Trade ideas

Scalp Long – COOKIE💎 Scalp Long – COOKIE

RSI has completed its correction and is now in the strong buy zone.

Buying volume is surging, showing renewed market strength.

Price is moving to retest the previous local high, signaling bullish continuation.

🎯 Plan:

→ Enter after confirmation of momentum continuation.

→ TP: 0.1251 | SL: 0.0911 | RR: 1 : 2.49

Market structure favors the long side.

Keep entries clean, trail SL as price climbs.

Stay focused — only engage when the setup confirms.

Cookie to the MoonStrong Bullish Pattern Forming

The chart is showing some really promising technical signals for COOKIE right now. Here's what I'm seeing:

Key Bullish Indicators:

1. Descending Wedge Pattern

Classic bullish reversal formation

Price is compressing near the apex with decreasing volume

These patterns historically resolve to the upside 60-70% of the time

We're approaching a critical breakout zone

2. RSI Bullish Divergence

Price making lower lows while RSI is showing higher lows (green arrow)

This is a textbook bullish divergence signal

Suggests weakening bearish momentum despite price decline

RSI bouncing from oversold territory

3. Strong Support Level

Horizontal support line being tested multiple times

Price finding buyers at this level

The more times support holds, the more significant the eventual move

4. Volume Profile

Volume decreasing during the downtrend (typical in wedge patterns)

Low volume = less selling pressure

Breakout should come with volume expansion

Scalp Long – COOKIE💎 Scalp Long – COOKIE

Price is recovering and preparing to break out of the short-term downtrend, signaling a potential shift in momentum.

🎯 Plan:

→ Enter after confirmation of breakout and retest.

→ TP: 0.1216 | SL: 0.086 | RR: 1 : 5.25

Momentum favors the long side.

Keep entries precise, trail SL as price advances.

Patience is key — only engage once the setup fully confirms.

#COOKIE/USDT BROKEN OUT OF DESCENDING TRAINGLE#COOKIE

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.0920, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.0950

First target: 0.0974

Second target: 0.1006

Third target: 0.1040

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

COOKIEUSDTOf course, here is the English version of the last signal:

🚨 New Signal 🚨

📊 Symbol: COOKIE/USDT

🐂 Position Type: BUY/LONG

🟢 Entry Point: 0.0998

🎯 Take Profit (TP):

0.1209

🚫 Stop Loss (SL):

0.0899

⚠️ Always practice proper risk management.

📌 Note: This setup is based on Smart Money Concepts (SMC) and is targeting the Fair Value Gap (FVG) at a higher price.

COOKIEUSDT 1D#COOKIE is moving inside a falling wedge pattern on the daily chart. In case of a breakout above the wedge resistance and the daily SMA50, the potential targets are:

🎯 $0.1356

🎯 $0.1586

🎯 $0.1771

🎯 $0.1956

🎯 $0.2221

🎯 $0.2557

⚠️ Always remember to use a tight stop-loss and follow proper risk management.

COOKIE/USDT – Accumulation before potential breakout This is truly an amazing chart. ✨ I haven’t seen anything like this in the altcoin world for a long time, and it even reminds me of Bitcoin’s structure.

On the weekly chart, COOKIE has been trading in a yellow accumulation zone, while forming a descending trendline (yellow). The price is approaching a decision point – either a breakdown or a potential breakout to the upside.

Support: around 0.10 – 0.13 USDT

Resistance: descending trendline

Volume profile: shows strong interest in this range

Upside target (if breakout): green zone $3 – $4.5 🟢

📌 Conclusion: The market is in accumulation. Watch closely how price reacts at the trendline. A breakout to the upside could open the door for a significant rally.

COOKIE / USDT — Final Support Test: Breakout or Breakdown?📊 Overview

COOKIE price is currently sitting at a critical decision point: resting right on the major support zone (yellow box) that has held multiple times, while also being pressed down by a long-term descending trendline from January 2025. This forms a classic descending triangle pattern — historically a bearish continuation, but in crypto it can also act as an accumulation base before a strong breakout.

