CROUSDT.P trade ideas

CRO/USDT – LONG, MAYBE a new HIGH in LINE !!CRO has broken out of a descending wedge pattern on the 4H chart after several weeks of consolidation. Historically, this setup often signals the end of a corrective phase and the beginning of a bullish continuation.

Key observations:

The breakout candle closed above the wedge trendline with increasing momentum.

Price is reclaiming the 0.260–0.270 support zone, which was previously resistance.

Strong bullish engulfing candle adds confirmation of demand stepping in.

If momentum sustains, CRO could target the upper resistance cluster near 0.328 – 0.385.

Entry zone: 0.260 – 0.270

Stop loss: Below 0.240

Targets:

T1: 0.294

T2: 0.310

T3: 0.328

Extended: 0.371 – 0.386

Insights: Holding above 0.265–0.270 is critical. Failure to hold could drag price back toward 0.245 before any continuation.

DYOR | Not Financial Advice

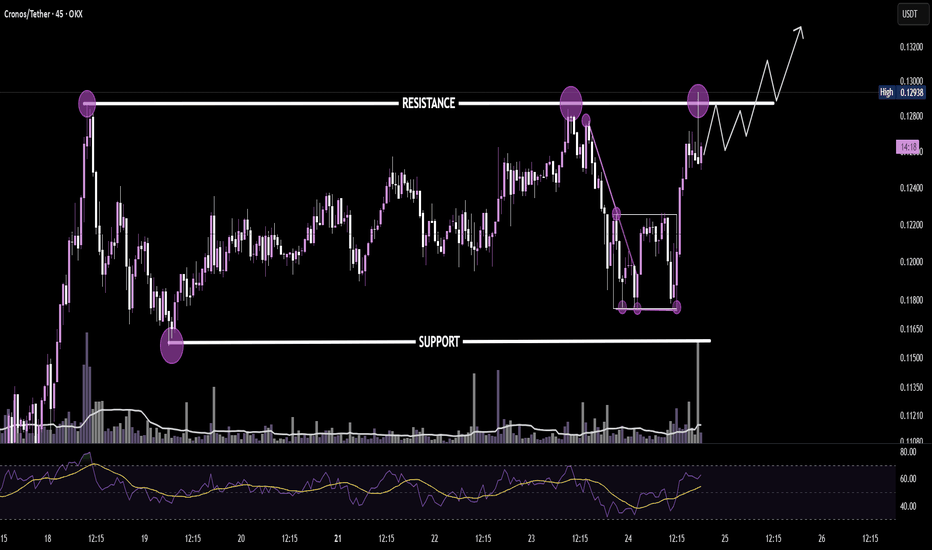

CroCro usdt daily analysis Time frame 4hours Risk rewards ratio =1.5

Target 0.2028$

Short position in short time

Cro has reached Target of my long position and continued to the green line that I drew before for my final target at this rally.

Now cro needs to reserve energy for another pump and reach to last ATH

$CRO price pumped hard after the big news:🚀 The price of CRYPTOCAP:CRO skyrocketed after major news:

SPAC-company Yorkville Acquisition Corp, TMTG, and Cryptocom signed a final merger agreement.

They are launching Trump Media Group CRO Strategy, Inc. — a new digital asset management firm focusing on acquiring #CRONOS.

💹 Key details:

▪️ Yorkville Acquisition Corp plans to file for listing Class A shares on Nasdaq under ticker MCGA

▪️ Charter capital:

• 6.3B #CRO (~19% of supply) ≈ $1B (avg. price $0.159)

• $200M in fiat

• $220M in warrants

• + $5B credit line

🤔 But here’s the catch…

As the old trader’s saying goes:

"Buy the rumor — sell the news"

OKX:CROUSDT is still far from ATH ($1), but the news already seems to be “priced in”.

So we may see a distribution phase coming… if it hasn’t started yet.

⚖️ And the key point:

the further CRYPTOCAP:CRO price moves from the $0.159 average set in the deal, the less appealing it looks to buy right now.

