

RDDT: Fractal Cup & Handle with a "Cheat" EntryReasoning:

Strong Industry/Sector (Social Media / AI Data Licensing)

Fractal Setup: Cup & Handle visible on both Monthly and Daily charts

Mid Cheat entry: Forming a low-risk pivot within the base

If Labelled a Swing trade(2-6 Week Holds)

Entry: Full position on breakout (See Chart)

Pr

Reddit, Inc. Class A

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.496 CHF

−439.82 M CHF

1.18 B CHF

133.27 M

About Reddit, Inc.

Sector

Industry

CEO

Steven Ladd Huffman

Website

Headquarters

San Francisco

Identifiers

3

ISIN US75734B1008

Reddit, Inc. operates an entertainment, social networking, and news website where registered community members can submit content. It provides online news services where users can select and rank web content. The firm also offers a personalized filter on the day's story, using previous votes to determine what new things the user might like to read. The company was founded by Steven Ladd Huffman and Alexis Ohanian on June 23, 2005 and is headquartered in San Francisco, CA.

Related stocks

Technical Analysis is All About Pattern RecognitionNYSE:RDDT : The Cup-and-Handle and VCP Breakout Setup

RDDT has established a clear "rhythm": after a two-month consolidation, it consistently reclaims the 20-day SMA (Red Line), followed by a volatility contraction phase where the price stops making new lows.

The stock just completed a Cup-and-Han

RDDT: Massive Monthly Cup & Handle (Long Term)Reasoning:

Strong Industry/Sector (Social Media / AI Data Licensing)

Monthly Cup and Handle (Major long-term structural setup)

Leveraged Option: NASDAQ:RDTL available for amplified exposure

If Labelled a Swing trade(2-6 Week Holds)

Entry: Full position on breakout (See Chart)

Profit

$RDDT showing relative strength One of the strong stocks that has defined the market volatility over the past couple weeks. It has formed a nice handle which shows that institution do not want to get out of this stock and are waiting for new highs to add to their position. This looks like a key leader to me to watch as market figu

Reddit (RDDT) – Daily AnalysisReddit (RDDT) – Daily Analysis

RDDT is respecting the bullish structure perfectly. Price bounced strongly from the demand zone (160–175) and is now pushing upward along the red bullish trendline.

The green bearish trendline was broken to the upside, and the retest held, confirming a shift back into

$RDDT Long Setup - $280 Target During Q1 2026Reddit is one of those gifts that keep on giving since the IPO. Right now, support seems strong and it doesn't seem to be going away, at least from some current indicators. As always, none of this is investment or financial advice. Please do your own due diligence and research.

$RDDT – Larger Head & Shoulders + Bear Flag = Trouble AheadReddit ( NYSE:RDDT ) is showing a bigger-picture head & shoulders pattern combined with a near-term bear flag, and the downside risk is real if the market continues to weaken — especially if NASDAQ:NVDA disappoints on earnings.

🔹 The Bigger Structure:

Head: The peak around $280

Right Shoulder:

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of RDDT is 209.930 CHF — it has increased by 2.88% in the past 24 hours. Watch Reddit, Inc. Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange Reddit, Inc. Class A stocks are traded under the ticker RDDT.

RDDT stock has risen by 17.79% compared to the previous week, the month change is a 10.53% rise, over the last year Reddit, Inc. Class A has showed a 31.89% increase.

We've gathered analysts' opinions on Reddit, Inc. Class A future price: according to them, RDDT price has a max estimate of 259.36 CHF and a min estimate of 91.77 CHF. Watch RDDT chart and read a more detailed Reddit, Inc. Class A stock forecast: see what analysts think of Reddit, Inc. Class A and suggest that you do with its stocks.

RDDT reached its all-time high on Sep 18, 2025 with the price of 221.197 CHF, and its all-time low was 49.907 CHF and was reached on Sep 16, 2024. View more price dynamics on RDDT chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

RDDT stock is 2.80% volatile and has beta coefficient of 2.24. Track Reddit, Inc. Class A stock price on the chart and check out the list of the most volatile stocks — is Reddit, Inc. Class A there?

Today Reddit, Inc. Class A has the market capitalization of 37.03 B, it has increased by 2.66% over the last week.

Yes, you can track Reddit, Inc. Class A financials in yearly and quarterly reports right on TradingView.

Reddit, Inc. Class A is going to release the next earnings report on Feb 18, 2026. Keep track of upcoming events with our Earnings Calendar.

RDDT earnings for the last quarter are 0.64 CHF per share, whereas the estimation was 0.42 CHF resulting in a 52.41% surprise. The estimated earnings for the next quarter are 0.74 CHF per share. See more details about Reddit, Inc. Class A earnings.

Reddit, Inc. Class A revenue for the last quarter amounts to 465.95 M CHF, despite the estimated figure of 437.37 M CHF. In the next quarter, revenue is expected to reach 527.57 M CHF.

RDDT net income for the last quarter is 129.56 M CHF, while the quarter before that showed 70.85 M CHF of net income which accounts for 82.87% change. Track more Reddit, Inc. Class A financial stats to get the full picture.

No, RDDT doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jan 11, 2026, the company has 2.23 K employees. See our rating of the largest employees — is Reddit, Inc. Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Reddit, Inc. Class A EBITDA is 222.21 M CHF, and current EBITDA margin is −41.91%. See more stats in Reddit, Inc. Class A financial statements.

Like other stocks, RDDT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Reddit, Inc. Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Reddit, Inc. Class A technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Reddit, Inc. Class A stock shows the strong buy signal. See more of Reddit, Inc. Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.