TSM: macro top being in My base case is that the price has likely put in a larger-degree top, at least for the trend that has been unfolding since the 2022 bottom.

A decisive breakdown below the 10-week MA would further increase the odds that the top is confirmed.

In that scenario:

• First meaningful mid-term support sits near 210.

• The ideal macro-support zone comes in substantially lower, at 163–110, where a larger structural reset would be expected.

Chart:

Trade ideas

TSMTaiwan Semiconductor Manufacturing Company Limited (TSM) pioneered the pure-play foundry business model and has consistently emerged as a global leader in specialty semiconductor foundries.

The overall trend remains bullish, but the price is currently undergoing a short-term correction. The price is currently in the key support zone of 283-274. If the price can hold above 274, a rebound is likely.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

This content is not financial advice. Always conduct your own financial due diligence.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

Derivatives and Risk Management in the Global Market1. Understanding Derivatives

A derivative is a financial contract whose value is derived from the performance of an underlying asset, index, rate, or event. The underlying asset can be anything with a fluctuating market value—such as stocks, bonds, commodities, currencies, or interest rates. Derivatives do not represent ownership of the underlying asset; rather, they are agreements to exchange cash flows based on the asset’s future price movements.

The four primary types of derivatives are:

Futures – Standardized contracts traded on exchanges, obligating parties to buy or sell an asset at a predetermined price on a future date.

Forwards – Customized over-the-counter (OTC) agreements similar to futures but negotiated privately between parties.

Options – Contracts that give the buyer the right (but not the obligation) to buy or sell an asset at a specific price within a set time frame.

Swaps – Agreements between two parties to exchange cash flows or other financial instruments, often used to manage interest rate or currency exposure.

Each of these instruments serves different strategic purposes—ranging from speculation and arbitrage to hedging and portfolio diversification.

2. Evolution of the Global Derivatives Market

The global derivatives market has grown exponentially over the past few decades. Initially, derivatives were developed to help agricultural producers hedge against crop price volatility. However, with the advent of modern finance and technology, they have expanded into nearly every sector of the global economy.

By the early 2000s, derivatives trading had moved from traditional exchanges to sophisticated electronic platforms, and the notional value of outstanding derivatives had reached hundreds of trillions of dollars. Today, the global derivatives market includes both exchange-traded derivatives (ETDs) and over-the-counter (OTC) derivatives, with the latter representing the majority of global trading volume due to their flexibility and customization.

Regulatory reforms following the 2008 financial crisis, such as the Dodd-Frank Act in the U.S. and EMIR in Europe, have made derivatives trading more transparent, requiring central clearing and reporting to mitigate systemic risks.

3. The Role of Derivatives in Risk Management

The primary purpose of derivatives is risk management. In an unpredictable global economy, price volatility in commodities, currencies, interest rates, and equities can pose significant threats to profitability and financial stability. Derivatives provide tools for hedging—reducing exposure to unwanted risks while allowing firms to focus on their core operations.

a. Currency Risk (Foreign Exchange Risk)

In international trade, companies deal in multiple currencies. Exchange rate fluctuations can significantly impact profits. For instance, an Indian exporter receiving payment in U.S. dollars can use currency forwards or options to lock in an exchange rate, ensuring predictable revenue even if the rupee appreciates later.

b. Interest Rate Risk

Banks, financial institutions, and corporations with loans or debt instruments face exposure to changes in interest rates. Interest rate swaps are widely used to manage this risk—allowing companies to exchange fixed-rate obligations for floating-rate ones, or vice versa, depending on market conditions.

c. Commodity Price Risk

Producers and consumers of commodities such as oil, gold, or agricultural products use futures contracts to hedge against price volatility. For example, an airline company may use oil futures to stabilize fuel costs, protecting itself from rising crude prices.

d. Equity Market Risk

Investors in stock markets can use equity options and index futures to hedge portfolio risks. For example, if a fund manager expects market volatility, purchasing put options can provide downside protection.

4. Speculation and Arbitrage

While risk management is the core function, derivatives are also used for speculation and arbitrage.

Speculators seek to profit from price movements without owning the underlying asset. For instance, traders may buy a futures contract anticipating a price increase.

Arbitrageurs exploit price discrepancies between markets or instruments. For example, if gold futures in London are priced differently than in New York, an arbitrageur can buy low and sell high simultaneously to earn a risk-free profit.

Although speculation adds liquidity and efficiency to markets, excessive leverage through derivatives can lead to systemic risks if not properly managed—as seen during the 2008 crisis.

5. Risks Associated with Derivatives

Despite their advantages, derivatives carry inherent risks that can amplify losses if misused.