In short, the market is in a make-or-break phase.

---

🔎 Pattern & Price Structure

1. Descending Triangle

Clear lower highs from the 0.825 peak.

Horizontal support zone (yellow box) repeatedly absorbing selling pressure.

Price now squeezed into the apex → signaling that a strong move is imminent.

2. Support Zone (Demand Area)

The 0.12 – 0.13 region is the last line of defense for bulls.

A breakdown below this would validate the bearish structure.

3. Key Resistance Levels

0.1658 → first breakout target.

0.2195 → key resistance above the breakout zone.

0.3074 → major resistance, ideal swing target.

0.5806 → long-term bullish extension if momentum sustains.

---

🚀 Bullish Scenario

Catalyst: confirmed breakout above descending trendline with strong 2D candle close + increased volume.

Additional validation: successful retest of the breakout line showing buyers’ dominance.

Upside targets:

Target 1: 0.1658 (≈ +27%)

Target 2: 0.2195 (≈ +69%)

Target 3: 0.3074 (≈ +137%)

Extended target: 0.5806 (multi-month rally potential).

Bullish strategy: enter on confirmation, take profits gradually, and move stop-loss to breakeven after first target is hit.

---

🐻 Bearish Scenario

Catalyst: breakdown below the yellow support zone (close 2D < 0.12).

Downside targets:

0.09 (≈ -30% from current price).

0.065 (≈ -50%).

Extreme case: retest historical low at 0.0192 (≈ -85%).

Bearish strategy: beware of false breakdowns (long wicks below support quickly reclaimed). Always wait for confirmation.

---

📌 Trading Strategy & Risk Management

Conservative traders: wait for a clear breakout/breakdown confirmation on the 2D timeframe.

Aggressive traders: may play the bounce off support, but must use strict stop-loss just below the yellow zone.

Position sizing: limit risk per trade (1–2% of capital) given the potential volatility once the pattern resolves.

---

📝 Conclusion

COOKIE is at a critical junction. The descending triangle often favors the bears, but in crypto, patterns are frequently invalidated by short squeezes or hidden accumulation. A confirmed breakout could spark a strong rally toward 0.1658 – 0.3074, while a breakdown may drag price below 0.09 and even to 0.065.

Bottom line: COOKIE is in an energy build-up phase. The next breakout or breakdown will likely define the medium-term trend — whether COOKIE becomes a “big winner rally” or continues deeper correction.

---

#COOKIE #CookieDAO #CryptoAnalysis #Altcoins #DescendingTriangle #SupportResistance #TradingStrategy #CryptoTrading #PriceAction

COOKIE/USDT – Wave 3 Setup After ABC CorrectionOver the past 100 days, COOKIE/USDT completed an explosive first wave rally of +300%, confirming strong bullish potential. Since then, price has been in a healthy ABC correction phase, allowing the market to reset and consolidate gains.

Recently, a liquidity sweep and trap has taken place, signaling the final stage of reversal and flushing out weak hands. With the correction phase nearly complete, the structure now points toward the start of Wave 3 typically the strongest and most explosive wave in Elliott Wave theory.

Cookie DAO · The Bullish Wave · Resistance & SupportWe need just one signal here and the market works based on resistance and support. When trading is happening above support, the bulls have the upper-hand, the advantage. When trading is happening below support, the bears have the advantage.

Here we are looking at COOKIEUSDT. The main support is the 3-February low for us. When the action moved below this level, we look for a bottom and reversal pattern. The bottom showed up and the pattern resulted in a cup or inverted triangle. When the action moves back above the 3-February support line the bullish bias is now confirmed.

Now fast forward to present day. COOKIEUSDT produced a retrace after peaking in May and the same support zone was tested. It was challenged for a few days and after suffering briefly, it seems to hold.