And next… 👇

🧠 DYOR | This is not financial advice, just thinking out loud.

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

Phemex Analysis #106: Is Cronos (CRO) Ready for a Comeback?Cronos (CRO), the native token of the Crypto.com ecosystem, has had a turbulent year but is beginning to show signs of recovery. After plunging to lows near $0.08 in early July, CRO rallied to $0.38 by end-August, before retracing and trading today around $0.25. This rebound has fueled optimism among holders who see CRO as a long-term play on exchange tokens and blockchain adoption.

Beyond price action, CRO continues to be supported by its strong ecosystem. As the gas token for the Cronos Chain, it powers DeFi apps, NFT platforms, and GameFi projects while offering utility within Crypto.com’s exchange. The combination of real-world usage and a dedicated user base gives CRO a strong foundation for potential growth.

With CRO now consolidating under key resistance, the market is watching closely to see if it can stage a sustained comeback. Let’s explore the possible scenarios ahead.

Possible Scenarios

1. Bullish Breakout Toward $0.33 - $0.38

If CRO manages to reclaim $0.28 with rising volume, it could trigger a bullish continuation toward $0.33 and potentially $0.38, aligning with prior resistance zones.

Pro Tips:

Enter after confirmation of a breakout close above $0.28.

Scale out profits at $0.33 and $0.38.

Use stop-loss orders slightly below $0.25 to protect capital.

2. Range-Bound Consolidation $0.24–$0.28

CRO may continue to oscillate between support at $0.24 and resistance at $0.28, as traders wait for clearer market direction.

Pro Tips:

Buy near $0.24 support and sell close to $0.28 resistance.

Avoid overtrading in the middle of the range.

Watch volume shifts as a signal of an impending breakout.

3. Bearish Pullback Toward $0.15

If CRO fails to hold $0.24 on strong sell volume, the bearish trend could resume, sending price back toward $0.15, its support before recent rally.

Pro Tips:

Reduce exposure if $0.24 fails to hold with conviction.

Long-term investors may consider DCA at deeper supports ($0.12–$0.15).

Look for reversal signals like RSI divergence before re-entering.

Conclusion

CRO has rebounded strongly from its summer lows and is now consolidating in a key zone. With real utility across the Crypto.com ecosystem and the Cronos blockchain, it remains a token with strong long-term potential. Traders should keep an eye on the $0.28 breakout level and the $0.24 support zone to navigate the next move effectively. Whether CRO is on the verge of a sustained comeback or preparing for another test of support, disciplined strategies will be essential to capture opportunities.

🔥 Tips:

Armed Your Trading Arsenal with advanced tools like multiple watchlists, basket orders, and real-time strategy adjustments at Phemex. Our USDT-based scaled orders give you precise control over your risk, while iceberg orders provide stealthy execution.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

CROUSDT Ready for a Bullish Rebound or a Brutal Trap? Yello Paradisers, is #CROUSDT about to give us a clean bullish rebound from demand or is this just another setup to wipe out impatient buyers?

💎After a prolonged descent within a clear downward channel, #CRO finally broke out, reclaiming strength above the major demand zone around $0.1400–$0.1450. This level acted as a turning point, pushing price back toward the $0.1550–$0.1600 region. Currently, GETTEX:CRO is hovering above minor demand and showing signs of retesting the zone near 0.1500.

💎That region, however, represents a heavy resistance cluster where profit-taking could easily trigger sharp rejections.On the flip side, if demand fails to hold and price breaks below 0.1480, the invalidation level near 0.1330 comes into play. A breakdown into that zone would trap late buyers and likely fuel another wave of panic selling before any real recovery attempt.

💎The key here is patience. Price is at a crossroads where both traps and opportunities are equally possible. Only disciplined traders who wait for confirmation at demand or rejection from resistance will avoid getting caught in the whipsaw.

🎖Strive for consistency, not quick profits. Trade with patience, protect your capital, and let the market show you the highest probability setups. That is how you stay in the winner’s circle.