Market Risk: Adverse price movements can result in significant financial losses.

Credit (Counterparty) Risk: In OTC derivatives, one party may default on its obligation.

Liquidity Risk: Some derivatives are hard to unwind due to low trading volumes.

Operational Risk: Errors, fraud, or system failures can cause unexpected losses.

Systemic Risk: Large interconnected derivative exposures can threaten global financial stability, as was evident in the collapse of Lehman Brothers in 2008.

6. Regulatory Reforms and Risk Controls

Following the global financial crisis, regulators worldwide introduced measures to make derivative markets more transparent and secure. Key reforms include:

Central Clearing: Mandating that standardized OTC derivatives be cleared through central counterparties (CCPs) to reduce counterparty risk.

Trade Reporting: Requiring all derivative transactions to be reported to trade repositories for transparency.

Margin Requirements: Imposing collateral requirements on non-centrally cleared derivatives to mitigate credit exposure.

Position Limits: Restricting speculative trading positions to prevent market manipulation.

Organizations like the International Swaps and Derivatives Association (ISDA) have also established standardized documentation and practices that enhance global consistency and reduce legal uncertainties.

7. Derivatives in Emerging Markets

Emerging economies such as India, China, and Brazil have increasingly integrated derivatives into their financial systems. For instance, the National Stock Exchange (NSE) of India is among the world’s largest derivatives exchanges, offering futures and options on indices, equities, and commodities. These instruments help local businesses manage currency volatility, interest rate exposure, and commodity price risks more effectively.

However, emerging markets face challenges such as limited liquidity, regulatory inefficiencies, and lack of market awareness among smaller investors. Continuous education and strong regulatory oversight are essential for sustainable growth.

8. Technological Innovations in Derivatives Trading

Technology has transformed the global derivatives landscape. Electronic trading platforms, algorithmic trading, and blockchain-based smart contracts have made derivatives trading faster, cheaper, and more transparent.

Blockchain and Smart Contracts: Enable automated settlement and verification, reducing counterparty and operational risks.

Artificial Intelligence and Analytics: Help institutions predict market movements and manage complex derivative portfolios.

Cloud Computing: Facilitates real-time risk monitoring and regulatory compliance across global markets.

These innovations are reshaping how institutions manage derivative risks and opportunities.

9. The Future of Derivatives and Risk Management

The global derivatives market continues to evolve in response to new financial products, geopolitical changes, and sustainability challenges. A growing trend is the emergence of climate derivatives and carbon credits, which allow businesses to hedge against environmental and regulatory risks. As ESG (Environmental, Social, and Governance) investing gains traction, derivatives will play a key role in financing green initiatives and managing sustainability-related risks.

Moreover, the integration of AI-driven risk models and real-time data analytics will further enhance the precision and responsiveness of global risk management systems.

Conclusion

Derivatives are the cornerstone of modern financial risk management. They empower corporations, investors, and governments to safeguard against uncertainties while facilitating efficient capital allocation and price discovery in global markets. However, their complexity requires robust understanding, disciplined use, and stringent regulatory oversight. When applied responsibly, derivatives strengthen financial stability, promote liquidity, and support the growth of the global economy.

In essence, derivatives are not merely speculative tools—they are vital instruments that, when managed prudently, transform financial uncertainty into strategic opportunity.

$AVGOExecutive Summary:

A significant technical development is underway for Broadcom Inc. ( NASDAQ:AVGO ). Beginning around Monday, April 7th, the stock has shown early signs of a potential trend reversal, characterized by the formation of a new ascending trendline. This bullish structure is consolidating within what appears to be a Symmetrical Triangle pattern, a classic formation that typically resolves in the direction of the preceding trend. The immediate resistance to monitor is the $340 level. A decisive breakout above this ceiling could trigger a powerful upward move, projecting a medium-term price target of $400. Key support levels are established at $330 and more critically at $300, which would act as the final defensive line should the pattern fail.

Detailed Technical Breakdown:

1. Emergence of a New Bullish Structure:

The price action observed from April 7th onwards is critically important as it marks a departure from previous consolidation. The formation of a higher low series, connected by a rising trendline, indicates that buyer demand is becoming more aggressive at successively higher prices. This ascending support line forms the lower boundary of the current technical setup and is the primary evidence for a strengthening short-term bullish bias.

2. The Symmetrical Triangle Pattern:

The price action is currently contained within the converging bounds of the ascending support line and a descending or flat resistance line near $340. This creates a Symmetrical Triangle pattern, which represents a period of indecision where the forces of supply and demand are nearly in equilibrium.

