AUDCHF: Pressure Builds at Key ResistanceAUDCHF: Pressure Builds at Key Resistance

AUDCHF is currently trading near a key technical area where price has previously reacted. The recent move shows slowing momentum, suggesting that the market is deciding between continuation and reversal.

The price is respecting a well-defined structure, w

Swiss Franc/Australian Dollar

No trades

Related currencies

AUD/CHF BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

AUD/CHF pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 4H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair

AUDCHFIf the AUDCHF price can remain above 0.53675, we expect there is a possibility of further price increases

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

This content is not financial advice. Always conduct your ow

AUDCHF - Price In A Clear Long‑Term DowntrendThe chart shows AUDCHF in a clear long‑term downtrend inside a bearish descending channel on the weekly timeframe.

Price is now rallying back into a marked supply zone that aligns with the channel’s upper trendline, so the idea is to watch this area for rejection and then look for short setups in l

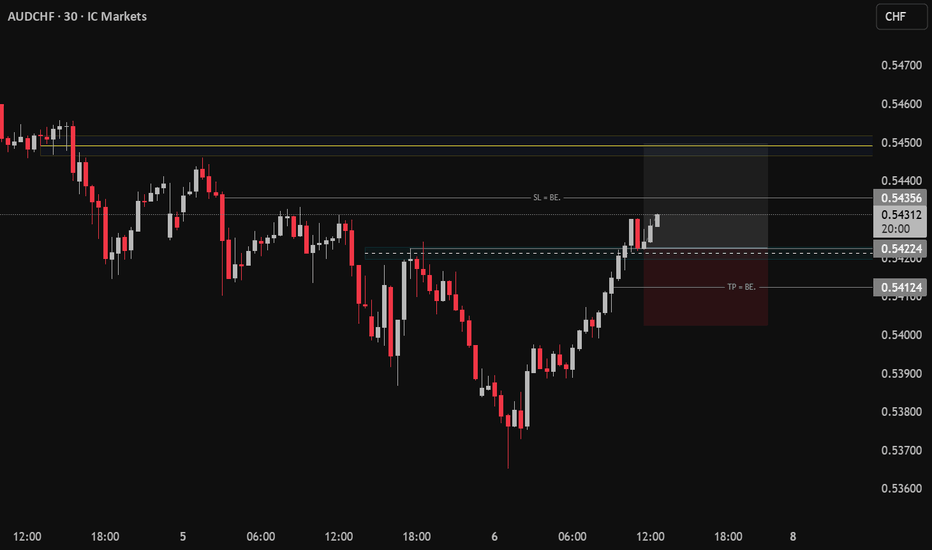

AUD/CHF SENDS CLEAR BEARISH SIGNALS|SHORT

AUD/CHF SIGNAL

Trade Direction: short

Entry Level: 0.542

Target Level: 0.539

Stop Loss: 0.544

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

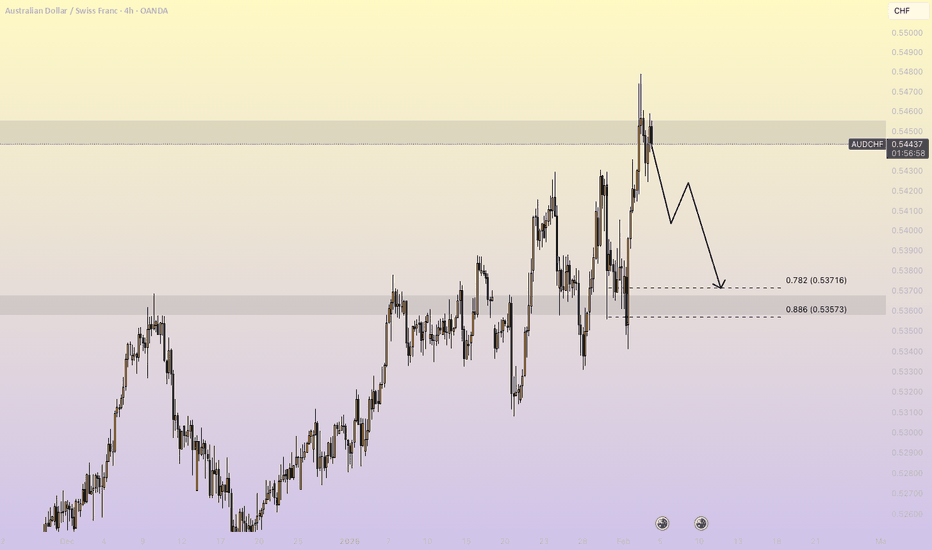

AUDCHF – Bearish On the 1D timeframe, price has taken rejection from the previous high, confirming strong selling pressure.

On the 4H chart, a clear double top pattern has formed, indicating a potential trend reversal.

