RUSSELL Overbought for the 3rd time in 7 months. Sell.Last time we had a look at Russell 2000 (RUT) was 2 months ago (November 28 2025, see chart below) where we gave a strong Buy Signal that quickly hit our 2600 Target:

This time, with the price approaching the top (Higher Highs trend-line) of its 10-month Channel Up, the technical sentiment turn

Russell 2000 Index

No trades

Related indices

US2000 H4 | Bullish Momentum To Extend?Based on the H4 chart analysis, we could see the fall to our buy entry level at 2,601.61, which is a pullback support that is slightly above the 50% Fibonacci retracemnt.

Our stop loss is set at 2,554.64, which is a pullback support that aligns with the 61.8% Fibonacci retracement.

Our take profit

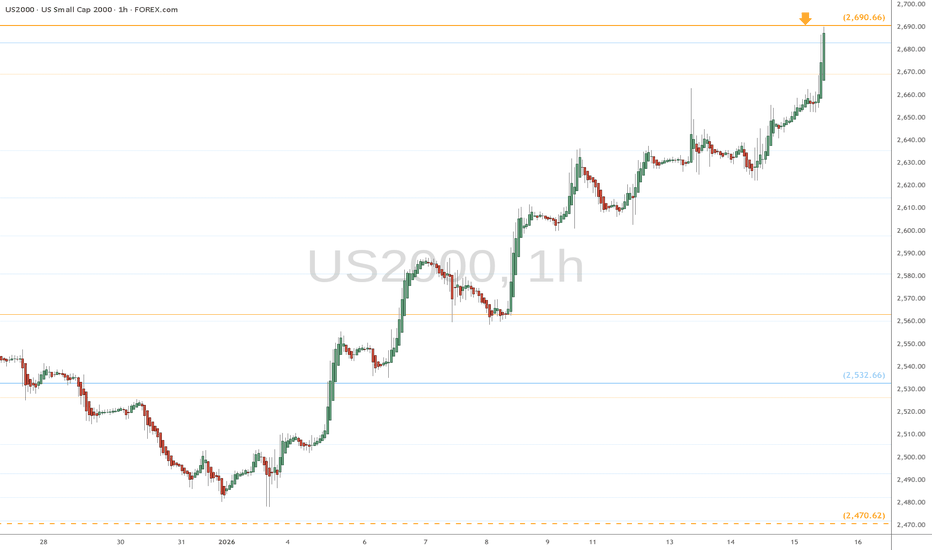

US2000 H1 | Bearish Reversal SetupBased on the H1 chart analysis, we could see the price rise towards our sell entry level at 2,692.02, which is a pullback resistance that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 2,738.46, which is a swing high resistance.

Our take profit is set at 2,626.00, which is a mu

US2000 (Russell) eyes on $2690: Golden Genesis fib may give DIP Small caps have been flying strong for some time now.

US2000 index just hit a Golden Genesis fib at $2690.66

Look for a Break-n-Retest or Dip-to-Fib to join trend.

.

See "Related Publications" for other examples of Golden fibs at work ----->>>>>>>>>>>

.

RUSSELL 2000 — Follow-up on prior liquidity-based scenario (15M)This post provides a follow-up observation on a previously published liquidity-based scenario.

Price has since interacted with the identified liquidity zone, with market behavior aligning with the initial structural framework.

This follow-up is shared for documentation purposes only and does not c

Russell 2K: Don't Let the Fake Move Cheat You Out of a 20% RallyRussell 2000: Don't Let the Fake Move Cheat You Out of a 20% Rally

For the past few years, the IG:RUSSELL has been a master of frustration . If you feel like this index has been moving sideways forever, you are right. However, there is a very specific pattern repeating itself that most retail

Russell 2000 Bullish Bias | Accumulation Before Expansion🎯 US2000 (Russell 2000) Index CFD | Bullish Swing Trade Setup 📈

🔥 MARKET OPPORTUNITY: Small-Cap Breakout Play 🔥

📊 TRADE PLAN OVERVIEW

Strategy: Bullish Accumulation → Resistance Breakout → Re-accumulation Zone

Timeframe: Swing Trade (Multi-day to weeks)

Technical Confirmation: Simple Moving Average

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's value movements over previous years to identify recurring trends.

Frequently Asked Questions

The current value of Russell 2000 Index is 2,666.70 USD — it has risen by 0.26% in the past 24 hours. Track the index more closely on the Russell 2000 Index chart.

Russell 2000 Index reached its highest quote on Jan 22, 2026 — 2,735.10 USD. See more data on the Russell 2000 Index chart.

The lowest ever quote of Russell 2000 Index is 106.07 USD. It was reached on Oct 28, 1987. See more data on the Russell 2000 Index chart.

Russell 2000 Index value has increased by 1.13% in the past week, since last month it has shown a 4.71% increase, and over the year it's increased by 16.44%. Keep track of all changes on the Russell 2000 Index chart.

The top companies of Russell 2000 Index are NASDAQ:SATS, NYSE:BE, and NASDAQ:CRDO — they can boast market cap of 35.46 B USD, 33.11 B USD, and 23.48 B USD accordingly.

The highest-priced instruments on Russell 2000 Index are NYSE:GHC, NASDAQ:CVCO, and NASDAQ:DJCO — they'll cost you 1,164.13 USD, 649.92 USD, and 612.50 USD accordingly.

The champion of Russell 2000 Index is NASDAQ:CELC — it's gained 915.53% over the year.

The weakest component of Russell 2000 Index is NASDAQ:MCHB — it's lost −99.94% over the year.

Russell 2000 Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy Russell 2000 Index futures or funds or invest in its components.

The Russell 2000 Index is comprised of 1934 instruments including NASDAQ:SATS, NYSE:BE, NASDAQ:CRDO and others. See the full list of Russell 2000 Index components to find more opportunities.