Implication: This pattern is a continuation pattern, meaning it typically pauses a larger trend (in this case, the long-term uptrend) before resolving with a breakout. The coiling action builds energy, often leading to a significant price move upon exit.

Trigger: The trigger for a bullish move is a decisive breakout above the $340 resistance level, confirmed by a strong bullish candle and, ideally, an increase in trading volume.

3. Critical Price Levels: Support and Resistance:

Resistance: The $340 level is the immediate technical hurdle. A sustained break above this, especially on high volume, is the required catalyst to validate the bullish thesis and signal the next leg up.

Support:

Primary Support ($330): This is the dynamic support offered by the ascending trendline. A bounce from this level reinforces the bullish structure.

Major Support ($300): This is a crucial psychological and static support level. A breach below the ascending trendline would invalidate the current bullish pattern, and a fall to $300 would represent a much deeper correction. This level must hold to prevent a more significant bearish reversal.

4. Projected Target and Strategic Outlook:

The measuring technique for a Symmetrical Triangle involves calculating the height of the pattern's widest part and projecting that distance upward from the point of breakout.

Price Target: A successful breakout above $340 projects a move towards the $400 zone. This objective aligns with both the technical measurement and the round-number psychological resistance, making it a credible and significant target.

Strategy: The tactical approach is to monitor the price action around the $340 resistance. A confirmed breakout offers a potential long entry with an initial profit target at $400. Stop-loss orders should be placed strategically, ideally below the ascending trendline (near $330) or more conservatively below the $300 major support, depending on risk tolerance. The integrity of the ascending trendline from April 7th is key to maintaining this optimistic outlook.

monday 7th april ascending trend formed for $TSM. the support zones are 0.236 (269.38) and 0.382 (243.56). our target price is 320. we can see if the trend breaks, it may land on one of our supports. reparaphase this and make it longer please

Of course. Here is a refined and expanded technical analysis of Taiwan Semiconductor Manufacturing Company ( NYSE:TSM ), building upon your initial observations.

Technical Analysis: Taiwan Semiconductor Manufacturing Company ( NYSE:TSM )

Executive Summary:

A significant technical development emerged for Taiwan Semiconductor Manufacturing Company ( NYSE:TSM ) around Monday, April 7th, with the establishment of a new, clearly defined ascending trend. This bullish structure suggests a resurgence of buyer confidence and positions the stock for a potential continuation of its upward trajectory. Our analysis identifies two key Fibonacci-based support levels that should provide buying interest on any pullback, while the primary upside target is projected at the $320.00 level. The integrity of the newly formed trendline is paramount; a breach would likely trigger a retracement towards the identified support zones, offering strategic entry points for capital allocation.

Detailed Technical Breakdown:

1. Emergence of a Bullish Trend Structure:

The price action beginning on or around Monday, April 7th, marks a pivotal shift for TSM. The formation of a consistent series of higher lows and higher highs has given rise to a definitive ascending trendline. This trendline now acts as a dynamic support level, illustrating that demand is overwhelming supply at progressively higher prices. This pattern is the foundational evidence for a positive near-to-medium-term bias, indicating that the momentum has shifted in favor of the bulls.

2. Hierarchical Support Framework:

In the event of a near-term pullback, we have delineated two critical support tiers derived from Fibonacci retracement levels of a relevant prior upward move. These zones represent high-probability areas where buyers are expected to re-enter the market.

Primary Support (Shallow Pullback): 23.6% Fibonacci Level at $269.38

A retracement to this level would constitute a shallow and healthy correction within a strong uptrend. A successful bounce from the $269 zone would signal underlying strength and likely serve as a launching point for a resumption of the move toward our target. This is the preferred and strongest support scenario.

Secondary Support (Moderate Correction): 38.2% Fibonacci Level at $243.56

A deeper pullback to the $243.56 area would indicate a more pronounced correction but would still remain within the normal bounds of a bull market. The 38.2% Fibonacci level, or "shallow retracement," is a classic level for institutional accumulation. While a test of this support suggests greater near-term weakness, it would also present a potentially higher-value entry point for long-term investors.

3. Price Projection and Strategic Outlook:

Upside Target: $320.00

The $320.00 price target is established as the next significant technical and psychological objective. This projection is based on a combination of factors, including measured move targets from the recent consolidation breakout and the identification of prior resistance levels. A successful ascent to this level would validate the strength of the current ascending trend.

Strategic Scenario Planning:

Bullish Scenario (Trend Holds): The price respects the ascending trendline from April 7th and uses it as a springboard to continue its advance. The path of least resistance remains upward, with pullbacks being shallow and brief, ultimately targeting $320.

