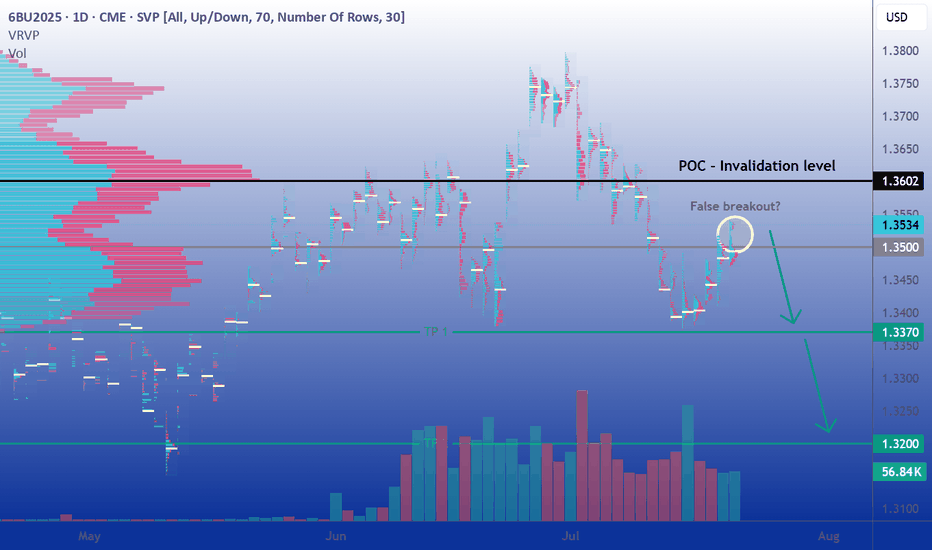

6B1!: GBPUSD Futures Outlook: Bearish Momentum Persists The GBPUSD CFD continues its cautious descent following a rejection from the critical 1.3590 supply area. This level, historically a significant resistance point, has thwarted recent bullish attempts, reinforcing the prevailing bearish sentiment among traders and investors alike.

Technical Breakdo

Related futures

GBP: ER & Options Align — A Signal Worth Watching📌 GBP: ER & Options Align — A Signal Worth Watching

Interesting confluence on the British Pound:

The 1σ Expected Range (ER) for the Friday expiry (22.08) perfectly aligns with the cluster of put options at 1.35 — the same level I highlighted earlier.

🎯 Why it matters:

When market structure (ER) mee

GBP/USD Faces Key 8-Hour Supply ZoneToday, the GBP/USD futures approached an 8-hour supply zone, presenting a potential shorting opportunity. The price action indicates the beginning of a possible downtrend within this timeframe. Additionally, the latest COT report reveals that non-commercial traders are increasing their short positio

Short the Slip Above 1.3500Fundamental Outlook: A stagflation trap

The UK economy continues to emit worrying signs of stagflation: inflation remains uncomfortably high, growth is weak, and the once-tight labor market is starting to soften. Consumer confidence has deteriorated, and house prices are experiencing record declin

GBPUSD. 14.07.2025. The plan for the next few days.The nearest interesting resistance zone was already worked out in the morning and gave a good reaction. Let's mark the others where we can expect a reaction. It's not certain that there will be a major reversal, but I think we'll see a correction that can be monetized. We're waiting for a reaction a

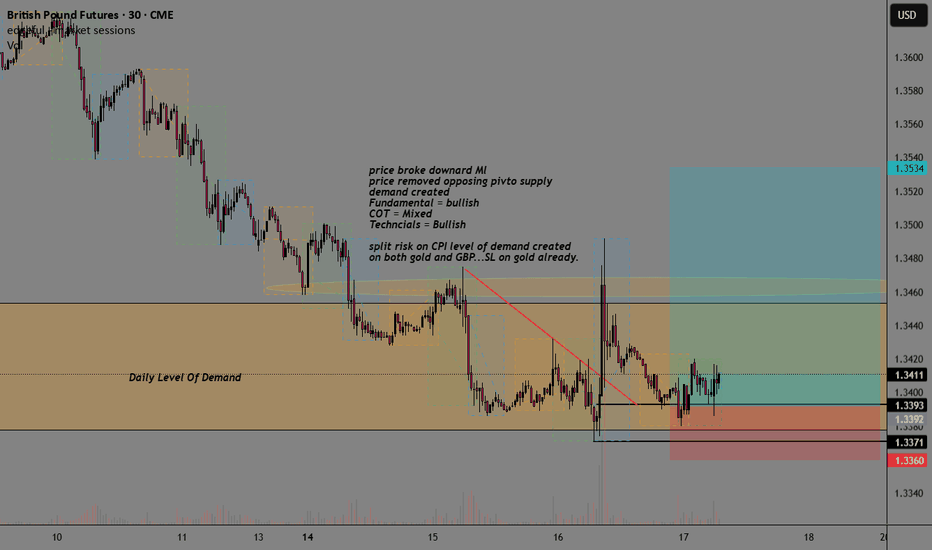

GBP GBPUSD Supply-Demand Long SignalHigher Timeframe Analysis:

- Price inside daily/Weekly level of demand + pivot

- Long term trend = uptrend

- Fundamentals Bullish

- COT Mixed

- Technicals Bullish

Lowertimeframe:

- Price broke downard ML

- Price removed the opposing pivotal level of demand

- DBR Demand created from CPI event

- Spli

Mid-Session Market ReviewMid-Session Market Review

S&P 500: After some initial volatility from the 8:30 news, the market accepted above the prior day’s levels but has since pulled back within range, consolidating just below the highs.

NASDAQ: The NASDAQ remains above all of yesterday’s levels and is currently balancing be

British Pound Futures (6B1!) Face Supply Area.Pound Futures: 6B1 Area Tests Bearish Resolve

Pound Futures are approaching a critical weekly supply zone (6B1). Today's price action saw a touch and rejection of this level, marked by a bearish candlestick. This suggests a potential for a short-term pullback, and we're eyeing a re-entry opportu

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for British Pound Futures (Mar 2020) is Mar 16, 2020.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell British Pound Futures (Mar 2020) before Mar 16, 2020.