Now COOKIE has been green five days moving up. The fact that the action today is happening at the top of the session moving above EMA21 is another positive signal. The day started red and prices actually moved much lower. All the selling was bought and now COOKIE is back green, this signal is double-strong (bullish).

We will see a bullish wave next. Market my words.

Namaste.

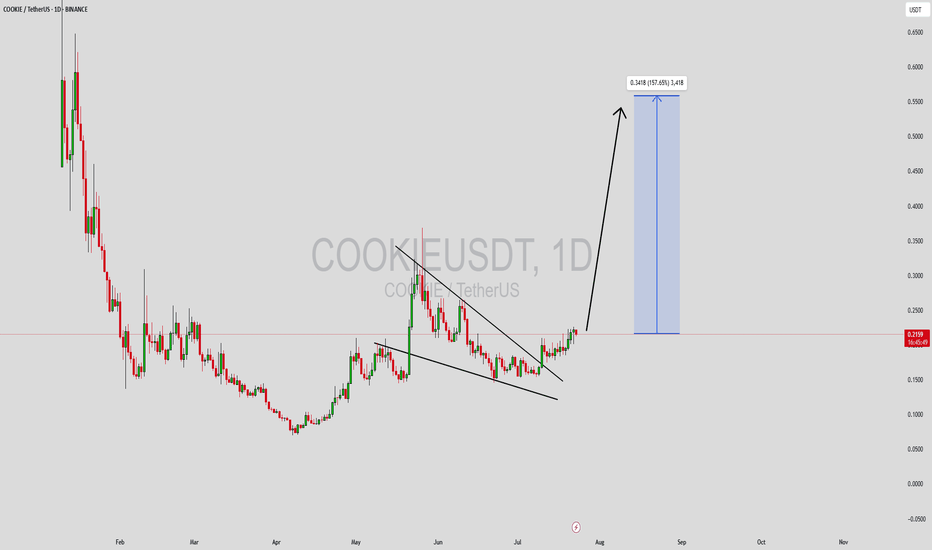

COOKIEUSDT Forming Falling WedgeCOOKIEUSDT has recently broken out from a bullish falling wedge pattern on the daily chart, a formation that typically signals a trend reversal and strong upward momentum. The wedge formed after a long consolidation and price compression, which usually results in a breakout supported by increased volume—and that’s exactly what we’re seeing. This breakout now opens the path for a potential move toward a 140% to 150% gain in the near-to-mid term.

The falling wedge breakout is accompanied by rising buying volume, which validates the pattern and confirms growing market interest in COOKIE. Price action has flipped from lower lows to forming higher highs, a technical shift that’s often the early phase of a parabolic move. COOKIEUSDT has established a solid support base, making this breakout structure more reliable for bullish continuation.

Investor sentiment around COOKIE has also been turning positive. With increased attention across crypto communities and favorable positioning on Binance, COOKIE is beginning to draw speculative momentum. The risk-reward ratio remains attractive at current levels, especially considering the technical setup and expected target levels projected around the $0.55–$0.60 zone.

Traders should keep an eye on short-term resistance zones for potential pullbacks and re-entry opportunities. As long as the breakout holds and volume remains strong, COOKIEUSDT could become one of the top-performing mid-cap altcoins in this cycle.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

COOKIE/USDT on the Verge of a Breakout? Descending Triangle

📊 Complete Technical Analysis

COOKIE/USDT has been forming a classic Descending Triangle since February 2025, indicating prolonged market consolidation. Sellers have been pushing the price down gradually (lower highs), but buyers have strongly defended the horizontal support around $0.16–$0.18.

Now, the price is testing the upper boundary of this structure, signaling a potential explosive breakout.