Consolidation/Correction Scenario (Trend Breaks): If the stock fails to maintain its momentum and breaks below the dynamic ascending support, a deliberate retracement towards the Fibonacci support levels at $269.38 and potentially $243.56 becomes the base case. This would not necessarily invalidate the broader bullish thesis but would instead offer strategic opportunities to build a position at more favorable prices within the context of the larger uptrend.

In conclusion, the nascent ascending trend provides a clear and optimistic framework for TSM. Traders and investors should monitor the dynamic trendline support for continuation signals, while viewing any breakdown not as a failure, but as a potential gateway to acquire shares at key value-based support levels on the path toward the ultimate $320 target.

TSM Trade Setup — Strategic Entries and Risk Control🏦 TSM — “The Chip Heist: Thief Layers Up for the Big Loot” 💎

🎯 Market Setup:

TSM (Taiwan Semiconductor Mfg. Co., Ltd) is showing a bullish setup after a potential retest at the ATR line. The ATR retest will confirm buyer strength before momentum kicks in.

💰 Thief’s Master Plan (Layer Entry Tactics)

We scale in like a disciplined thief stacking gold bars:

Buy Limit 1 → 288

Buy Limit 2 → 292

Buy Limit 3 → 296

Buy Limit 4 → 300

(You can add more layers depending on your plan and risk appetite.)

🕵️♂️ Each layer reduces average entry cost and catches dips before the next move.

🧨 Stop-Loss Protocol:

Thief’s SL → 280

⚠️ This is my personal stop. Set your own stop according to your risk tolerance.

💎 Profit Extraction Zone (Target):

Target → 330 (Police Barricade / resistance zone + potential overbought trap)

Lock profits before the “trap” — that’s where pros exit quietly. 🚔💨

🧠 Key Cross-Market Links (For Confirmation)

Watch correlated tickers for better trade context:

NASDAQ:ASML → European semiconductor momentum

NASDAQ:NVDA → US chip leader, sentiment gauge

$SOX.X → Philadelphia Semiconductor Index, sector strength

NASDAQ:TSLA → Proxy for chip demand (AI + EV)

If NVDA and SOX are strong, TSM retest is likely to succeed. If they stall, be cautious.

📊 Trade Summary (Normal Format)

Confirmation: Retest at ATR line (momentum check)

Entry Plan: Layer buys at 288 / 292 / 296 / 300

Stop: 280 (adjust as needed)

Target: 330 resistance zone

Risk/Reward: Approx. 1:2.5+ depending on execution

💬 Side Note (For Thief OGs Only)

Not financial advice. We rob liquidity, not peace of mind. 😎

Trade it your way, manage risk, and protect your capital — that’s the real treasure.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

⚠️ Disclaimer: This is a Thief-style trading strategy shared just for fun. Trade responsibly and DYOR before entry.

#TSM #Semiconductors #SwingTrading #DayTrading #TradingStrategy #StockMarket #BullishSetup #TradingView #ThiefTrader #LiquidityHunt #ATRstrategy #SmartMoneyConcepts #LayerEntry

TSM: Unveiling Over 40% UndervaluationTSM: Unveiling Over 40% Undervaluation – SWOT and Intrinsic Value Deep Dive

Introduction

📊 As of October 27, 2025, Taiwan Semiconductor Manufacturing Company Limited (TSM), the world's leading semiconductor foundry specializing in advanced chip production for AI and high-performance computing, is riding a wave of AI-driven growth amid broader technology sector momentum. Macroeconomic factors, including surging demand for AI infrastructure and stabilizing global supply chains, have fueled positive shifts in investor sentiment.

Sector dynamics feature rapid adoption of 3nm and 2nm technologies, with public data from recent earnings highlighting quarterly revenue growth of 40.1% year-over-year, positioning TSM for continued expansion in a high-growth environment. This overview is based on verifiable metrics without promoting any investment.

SWOT Analysis

Strengths 💹

TSM holds a dominant market position with first-mover advantages in advanced nodes, supplying chips to leading companies like NVIDIA and Apple, which drives consistent demand. Financial robustness is evident in its low debt-to-equity ratio of 19.00%, strong operating cash flows, and quarterly earnings growth of 52.98% year-over-year, supported by economies of scale and technological leadership. Global fabrication facilities enhance resilience and efficiency.

Weaknesses ⚠️

Geopolitical vulnerabilities tied to Taiwan's location expose TSM to potential disruptions from cross-strait tensions or trade restrictions. High capital expenditures for R&D and fab expansions strain short-term margins, while talent shortages in specialized engineering could hinder innovation pace. Return on assets remains moderate amid intensive investments.