MyCryptoParadise

iFeel the success🌴

$CRO Dominate the Market Epic TP/SL!KUCOIN:CROUSDT

CRYPTOCAP:CRO Dominate the Market with Entry at 0.20650 - 0.20750 & Epic TP/SL!

Entry Point: Marked at 1 0.20650 - 0.20750 USDT, indicating the price level to enter a long position.

Take Profit (TP) Levels:TP1: 0.7860 (0.19129 USDT)

TP2: 0.6180 (0.17935 USDT)

TP3: 0.5000 (0.17097 USDT)

TP4: 0.1354 (0.11354 USDT)

These levels suggest a descending target strategy, likely based on Fibonacci retracement or similar technical analysis.

Stop Loss (SL):Set at 1.272 (0.22583 USDT), above the entry to limit potential losses.

Dollar-Cost Averaging (DCA):Marked at 1.135 (0.21609 USDT), indicating an additional buy level if the price retraces.

Price Action:The chart shows a recent upward movement around the entry point (1 0.20650 - 0.20750 USDT), following a period of consolidation and a prior downtrend.

The candlestick pattern near the entry suggests a potential reversal or continuation, depending on the next few candles.

Relative Strength Index (RSI):

The RSI (bottom panel) is currently at 85 - 84, indicating overbought conditions (above 70). This suggests the price may be due for a pullback or consolidation unless strong bullish momentum continues.

CRO/USDT 1W Chart📊 Current situation

• Price: ~ 0.2067 USDT (+33% per week).

• Trend: strong Breakout after a long consolidation.

• SMA:

• Short -term (red, ~ 0.1236 and 0.1592) was pierced → confirms the change of trend.

• Green (SMA #2) also below the price → bull signal.

• MacD: heavily growing histogram, MacD line above the signal → growth moment.

• RSI: ~ 70 → enters the purchase zone, but not yet extreme (no divergence).

⸻

📈 levels of support and resistance

• Support:

• 0.1592 (last Breakout Level).

• 0.1236 (strong zone of previous consolidation).

• resistance:

• 0.2347 (nearest resistance).

• 0.3374 (key resistance from higher intervals).

⸻

🧐 Interpretation

• We have a confirmed upward trend - the price has pierced the relegation line (yellow trend line) and the SMA broke.

• Momentum is growing (MacD, RSI, volume).

• However, RSI signals the possibility of short -term correction if the price hit 0.2347.

⸻

🔮 Scenarios

1. Bycza (more likely)

• If we keep it above 0.1592, possible attacks on:

• 0.2347 → Then even 0.3374.

• A good chance of continuing the trend within the average time.

2. Bear (correction)

• a decrease below 0.1592 → correction to 0.1236.

• Only a breakdown 0.1236 will negate the current upward trend.

CRO Breakout Alert – Red Resistance Cleared! 🚨 GETTEX:CRO Breakout Alert – Red Resistance Cleared! 🔴✅

GETTEX:CRO has successfully broken out of the red resistance zone.

📈 Momentum is in play — next targets in focus:

🎯 First Target → Green line level 1

🎯 Second Target → Green line level 2

Strong breakout confirms buyer control — watching for continuation toward both targets.

CRO Signals Big Move: 3 Soldiers Pattern + 4 Fibonacci Target(CRO/USDT) is showing a strong bullish reversal on the chart, forming the classic Three White Soldiers pattern — a powerful signal of trend reversal and sustained momentum.

This move comes after a prolonged consolidation phase, making CRO an ideal low-capital investment with the potential for a high reward.