🔍 Pattern Breakdown

Pattern Name: Descending Triangle

Key Traits:

Lower highs compressing price action

Strong horizontal support zone holding steady

Typically a continuation pattern, but in this case, it can act as a reversal signal if breakout occurs to the upside

Formation Duration: ±6 months

Breakout Confirmation: A daily candle close above ~$0.22 with strong bullish volume

🚀 Bullish Scenario (Upside Breakout)

If COOKIE/USDT successfully breaks above the triangle resistance, here are the potential bullish targets:

Target Price Reason

🎯 Target 1 $0.259 Local resistance zone

🎯 Target 2 $0.299 Key breakout confirmation

🎯 Target 3 $0.407 Measured move from triangle height

🎯 Target 4 $0.626 – $0.700 Historical resistance range

🏁 Final Target $0.842 (ATH Zone) If bullish sentiment fuels momentum

✅ Volume confirmation is crucial. A breakout without strong volume might signal a fakeout.

🛑 Bearish Scenario (Rejection or Breakdown)

On the flip side:

❌ If the price fails to break the triangle resistance (~$0.22) and gets rejected again, we could see a retest of:

Support zone around $0.18

A breakdown below this level could drive the price toward:

$0.140

$0.120

Possibly as low as $0.095 – $0.075 if sentiment worsens

❗ Be cautious of fake breakouts or bear traps near key levels.

📚 Summary & Insights

> The current descending triangle is a textbook setup of “compression under pressure.” If the structure breaks upward with conviction, COOKIE/USDT may enter a powerful bullish trend after months of consolidation.

This setup is ideal for swing traders, breakout traders, or early trend investors seeking solid entries before momentum accelerates.

#COOKIEUSDT #CryptoBreakout #DescendingTriangle #AltcoinAnalysis #BullishReversal #TechnicalAnalysis #TradingView #CryptoTA #AltcoinSetup #ChartPattern

COOKIEUSDT UPDATE

Pattern: Falling Wedge Breakout

Current Price: \$0.1996

Target Price: \$0.32

Target % Gain: 70.82%

Technical Analysis: COOKIE has broken out of a falling wedge pattern on the 12H chart, supported by a strong volume surge. The breakout is confirmed with a close above the trendline, indicating bullish momentum.

Time Frame: 12H

Swing Trading Plan For COOKIEUSDTBINANCE:COOKIEUSDT

📄 Trading Idea

💵 Currency $COOKIE

📄 This path is considered positive and forms a Falling Wedge pattern

⭕️ Entry points for this currency: current price 0.1640 and at 0.1329 - 0.1007 at the same size if it experiences a drop

◀️ This is the main support range for the currency to maintain a positive structure. Caution and attention should be given to a break below 0.10

🔼 The main target for this pattern is to rise towards the range of 0.3328 - 0.4044, which is a doubling in the market value of COOKIE currency

🚨 The pattern fails with a break below 0.0703 and is considered distant, so you should calculate the size of your trade correctly before entering and use this analysis

Bearish opportunityThere is a H&S pattern that is currently in play, the sell movent has already started but its still in its initial stages.

A sell position current with a stop loss slitely above 0.1875 and a take profit at 0.00712 would be most ideal.

A conservative trader can go with the most recent structure which would be a continous bearish pattern,if and only if you wait for a retest or volume to the down side and enter then but with a bigger stop loss.

Cookieusdt trading opportunityCOOKIEUSDT has broken down from its rising channel and is now heading toward a potential reversal zone. If price finds support and reacts positively from this area, a move toward the important supply zone is expected. A confirmed breakout above this supply zone would open the path toward the projected final target, as outlined on the chart.

COOKIE/USDT H&S +100d Accumulation COOKIE has broken out of a 100-day accumulation range with strong buy volume stepping in. The $0.20 level continues to act as strong support, holding firmly through recent price action.

Additionally, price has formed a clear and well-defined Inverse Head and Shoulders pattern, now targeting the completion of this bullish structure — a textbook signal of a potential trend reversal.

Take Profit Levels:

TP1: $0.30

TP2: $0.39

TP3: $0.50

Stop Loss: $0.198

Pattern confirmation + volume surge = strong potential for follow-through.