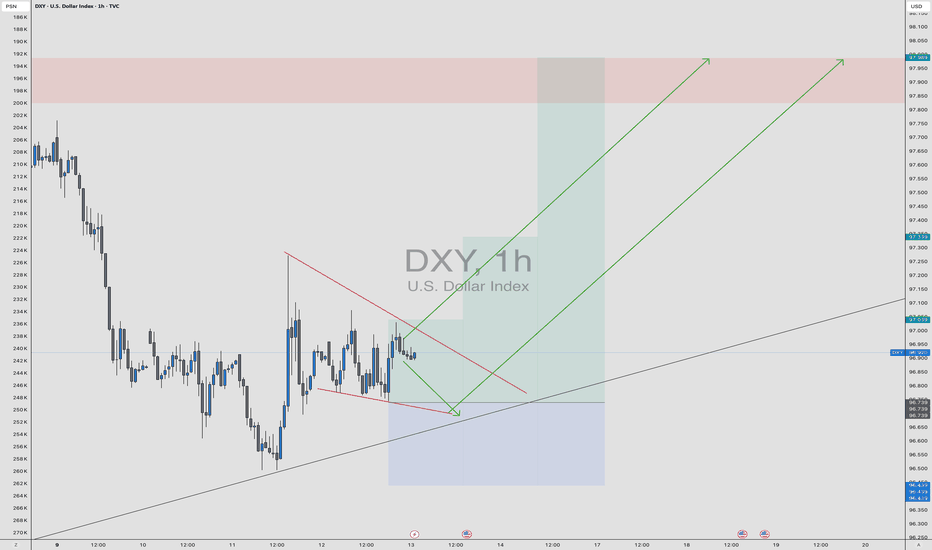

Dollar - Daily CLS - Model 1 - HTF FrameworkHi friends, new range created. As always we are looking for the manipulation in to the key level around the range. Don't forget confirmation switch from manipulation phase to the distribution phase to make the setup valid. Stay patient and enter only after change in order flow. If price reaches 50%

U.S. Dollar Index

No trades

About U.S. Dollar Index

The U.S. Dollar Index tracks the strength of the dollar against a basket of major currencies. DXY was originally developed by the U.S. Federal Reserve in 1973 to provide an external bilateral trade-weighted average value of the U.S. dollar against global currencies. U.S. Dollar Index goes up when the U.S. dollar gains "strength" (value), compared to other currencies. The following six currencies are used to calculate the index:

Euro (EUR) 57.6% weight

Japanese yen (JPY) 13.6% weight

Pound sterling (GBP) 11.9% weight

Canadian dollar (CAD) 9.1% weight

Swedish krona (SEK) 4.2% weight

Swiss franc (CHF) 3.6% weight

Euro (EUR) 57.6% weight

Japanese yen (JPY) 13.6% weight

Pound sterling (GBP) 11.9% weight

Canadian dollar (CAD) 9.1% weight

Swedish krona (SEK) 4.2% weight

Swiss franc (CHF) 3.6% weight

Related indices

DXY 1W — Weekly Impulse Completed, Compression Before ExpansionFundamental Snapshot

The 2026 narrative still supports a softer USD: rate-cut expectations + shrinking yield advantage + capital rotation.

Bounces can happen, but until major weekly highs are reclaimed, the macro backdrop stays corrective-to-bearish.

My Bias

The weekly impulse from the ma

DXY Coiling for Expansion — Liquidity Grab Before the Move?DXY is currently compressing inside a descending wedge while holding above a rising trendline — a classic accumulation structure.

Price swept liquidity to the downside and reacted from higher-timeframe support, suggesting sellers are weakening. As long as the trendline holds, the probability shifts

Falling towards overlap support?US Dollar Index (DXY) is falling towards the pivot, which has been identified as an overlap support that aligns with the 61.8% Fibonacci retracement.