Opportunities 🚀

TSM's undervalued metrics, such as a forward P/E of 24.73 and PEG ratio around 0.83, make it attractive for growth investors amid AI megatrends. Analyst projections forecast 30% revenue growth for 2025, reaching approximately $120B, with EPS expansion of 19.8% to $12.34 in 2026, driven by AI/HPC segments and expansions in Arizona and Japan. Emerging opportunities in IoT, automotive chips, and quantum computing further bolster long-term prospects.

Threats 🛑

Intensifying competition from Intel's foundry ambitions and Samsung could pressure market share, while U.S.-China trade tensions risk supply chain interruptions. Cyclical semiconductor demand and potential economic slowdowns may impact client orders, with regulatory scrutiny on technology exports adding uncertainty.

Intrinsic Value Calculation

💰 Value investing focuses on estimating intrinsic value to spot assets below their fundamental worth, applying a margin of safety for risks like geopolitical factors. For growth-oriented firms like TSM, we weight book value lower (e.g., 0.3) to emphasize earnings potential: Intrinsic Value = (Book Value per Share × Weight) + (Forward EPS × Growth Multiplier), with a multiplier (e.g., 40) reflecting sector growth averages adjusted for 30% projected expansion.

Using recent data: Book Value per Share ≈ $31.85 (adjusted for ADR), Forward EPS = $12.34. Assume a 25% average growth rate from revenue and EPS forecasts, supporting the multiplier for sustainability.

Calculation:

- Book component: $31.85 × 0.3 = $9.555

- Earnings component: $12.34 × 40 = $493.6

- Intrinsic Value ≈ $9.555 + $493.6 = $503.155

Compared to the current price of $294.96, TSM appears undervalued by over 40%, offering a strong margin of safety (e.g., 30-50% discount to account for threats like competition). 📉 Debt flags are minimal at 19% D/E, with robust earnings momentum (24.6% growth to $15.48 in 2027) underpinning long-term sustainability if global demand persists. Annotate intrinsic value lines in green on the chart, with current price in red for visual comparison.

Entry Strategy Insights

🔍 Institutional strategies target bottom-extreme zones, such as oversold levels from historical supports during sector pullbacks, for unleveraged long-term positions. Dollar-cost averaging enables gradual accumulation in dips, leveraging non-repainting price signals for reversal confirmation. For TSM, scan areas near key moving averages amid AI-driven rebounds, focusing on fundamentals like revenue surges over volatility.

Risk Management

⚠️ Constrain position sizing to 1-5% of capital to manage potential downturns. Diversify across semiconductors and tech to buffer geopolitical exposures, committing to long-term holds based on sustained AI growth. Review debt and capex in quarterly reports, with predefined exits for escalating trade risks or demand softening.

Conclusion

This breakdown illuminates TSM's technological strengths and AI opportunities, mitigated by external threats, with intrinsic assessments revealing significant upside for growth-focused investors. Independently verify through latest filings and seek professional counsel.

This is educational content only; not financial advice. Always conduct your own due diligence.

TSMCTSMC is the world's largest semiconductor foundry, headquartered in Taiwan. It leads the global advanced chip manufacturing market, producing cutting-edge chips for diverse applications such as AI, mobile, automotive, and consumer electronics.

Major Shareholders of TSMC (2025)

Shareholder Ownership %

National Development Fund of The Executive Yuan 6.377%

GIC Pte Ltd. (Singapore Sovereign Wealth Fund) 3.149%

Labor Pension Fund Supervisory Committee 1.314%

Fubon Life Insurance Co., Ltd. 0.653%

Fidelity Management & Research Co. LLC 1.184%

Capital Research & Management Co. (World Investors) 0.615%

JPMorgan Investment Management, Inc. 0.548%

Fisher Asset Management LLC 0.341%

State Street Global Advisors Ltd. 0.165%

Nordea Investment Management AB 0.075%

The Taiwanese government through its National Development Fund remains the largest shareholder, reflecting TSMC’s strategic importance to Taiwan’s economy and technology sector.

Recent Developments

TSMC continues to expand its manufacturing capacity globally, notably with a large fabs manufacturing advanced chips near Phoenix, Arizona.

The company raised its 2025 revenue outlook by 30+% fueled by soaring demand for AI chips and advanced semiconductors.

TSMC’s role as a critical supplier to major technology firms like NVIDIA and Apple underscores its market dominance.