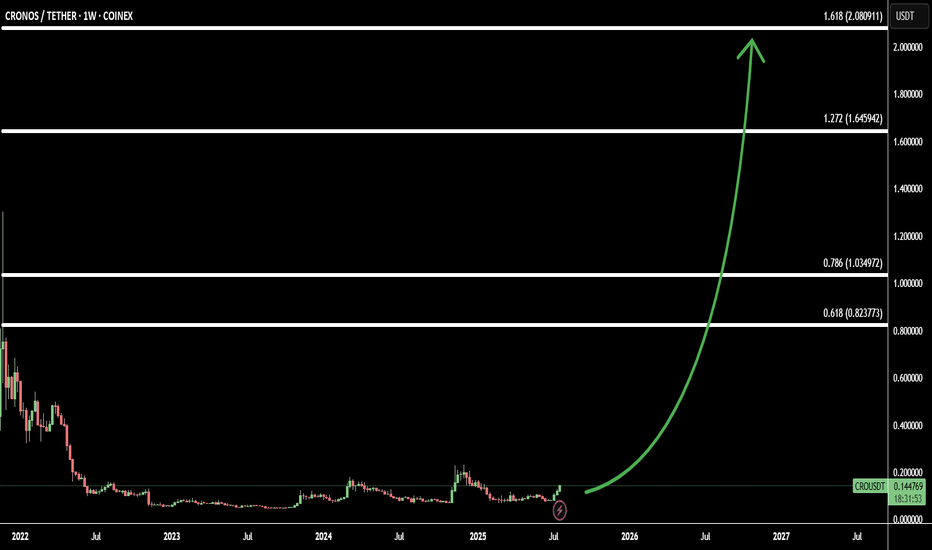

Using Fibonacci extensions, I’ve identified 4 bullish targets:

Target 1: 0.618 Fib – 0.82 - confirmation of trend shift

Target 2: 0.786 Fib – 1.03 - key resistance zone

Target 3: 1.272 Fib – 1.64 - major breakout level

Target 4: 1.618 Fib – 2.08 - full bullish potential zone

With technicals and sentiment aligning, CRO may be gearing up for a big move, and current prices offer one of the best risk-reward opportunities in the market.

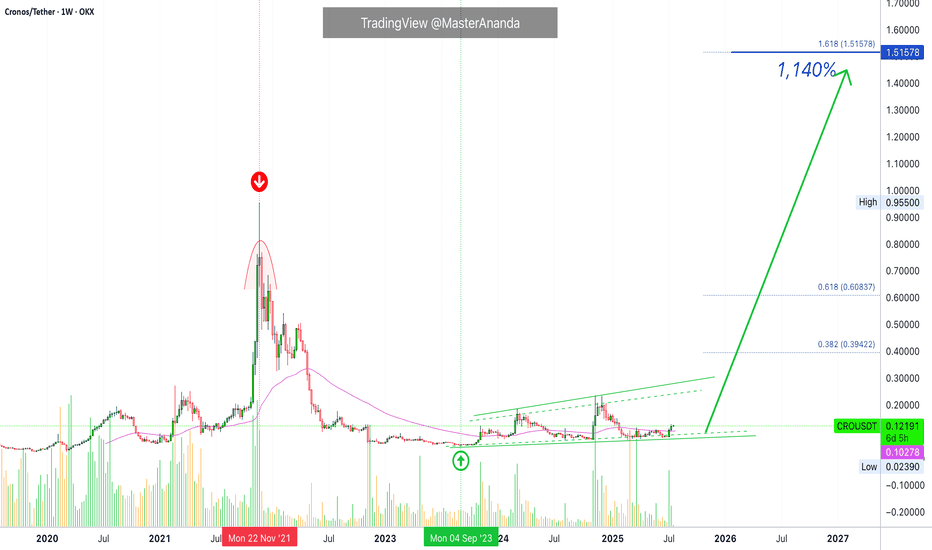

Cronos 2025/26 New All-Time High Revealed · PP: 1,140%Cronos has all the classic signals ready, confirmed and combined. RCC. And this opens the doors for a major advance which will not be shown fully on this chart. That is because I am using the linear chart for perspective but the log chart is needed to see all the major targets. Just trust, it is going to move very high in this bullish cycle run.

Good afternoon my fellow Cryptocurrency trader, I hope you are having a wonderful day.