Pivot: 96.43

1st Support: 96.05

1st Resistance: 97.23

Disclaimer:

The opinions given above constitute general market commentary and do not constit

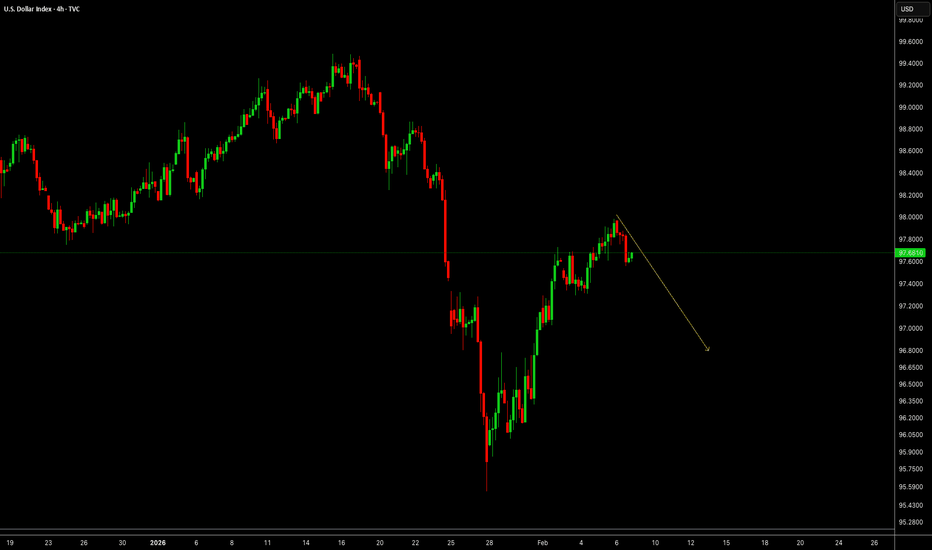

DXY – H4 | Short-Side Technical ContextThe U.S. Dollar Index recently completed a corrective bullish channel following a strong impulsive decline. Price respected the rising channel structure but failed to sustain acceptance near the upper boundary, indicating weak continuation strength.

A decisive move lower has now occurred, with pric

DXY: Lower lows or are we due for a bounce?Will the decline in US Unemployment boost TVC:DXY , or will the probability of further rate cuts push the price below support? Let's break down both scenarios and prepare a trading plan for either outcome.

Technicals:

- after tagging the 0.618 Fibonacci retracement, price action faced a sharp

DXY at a Decision Point : Momentum Building The U.S. Dollar Index is entering a critical phase where price action is tightening and momentum is gradually building. Recent structure suggests the market is preparing for its next directional move, with volatility likely to expand in the coming sessions.

Instead of chasing short-term noise, this

US DOLLAR INDEX (DXY): Classic Breakout TradeThe Dollar Index successfully broke and closed above a significant daily horizontal resistance cluster earlier this week.

Following this, the pair started to consolidate on a 4-hour timeframe, retesting the previously breached structure.

A bullish breakout of this consolidation serve as a strong

DXY H1 | Bullish Bounce OffThe price has bounced off our buy entry level at 86.63, which is a pullback support.

Our stop loss is set at 96.63, which is a pullback support.

Our take profit is set at 97.01, a pullback resistance slightly above the 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limit

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's value movements over previous years to identify recurring trends.

Frequently Asked Questions

The current value of U.S. Dollar Index is 96.884 USD — it has fallen by −0.04% in the past 24 hours. Track the index more closely on the U.S. Dollar Index chart.

U.S. Dollar Index reached its highest quote on Feb 25, 1985 — 164.720 USD. See more data on the U.S. Dollar Index chart.

The lowest ever quote of U.S. Dollar Index is 70.698 USD. It was reached on Mar 17, 2008. See more data on the U.S. Dollar Index chart.

U.S. Dollar Index value has decreased by −1.11% in the past week, since last month it has shown a −2.26% decrease, and over the year it's decreased by −9.56%. Keep track of all changes on the U.S. Dollar Index chart.

U.S. Dollar Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy U.S. Dollar Index futures or funds or invest in its components.