Taiwan Semiconductor Manufacturing Company (TSMC) has made substantial investments in the United States, focusing primarily on expanding its manufacturing capacity and advancing semiconductor production technology.

Key Points on TSMC’s US Investments (2025):

Investment Size: TSMC has committed approximately $165 billion to build and expand semiconductor manufacturing facilities in the US. This investment includes funding for multiple chip fabrication plants (fabs), advanced packaging, and research & development centers.

Arizona Megafab Cluster: The company is developing a major "megafab cluster" in Arizona, consisting of multiple wafer fabs. The first Arizona fab began commercial production in 2024, with plans to construct three additional fabs, two IC assembly plants, and a large R&D facility as part of a $100 billion extension over the coming years.

Technology: TSMC plans to deploy sophisticated process technologies such as 2-nanometer node production in its US plants, expected to complement its leading-edge manufacturing in Taiwan.

Strategic Motivation: These investments align with U.S. government goals to reduce dependency on Asian semiconductor supply chains for national security reasons and foster domestic high-tech manufacturing.

Market Demand: High demand for chips used in smartphones, AI, and high-performance computing drives the urgency and scale of TSMC’s US expansion.

Summary:

TSMC is accelerating its US manufacturing footprint significantly by investing $165 billion, primarily in Arizona, to produce cutting-edge chips locally. This expansion enhances US semiconductor self-sufficiency, supports high demand in AI and mobile markets, and reduces geopolitical risks related to regional supply chain concentratio

TSMC holds a dominant position as the premier semiconductor foundry globally, backed by a stable mix of government, institutional, and investment fund shareholders, driving innovation and growth through expansive manufacturing and R&D.

#STOCKS #TSMC

TSM - looking like a top?Is it just me or are things starting to look a bit 'toppy' for this stock? On this weekly chart of TSM I think it is possible to make a reasonable 5 wave count from the 2022 low and, on a lower degree, from the deep correction from April this year. There is also some support from the Fibonacci levels too.

TSM Bullish or Bearish?TSM (1H chart) is consolidating in a symmetrical triangle after a strong rally, with price hovering around the 20 EMA and MACD momentum flattening, suggesting a balance between bulls and bears; a breakout above the upper trendline could extend the uptrend toward the 290 area, while a breakdown below the lower boundary may trigger a pullback toward the 260 support zone.

TSMC: AI Chip Titan – Still the King or Facing New Challengers?Good morning, everyone! ☀️ TSMC: AI Chip Titan – Still the King or Facing New Challengers?

(1/9)

TSMC’s riding the AI wave with record Q4 2024 profits, but with U.S.-China curbs and fab delays, is this semiconductor king untouchable or at a crossroads? Let’s unpack it! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Q4 2024: Net income up 57% to $11.4B, revenue climbed 39% 💰

• Full Year 2024: Revenue hit $87.1B, up 34% from 2023 📏

• Sector Trend: AI chip demand soaring, per Reuters 🌟

It’s a powerhouse, driven by tech’s hunger! ⚙️

(3/9) – MARKET POSITION 📈

• Market Share: Over 60% of global foundry market 🏆

• Clients: Apple, Nvidia, AMD—big names rely on ‘em ⏰

• Trend: Expanding fabs in U.S., Japan, Germany 🎯

Firm, holding the throne but not without battles! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Q4 Earnings: Record $11.4B profit, per Jan 16 Reuters 🔄

• Expansion: Arizona fab faces delays, full ops by 2027? 🌍

• Market Reaction: Shares up 81% in 2024, still strong 📋

Adapting, with global eyes on its moves! 💡

(5/9) – RISKS IN FOCUS ⚡

• Geopolitics: U.S.-China export curbs hit demand 🔍

• Costs: U.S. fab chips 50% pricier than Taiwan 📉

• Talent: Lack of skilled U.S. workers slows growth ❄️

Tough, but risks loom large! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Profit Surge: 57% net income jump in Q4 2024 🥇

• Tech Lead: 5nm mass production, 3nm in R&D 📊

• Client Base: Powers Apple, Nvidia, more 🔧

Got silicon in the tank! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: High U.S. fab costs, talent gaps 📉

• Opportunities: AI chip demand, new fabs in Japan, EU 📈

Can it keep the lead amid global shifts? 🤔

(8/9) – 📢TSMC’s Q4 profit up 57%, AI booming, your take? 🗳️

• Bullish: Still the king, long-term winner 🐂

• Neutral: Steady, but risks weigh ⚖️

• Bearish: Curbs and costs slow growth 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

TSMC’s record profits signal AI dominance 📈, but U.S.-China curbs and fab delays add caution 🌿. Volatility’s our friend—dips are DCA gold 💰. Grab ‘em low, climb like pros! Gem or bust?