Didn't I told you that you would see so much growth, that you will become complacent at some point? We are not there yet, but we will get there and you will have new challenges to face. Believe it or not, taking profits, using your earnings, will be one of the hardest things to do but the only right choice. A win is only a win when you close when prices are up.

Just as you cannot incur a loss unless you sell when prices are down; you cannot secure a win unless you sell when prices are up. When a pair grows 1,000%, you should take profits, period. When a pair growths 500%, it is wise to secure, 10%, 20%, etc. A plan is needed to achieve maximum success.

How you approach the market will depend on your goals, your capital, your trading style, which projects are available to you in your home-country, and so on.

A long-term investor does not need to sell, can continue to buy, accumulate and hold for a decade or more. Can you see? Each strategy is dependent on the person behind it.

CROUSDT · Trading weekly above EMA55 while still near the bottom. The bottom is revealed when we compare current candles size and location to the 2021 high price.

Last but not least, notice how each time there is a strong increase in trading volume the weekly session ends up closing green. Bullish volume is dominating this chart. A long-term accumulation phase.

Without further ado, the next and easy all-time high target is $1.51 but it can go much higher. Total profits reaching 1,140%.

Thank you for reading.

Namaste.

CRO at a Turning Point ?This is CRO on the daily chart.

Price has interacted multiple times with the key resistance at **0.10649** (black line). It’s now testing that level again, and there's a real possibility it flips it into support.

On top of that, CRO is attempting to reclaim the 200MA, while the 50MA is starting to flatten out—potential signs of a longer-term shift.

That said, this process might take some time and could be volatile. CRO’s relatively small market cap of \$3.33B and this week’s major macro events (starting today with CPI) could add pressure in both directions.

Always take profits and manage risk.

Interaction is welcome.

CROUSDT trading ideaCROUSDT is holding above the Immediate Demand Zone near $0.068. A successful defense here could trigger a bullish recovery targeting $0.166, $0.232, and possibly $0.881 if price breaks the long-term descending trendline and reclaims the Internal Supply Zone. However, a breakdown below this level could send price toward the Crucial Demand Area around $0.039.

Cronos Holds Key Trendline – Will Resistance Crack Next?CRO is bouncing off its rising support line again.

The price has respected this trendline multiple times, showing steady accumulation. It’s also sitting just below a key resistance zone, if it breaks above that, we could see momentum kick in.

For now, the structure looks healthy as long as the support holds.

DYOR, NFA

Cronos Rallies 18% After Truth Social Files for Blue-Chip ETFOKX:CROUSDT is a leading candidate for a Binance listing this month, following the proposed Crypto Blue-Chip ETF filed by Truth Social with the SEC. The fund includes 70% Bitcoin, 15% Ethereum, 8% Solana, 5% Cronos, and 2% XRP , positioning Cronos as a key asset in the fund.

Of the tokens in the proposed fund, only Cronos (CRO) is not currently listed on Binance. If the SEC approves the Crypto Blue-Chip ETF, Binance could fast-track the listing of Cronos . This move would likely draw more liquidity and investor interest toward CRO, fueling its price growth.

OKX:CROUSDT price surged by 17.8% over the last 24 hours, signaling strong momentum. If the ETF listing is approved and Binance acts swiftly, CRO could break through key resistance levels, potentially surpassing $0.1007. This upward movement would benefit investors, continuing the positive trend for the altcoin.

CRO Building Bullish Momentum, Eyes BreakoutCRO is currently showing signs of continued bullish momentum as its Relative Strength Index (RSI) holds above 50. signaling that the asset is neither overbought nor oversold.

This reading reflects healthy buying pressure and suggests that the current trend of accumulation could continue. As long as the RSI stays below the overbought threshold of 70, CRO may maintain its upward momentum.

Price action on the daily chart shows that CRO has broken above its 20-day Exponential Moving Average (EMA), further strengthening the bullish case. A sustained close above this short-term EMA indicates a positive shift in market sentiment, suggesting that buyers are in control and short-term momentum is favoring the upside.

If bulls maintain control, CRO could extend its price rally.