With price currently holding near the 78.2 Fibonacci level as a key support, a breakdown from thi

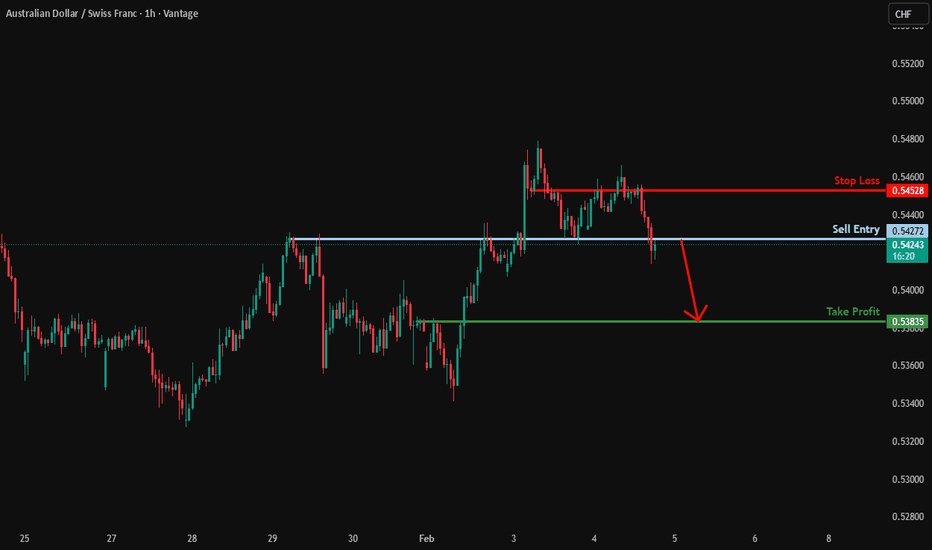

Could we see a drop from here?AUD/CHF is reacting off the resistance level, which is an overlap resistance, and could drop from this level to our take profit.

Entry: 0.54272

Why we like it:

There is an overlap resistance level.

Stop loss: 0.54528

Why we like it:

There is a pullback resistance level.

Take profit: 0.53835

Why w

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of CHFAUD is 1.82767 AUD — it has decreased by −0.45% in the past 24 hours. See more of CHFAUD rate dynamics on the detailed chart.

The value of the CHFAUD pair is quoted as 1 CHF per x AUD. For example, if the pair is trading at 1.50, it means it takes 1.5 AUD to buy 1 CHF.

The term volatility describes the risk related to the changes in an asset's value. CHFAUD has the volatility rating of 0.70%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The CHFAUD showed a −0.27% fall over the past week, the month change is a −1.99% fall, and over the last year it has increased by 5.07%. Track live rate changes on the CHFAUD chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

CHFAUD is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade CHFAUD right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with CHFAUD technical analysis. The technical rating for the pair is sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the CHFAUD shows the sell signal, and 1 month rating is neutral. See more of CHFAUD technicals for a more comprehensive analysis.