TSM - LONG Swing Entry PlanNYSE:TSM - LONG Swing Entry Plan

E1: $231.00 – $229.00

→ Open initial position targeting +8% from entry level.

E2: $221.00 – $218.00

→ If price dips further, average down with a second equal-sized entry.

→ New target becomes +8% from the average of Entry 1 and Entry 2.

AD: $212.00 – $207.00

→ If reached, enter with double the initial size to lower the overall cost basis.

→ Profit target remains +8% from the new average across all three entries.

Risk Management:

Stop Loss:

Risk is capped at 12% below the average entry price (calculated across all executed positions including the Edit Zone).

Position Sizing Approach:

Entry 1: 1x

Entry 2: 1x

AD Zone: 2x

→ Total exposure: 4x

→ Weighted average determines final TP and SL calculations.

______________________________________

Legal Disclaimer

The information provided in this content is intended for educational and informational purposes only and does not constitute financial, investment, or legal advice or recommendations of any kind. The provider of this content assumes no legal or financial responsibility for any investment decisions made based on this information. Users are strongly advised to conduct their own due diligence and consult with licensed financial advisors before making any financial or investment decisions.

Sharia Compliance Disclaimer: The provider makes no guarantees that the stocks or financial instruments mentioned herein comply with Islamic (Sharia) principles. It is the user’s responsibility to verify Sharia compliance, and consultation with a qualified Sharia advisor is strongly recommended before making any investment decisions

______________________________________

Legal Disclaimer

The information provided in this content is intended for educational and informational purposes only and does not constitute financial, investment, or legal advice or recommendations of any kind. The provider of this content assumes no legal or financial responsibility for any investment decisions made based on this information. Users are strongly advised to conduct their own due diligence and consult with licensed financial advisors before making any financial or investment decisions.

Sharia Compliance Disclaimer: The provider makes no guarantees that the stocks or financial instruments mentioned herein comply with Islamic (Sharia) principles. It is the user’s responsibility to verify Sharia compliance, and consultation with a qualified Sharia advisor is strongly recommended before making any investment decisions

Can the World's Most Critical Company Survive Its Own Success?Taiwan Semiconductor Manufacturing Company (TSMC) stands at an unprecedented crossroads, commanding 67.6% of the global foundry market while facing existential threats that could reshape the entire technology ecosystem. The company's financial performance remains robust, with Q2 2025 revenue reaching $30.07 billion and over 60% year-over-year net income growth. Yet, this dominance has paradoxically made it the world's most vulnerable single point of failure. TSMC produces 92% of the world's most advanced chips, creating a concentration risk where any disruption could trigger global economic catastrophe exceeding $1 trillion in losses.

The primary threat comes not from a direct Chinese invasion of Taiwan, but from Beijing's "anaconda strategy" of gradual economic and military coercion. This includes record-breaking military flights into Taiwan's airspace, practice blockades, and approximately 2.4 million daily cyberattacks on Taiwanese systems. Simultaneously, U.S. policies create contradictory pressures—while providing billions in CHIPS Act subsidies to encourage American expansion, the Trump administration has revoked export privileges for TSMC's Chinese operations, forcing costly reorganization and individual licensing requirements that could cripple the company's mainland facilities.

Beyond geopolitical risks, TSMC faces an invisible war in cyberspace, with over 19,000 employee credentials circulating on the dark web and sophisticated state-sponsored attacks targeting its intellectual property. The recent alleged leak of 2nm process technology highlights how China's export control restrictions have shifted the battleground from equipment access to talent and trade secret theft. TSMC's response includes an AI-driven dual-track IP protection system, which manages over 610,000 cataloged technologies and extends security frameworks to global suppliers.

TSMC is actively building resilience through a $165 billion global expansion strategy, establishing advanced fabs in Arizona, Japan, and Germany while maintaining its technological edge with superior yields on cutting-edge nodes. However, this de-risking strategy comes at a significant cost - Arizona operations will increase wafer costs by 10-20% due to higher labor expenses, and the company must navigate the strategic paradox of diversifying production while keeping its most advanced R&D concentrated in Taiwan. The analysis concludes that TSMC's future hinges not on current financial performance, but on successfully executing this complex balancing act between maintaining technological leadership and mitigating unprecedented geopolitical risks in an increasingly fragmented global order.

TSM Weekly Chart Analysis – Momentum Shift in PlayTaiwan Semiconductor (TSM) is showing signs of a major momentum shift on the weekly chart. Using a combination of MutantBuy.AI, Ultimate Algo, and BBR Extreme Close, we’ve identified key zones of support and resistance, along with potential buy/sell signals and profit targets.

Key Highlights:

Momentum Shift detected via – signaling a possible trend reversal.

Uncertain Classification Std. suggests volatility ahead – ideal for strategic entries.

Support and Resistance zones mapped across 1D and 2W timeframes.

Algorithmic signals from MutantBuy.AI point to bullish potential.

Trade Setup:

Target 1: 272.00

Target 2: 300.00

Stop Loss: 198.95

Follow me for more AI-powered insights and weekly chart breakdowns.

Like and follow if you want to stay ahead of the curve with smart trading strategies.

8/5/25 - $tsm - Good to be back8/5/25 :: VROCKSTAR :: NYSE:TSM

Good to be back

- you all know i stick to the winners so it's always been $TSM/ NASDAQ:NVDA and then everyone else (go read the posts if inclined w/ more thoughts on either)

- NYSE:TSM is a key infrastructure layer for the next 5-10 yr of hyper-AI growth and not disappearing

- 4.5% fcf yield, growing teens

- sub 20x PE and growing big DD's (easy)

- does it dip, find a lower lower? no clue, but i'll be adding

V

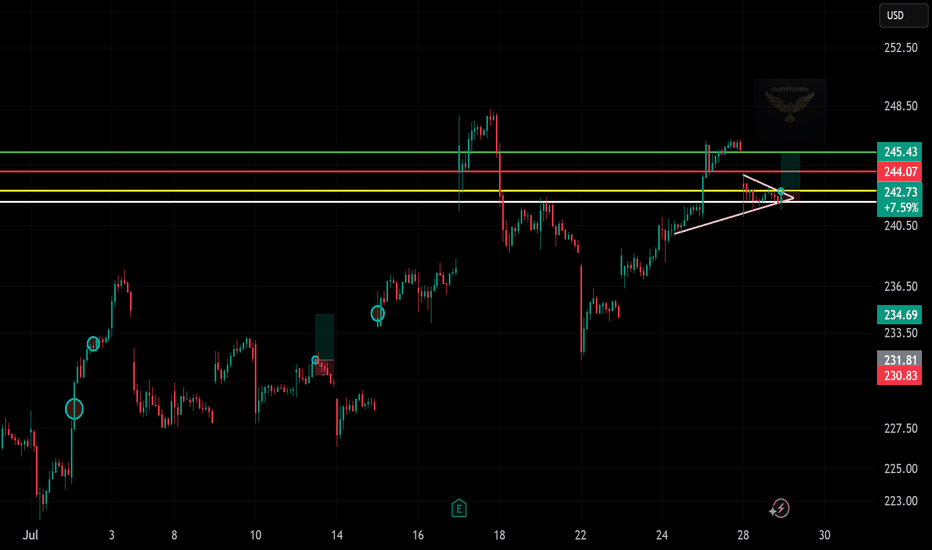

Trade Setup: LONG on TSM !📈 (Taiwan Semiconductor)

🕰️ Timeframe: 30-minute chart

🔍 Pattern: Ascending triangle breakout

📉 Previous Trend: Recovery after drop

🔁 Setup: Bullish continuation with breakout confirmation

🧩 Technical Breakdown:

Support Zone:

~$242.50 (yellow horizontal support)

Uptrend line holding as dynamic support (pink diagonal)

Entry Zone:

Around $242.75, just above triangle breakout and support retest

Resistance / Target Levels:

TP1: $244.07 (red zone — minor supply)

TP2: $245.43 (green zone — prior high, resistance zone)

Stop Loss:

Below $241.80 or just under triangle trendline (~$241.25)

Risk-Reward Estimate:

Approximately 1:1.5 to 1:2 based on $1.5 risk and $3 reward potential

⚠️ What to Watch:

Volume confirmation during breakout or retest

Holding above yellow support zone and triangle trendline

Potential fake-out risk near $244 zone if volume fades

✅ Summary:

TSM is setting up a bullish continuation after reclaiming key levels and forming a tight ascending triangle. A clean breakout above $243 may trigger a move toward $245+ if buyers step in.

TSM eyes on $194: Major Resistance to Break-n-Run or Dip-to-Buy TSM has been recovering with the chip sector.

Currently testing a Major Resistance zone.

Look for a Dip-to-Buy or Break-n-Retest entry.

$193.92-195.18 is the exact zone of concern.

$177.83-178.31 is the first major support.

$203.68-204.56 is the first resistance above.

========================================

.